Key Takeaways

- The Fed lowered rates by 0.25% but is divided on whether more cuts are necessary this year

- We expect more rate cuts in the months ahead

- The U.S. economy is likely to remain resilient

The U.S. Federal Reserve (Fed) cut interest rates by 0.25% today in a decision widely expected by investors. More notably, the central bank’s forecasts reveal a committee starkly divided on the path forward for rates. Seven participants expect that no more rate cuts will be needed this year while 12 favor further reductions. Newly appointed Fed Governor Stephen Miran made the biggest splash, dissenting in favor of a string of 0.50% cuts into year-end.

Overall, the meeting conveyed a balanced view of the economic outlook. The Fed’s statement flagged downside risks to employment, and Chair Jerome Powell characterized the decision as a “risk management cut” to get ahead of evolving risks to the labor market. But in the follow-up press conference, Powell emphasized uncertainty and a meeting-by-meeting approach to future interest rate decisions.

Holding Strong

Our baseline scenario is for the Fed to gradually lower rates to more normal levels due to the ongoing resilience of the U.S. economy. This expectation is based on three intertwined macroeconomic forces:

- Strong corporate earnings, which are keeping layoffs at bay

- Healthy wages due to low layoffs

- Strong consumer spending, which is also supported by limited layoffs

Bottom line: This is not a strong economy but one that is holding up well in an environment of significant policy change.

Room to Run

Markets fluctuated around the announcement but were little changed by the end of Chair Powell’s press conference.

10-year U.S. Treasuries are trading near 4.1%, which is our estimate of fair value. From our vantage point, this supports a strategic allocation to duration in portfolios.

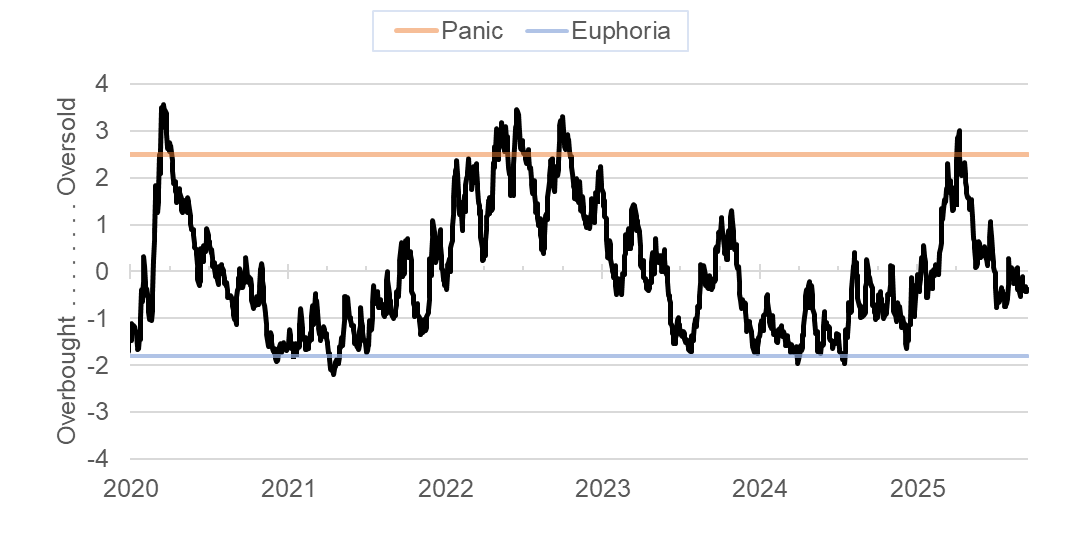

Meanwhile, positive momentum from earnings season continues to lift stocks. We’re encouraged to see that investor attitudes remain broadly balanced—not overly optimistic or pessimistic—even with many global markets trading at or near all-time highs. This suggests the current stock market rally may have further room to run.

A Balanced Mood

Investor attitudes are balanced despite the strong market rally

Investor sentiment remains near neutral and far from bullish or bearish

Source: Russell Investments. Last observation: -0.4 standard deviations, as of Sept. 15, 2025