Helping non-profits achieve their investment goals through investment outsourcing

Investment outsourcing goes by many names, including; fiduciary management, outsourced chief investment officer, outsourced CIO, OCIO, and just as there are many names, the model for which OCIO's service clients can vary widely too. The most common model includes asset allocation, manager selection and monitoring.

We help non-profits secure their financial future by delivering strategic advice on asset allocation and governance structure, and then implementing that advice by selecting, monitoring, and managing managers and products designed to meet their return and spending goals. We complement these investment services with administrative support to help their team focus more on their mission, and less on paperwork and reporting.

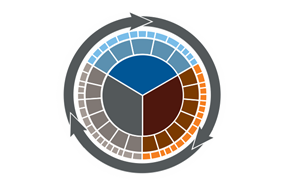

We'll work with you to build your investment program through a three-step implementation and management process we call Design, Construct, and Manage.

Design

Focusing on your investment objectives

We will work with your team to determine a strategic asset allocation for your investment program based on your organization's goals, return objectives, spending policy, ability to tolerate risk and liquidity needs.

Construct

A total portfolio view

We will then take the portfolio we designed with you, and populate it with a diversified mix of investment managers and products from a variety of asset classes and investment styles.

Manage

Dynamic access to a widened opportunity

Once your portfolio is built, we will continually assess the changing market environment and adapt your portfolio, as needed, when the markets change – not once a quarter as many non-profits do today.

As our portfolio management team constructs and dynamically manages your investment portfolio, they will:

- Incorporate investment strategies that may offer incremental returns

- Avoid taking risks for which they don’t expect to get paid

- Ensure that manager changes, trades, or adjustments to their portfolios are implemented efficiently

This approach helps our non-profit clients capture short-term market opportunities without derailing their long-term investing goals. It also helps time strapped non-profit fiduciaries ensure that their portfolios are optimally positioned as markets shift.

Benefit from our tailored non-profit OCIO solutions

We have been providing OCIO services to non-profit organizations for over 30 years. In that time, we have built a suite of products and capabilities which will allow you to:

- Refocus your attention on the strategic decisions which drive most of your portfolio returns

- Benefit from daily portfolio management, reducing the need to spend significant time reviewing past performance in quarterly meetings

- Make certain that short-term market shifts are managed, monitored, and mitigated in real-time

- Take non-investment issues such as reporting, administration, audit support, and accounting off your plate

Our comprehensive solution builds on our award-winning manager research, global team of investment professionals, in-house implementation and administrative expertise, and our willingness to act as a co-fiduciary for your assets. Our entire solution is designed to help you increase returns and reduce risk – all at a competitive price.

Explore more with these related links:

- Non-profit spending policy options

- Materiality matters: Targeting the ESG issues that can impact performance

- Elements of a clearly defined investment policy statement for non-profits

- How do your investment committee meetings measure up?

Looking for more non-profit related research? Visit our Insights library for the latest research.

CONNECT WITH US

We'd love to talk.

Please reach out to me directly through this form.

Lisa Schneider, CFA

Managing Director,

Head of Client Solutions

* Asterisks indicate required fields.

Your information is never shared with third parties. View our Privacy Policy.