Executive summary:

- Momentum strategies outperformed in Q1 2024 due to strong investor sentiment and economic strength, with the MSCI All Country World Index (ACWI) rising by 8.3%.

- Russell Investments' Factor Portfolios (RFPs) like Global Large Cap Growth, Momentum, and Quality outperformed the MSCI ACWI, while Global Large Cap Value, Size, and Low Volatility portfolios underperformed.

- Performance dynamics varied across factors and regions, but Momentum consistently outperformed and Size consistently underperformed, while a rotation from Growth to Value occurred throughout the quarter.

Overview

Strong investor sentiment and continued economic strength led momentum strategies to outperform in Q1 2024, with the MSCI ACWI Index up by 8.3% in the first quarter. During the quarter, investors did not express overt concern over the prospect of the U.S. Federal Reserve (Fed) holding higher interest rates over a longer period and continued the upward trend in stock prices from the prior quarter. The MSCI Emerging Markets Index gained less (+7.9%) than the U.S. and MSCI World ex-U.S. Indices (+12% and +10.6%, respectively). While the Momentum factor sustained its outperformance throughout the quarter, we observed a rotation out of Growth and into Value across all regions starting in February.

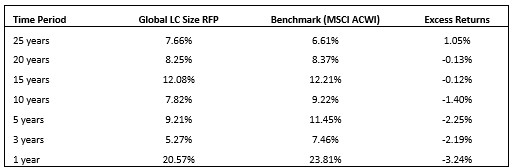

When considering Russell Investments’ Factor Portfolios (RFPs), the Global Large Cap Growth, Momentum and Quality outperformed the MSCI ACWI, with positive excess returns of +1.98%, +3.8%, +0.4%, respectively. Conversely, the Global Large Cap Value, Size and Low Volatility portfolios underperformed, with negative excess returns of -0.5%, -2.3% and -1.5%.

Figure 1: Cumulative excess returns for Global Russell Investments Portfolios vs. MSCI ACWI

(1/01/2024-03/29/2024)

Source: Russell Investments and MSCI

Factor Performance

Global Russell Investments Factor Portfolios’ performance dynamics

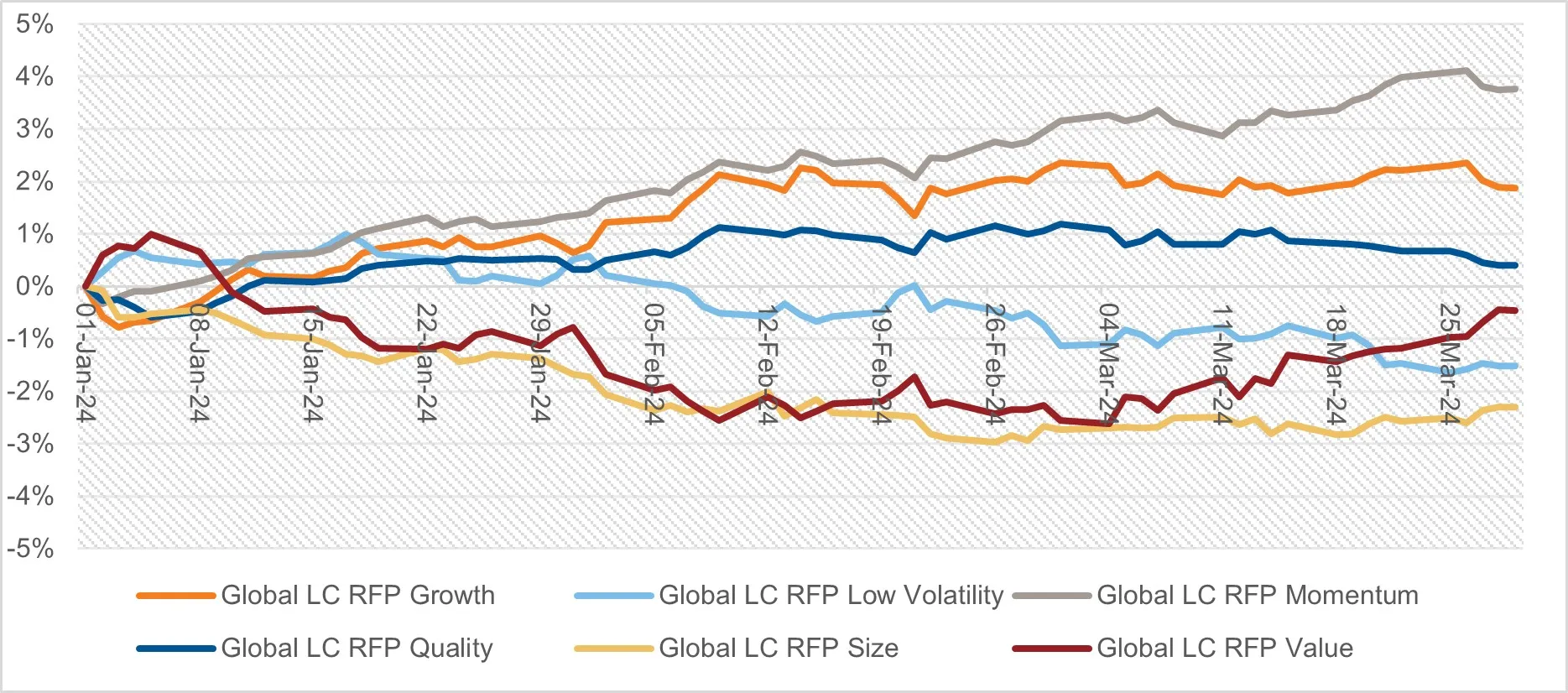

The performance dispersion among Global Russell Investments Factor Portfolios (RFPs)this quarter was quite large at the beginning of the quarter with value and growth having a 3% performance deviation. As the quarter progressed, value stocks had a strong reversal, underperforming in January and early February but flipping that trend at the end of February and into March. It was the opposite for Growth, which outperformed early in the quarter and then gave up those gains as the quarter progressed. Momentum consistently outperformed through the quarter while Low Volatility consistently underperformed. Quality started the quarter with positive gains but turned negative as the quarter progressed.

Figure 2: 10-Day rolling excess returns for Global RFPs vs. MSCI ACWI

(01/01/2024-03/29/2024)

Source: Russell Investments and MSCI

Russell Investments Factor Portfolios’ performance across regions

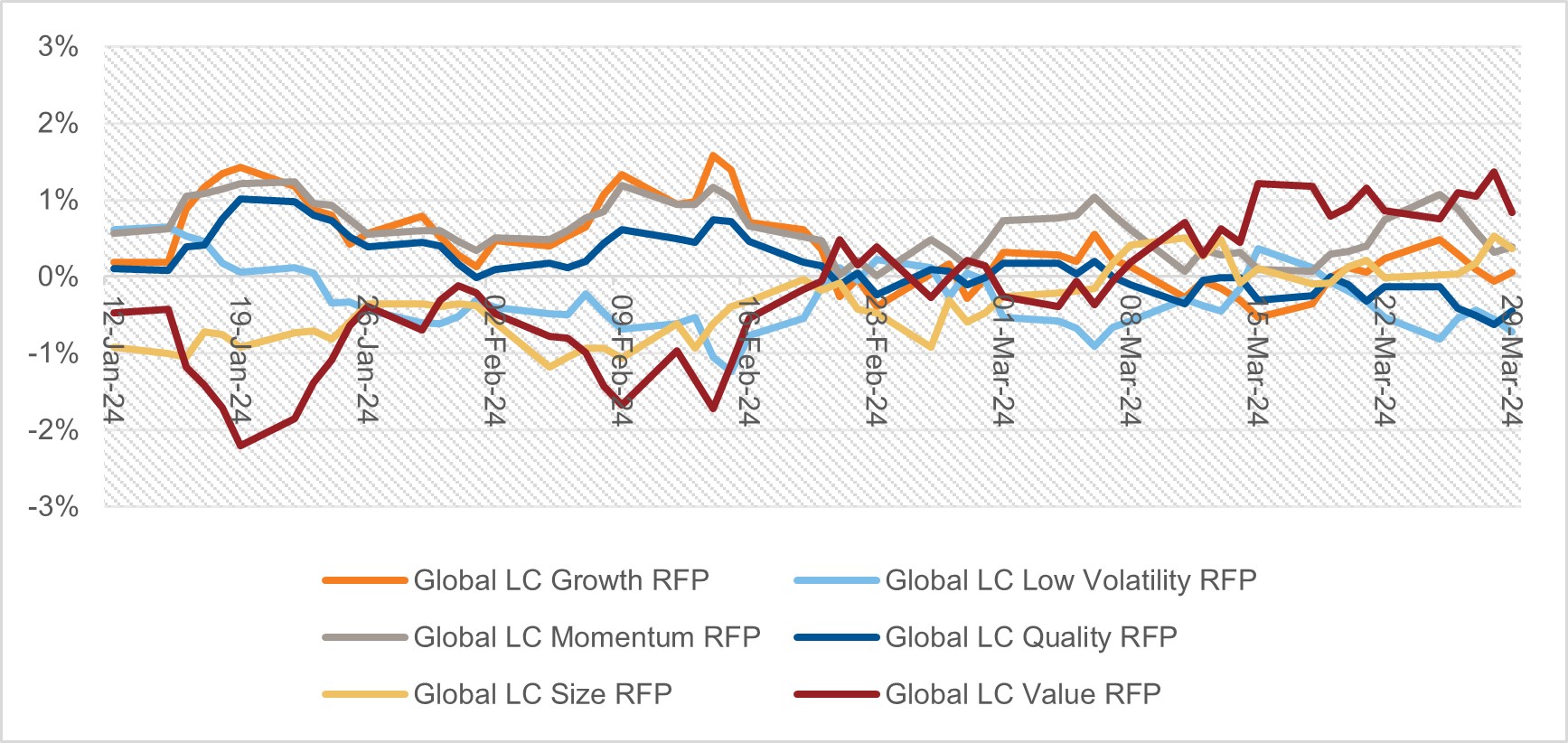

In the first quarter of 2024, the performance of the factor portfolios across regions continued to trend similarly with the largest outperformers and underperformers observed in the prior quarter. The Momentum factor strongly outperformed, while Size factor strongly underperformed across all regions. The U.S. and Developed ex-U.S. Large Cap Growth factor diverged this quarter with outperformance in the U.S. of 1.9% and underperformance in the ex-U.S. region of -1.7%. Emerging Markets outperformed by 0.9%. The performance of Value and Quality was mixed in terms of direction, but Low Volatility and Growth had a higher dispersion across regions. The strongest performance among factors was seen in Developed ex-U.S., where Large and Small Cap Momentum outperformed by 4.1%. The weakest performance among factors was in Developed ex-U.S. Small Cap, where the Size factor underperformed (-4.5%).

Figure 3: Excess returns of RFPs vs. corresponding benchmarks (Q1 2024 and Q4 2023)

Source: Russell Investments; FTSE Russell; MSCI

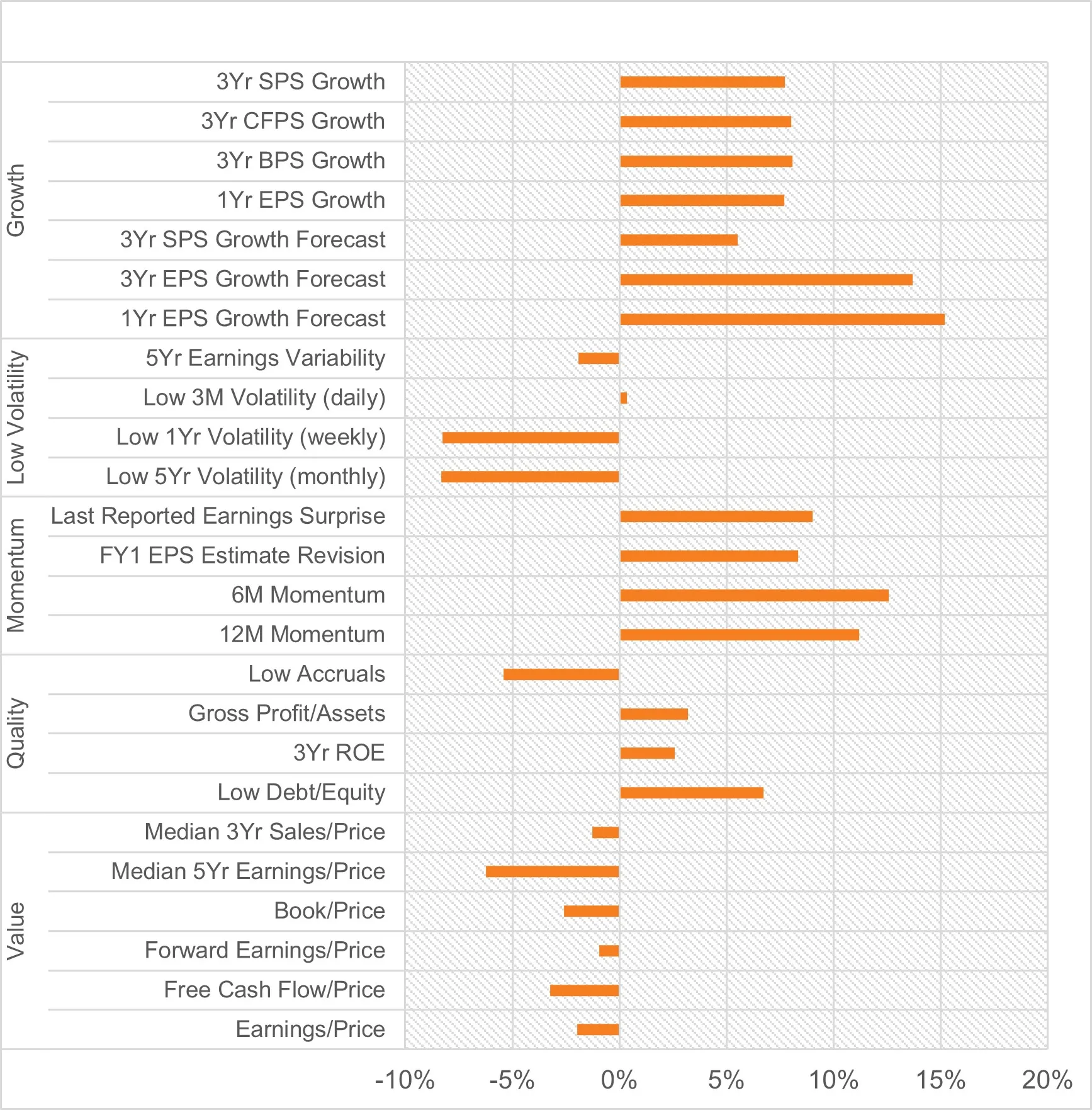

Performance of subfactors in the global universe

Figure 4 below illustrates the performance of various subfactors in the MSCI ACWI universe for the last quarter, represented by top minus bottom quintile portfolios.1 All Value subfactors underperformed in Q1, continuing a trend from the prior quarter. The underperformance of Value was somewhat moderated with a positive rotation into the factor in March. Most Low Volatility subfactors underperformed as well with 3 Monthly Daily Volatility as the lone exception, with a small outperformance of 0.4%. 5-Year Monthly Volatility had the weakest performance with a -8.3% return. The performance of all Momentum and Growth subfactors was strongly positive with 1-Year EPS Growth Forecast having the best performance for the quarter with a robust 15.2% return. Quality subfactors also outperformed with accruals being the lone exception.

Figure 4: Performance of cap-weighted top-minus-bottom quintiles (Q1 2024)

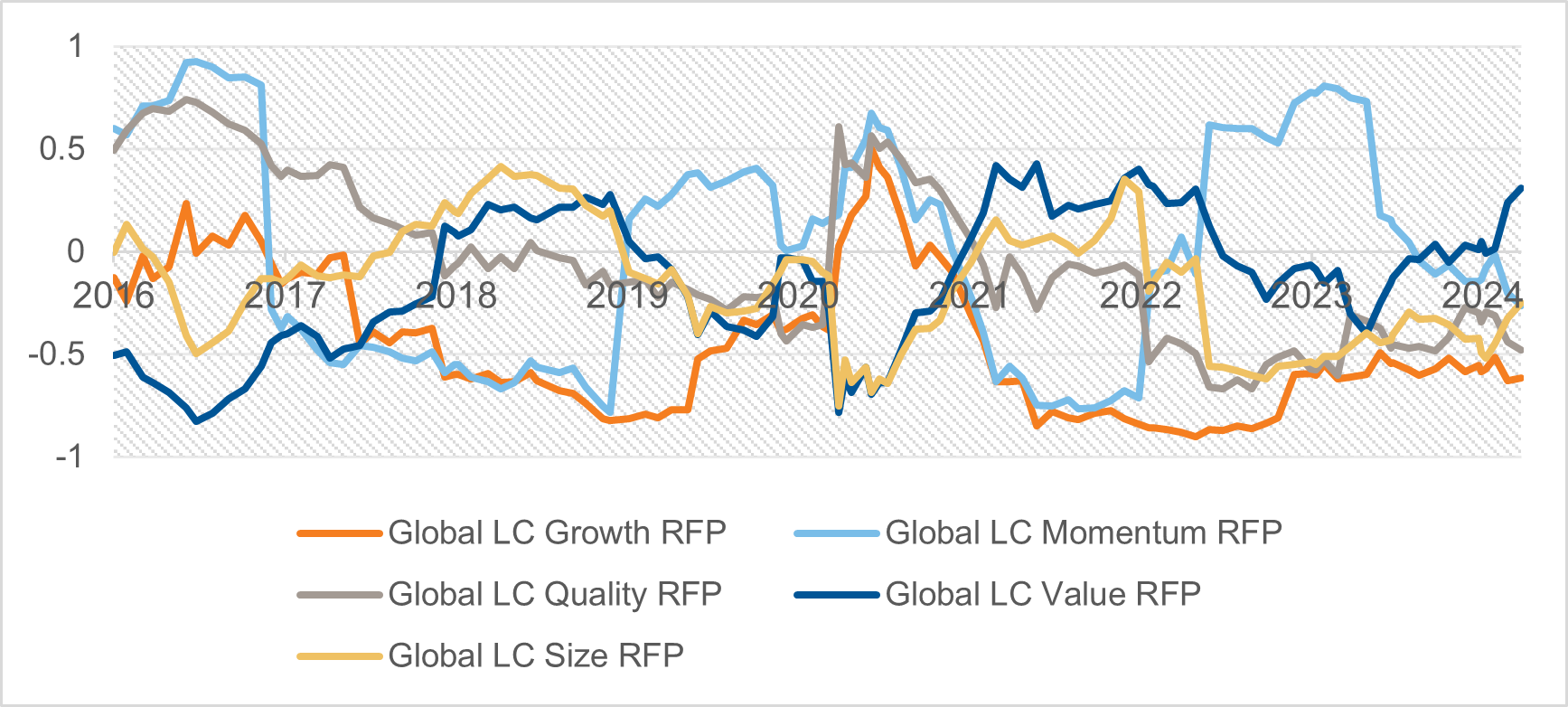

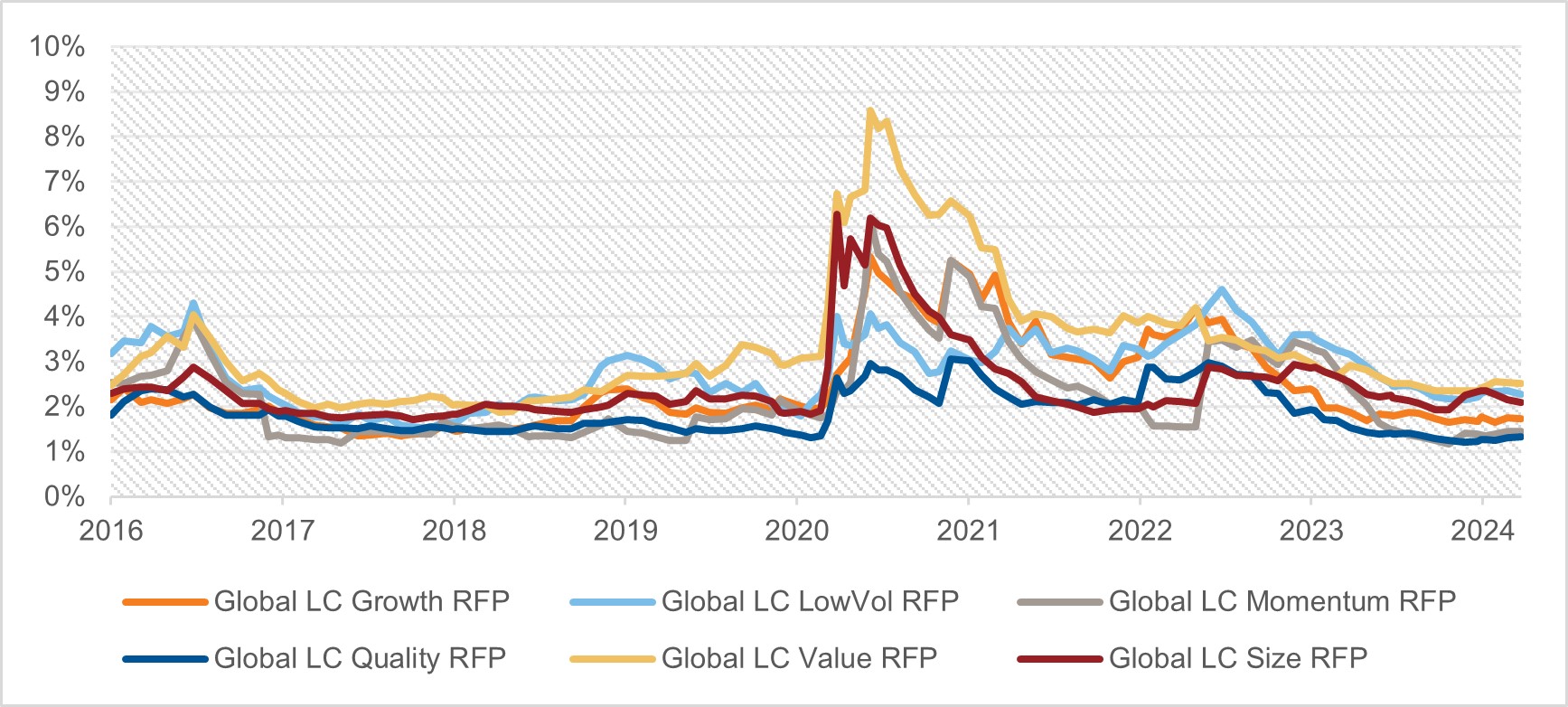

Ex-ante correlations and active risk of Global Russell Investments Factor Portfolios

In the first quarter, we see a continued rise in correlations between the Value factor and Low Volatility, as illustrated in Figure 5 below. A shift in the trend between Size and Low Volatility from the prior quarter accelerated from being negatively correlated to uncorrelated. Momentum continued its trend of moving from positively correlated with Low Volatility at the beginning of the year to uncorrelated. The rest of the correlation estimates have largely remained stable, with no significant changes. An uptick in the ex-ante active risk levels—predictive measures of the active risk associated with factor portfolios in Figure 6—for Size in the prior quarter has moderated in Q1 2024. The remaining factors have maintained on a consistent downward trajectory, continuing a signal from the prior quarter of a return to normal in the active riskiness of these portfolios.

Figure 5: Ex-ante correlations with Global LC Low Volatility RFP (01/2016-03/2024)

Source: Russell Investments; Axioma; MSCI

Figure 6: Ex-ante tracking errors of Global RFPs (01/2016-03/2024)

Source: Russell Investments; Axioma; MSCI

Spotlight on: The importance of size in factor portfolios

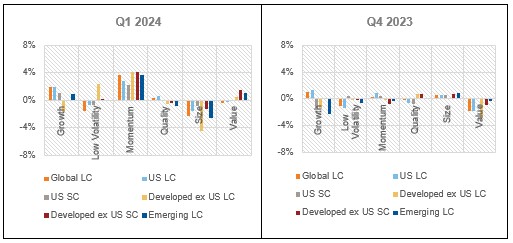

Since its introduction in academic research in 19812, the size factor’s premium has been less pronounced with the past two decades having an extended period of underperformance (Figure 7). The size premium refers to the potential positive difference in performance between smaller and larger companies. These results have been reported by others in the industry and in academia.3

Source: Russell Investments and MSCI

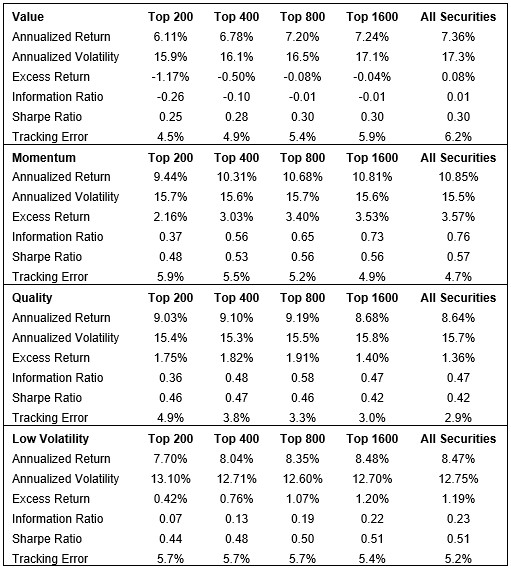

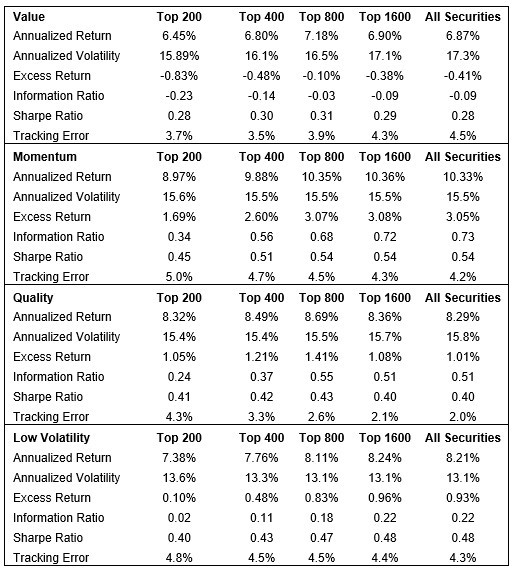

However, size still plays a significant role in the risk and returns of factor portfolios. There is significant evidence that the performance of other factors is improved when combined with the size factor. In this analysis, we investigate the relationship between factor portfolios and size exposure. For this, we apply the Russell factor portfolio methodology using the MSCI ACWI universe but restrict the selection universe to the top 200, 400, 800, 1600 and all securities by each security’s market cap. To fully reflect the impact of the size exposure, we make one modification to the portfolio construction by removing all investability constraints.

In Figure 8, we can see that as the size exposure is increased, the excess returns of the other factors (except Quality), increase but at a marginally decreasing rate. Surprisingly, the volatilities of the portfolios do not increase materially except for the Value factor where we see an increase from 15.9% in the top 200 scenario to 17.3% when all securities are considered in the opportunity set.

Tracking errors decrease for all the portfolios except for the Value factor as the number of securities increased. The biggest decrease in tracking error is in the Quality factor where it is almost halved when only 200 securities are in the opportunity set versus when all securities are included. In the Value factor, tracking errors rose as the size exposure increased.

When comparing the all-securities to the top 200 scenario, the biggest improvement in excess returns occurs in Momentum where the excess returns are improved by 1.4%, followed by Value and Low Volatility (1.24%, 0.78%, respectively). Quality is the only factor where the returns were lower between these scenarios with the all-securities scenario lower by 0.39%.

Figure 8: Portfolio Characteristics of factors as size exposure is increased in the selection universe (December 1997 to March 2024)

Source: Russell Investments, MSCI and Refinitiv

As smaller cap securities are included in the portfolios, the risk profile of the portfolio also changes with higher idiosyncratic risk, liquidity risk and higher volatilities. To address these concerns, constraints such as maximum active weights and limits on the active positions of each security relative to the benchmark weights, are typically applied within the portfolio construction process. Next, we explore whether the performance improvement we observed will continue when we apply risk and investability constraints in constructing the factor portfolios.

A similar pattern emerges with improvements in returns and active risk with little change to volatility of the portfolios (Figure 9) when these constraints are applied. The same exceptions observed in the unconstrained portfolios appear in the constrained portfolio for the Value factor with active risk and volatilities increasing as the size exposure increases. Like the unconstrained portfolio, the Quality factor premium does not improve when increasing the size exposure.

While we observed absolute return increases in the unconstrained portfolios as the number of securities increased, this was much more limited in the constrained portfolios, with only marginal improvement after 800 securities.

Figure 9: Portfolio Characteristics of factors as size exposure is increased in the selection universe with constraints applied in portfolio construction (December 1997 to March 2024)

Source: Russell Investments, MSCI and Refinitiv

When comparing the unconstrained portfolios to the constrained portfolios, we see a smaller improvement in excess returns relative to each scenario. A significant drop in the active risk of the portfolios was also observed as security level active bets are moderated with constraints to moderate the portfolio risks that the size factor introduces.

The bottom line

- While the Size factor has not performed well as a standalone factor in the past two decades, it can be used in combination with other factors to improve their performance. This improvement is muted when constraints that account for portfolio risks are taken into consideration.

- The Momentum and Growth factors had a stellar quarter with all subfactors outperforming. All Value subfactors underperformed, although a rotation from Growth to Value was observed as the quarter progressed.

- Correlation between the Global LC Value and Low Volatility RFPs continues to increase while correlation between Global LC Momentum and Low Volatility Russell Investments Factor Portfolios continues to decrease.

1 Top minus bottom cap-weighted quintile portfolios are not investible and are used to proxy the performance of the subfactors used in the construction of RFPs. RFPs are long only portfolios.

2 Banz, “The Relationship Between Return and Market Value of Common Stocks”

3 See Alquist, Israel, and Moskowitz, “Fact, Fiction, and the Size Effect,” (2018) and Hou, Xue and Zhang, “Replicating Anomalies” (2017)

4 Esakia, Goltz, Luyten and Sibbe, “Size factor in muti-factor portfolios: Does the size factor still have its place in multi-factor portfolios? (2019)