Key takeaways

- Recent defaults appear idiosyncratic rather than systemic, stemming largely from bank or public debt markets, with minimal private credit exposure.

- Data signals contained stress in borrower fundamentals, with little to no spillover into public credit markets.

- Vigilance remains essential—particularly around liquidity management and valuation transparency.

Private credit’s rapid growth faces its first real test

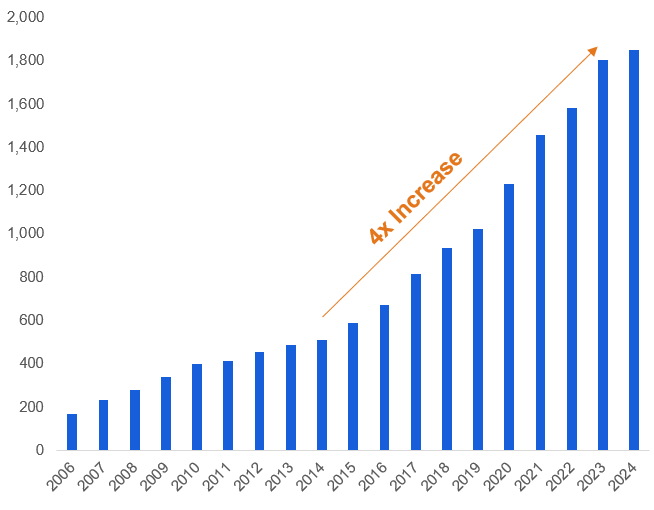

Private credit has rapidly grown to be a leading source for corporate lending, representing more than $2 trillion in assets under management. However, in the wake of a few recent borrower defaults and headlines in select sectors, there has been debate as to whether these represent cracks in the system or are simply isolated events.

As the chart shows, the rise of private credit has been dramatic, underscoring how material the market has become to institutional portfolios. Yet scale alone doesn’t make it systemic. These defaults stem largely from alleged fraud and sector-specific shocks rather than broad deterioration in credit quality.

Private credit AUM has quadrupled since 2014

AUM in USD billions

Source: Preqin, Bloomberg, Russell Investments analysis

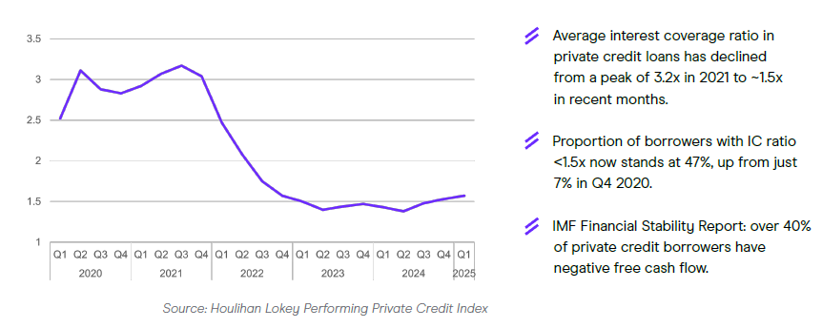

Borrowers are feeling the squeeze

The data does show some softening in borrower fundamentals. Interest coverage ratios have declined, free cash flow has weakened, and the share of payment-in-kind (PIK) income has risen. These are classic indicators of tightening financial conditions.

Still, context matters. As of November 2025, for most borrowers, this reflects a normal adjustment to higher rates, not widespread distress. Defaults are rising, but from a very low base. As illustrated, the average interest coverage ratio has fallen meaningfully—yet remains above pre-pandemic levels.

Average interest coverage ratio and share of PIK income across BDCs.

Stress contained within private markets

Despite localized strains, there’s little evidence private credit stress has spilled into public markets. Listed business development companies (BDCs)—a reasonable proxy for private credit performance—have softened modestly but stabilized in recent months. High-yield spreads, another important barometer, remain near their year-to-date averages.

Managers we engage report a similar story: A few challenged borrowers, limited contagion, and healthy levels of interest coverage overall. Transparency is improving as institutional allocators demand more detailed loan-level data and tighter documentation standards as well

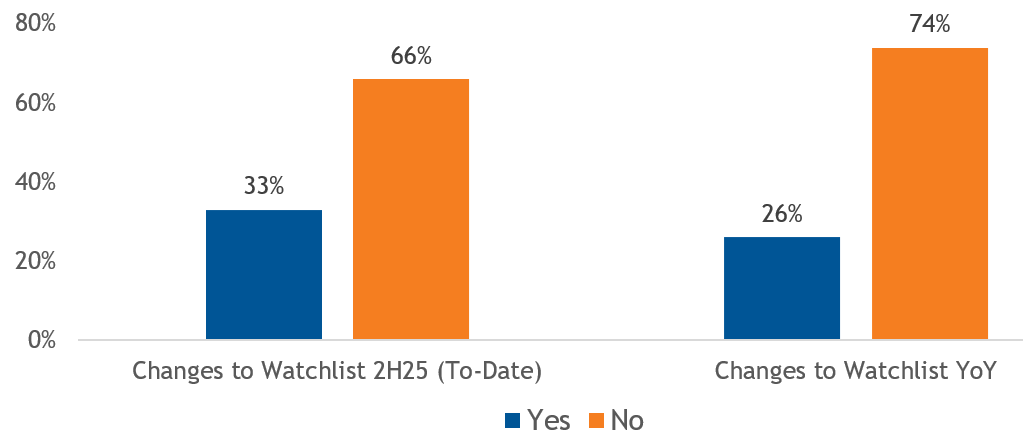

Importantly, our recent survey of funded managers show most private-credit GPs (general partners) report stable or improving portfolio quality. According to a review of the internal watchlist for each of our managers, the majority of GPs have actually seen declines in the number of monitored credits, and several managers currently have no watchlist positions. Our survey reported only isolated, sector-specific names which have shown any deterioration, with most managers indicating issues are not expected to lead to material losses.

Changes to watchlist composition from Russell Investments’ private credit managers

Source: Russell Investments. Date through November 7, 2025.

Credit fundamentals remain sound: Among managers surveyed, leverage averages roughly 4.9× Debt / TTM EBITDA and interest coverage about 2.3× across portfolios, leaving borrowers with adequate service cushions even under tighter financial conditions. We do see dispersion widening. Managers are conducting what many describe as “full portfolio scrubs,” reflecting a proactive stance toward credit surveillance and documentation discipline rather than reactive distress management.

In short, the system looks similar to isolated events in other markets rather than a “Bear Stearns moment” signaling systemic breakdown.

Please note while data and manager commentary are current as of November 2025, conditions may evolve.

Private credit proxies vs. high-yield spreads

Global high yield OAS

Source: Bloomberg, Russell Investments analysis.

Watchpoints and the road ahead

While we believe current stresses are idiosyncratic, certain risk markers deserve continued attention. Liquidity constraints in semi-liquid vehicles, slower fundraising, and valuation disputes could amplify pressure if macro conditions tighten.

At the same time, the manager behavior shift revealed in our recent survey is notable: GPs are transitioning to forensic oversight, tightening credit standards and reassessing loan protections in specific sub-markets. This diagnostic approach underscores an industry that remains healthy but alert—focused on preserving value through disciplined monitoring rather than aggressive growth.

The chart below outlines these watchpoints—from borrower quality and funding liquidity to valuation discipline. Each represents a possible transmission channel if local cracks were to widen. For now, though, these remain monitoring points rather than catalysts for systemic stress.

PRIVATE CREDIT RISK WATCHPOINTS

Borrowers & Collateral

- Deterioration in interest coverage and free cash flow across portfolios.

- Rising use of PIK, amend-and-extend, and liability-management deals.

- Increasing number of opaque collateral, fraud, or double-pledging cases across similar structures.

Funding & Liquidity

- Potential constraints on liquidity: gates or delays in semi-liquid private credit funds.

- Challenges in fundraising activity.

Valuation

- Sudden NAV cuts or restatements at major platforms.

- Disputes over collateral quality or perfection of security.

We continue to monitor these areas closely.

Investor implications

For credit and fixed income investors, the message is one of cautious confidence. We believe recent defaults are isolated, not the start of a broader credit cycle downturn. Still, selective positioning and disciplined liquidity management are key.

We believe investors should focus on:

- Diversifying across managers, vintages, and deal types to mitigate idiosyncratic exposure.

- Prioritizing transparency in documentation and valuation practices.

- Maintaining appropriate liquidity buffers within semi-liquid structures.

In our view, private credit remains an attractive income source — provided investors remain vigilant and active in monitoring the evolving landscape.