Key Takeaways

- Markets de-risk in anticipation of potential conflict escalation

- U.S. less exposed to the energy shock than Europe

- Overall market sentiment remains calm

On Thursday evening, Israel launched an airstrike against Iran, damaging the country’s nuclear facilities while also hitting Iran’s military leadership and senior scientists.

An Israeli official commented that the operation will last “at least two more weeks”. In our view, the conflict marks one of the riskiest moments for the Middle East in years.

Markets De-risk

Markets traded risk-off in overnight futures. As of 08:40am Eastern Time, the S&P 500 sold off 0.9%, Brent crude oil jumped 7.5%, the U.S. Dollar Index (DXY) was up 0.5%, and the 10-year Treasury yield was down just a basis point as the crosscurrents from a flight to safety and higher energy prices buffeted government bonds.

After an initial shock, markets calmed somewhat, with Brent crude oil dropping roughly 4.5%, from an overnight peak of $78.5 per barrel, to $74.5.

Oil Price Surges

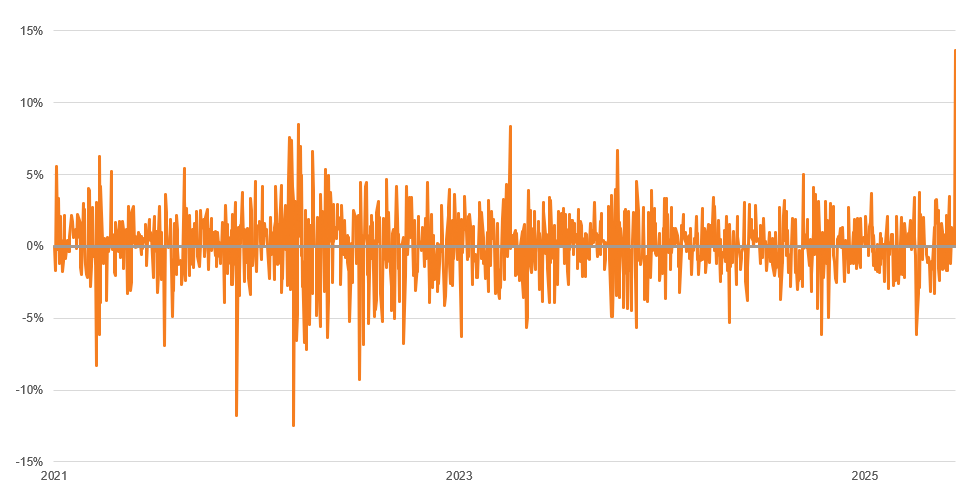

Daily change in Brent oil price sees largest spike in years

Source: LSEG Datastream. Data as of 13th June 2025.

Watch Points

The conflict will be a key focus for investors through Friday’s session and into the weekend. We believe the most consequential watch point for global markets will be if there are disruptions to cargo transitioning the Strait of Hormuz – a chokepoint bordering Iran that roughly 20% of global crude oil and petroleum products pass through each year.

Market focus will also likely center on whether the fighting escalates further e.g. if Israel attacks the political leadership in Iran and if Iran damages Israeli or U.S. assets in the region. The development also puts into doubt whether Iran will partake in the latest round of negotiations with the U.S. that were scheduled to take place over the weekend.

U.S. Exposure

From a fundamental perspective, it’s important to note that the U.S. is less exposed to energy shocks than it was back in the 1970s and 1980s. The U.S. is now the biggest oil and gas producer in the world, a net exporter of crude oil. Additionally, the wallet share of U.S. consumption on gasoline and other energy goods has halved since the early 70s, further reducing the country’s exposure to the conflict.

Given these mitigating factors, we estimate higher energy prices to dent U.S. real GDP growth by 0.2 percentage point and to boost core PCE prices by about a tenth of a percent – another stagflationary impulse on top of prevailing growth and inflation concerns. However, we currently do not see the changes as material enough yet to meaningfully reshape the likelihood of recession.

European Outlook

In contrast to the U.S., Europe's economic outlook is more sensitive to oil shocks. High dependency on imported energy, particularly natural gas and crude oil, positions Europe at greater economic risk from prolonged disruptions or sustained high prices. These factors, particularly if they intensify, could increase inflationary pressures and impact the economic growth experienced in the region since the start of the year.

Sentiment remains stable

Following the strong market rally since early April, our measure of investor sentiment no longer shows panic. The moderate selloff overnight is insufficient to change that conclusion. Our sentiment process will be an important building block for our strategy as we track markets in the days ahead.

We do not currently see significant dislocations in markets and believe maintaining current portfolio positioning is appropriate.