Key Takeaways

- The federal government is closed until Congress passes a new funding bill

- Most government shutdowns are brief and have little economic impact

- This one will probably be similar, although there’s a risk of permanent job cuts

The government shutdown may spark some short-term volatility for stocks, but investors aren’t likely to bear the brunt of a red October.

The U.S. government officially shut down just after midnight today when Congress failed to reach an agreement on a funding bill. Despite this, U.S. stock markets barely sold off, with the S&P 500 down only 0.1% as of 10:30 a.m. Eastern—still within striking distance of its all-time high. Bond market reaction was muted too, with U.S. 10-year Treasury yields declining by just 0.04%

Low Impact

The government shutdown means that only essential federal government services will continue. Government employees outside of these services are being temporarily furloughed without pay until a funding bill is passed.

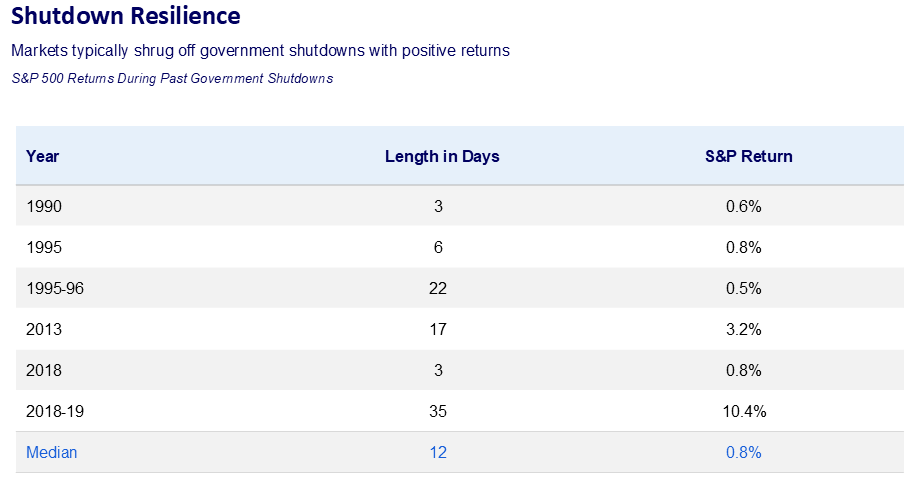

While a shutdown may seem scary at first glance, a look to history shows the economic impacts are typically minimal. Most shutdowns see only slightly reduced GDP growth, typically by about 0.1% to 0.2% per week. Because the median shutdown lasts just 12 days, the overall hit to GDP is usually only 0.2% total.

In this instance, many lawmakers have stated they plan to remain in Washington, D.C., amid the shutdown. This suggests there may be a desire to reach an agreement as soon as possible.

Source: Russell Investments, LSEG Datastream. Stocks measured as the total return on the S&P 500 Index.

Temporary Layoffs?

One potential difference between this shutdown and prior ones is the possibility some government agencies could make permanent job cuts. The scope of how many employees would be impacted remains uncertain for now. However, a notable increase in permanent layoffs could weaken the labor market more than expected, creating the risk of pushing the economy beyond a soft landing and into a deeper slowdown instead.

Another complicating factor is the shutdown will likely delay the release of the September jobs report, which was scheduled to be published on Friday. This may make it more difficult for investors to get a full picture of the U.S. labor market, although other measures may hold some clues. Tuesday’s JOLTS report pointed to a stable labor market with a low rate of layoffs, but this morning’s ADP report showed net job losses in September. Fortunately, the Federal Reserve’s next interest rate decision is near the end of this month, meaning that there’s still a good chance it will be able to get the nonfarm payrolls data before making its next rate decision.

Don’t Get Spooked

We expect this shutdown to only be a minor footnote in financial history. Accordingly, we think investors are best-served by focusing on the long term and staying close to their strategic plans, rather than getting spooked by the headlines.