Key Takeaways

- Small-caps stocks may benefit soon from deglobalization, increased defense spending and a new era of tech advancement

- We believe active managers are well-situated to capitalize on inefficiencies in this space due to limited analyst coverage and less-concentrated indices

Is a small-cap rally around the corner?

The valuation of small-cap stocks relative to large caps remains historically attractive, and small-cap recoveries in the past have resulted in meaningful periods of outperformance. However, the big question we often get asked is, “Sure, that sounds great … but what would be the catalyst for a small-cap rally?” We think the tide could be turning in their favor soon. Factors driving this potential shift are:

- The rise in deglobalization

- Increased infrastructure

- Increased defense spending

- A new wave of technological innovation driven by AI, coupled with a compelling public listing pipeline across the globe

Additionally, we think gaining exposure to small caps through skilled active managers will be key.

Let’s start by lifting the hood on one of these drivers: the return to regionalism.

Rise of Regionalism

The geopolitical shift away from globalization and free trade, which began in the mid-2010s, has accelerated since Covid. We’ve seen a broad global trend in governments incentivizing domestic production, particularly with the reshoring and nearshoring of supply chains. Defense spending has also increased, with an emphasis on localized production. Recent rises in global tariff rates have furthered this trend.

As the world becomes more regional, we see this as an opportunity for the globe’s smaller companies. Here's why.

Going Local

Small-cap companies are generally more domestically focused than large multinationals. Deglobalization shifts economic activity inward, benefiting companies that serve local markets. If a country boosts domestic manufacturing, companies will likely create new manufacturing plants, logistics hubs and supply chain solutions. Domestically facing small-cap industrials and materials companies may see increased demand.

Playing Defense

Another factor that could boost small caps is the ramp-up in defense spending. As governments commit to spending more on defense, these investments cascade through the supply chain. While major players such as Boeing and Airbus might win the overall contract, the benefits trickle down into specialized small caps in aerospace, tech and engineering. These firms often deliver higher growth and are nimble enough to win niche contracts that large players overlook.

IPO Wave

Small caps also stand to benefit from a potential increase in initial public offerings (IPOs). Recent macroeconomic challenges—including high inflation and rising interest rates—have delayed IPO plans for many venture-backed firms like Stripe, Klarna and Instacart. This has created a backlog of mature startups (Series D and beyond), particularly in high-growth sectors such as enterprise software, fintech, digital health, climate tech and applied AI. While a few may debut with valuations over USD $5-10 billion, most are likely to enter the market under USD $2 billion, expanding the innovation-rich small-cap universe.

Startups like Jasper, Vanta and Drata are leveraging AI to reshape industries, while climate tech firms such as Form Energy and Twelve benefit from supportive legislation. In digital health and biotech, companies like Omada Health and AI-driven genomics startups are advancing rapidly, often with FDA support. Meanwhile, B2B fintech infrastructure players like Alloy and Unit have gained momentum amid improving regulatory conditions. Across the board, these companies offer early-stage exposure and innovative, scalable solutions that are drawing strong investor interest.

Going Public

Meanwhile, in the U.S., recent SEC reforms (like confidential filings) and policies from the Inflation Reduction Act and CHIPS Act make it easier for startups to go public. In addition, stricter antitrust enforcement has limited M&A by tech giants, nudging more startups toward IPOs as a primary exit.

Small caps not only offer more room for growth and attractive valuations post-reset. They also provide access to high-quality IPOs driven by recurring revenue and exposure to major themes like AI and climate tech. This positions them for stronger post-IPO performance than previous cycles.

Active Advantage

As the small-cap landscape evolves, so do the opportunities and challenges. That’s where we believe active managers can add real value. Active management in global small-cap equities has the potential to outperform passive benchmarks over time. This advantage is rooted in both informational inefficiencies and structural market dynamics that are particularly pronounced in the small-cap segment.

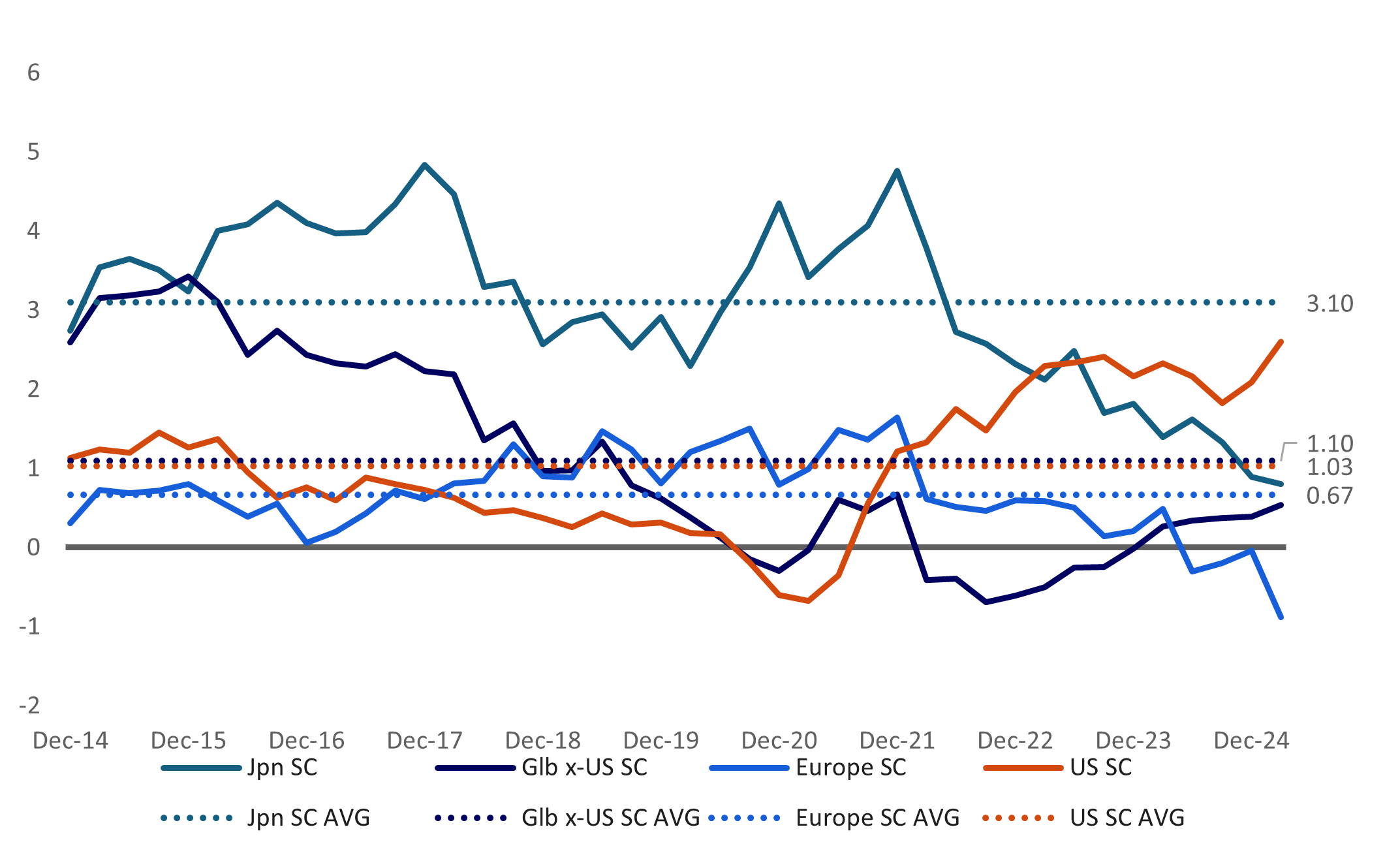

Data demonstrates that median small-cap managers have outperformed their benchmarks across most time periods. The average 5-year median manager outperformance ranges from 0.67% in European small caps to 3.10% for Japanese small caps.

Benchmark Busters

Small-cap managers tend to outperform passive benchmarks over time

Median manager outperformance by asset class, 5-year rolling average

Source: Russell Investments

One of the key drivers of active manager outperformance is the disparity in analyst coverage between large- and small-cap stocks. While large-cap stocks are typically covered by an average of 16.4 analysts, small-cap stocks receive coverage from only about 5.7 analysts. This creates an information gap that active managers can exploit through proprietary research and deeper analysis.

In addition to limited coverage, small-cap benchmarks tend to include a higher proportion of lower-quality companies. Over 40% of U.S. small-cap companies are unprofitable (15-20% of weight), compared to approximately 20% of mid-cap companies.

Despite the increasing presence of unprofitable companies in small-cap indices, data shows that profitable companies within the Russell 2000 Index have delivered significantly better returns over time. Active managers are better positioned to identify and invest in these higher-quality firms, avoiding those with weak balance sheets or unsustainable business models.

Finally, the structure of small-cap benchmarks is inherently more favorable to active management. Unlike large-cap indices, which are often dominated by a few mega-cap stocks, small-cap indices are more evenly distributed. Even when Super Micro Computer, Inc. (SMCI) peaked in 2024, it did not exceed 5% of the overall weight of the Russell 2000 Growth Index. This flatness allows active managers to make larger bets on high-conviction ideas without being constrained by the weightings of a few dominant names.

Lightening the Load

The weighting of individual securities is more evenly distributed in small-cap than large-cap indices

The weightings of the top 10 companies in the MSCI World Small Cap Index and the MSCI World Index

Source: MSCI, Russell Investments, as of May 30, 2025

The active small-cap manager’s advantage lies in the ability to exploit inefficiencies, navigate volatility, leverage structural flexibility and ultimately outperform over an entire cycle.

Small But Mighty

Is a small-cap recovery in the cards? It’s certainly possible. New policies that incentivize shorter supply chains and domestic production, along with a coming wave of public listings related to innovation in multiple sectors, could be the spark that lights the match.

Due to inefficiencies in the small-cap space, we believe investing is best done via skilled active managers. Three things investors should consider:

- Including small caps in your asset allocation

- Looking globally for diversification in the small-cap space

- Using actively managed strategies to capitalize on market inefficiencies

Ultimately, when spanning the globe for big ideas, sometimes it pays to think small.