Market

Outlook

Market

Outlook

PENT-UP EXUBERANCE

Soft-landing optimism can deliver more near-term market gains but the risks of a sharper economic slowdown later in the year are elevated. Although declining inflation means central banks can start easing in the second half of the year, the lagged impact of previous rate rises is yet to be fully felt.

From the desk of the CIO

As we step into the second quarter of 2024, I’m excited to share our latest Global Market Outlook.

The evolving landscape continues to present market anomalies that challenge traditional expectations and some long-held investment assumptions.

In 2023 we saw inflation fall rapidly – without the global recession that many leading economists said was needed to restore price stability.

In the U.S. specifically, price and wage pressures were reduced even though the economy delivered strong economic growth, which is rare.

Increased workforce participation helped improve the labour supply, reducing inflation without companies resorting to mass layoffs – a phenomenon we have not seen in post-World War history.

At the same time, globally, we are seeing other unexpected developments. In Japan there has been a notable shift in corporate behaviour, helping drive improved return on equity. In Canada, unlike the U.S., growth has been slow, and yet the market seems to expect the Bank of Canada’s actions on rates to be similar to the Fed. Meanwhile, returns across U.S. mega-cap stocks are increasingly divergent. For instance, Tesla is down 35% while Nvidia is up 78%.

Taken together, this complex economic and investment landscape calls for investors to strategically re-evaluate risk assets and have a more discerning approach. While the era following the Global Financial Crisis favoured a blend of active and passive investing, we believe the current climate demands a more assertive and judicious approach, incorporating fresh sources of alpha and diversification.

Our latest Global Market Outlook delves deeper into these emerging trends with valuable insights from our Chief Investment Strategist, Andrew Pease, and his team. Thank you for allowing us to share these with you.

Kate El-Hillow

President & Chief Investment Officer

Andrew Pease

GLOBAL HEAD OF INVESTMENT STRATEGY

2024 Global Market Outlook: Q2 update

Pent-up exuberance

Raphael Bostic, president of the Federal Reserve Bank of Atlanta, coined the phrase “pent-up exuberance1” in a recent speech. He was referring to the risk of renewed economic acceleration in the U.S., but it also captures the mood of investors. Economic growth is proving resilient, inflation is falling, and corporate profits are holding up, particularly for artificial intelligence-themed mega-cap stocks. Those investors who were fearful of recession in 2023 are being drawn into the market and positive momentum has the potential to push the S&P 500® Index to further record highs. Exuberance about the surprising robustness of the U.S. economy is spilling over to investor enthusiasm.

Is the U.S. labour market slowing down?

Scratch below the surface, however, and cracks are becoming visible. The U.S. labour market is cooling, with job openings down about 25% as of mid-March from their early 2022 peak, and there are signs that lower-income households are coming under stress. Default rates on credit cards and auto loans are above pre-pandemic levels. In the corporate sector, high-yield default rates are picking up and commercial real estate delinquencies continue to rise.

Corporates and households built strong defenses against U.S. Federal Reserve (Fed) tightening following the pandemic, accumulating large cash reserves and locking in low interest rates on 30-year mortgages and longer-term corporate bonds. These defenses, however, are now weakening. It is possible the Fed can calibrate monetary policy perfectly, so inflation settles near 2% and job growth cools from the average of 265,000 over the past three months to the near 100,000 per month needed to keep the unemployment rate from falling further.

The Fed’s dilemma is that delaying rate cuts and easing too slowly may create the risk of a recession, while easing too quickly could trigger the inflation rebound that Bostic worries about.

When could the Fed start cutting rates?

We are still in the this time is longer rather than this time is different camp with regards to the lagged impact of Fed tightening on the U.S. economy. Our concern is that the Fed’s caution about inflation being sticky will further delay rate cuts. This increases the likelihood that the soft landing currently priced by markets overshoots into a mild recession. We expect the Fed to start easing in the middle of the year. We will become more concerned about the longer-term outlook if Fed funds rate cuts are delayed to the end of the year.

What’s powering Europe’s economic resilience?

Economic resilience has also been the story in most other developed economies. Europe and Japan have surprised to the upside. Europe has been helped by natural gas prices that are lower than before the Russian invasion of Ukraine, the pick-up in global manufacturing activity and a recovery in bank lending growth. The European Central Bank (ECB) has hinted that rate cuts are likely to commence in June in response to the downward trend in core inflation.

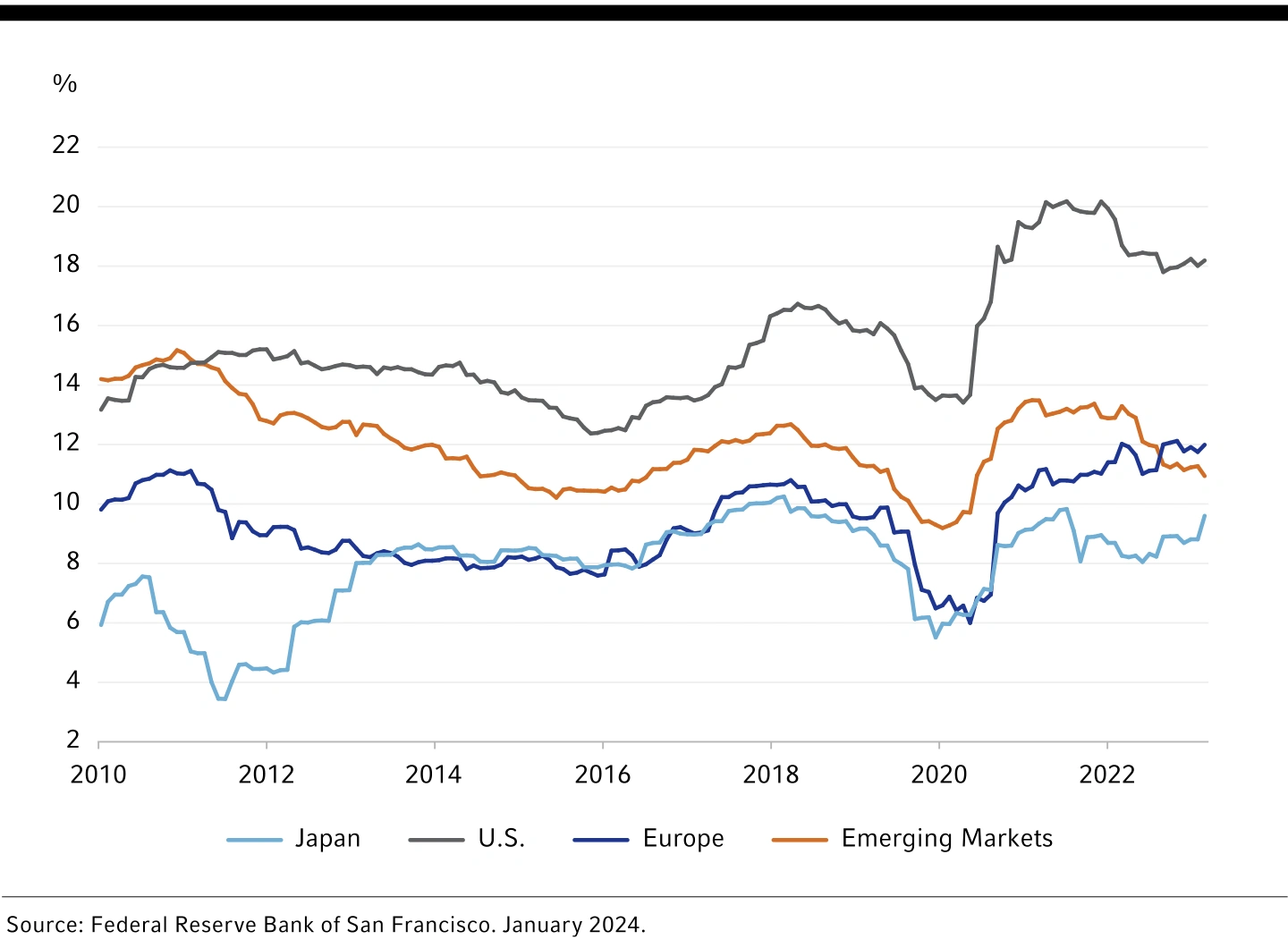

Japan is also beating expectations, both in terms of economic activity and corporate profits growth, and in financial markets where the Tokyo Stock Price Index (TOPIX) is the best performing market year-to-date. The risks around Japan are that corporate governance improvements are now fully priced into equity valuations, and that the Bank of Japan (BoJ) will threaten the economic revival by tightening policy and triggering yen strength.

The exception to the positive surprise narrative is the United Kingdom, where economic activity is subdued and inflation is falling more slowly than in other developed economies.

What’s China’s 2024 GDP growth target?

The news on China continues to be mixed. The property-market problems are far from resolved and the consumer price index is in deflation. The stimulus measures so far have been piecemeal, but the government’s 5% GDP growth target for 2024 suggests that more meaningful policy moves will be forthcoming.

Our 2024 annual outlook report in December proposed that this year would be a twilight zone between slowdown, possible recession, and recovery, where nothing is likely to be quite what it seems. Markets and forecasters are anticipating a soft landing, where inflation slows and growth cools without sliding into recession. This is possible, but we think the risks of economic growth eventually disappointing are underappreciated. Bostic’s warning of “pent-up exuberance” is one that investors should carefully consider. Just as last year’s investor pessimism was overdone, we worry this year’s optimism could eventually prove to be excessive.

The immaculate disinflation

At the peak of the inflation problem in 2022, most economists thought a global recession was both likely and needed to restore price stability. For example, Larry Summers, the distinguished American economist, argued the U.S. unemployment rate would need to rise to 10% to contain inflation within a year. Instead, inflation fell rapidly in 2023 without any meaningful damage to the business cycle at all – the immaculate disinflation. This disinflation occurred globally but was particularly immaculate in the United States, where price and wage pressures faded despite strong, above-trend economic growth.

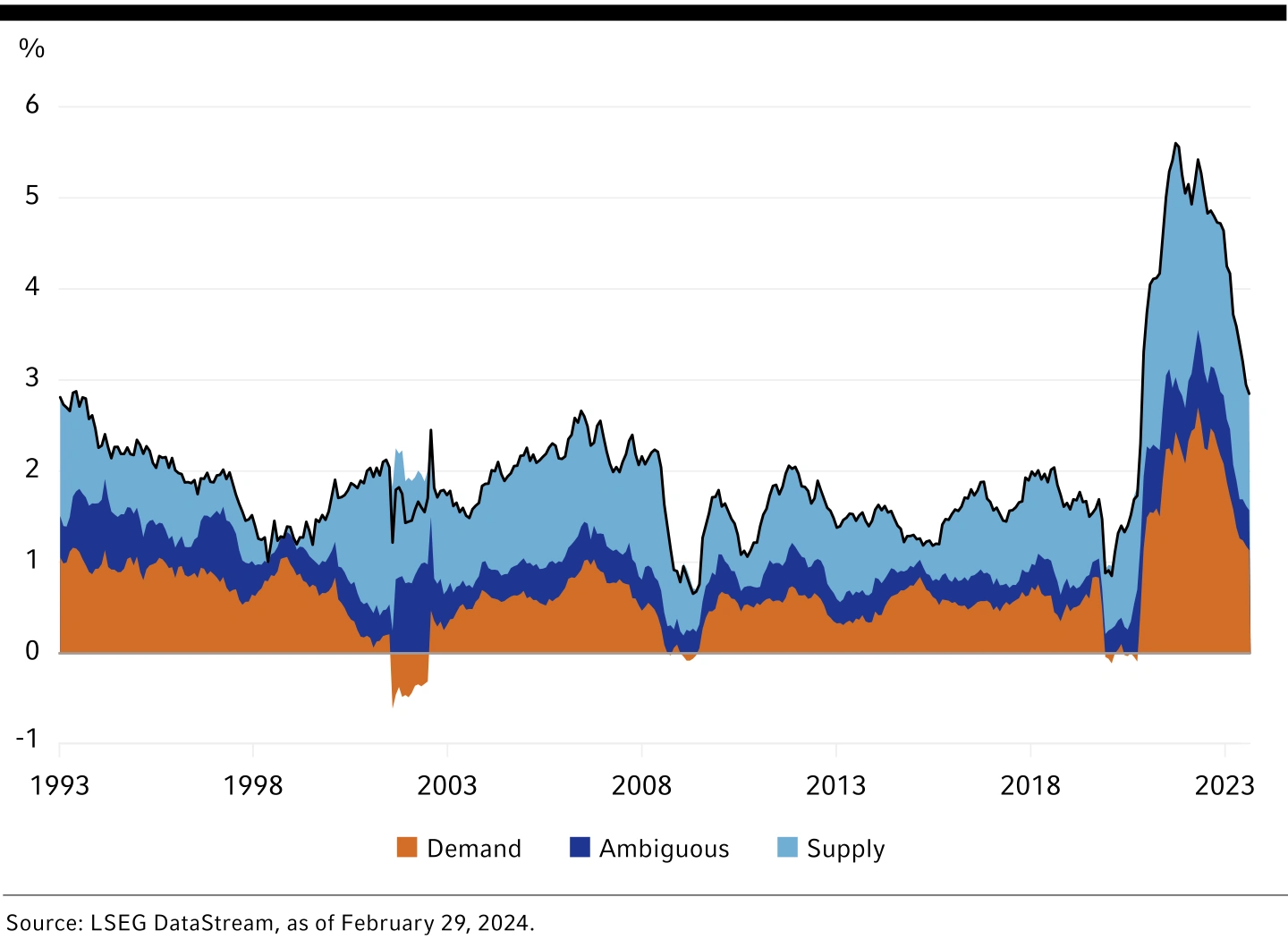

This is a rare and unusual constellation of outcomes. High inflation is principally a consequence of there being too much demand for goods and services relative to their available supply. Therefore, high inflation can be brought back under control through weaker demand, increased supply, or both. Importantly, supply-side gains offer a relatively painless way for overheated economies to rebalance, and these appeared to drive roughly two-thirds of the disinflation in the United States in 2023.

Core PCE inflation, y/y% change

What factors have helped inflation ease in the U.S.?

U.S. supply recovered in two ways. First, the supply of goods – which broke down globally during the pandemic due to factory closures, worker shortages, and shipping bottlenecks – now looks mostly healed. This was expected, but welcome. Encouragingly, core goods prices declined over the last eight months. Second, and more surprising to us, labour supply also recovered through a pickup in the participation rates of near-retirement age workers, disabled workers, and young women, but also through a surge in net immigration. This recovery in labour supply helped tame wage inflation without a need for widespread layoffs – something that has never happened before in the post-World War history of the United States.

In terms of the outlook, the U.S. economy is now in much better balance. Most industry estimates of the underlying inflation rate are back below 3%. We also see further disinflation in the pipeline as housing inflation moderates and becomes more in line with alternative, timelier rent measures in the coming months. We think 2%-2.5% inflation is in sight for year-end 2024 which should allow the Fed to start gradually transitioning policy back to a more normal setting over time. Upside inflation risks include pent-up exuberance, an economy that is still running close to full capacity, and the potential for further supply chain disruptions from the wars in Ukraine and the Gaza Strip. Downside risks to inflation include a recession, a productivity boom from the increased use of AI, and a more sustained recovery in labour supply. Importantly, the Fed is committed to its inflation target, which should keep realised inflation and inflation expectations close to 2% over the medium term.

The revival of Japanese corporations

The macro environment in Japan is shifting, with inflation expectations and wage growth moving higher. This change, plus initiatives from the Tokyo Stock Exchange, have seen corporate behaviour in Japan begin to evolve.

The Tokyo Stock Exchange is particularly targeting companies that trade below equity book value: equities that are worth less than the net assets. Initially, we saw several companies engage in stock buybacks to push their stock price toward book value. More recently though, we have seen the focus shift to actual reform and a focus on return on equity, including a pickup in mergers and acquisitions activity.

The chart below compares Japan’s return on equity2 to other major developed markets and emerging markets. We are starting to see some of these efforts bear fruit with a pick-up in return on equity. This is an encouraging sign; however, our valuation models are indicating that a lot of this ‘good news’ has now been fully priced into the market.

Return on equity, %

The U.S. primary fiscal deficit is currently around 5.5% of GDP. The last surplus was in 2001 and the deficit has averaged 4% of GDP over the past decade. The Congressional Budget Office predicts that the primary deficit will average 2.9% over the next decade. The yield on government debt would need to fall below 2% to prevent the debt-to-GDP ratio from rising further. The problem, of course, is that ongoing deficits will keep upward pressure on U.S. Treasury yields.

What steps can governments take to reduce deficits?

There are only two available choices for governments. One is to undertake the politically painful process of reducing spending and increasing taxes. The other is to allow higher inflation to boost nominal GDP growth and reduce debt in real terms.

Former Prime Minister Liz Truss’ short-lived government in the United Kingdom discovered the intimidatory power of the bond market last year when it tried to boost the economy with unfunded tax cuts. Bond investors saw there was no plan to reduce the fiscal deficit and control inflation. The yield on 10-year gilts rose by over 100 basis points in three days, Sterling plunged, and Truss was forced to resign.

A fiscal crisis in the United States or other major developed economies seems unlikely anytime soon (aside from Italy, which has made improvements). The UK example stands as a salutary lesson to other politicians. Our main conclusion is that the era of big fiscal expansions is over, and politicians are going to be constrained by the realities of debt burdens and interest costs. There will be less ability to respond to the next economic downturn with fiscal support. There is a risk that central banks will be forced to accommodate inflation above their targets, but as we learned in 2023, inflation is unpopular with voters. The bond market bullies are back.

Regional snapshots

Eurozone

Eurozone economic activity indicators are surprising to the upside while core inflation is tracking toward the European Central Bank’s (ECB) 2% target. The growth tailwinds are coming from falling energy prices, real wage gains for households and a rebound in global manufacturing activity. The recovery in bank lending suggests the positive economic momentum can be maintained over the next quarter. We expect economic growth will slow later in the year as the lagged impact of ECB tightening flows through, but the risks of a deeper downturn are declining. The ECB has hinted it could begin cutting rates in June; easier monetary policy will help cushion the slowdown.

European indexes lack the AI-themed stocks that have boosted the S&P500, but are cheap relative to the U.S. They could benefit if earnings can outpace the relatively lacklustre market consensus of just 2.8% earnings-per-share (EPS) growth this year.

United Kingdom

The outlook for the UK continues to be challenging. GDP (gross domestic product) growth is stagnant, and inflation is declining at a slower pace than for other developed economies. Market expectations are for the Bank of England (BoE) to begin lowering interest rates in the third quarter, which will provide some relief, but the impact of the substantial rise in 2-to-5-year fixed-rate mortgage interest rates is still to be fully felt.

The opposition Labour Party, led by Keir Starmer, holds a strong lead according to recent public opinion polls and an election is likely before the end of the year. The incumbent Conservative Party government has cut some taxes to boost its poll ratings, but as these are pushing in the opposite direction to monetary policy, a risk is that they could delay the BoE’s monetary easing.

Fixed income markets appear to have priced in two to three 25-basis point BoE rate decreases, which we believe seems an underestimate given the underlying weakness of the economy. UK gilts are attractive with the 10-year yield at 4.1%.

United States

A surprising recovery in labour supply has brought the U.S. economy back into better balance. While the Fed is not in a hurry to cut interest rates, the progress it is making on inflation should warrant gradual rate cuts starting around mid-year. We think it is more likely than not that the United States can avoid recession in 2024 but uncertainty remains high given the economy is running at full capacity, household savings are diminished, the labour market is slowing down, and the yield curve remains inverted. Market psychology is optimistic but not euphoric. Market pricing assigns very low odds to a recession and the industry consensus expects strong, 10% earnings growth for the S&P 500 in 2024. These expectations are achievable, but investor optimism creates a cautious asymmetry where a focus on portfolio diversification is key. We continue to see good value in U.S. Treasuries at current yield levels.

Japan

We expect trend-like growth from Japan through the rest of the year. Wage growth and inflation expectations have moved toward levels that are consistent with the Bank of BoJ's inflation target. This should allow the BoJ to normalise policy slowly through 2024. The market expects interest rates to rise 0.4% this year, which may be challenged by the global easing cycle.

Japanese equities stand out as overvalued across our valuation models following the impressive run over the last six months. We expect upward pressure on bond yields this year as the central bank reduces bond purchases and gradually lifts the policy rate. The Japanese yen looks very cheap but is unlikely to appreciate much until the Fed cuts U.S. interest rates and/or the global economy slows.

China

China has announced a 2024 GDP growth target of ‘around 5%’. Unlike last year, the economy will not benefit from the post-pandemic reopening, and we expect that 5% growth will be a difficult target to achieve. Fiscal policy is providing only limited support, but more measures may be implemented if the 5% GDP growth target is under threat. The health of the consumer will be a key watchpoint, as well as any indication that China is remaining stuck in deflation.

Chinese equities are cheap, trading at less than 10 times earnings. Our sentiment model suggests highly oversold levels, but this has pulled back slightly after the recent rebound. Analyst expectations for 15% earnings growth this year are achievable should the economy see some reflation and growth momentum.

Canada

Canada has avoided recession, but growth remains lackluster, and we believe a recession is more likely than not over the next 12-18 months. GDP growth contracted in the third quarter of 2023, while average annual growth was roughly 1.0%, below its potential rate3 of about 2%. Preliminary estimates in 2024 indicate GDP is tracking toward positive growth.

The Bank of Canada (BoC) recognises the economic challenges and has indicated rates are sufficiently restrictive. The BoC, however, is awaiting evidence of inflation sustainably moving toward its 2% target before cutting the policy rate. It is a delicate balancing act: delaying rate cuts too late risks recession, while acting prematurely could fuel the housing market and inflation. Nonetheless, by mid-year, we believe the BoC will have the evidence that it seeks to start cutting its target rate.

Given that GDP and employment trends have been weaker in Canada, it is perplexing that markets have similar rate cut expectations for the BoC and the Fed by year-end. We expect the BoC should eventually cut rates more than the Fed. Our economic outlook favours Canadian government bonds, while we remain cautious towards Canadian equities due to their cyclicality.

Australia and New Zealand

We expect the Australian economy to continue with below-trend growth but should avoid recession. Wage growth is moderating and inflation is below the Reserve Bank of Australia’s (RBA) forecasts. Labour demand has been slowing, and labour supply growth is being lifted by high immigration levels. The housing market has remained resilient through the cash rate increases, and we expect this will continue. The RBA will likely lag other central banks in cutting rates, and we expect the first rate cut at the end of the third quarter.

Australian equities valuations are cheap relative to the U.S. but in line with other developed markets. Australian government bonds still offer attractive value, despite trading below U.S. government bonds. The Australian dollar should see some upside through this year on the back of improving interest rate differentials.

The New Zealand economy has been under more pressure than Australia, in large part because the Reserve Bank of New Zealand (RNBZ) tightened monetary policy more aggressively. The positive signs are that business confidence has been rising and the RBNZ has signalled the hiking cycle is likely finished.

New Zealand equities look expensive relative to Australia and international equities. New Zealand bonds are fairly priced and offer some upside if the economy experiences a more severe slowdown and the RBNZ is forced to cut rates more aggressively.

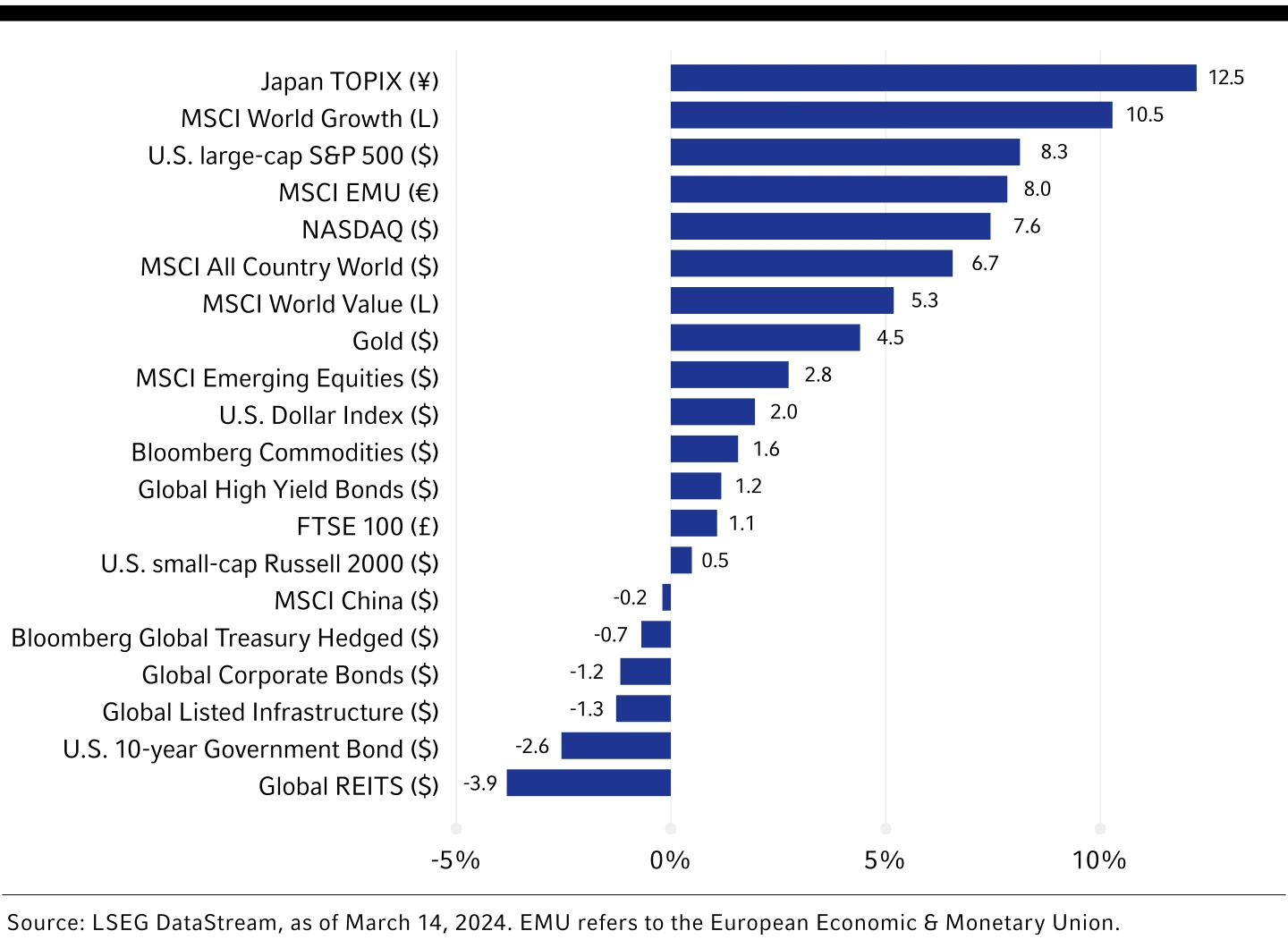

Asset-class preferences

2024 is off to the races again with strong equity market returns across Japan, Europe, and the United States. Within the U.S. market, the Magnificent Seven stocks4 continue to outperform benchmark exposures but returns across these mega-caps are increasingly divergent. For example, Tesla is down 35% while NVIDIA is up 78% on the year through March 14. The Russell 2000® Index – which measures the performance of small-cap U.S. companies – is flat on the year and remains 17% below its peak from 2022 as smaller companies bore the brunt of higher interest rates and generally show weaker profitability. Meanwhile, China continues to hold the emerging markets back as its measured policy response and property market challenges have left many global investors sitting on the sidelines.

Asset performance since the beginning of 2024

Our cycle, value, and sentiment (CVS) investment decision-making process is still slightly cautious toward markets for the year ahead. Smart diversification with listed real assets and private markets complementing traditional portfolio exposures is likely to be important to weather the wide range of potential scenarios confronting investors.

Public equity valuation multiples are expensive – particularly in the United States – and corporate credit spreads are tight. Rich valuations dampen the outlook for risk assets. Government bonds, by contrast, look attractively priced with U.S. Treasury yields continuing to trade well above expected inflation.

What’s the business cycle outlook?

The global business cycle outlook has brightened over the quarter with the U.S. economy coming back into better balance, early signs of a positive inflection in the global manufacturing cycle which could benefit Europe, and improving return on equity as a result of recent structural reforms in Japan. While we think it is more likely than not that the U.S. can avoid a recession in 2024, uncertainty is still elevated, and markets have priced in all, if not more than all, the positive news in recent months.

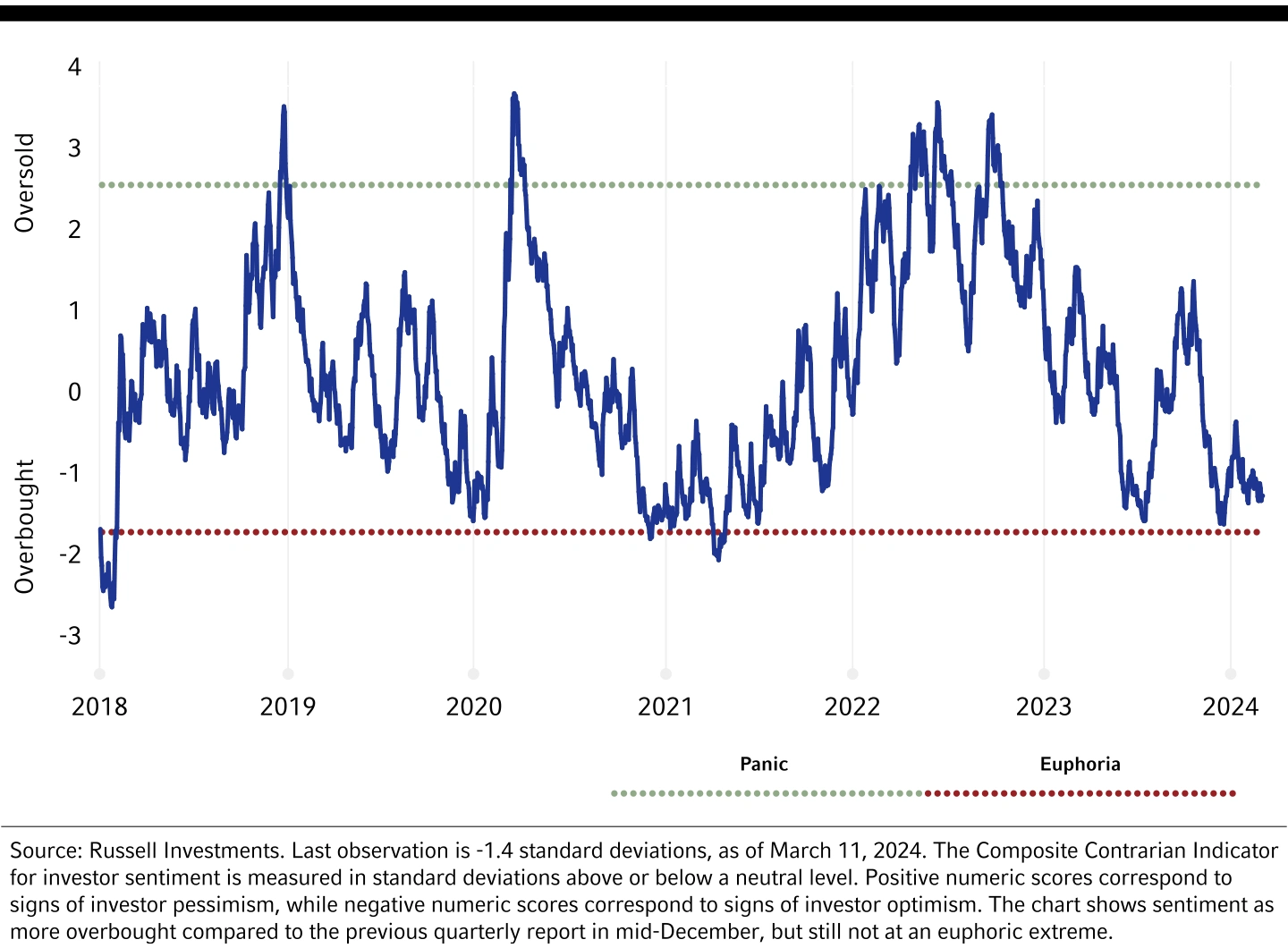

Our proprietary index of investor psychology confirms this optimism in markets and shows that most investors are bullish as of mid-March. These sentiment readings directionally reinforce the idea of downside asymmetry in markets. Importantly, however, sentiment has not moved to an unsustainable extreme of euphoria that would warrant a significant risk-off posture in portfolios.

COMPOSITE CONTRARIAN INDICATOR:

INVESTOR SENTIMENT NOT YET AT EUPHORIC EXTREME

On balance, our CVS decision-making process leans slightly cautious but does not show markets at an extreme that would incline us to position portfolios markedly risk-on or risk-off. Instead, most of our portfolio strategies at the beginning of the second quarter of 2024 are emphasising security selection and diversification to protect client outcomes across a wide range of potential scenarios in the year ahead.

- The equity market outlook is constrained by expensive valuation multiples, optimistic industry consensus earnings growth expectations, and overbought sentiment. We previously preferred Quality equities – profitable companies with strong balance sheets – however that overweight was neutralised in February following a stretch of strong performance for these stocks.

- Our portfolio strategies are neutral across major equity regions. Non-U.S. developed equities still trade at a steep discount to U.S. equities but there is significant uncertainty around the ability for these markets to deliver differentiated earnings. Chinese equities have sharply underperformed in recent years. The market is very cheap, with the index trading at book value and many companies trading in-line with the value of the cash on their balance sheet. Our proprietary measure of market psychology shows extreme pessimism towards Chinese equities, which is a positive signal for the market outlook. However, China faces numerous structural challenges, weak consumer confidence, and has thus far only delivered a measured policy response to support its economy and markets. We are neutral to slightly overweight China across our equity portfolio strategies with the latter largely driven by where our underlying money managers are finding the best value in emerging markets.

- Government bonds provide attractive value for investors as yields still trade well in excess of expected inflation. Markets are not currently putting much weight on the possibility of adverse economic scenarios. Therefore, if developed market economies slow or slip into recession, we expect central banks to cut interest rates more aggressively than what is currently priced into forward curves. U.S. Treasuries are a preferred overweight exposure where our fixed income strategy team sees particularly good value in the five-year point of the yield curve. They also see potential for the curve to re-steepen if more aggressive rate cuts are delivered in the next few years. Our favourable outlook for government bonds still extends across most major developed sovereign markets, including Canada, Germany, Australia and the UK. The only notable outlier is Japan, where yields are depressed and out-of-synch with the rest of the world.

- U.S. High yield and U.S. investment grade spreads are very tight into an environment of elevated economic uncertainty, leading us to dampen our normal strategic overweight to corporate credit.

- The prospect of developed market central banks cutting interest rates in 2024 should be a major tailwind for real estate. Real Estate Investment Trust (REIT) valuations continue to look attractive. Given the significant uncertainty surrounding the macro-outlook, we think the defensive nature of infrastructure investments make them a useful lever for portfolio diversification – cushioning the portfolio in a market downturn, while not giving up significant upside potential should a soft landing come to pass. Oil prices might remain rangebound as the tug-of-war between softer growth and supply constraints from the OPEC+ group of oil-producing countries continue. Gold, which is trading at near record highs, appears overvalued relative to current real yields. While gold prices may soften later this year, several factors – elevated recession risks, the potential for lower real interest rates, heightened geopolitical tensions, and structural support from central bank purchases – still create a favorable cyclical environment for gold that could mitigate the extent of price declines.

- The U.S. dollar is expensive which suggests potential for the greenback to decline over the medium-term. However, the potential for a global recession in 2024 could result in further upside for the dollar in the short term as investors flock to the relative safety of U.S. assets. We believe these two-sided risks warrant a neutral stance.

- Private credit yields are still high even as public credit yields have compressed, creating attractive return opportunities for private credit. Interest rate floors in private credit can help preserve yield in floating rate private credit even when central banks start cutting interest rates. Elevated macroeconomic uncertainty will likely create a dispersion of returns amongst private credit funds – where fund managers with the most robust diligence processes will likely fare better. The increase in mergers and acquisitions activity amid optimism around lower interest rates and the prospect of a soft landing should help unlock more high-quality investments for private equity funds. At the same time, an improved initial public offerings (IPO) market could also offer better exit opportunities for private equity holdings and enable more distributions to limited partners.

Prior issues of the Global Market Outlook

1 Raphael Bostic commented on March 4, 2024, that business leaders were ready to "pounce" at the first hint of a U.S Federal Reserve (Fed) rate cut. "This threat of what I'll call pent-up exuberance is a new upside risk that I think bears scrutiny in coming months," he said.

2 Return on equity (ROE) is a ratio that provides investors with insight into how efficiently a company’s management team is handling the money that shareholders have contributed to it. In other words, ROE measures the profitability of a corporation in relation to stockholders’ equity. The higher the ROE, the more efficient a company's management is at generating income and growth from its equity financing.

3 Potential growth approximates what the sustainable growth rate is for the economy. It is roughly calculated as long-term growth in productivity plus growth rate of the labour force.

4 The term "Magnificent seven" refers to the most dominant tech companies: Apple, Alphabet, Microsoft, Amazon, Meta Platforms, Tesla and Nvidia.