Standing at the crossroads: An investor's choice of response after market turmoil

The decision to stay with your plan is often better than timing when to sell and buy.

Staying the course during market volatility is often difficult for many investors. Some choose to move to cash investments, while others try to time the market. Unfortunately, these investors are often buying high and selling low—and miss the rallies that follow the challenging periods.

So, does staying the course pay off?

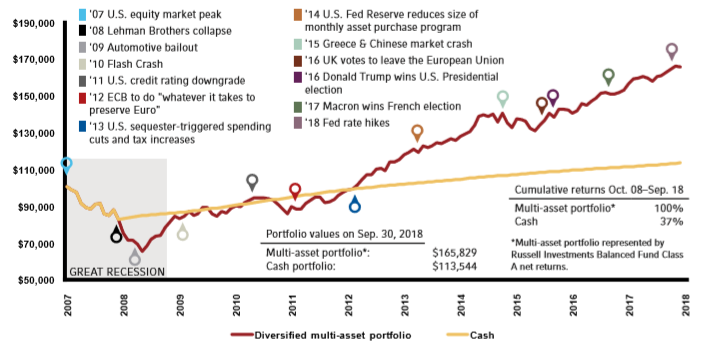

In the chart (below), we look at an investor in a diversified multi-asset portfolio 'standing at the crossroads' faced with two alternatives as of Sept. 30, 2008 (two weeks after the collapse of Lehman Brothers).

The starting point for the $100,000 hypothetical portfolio is Oct. 1, 2007, the prior market peak. The choices as of Sept. 30, 2008 are:

Road #1: Stay invested in a multi-asset portfolio, and make no changes.

Road #2: Move to 100% cash, represented by the Bloomberg AusBond bank Bill Index, and remain in cash.

As the chart shows, when sticking with a diversified multi-asset portfolio, investors recovered a greater percentage of their lost value than going to cash.

(Click to enlarge image)