Our extensive manager research, scale, infrastructure, and industry experience enable Russell Investments to secure favorable capacity terms well in advance for our clients.

Global Unlisted Infrastructure

Unlock opportunities with our unlisted infrastructure investments

What is unlisted infrastructure investing?

Infrastructure is the backbone of our society. It provides the essential services that we rely on every day, such as transportation, connectivity, energy, water, and sanitation. Infrastructure also plays a vital role in economic growth and development.

However, unlisted infrastructure remains underutilized as a diversifier. Traditional asset classes like equities and fixed income play crucial roles but are more susceptible to broader market volatilities and may be supplemented to meet the long-term return objectives of investors.

The global infrastructure landscape is diverse, encompassing transportation, utilities, and social infrastructure. Unlisted infrastructure within the broader infrastructure sector has a valuation surpassing $10 trillion and is expected to experience substantial growth 1. Key drivers include the need for enhanced energy efficiency, rising data demands, challenges in digital communications from changing work and lifestyle dynamics, and evolving demographics.

1Source: Prequin, as of December 31, 2021.

Benefits of investing in unlisted infrastructure

Diversification

As a real asset category, infrastructure offers a distinct risk, return, and diversification profile relative to other asset classes, and thus merits consideration for a discrete allocation in a diversified portfolio.

Income generation

Infrastructure investments typically feature steady cash flows derived from tangible, long-life assets with monopoly-like pricing power; many are regulated and may feature income linked directly to inflation.

Long-term return potential

Secular growth trends in renewables, digital and social. Business models that are effective at harvesting these long-term trends are difficult to access in the listed market.

Why Russell Investments for unlisted infrastructure?

For 50+ years, Russell Investments has adeptly integrated private markets into institutional portfolios. Our robust governance culture, consulting legacy, and fiduciary mindset ensure that tailored solutions align with client returns, risk preferences, and regulatory obligations

We use thorough research and expertise to build portfolios, seeking distinct sources of return, creating value, and minimizing downside risk. We collaborate with managers specializing in unique, hard-to-replicate strategies.

Risk management

Managing risk across vintages and profiles

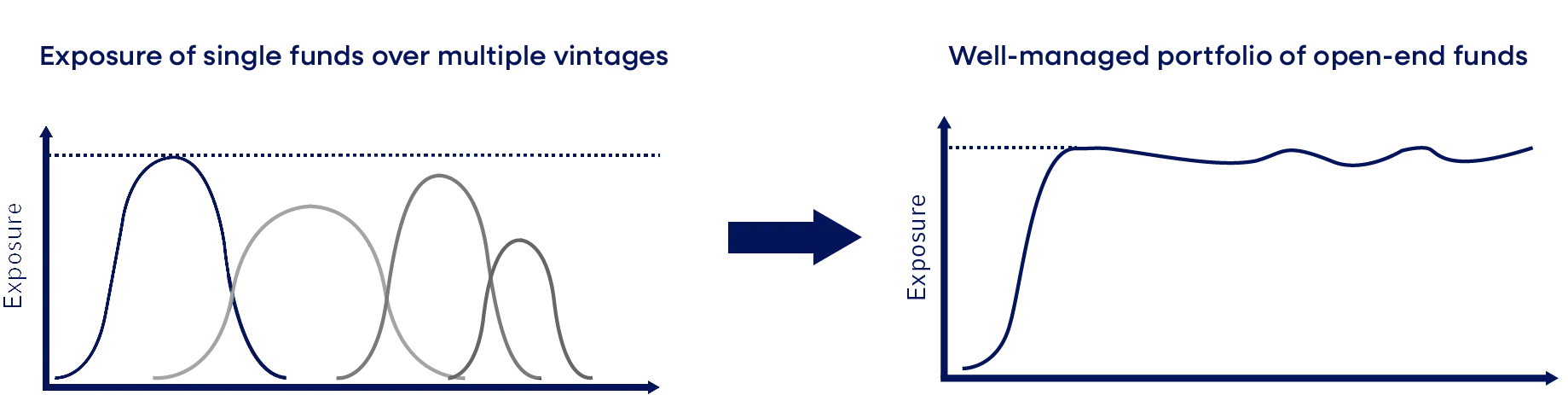

Creating an unlisted/private infrastructure portfolio requires investors to maintain the designated exposure in capital and strategic allocations. Closed-end funds, commonly used for this purpose, present challenges due to their fixed legal duration. Navigating commitments, predicting capital calls and distributions is complex, especially with unpredictable business scenarios and blind pool commitments. Closed-end funds' continuous asset changes disrupt portfolio diversification metrics, necessitating ongoing oversight. Conversely, an open-end (or “evergreen”) fund structure provides a streamlined and less complex approach, alleviating these challenges.

Types of unlisted infrastructure assets

There are different types of infrastructure assets and their relative position with respect to expected risk and expected return:

Our unlisted infrastructure solution

Our solution

Russell Investments Global Unlisted Infrastructure Fund S.C.A., SICAV-RAIF, provides exposure to assets that provide essential services to enable, sustain or enhance economic activity and standards of living, such as Renewables, Digital, Social Utilities, Transportation, and Energy.

DISCRETIONARY AND NON-DISCRETIONARY SUBSCRIPTION AGREEMENTS ARE FOR ACCREDITED INVESTORS ONLY.

Ready to invest?

Please provide your contact information. After submitting, this will initiate your registration process to invest in Russell Investments iCapital Global Unlisted Infrastructure Fund L.P. You will receive an email from iCapital in the next 2–3 business days to create a login and password to their web portal.

Unlisted infrastructure videos

Russell Investments' Chairman and CEO, Zach Buchwald sits down for a conversation with Michael Steingold, CFA, Director of Private Markets, to get his perspective on how we're investing in infrastructure and its impact to our daily lives if we invest now.

Part 1: Infrastructure projects that will help create a more renewable world

Part 2: How investing in infrastructure now, will impact our daily lives in the future

Frequently-asked questions

Unlisted Infrastructure investments are suitable for both individual and institutional investors seeking portfolio diversification, income stability, and exposure to long-term assets.

Unlisted infrastructure investments often involve long-term contracts, concession agreements, or regulatory frameworks that provide a degree of revenue predictability, contributing to stable returns.

Unlisted infrastructure investments often exhibit lower volatility, have longer investment horizons, and generate steady income streams compared to the more fluctuating returns of stocks and bonds.

Investing in unlisted infrastructure can be beneficial as it offers the potential for stable returns, long-term income streams, and the opportunity to contribute to critical developments that benefit society.

Unlisted infrastructure investing involves allocating capital to projects or assets that support essential services and physical structures such as transportation, utilities, energy, communication, and social infrastructure.

Unlisted infrastructure assets include toll roads, bridges, airports, ports, power plants, water utilities, renewable energy projects, telecommunications networks, and social infrastructure like schools and hospitals.

Investing in unlisted infrastructure assets can provide a hedge against inflation, low correlation with traditional asset classes, and exposure to essential services that are less sensitive to economic cycles.

For Accredited Investors Only.

The contents on this webpage is for information purposes only and is not to be construed as an offer, solicitation or invitation to buy or sell a fund or any securities or related financial instruments or to participate in any particular trading strategy. It does not constitute investment, tax, accounting or legal advice. The performance of the mandates is not guaranteed, and past performance may not be repeated. Past performance is not a reliable indicator of future performance. You should not rely on past performance to make investment decisions.

This document or material is not, and under no circumstance is to be construed as an offering memorandum, an advertisement or a public offering of any securities described herein in any province or territory of Canada (each, a “Canadian Jurisdiction”). Under no circumstances is this document or material to be construed as an offer to sell securities or the provision of advice in relation to any securities. Any offer or sale of any securities described in this document or material will be made pursuant to the definitive private placement documents for the securities, which do not include this document. In addition, any offer or sale of, or advice related to, any securities described in this document or material will be made only by a dealer or adviser registered or relying on an exemption from registration in the applicable Canadian Jurisdiction. No Canadian securities regulatory authority has reviewed or in any way passed upon the information contained in this document or the merits of any securities described in this document or material, and any representation to the contrary is an offense.