2019 ESG survey

The importance of environmental, social and governance (ESG) factors in investment decisions continues to grow exponentially—to the point where an understanding of ESG now appears critical to carrying out a skillful investment process. At Russell Investments, we are committed to helping our clients navigate this important and evolving aspect of investment management. In light of this, we surveyed 300 firms from the active management industry1 across equity, fixed income and private markets to understand how asset managers are integrating ESG considerations in their investment process. Our results are presented across the following categories:

- Formalization of responsible investment policies

- Dedicated personnel for ESG-related research

- The use of quantitative ESG data

- Engagement with portfolio companies

Corporate commitment to ESG policies and professionals

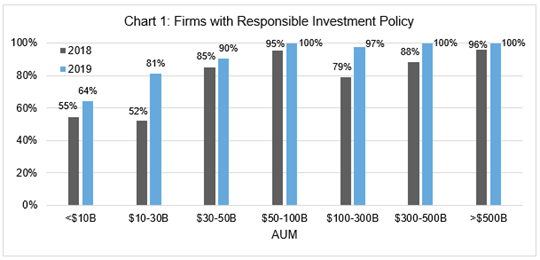

We surveyed respondents as to whether or not their organization had developed a Responsible Investment Policy on a firmwide basis—and were positively surprised to see that 82% reported having a formalized policy. That’s a 26% increase from 2018’s survey results—a significant rise in a year's time. As you can see in chart 1, the highest year-over-year percentage increases came from smaller-sized firms (i.e., <$10B USD, $10-30B USD). This indicates increased commitment to ESG considerations in small firms, although they may not have the same resources as larger firms where adoption was already strong in 2018.

Source: Russell Investments 2018 and 2019 ESG surveys

We also asked firms about personnel resources they have in place dedicated to ESG issues. Roughly 80% of firms with assets under management (AUM) greater than $50 billion have professionals spending more than 90% of their time in ESG-specific matters. Comparatively, only 20% of firms with AUM less than $50 billion have dedicated ESG professionals. Although smaller firms have demonstrated commitment to ESG integration through responsible investment policies, they have not yet made significant progress in staffing to support these efforts.

Leveraging data to make decisions

Firms are increasingly leveraging quantitative ESG data in their investment process. 73% of respondents rely on a combination of qualitative and quantitative data to develop ESG-specific insights. Consistent with 2018’s survey results, this year’s respondents are primarily using a combination of internally produced and externally provided ESG data. The most common external quantitative ESG data providers are MSCI, Bloomberg, Sustainalytics and ISS/oekem. On the contrary, 21% of respondents rely solely on qualitative data to develop ESG insights, down from 44% in 2018, with sources of information including direct engagement, company reports, regulatory filings and external vendors.

Engagement

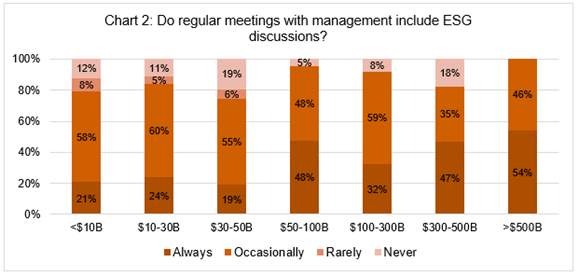

Governance continues to remain the most important ESG component, as claimed by 86% of respondents. Compared to 2018, 48% more of survey respondents always incorporate ESG matters in regular meetings with management. The increasing industry awareness and effort on engaging with portfolio companies is a positive development. Chart 2 shows 100% of firms with AUM greater than $500 billion either always or occasionally include ESG discussions in meetings with management, whereas 79% of firms with AUM less than $10 billion do the same.

ESG influencing decision-making

ESG factors are increasingly influencing investment decisions. 55% of respondents allow material ESG considerations to drive investment decisions. In terms of motivation, 36% of respondents claimed they were initially motivated to integrate ESG considerations into their investment process based on the opportunity for superior risk-adjusted returns, compared to 28% in 2018.

Regional differences

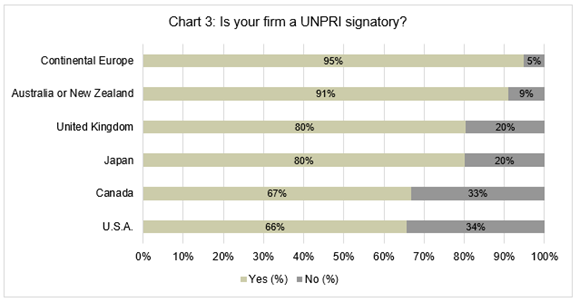

Consistent with our 2018 survey results, we continue to observe a clear distinction between ESG integration across regions. Continental Europe, the United Kingdom, Japan, Australia and New Zealand compare favorably to peers in the United States and Canada in chart 3 when comparing UNPRI signatory status.

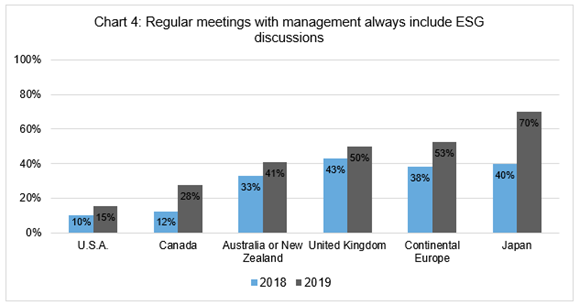

Regions that were already strong in regularly engaging with companies in 2018 continue to build on that momentum. As evidenced in chart 4, regions that were global leaders in engagement in 2018 continue to maintain that position in 2019. The U.S. made the least progress of all surveyed regions in terms of consistently including ESG discussions in meetings with management.

1 Source for ESG survey: Russell Investments research