Active Ownership

Underpinning our approach to responsible investing

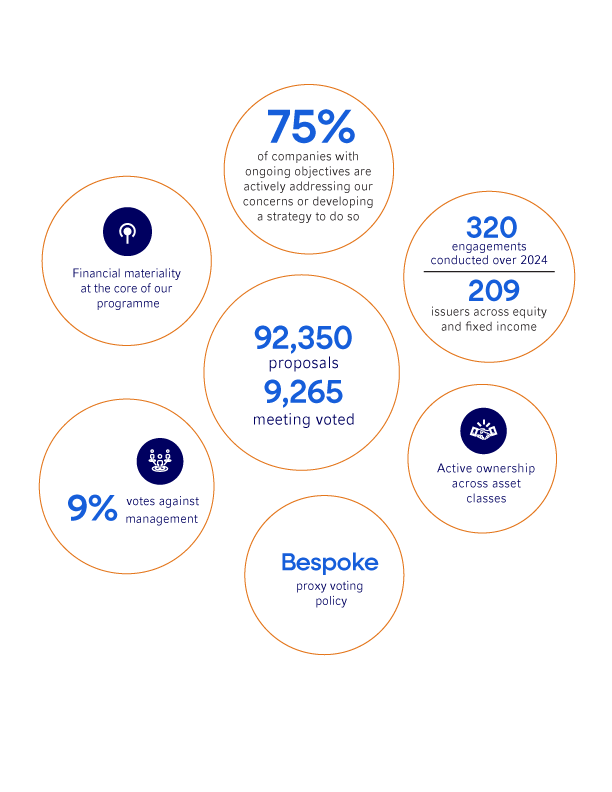

Through engagement on critical issues — including board composition, capital allocation, and sustainability — we advocate for effective risk management and governance practices. This ongoing dialogue helps us understand risk and return profiles, drive positive change, and promotes long-term sustainable value and shareholder rights, benefiting our clients.

Our Approach

We take an integrated approach, combining insights from our global investment teams with the depth of our multi-asset, multi-manager platform. Our strong relationships with sub-adviser partners enhance our influence on corporate behaviour, enabling targeted, high-impact engagement across portfolios.

Investment Stewardship Report

Download the report (PDF)

Why Russell Investments?

Our unique business model and service capabilities enable us to adopt a multi-channel approach to stewardship. This approach allows us to engage directly with issuers, collaborate with our sub-adviser partners, and leverage third party partnership to drive meaningful impact.

These channels collectively offer a robust framework for engagement opportunities. We use these avenues strategically, selecting the channel which provides the optimal access to a target company, issue-specific expertise and the greater potential for a positive outcome on a case-by-case basis. Direct dialogue with corporate securities issuers remains the primary activity across all channels.

Engagement

Our engagement strategy is designed to focus on what matters most—financially material issues that can drive long-term value or mitigate risk.

At Russell Investments, we concentrate on key environmental, social, and governance themes aligned with client priorities and investment outcomes. Our engagement focus areas are dynamic by design—regularly reviewed and updated to reflect market developments, regulatory shifts, and emerging megatrends.

This ensures our stewardship remains targeted, forward-looking, and impactful in a fast-changing sustainable investment landscape.

Governance

- Responsible AI

- Executive Compensation

- Board Composition

- Transparency

- Shareholder Rights

- UNGC Compliance

Environment

- Climate Change

- Natural Capital Management

Social

- Human Capital Management

- Human Rights

More resources:

Proxy Voting

For over 30 years, Russell Investments has led a disciplined, global proxy voting programme that is foundational to our active ownership strategy.

Our custom Proxy Voting Guidelines are grounded in global best practices and regulatory expectations—crafted to consistently advance the long-term interests of our clients.

Reviewed and updated annually by our Active Ownership Committee, the Guidelines cover a wide range of issues with clear, issue-specific rules. For more complex or nuanced matters, votes are escalated to the Committee—comprised of senior investment experts from across our global platform—for case-by-case judgement.

This rigorous, principle-driven approach ensures every vote reflects our fiduciary duty and strengthens our stewardship impact.

While our core voting guidelines reflect governance best practices and fiduciary rigour, we recognised the need for flexibility. Russell Investments offers segregated account clients the ability to implement thematic voting policies tailored to their specific priorities that reflect their unique stewardship priorities.

More resources: