Executive summary:

- Portable alpha is a valuable tool for institutional investors. A popular modern approach involves combining alpha from hedge funds with synthetic beta exposure through derivatives like futures contracts or swaps.

- When designing a portable alpha strategy, there are five key factors for investors to consider: Beta selection, collateral, valuation changes, embedded beta, and synthetic hedge fund exposure.

- Separating the concepts of alpha and beta in a portfolio allows investors to find the most efficient ways to obtain both. The two can then be combined effectively to help enhance the overall portfolio.

The concept of portable alpha is over 40 years old. And while it has evolved through various forms over that time, it continues to be a valuable portfolio tool for institutional investors. Arguably, the most popular iteration right now is adding alpha expected from hedge funds on top of synthetic beta exposure. The hedge funds represent the alpha while the beta is comprised of broad index derivatives like futures contracts or total return swaps. This combination has been a powerful alternative to finding consistent, alpha-generating, long-only managers. The strategy is most successful when the hedge fund portfolio is expected to consistently outperform the cash rate and the beta is implemented in a capital-efficient and cost-effective manner.

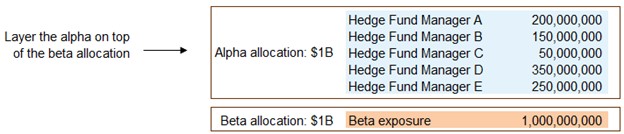

Let’s walk through an example to highlight some considerations for implementing a portable alpha strategy.

Suppose an institutional investor is building out its hedge fund portfolio to $1 billion, expressing their conviction that such mandates have a high potential to generate alpha. The allocation will consist of market neutral (or absolute return) mandates in which they expect to outperform cash by several percentage points. To source the cash for hedge fund investments, they’ll be redeeming from their passive equity (or fixed income) funds and replacing the beta with derivatives managed by an overlay provider. Finally, a small amount of the redemptions will be in cash to support the derivatives rather than invested in hedge funds.

Here are some considerations:

1. Beta selection

Equity beta: Equity beta can take a variety of forms (e.g., S&P 500, MSCI World, MSCI ACWI IMI). Synthetic beta is most commonly in the form of equity futures. However, depending on factors like the portfolio size, investment horizon, index selection, and the investor’s account documentation (to allow for over-the-counter transactions), a combination of futures and total return swaps may be appropriate (see Figure 2). When a combination is used, the swaps tend to serve as the core position while the futures will be the smaller but more nimble positions which can be easily adjusted up or down, in concert with the valuation changes in the underlying hedge funds. While most portable alpha strategies rely solely on derivatives for the beta, incorporating a fully funded physical allocation (e.g., ETFs or a custom basket of physical securities) can be a good strategy for decreasing the total implementation cost when derivatives are pricing at a premium. A cost/benefit analysis can be conducted to find the optimal level of physicals and derivatives. The implementation of T+1 settlement in the U.S. has made this a greater possibility.

Figure 2: Equity beta example

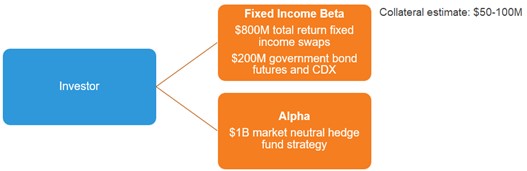

Fixed Income beta: Some institutions prefer a beta component with lower projected volatility than equity. Others may be more interested in the diversification benefits from fixed income beta—especially in cases where the total portfolio allocation to core fixed income is low. To replicate fixed income beta, a combination of government bond futures, credit default swaps (CDX), and total return swaps can be an effective strategy. These clients also tend to value the lower collateral requirements needed to support the portable alpha program.

Figure 3: Fixed income beta example

2. Collateral

A collateral pool must be established to satisfy the initial margin requirements for derivatives and for daily gains and losses. A good rule of thumb is to allocate 10-20% of the total notional value—closer to 10% for fixed income and upward of 20% for equity. Initial margin requirements vary depending on what instruments are traded and whether Uncleared Margin Rules (UMR) need to be considered for swaps. Expect to budget between 5-7% for initial margin requirements for equity futures and 2-4% for fixed income futures. Importantly, initial margin for futures contracts can be satisfied with physical securities, not just cash. Pledging physical government bonds from an existing fixed income mandate is a popular strategy for improving cash efficiency. For the liquidity buffer used to support the daily mark-to-market of the derivatives, we’d suggest 10-15% for equity beta and 5-10% for fixed income beta. The size of the liquidity pool depends on many factors, including the accessibility of additional cash if market conditions become unfavorable. For instance, if quickly sourcing additional cash is challenging, it may be prudent to double these estimates to 40% of the equity notional and 20% for fixed income. Finally, investors typically prefer the collateral pool itself to be included in the total overlay position so that the performance drag of holding cash is minimized. This can be done as part of the portable alpha program or segmented into a cash equitization program.

3. Valuation changes

Overlay managers often have read-only access to custodial valuations of the hedge fund lineup so that adjustments to the beta positions can be made in a timely manner. Investors who may have more timely records or valuation estimates can relay those to the overlay manager for faster implementation.

4. Embedded beta

Some clients have analyzed their hedge fund lineup and discovered a persistent beta that should be considered. An overlay manager can easily adjust the valuation of the applicable hedge funds so that beta is not duplicated, thus minimizing the potential for beta leverage.

5. Synthetic hedge fund exposure

For clients who want additional exposure to hedge funds but are concerned about the delay in contracting or have difficulty sourcing the cash to fund those mandates, they may be able to more quickly obtain the same exposure, synthetically, through total return swaps, less a broker fee. An alternative use case would be to overlay an existing physical beta position with synthetic hedge fund exposure. While such an alternative involves the same components of alpha and beta, it flips the convention of what is traditionally the physical and synthetic elements of portable alpha.

The bottom line

The growth in derivatives has enabled investors to think differently about the building blocks of alpha and beta in a portfolio context. By divorcing the alpha from the beta, investors can pursue the most efficient ways to obtain each. When beta can be implemented efficiently through derivatives, and alpha is delivered by market neutral hedge funds, the combination of the two can create a lovely matrimony.