Managing success: How do active managers handle increasing AUM?

We’ve been talking a great deal recently about the debate between active management and passive investing. In our multi-asset approach, we take an active and passive approach to building portfolios. We firmly believe active has a place, but only when you have skill in selecting active managers. Finding the right managers is hard work.

Toward that end, we have our own sets of preferences, which we believe contribute to active manager outperformance. And it’s no secret that we believe, all else being equal, active managers will do better with a relatively small amount of assets under management (AUM). The reasoning behind this is a combination of science (in the form of 15 years of data and in-depth analysis) and art (in the form of face-to-face meetings with managers, for nearly 50 years, and assessing multiple more nuanced factors). Less AUM to manage means, in the simplest terms, more nimbleness when it comes to finding upside opportunities and managing against uncompensated risk. This is especially true in portfolios with liquidity constraints.

Our early research on the “Perils of Success,”1 and University of California Professor Jonathan Berk's2 well-known 2005 conclusion that "competition between them increases the size of the fund and drives the alpha to zero. Instead the manager himself captures this value through the fee he charges" both support the preference for smaller AUM managers.

In all of these examples, the presumption is that size alone can erode success. The most damning, however, is Berk’s conclusion. Is it true? Can active managers kill the goose that lays the golden egg? And why would investors continue to fund the active manager once the manager has extracted all value?

Yet, we note that some active managers have demonstrated the potential to generate strong performance, even with large AUM, across several equity and fixed income strategies and regions. The general data also show us that increasing AUM is not necessarily the kiss of death.

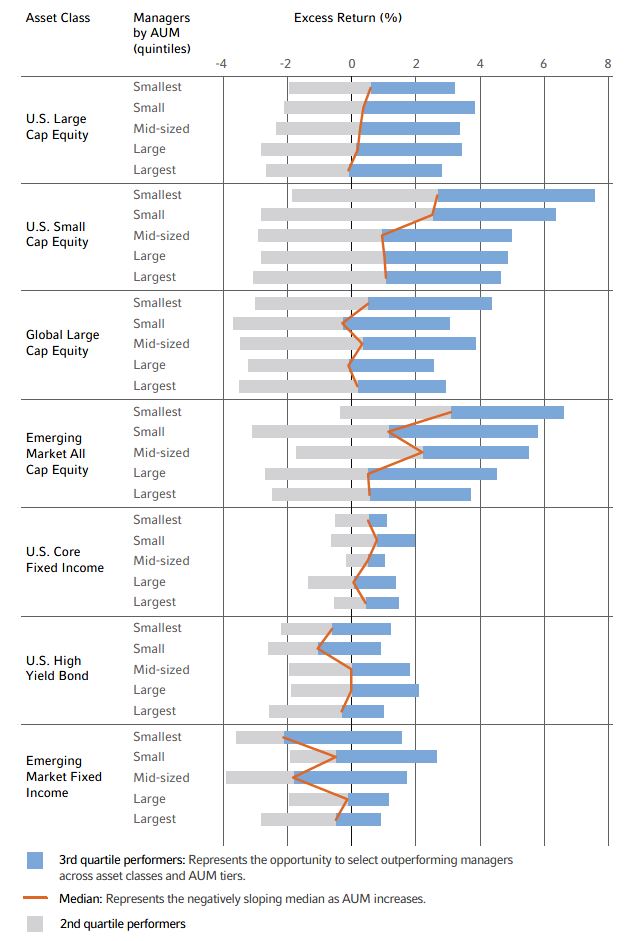

Exhibit 1 displays the interquartile ranges of one-year returns (2001-2015), broken out by AUM quintiles, for active managers across various equity regions and fixed income strategies. While we observe a (mostly) downward trend for the range of excess returns as AUM increases in the equity regions, the third quartile performers have positive excess returns. Additionally, the median performers are mostly positive.

In the case of equity, we find the negative AUM size effect is strongest for U.S. small cap and emerging markets equity where, as investors would expect, liquidity is more of an issue. Yet even in the U.S. small cap space, we find that increasing AUM is not as strong a detractor as it was 15 years ago when we did our first study.

In the case of fixed income, a trend is not so clear. Yet, in the case of fixed income strategies, we also observe strong upside for the third quartile performers.

Exhibit 1: Can managers with more assets outperform?

Why? We suspect that skilled active managers may carefully manage their AUM to have it both ways. A reasonable strategy for them is to collect profits while also providing value to their clients in the long run. In a way, they are self-regulating.

So, if we have evidence of larger AUM managers producing strong returns (and indications that it’s in their best interests to do so), how do these active managers manage their success? Especially when market impact, costly trading and illiquidity are constantly nipping at their heels.

We put these questions to our own team of specialist manager research analysts and captured a number of insights. We learned that the differences between an analysts’ AUM watchpoint and the reasonable upper limit of capacity—and indicators of rising AUM causing negative return impacts—vary considerably across asset classes and strategies.

Our analysts typically see active managers seeking to accommodate and manage rising AUM by increasing the number of holdings, reducing their active share, reducing turnover, moving toward more liquid stocks and even closing products to new AUM at reasonable capacity limits. Some managers do this better than others and, through our 48 years of researching managers, we’ve identified some of the better techniques used by managers to increase their chances of success.

Managers who accommodate AUM growth effectively tend to:

- Manage growth, so that it doesn't come too quickly

- Don’t hide growth in multiple, similar products

- Stay in their habitat (e.g., capitalisation, risk profile)

- Stay invested (i.e., less in cash)

- Play liquidity well, and are mindful of their investment horizon

- Are mindful of cash flow requirements

- Employ wise use of derivatives and other capacity expanding securities

Ultimately, our conclusions support an investment community that is mindful of AUM limitations and has learned to manage AUM growth well.

1 Christopherson, Jon, Zhuanxin Ding, Greenwood, Paul. (2001). “Perils of Success”. Russell Investments.

2 Berk, Jonathon B., (2005). “Five Myths of Active Portfolio Management,” The Journal of Portfolio Management, Vol. 31, Issue 3, Pages 27-31.