Key Takeaways

- Europe’s defense budgets are rising rapidly, with the UK, Germany, France and NATO driving historic increases in military spending.

- Defense technology investment is accelerating, with AI, drones, satellites and software attracting more than $5 billion in 2024.

- A funding gap remains as U.S. investors dominate late-stage defense tech, creating strong opportunities for European private capital.

Europe is undergoing a historic reawakening in its defense spending, which is providing a great entry point for European private capital to the defense sector.

The UK has pledged to raise military expenditure to 2.5% of GDP by 2027, Germany has surpassed 2% for the first time, France is on track toward a 3.5% target and NATO has set an ambitious 5% target by 2035.

This resurgence in defense spending is being driven by the realities of modern security, exacerbated by past European failures to deter aggression, slow innovation cycles and the urgent need to build societal resilience.

The result? Legacy defense contractors are now being nationally pushed to integrate with agile technology start-ups. This collective modernization effort opens the door for investors to access innovation-driven growth within an industry that was once seen as closed and traditional.

Fresh Perspective

Historically, barriers such as regulation, environmental, social and governance (ESG) concerns, and doubts over growth potential kept private investors away from the defense sector. However, this narrative is shifting rapidly.

Defense is being reframed as a form of responsible investment. Protecting sovereignty and civilian populations is increasingly seen as a social responsibility. Governments are recognising that deterrence is no longer only about weapons, but also data, the cloud, AI, autonomy, and software, with growing opportunities for responsible, growth-oriented investment.

The market has already taken note. European defense stocks rose roughly 50% in valuation over the past year. At least 30 European sustainable-linked funds have added aerospace and defense holdings. Venture funding in European defense-tech jumped 20–30% in 2024, reaching over $5 billion.

Defense Deals Surge

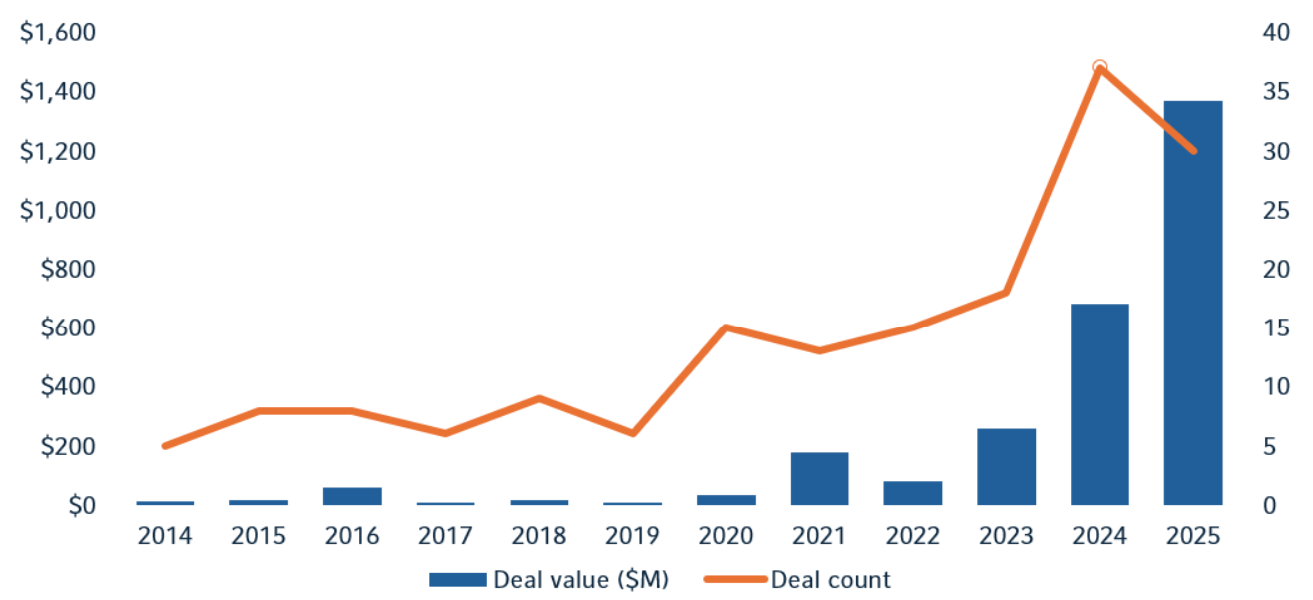

The number and size of defense tech deals in Europe is heating up

European defense deal value and deal count

Source: Pitchbook, July 29, 2025

The shift is clear: What was once a sector that was excluded is now being re-rated by the market as essential for both security and long-term competitiveness.

Standout Startups

There are already several successful examples of European defense start-ups:

- Helsing (Germany): AI defense software, €600m Series D, €12bn valuation.

- ICEYE (Finland): Synthetic aperture radar satellites, €500m raised.

- Unseenlabs (France): Satellite observation, €85m Series C.

- Tekever (Portugal): AI-enabled unmanned aerial systems, €70m raised, €1bn+ valuation.

- Quantum Systems (Germany): AI eVTOL drones, €160m Series C, €1bn+ valuation.

These success stories show that achieving large scale investment is possible. However, capital, facilities and procurement speed remain bottlenecks. This gap creates attractive entry points for private investors with the ability to provide early stage to growth-oriented funding to support company scaling.

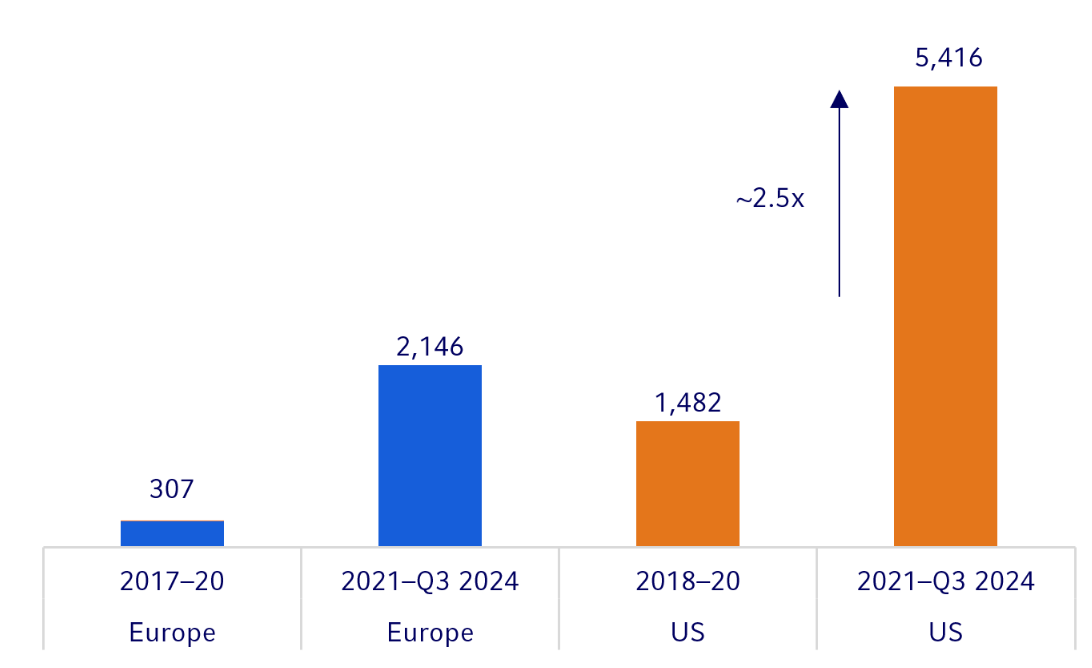

Short on Capital

Despite progress, roughly 65% of European defense-tech funding still comes from U.S. investors. Nearly 50% of late-stage rounds are funded by U.S. or Asian investors, with over 60% of $200m+ financings dominated by non-European sources. This imbalance creates both urgency and opportunity. Europe needs sovereign and allied capital to take advantage of the attractive valuations present in the market before other global investors do.

Deal Disparity

U.S. defense tech deal volume outpaces Europe by 2.5 times

Total venture deal volume for defense tech start-ups in Europe and the U.S. $ million

Source: McKinsey analysis, leveraging data by PitchBook, Inc.

The Bottom Line

The next 12–24 months represent a rare window for investors to capture outsized opportunities in European defense technology. Rising budgets, shifting ESG narratives and capital gaps have converged at the same time. Defense is no longer just about legacy primes—it is becoming a dynamic, innovation-driven ecosystem where start-ups and scale-ups are central to sovereignty and resilience.

Now is the time to act.

Why Russell Investments?

Russell Investments can help mobilize European capital by helping clients cut through the complexity of defense-tech investing and translate it into actionable opportunity.

Translating policy: We convert rising government budgets and strategic priorities into investable themes such as AI, cybersecurity, space systems and dual-use infrastructure.

Responsible investing: We provide frameworks that separate responsible deterrence and resilience from unacceptable exposures, helping investors align with both fiduciary duty and ESG mandates.

Credible innovators: Leveraging our global manager research and due diligence, we identify and connect clients with the most credible and scalable defense-tech companies.

Risk management: We integrate defense allocations into well-diversified, multi-asset portfolios, balancing opportunity with prudent risk control.