Fundamentals—and not feelings—are the best measure of economic health. Are we ignoring the data and overplaying sentiment? Maybe.

Talk of a recession is everywhere. The case is simple: Liberation Day delivered the biggest increase in tariffs in a century. Consumer prices will rise. Purchasing power will decline. Recession…right?

Maybe. We peg the chances of a recession this year at a close call, 40%, which means there’s also a good chance the U.S. dodges one. Here are four ways this could happen.

1. Policy is dynamic

The macro impact of tariffs will depend on how long they remain in place. Tariff policy has been a dynamic tool in recent weeks. For example, we estimate the exemption for imported electronics on April 11 lowered the effective tariff rate from 23% to 18%. Tariffs have also rotated from initially being broad-based to more narrowly focused on China. This allows supply chains to shift toward providers with preferential rates.

The U.S. administration is also pursuing multiple trade deals, which means further agreements, exemptions, and delays are possible. For example, President Trump recently said he was looking at helping U.S. automakers who need more time to adjust to the tariffs. So, while tariffs are high now, they could fall in the coming weeks.

2. The U.S. is a closed economy

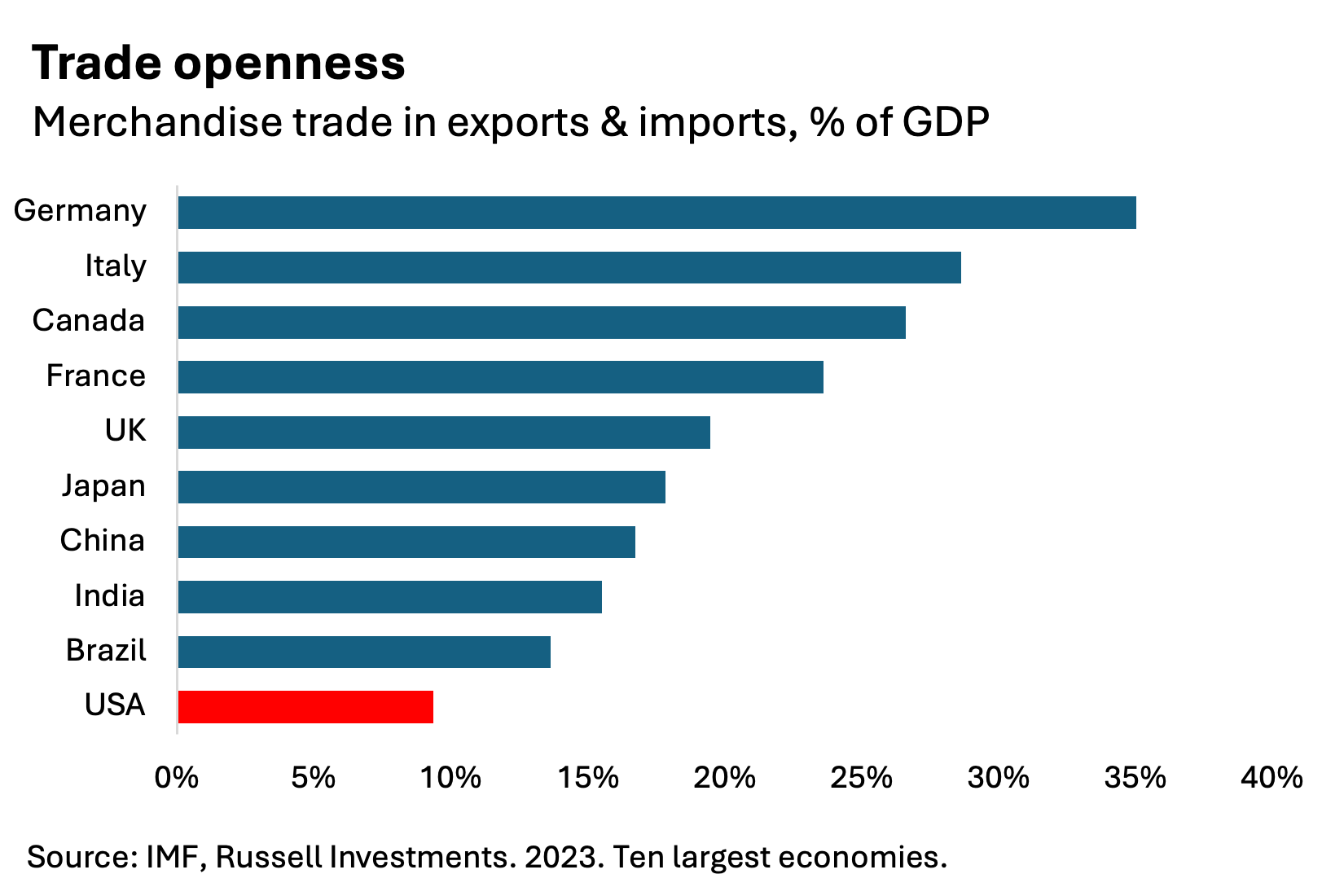

If anyone can get away with kickstarting a major trade war, it is the United States. The U.S. is a large and “closed” economy, where trade makes up a small share of GDP. This usually means the hit to growth from tariffs is modest.

Admittedly, the tariffs imposed in recent weeks are historically large. As a rough rule of thumb, a 1% increase in tariffs equals a 0.1% drag onto real GDP growth. Tariffs have increased roughly 15% (blue dot above), which suggests a growth hit of 1.5%. That would put the U.S. growth rate around 0.5%—slower, but maybe not enough to spark an outright recession.

3. Confidence isn’t the best predictor

U.S. confidence stinks. Consumer sentiment is at levels rarely seen outside a recession. And business confidence has fallen in recent months as well. This could cause a recession. That’s a real risk, but there are two caveats:

- First, we had a similar constellation of signals in 2022, and there was no recession.

- Second, confidence surveys appear increasingly polarized.

To be clear, we’re not saying either political party is right or wrong. The question is if—and how much—weak consumer vibes will slow spending? Sure, it’s a drag. But I struggle to believe spending will slow to the same extent as the GFC at a time that fundamentals are far stronger.

4. High frequency activity data continues to show resilience

Finally, we can just let the data speak for itself. Looking at the macro picture beyond Liberation Day requires us to lean on alternative, high-frequency data sets.

Are businesses cutting back on hiring? Not yet. Indeed—a leading platform for online job postings—shows no decline in its daily data for new listings through April 11 (chart).

Are consumers cutting back on spending? Not yet. Chase—a leading credit and debit card provider—shows that spending, including on more confidence-sensitive discretionary items, was still chugging along through April 9.

The bottom line

Recessions are incredibly difficult to forecast. We may well have a U.S. recession in 2025. The risks are high, and it’s a close call. But there is an alternative outcome—especially given the U.S. economy started the year on solid footing. Perhaps the ground will hold.