2026 Global Market Outlook

The Great Inflection Point

Policy upheaval defined the first half of 2025. Investors faced a multitude of policy shifts this year. April’s Liberation Day ushered in the biggest increase in tariffs since the 1930s. We saw the sharpest immigration restrictions since the 1950s, the most ambitious deregulation agenda since the 1980s, and stimulus bills in the United States and Germany.

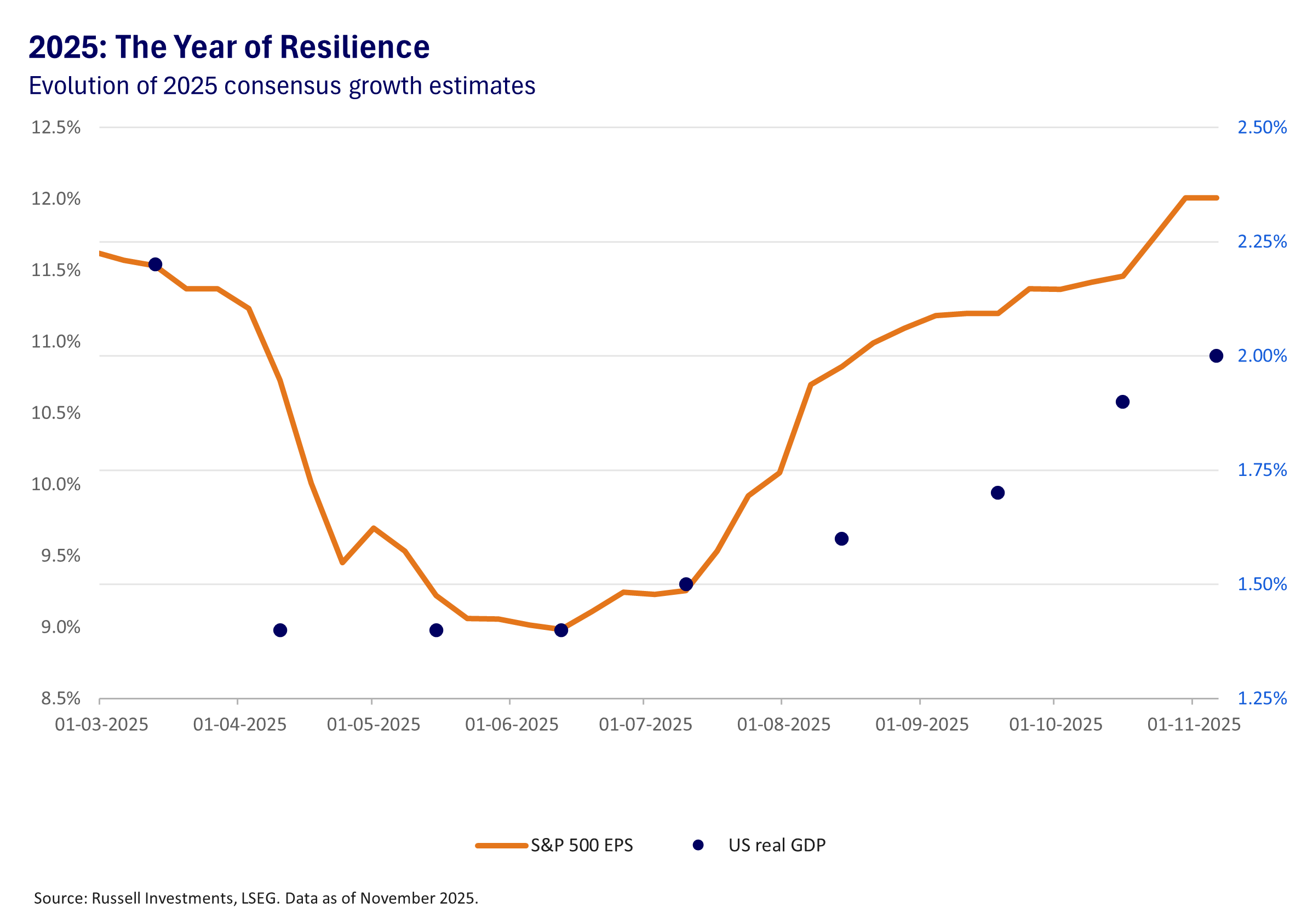

Yet through that turbulence, markets adapted. Resilience emerged as the defining theme for 2025, with most global equity markets dramatically rebounding from their April lows to close out the year near all-time highs. Fundamentals have since exceeded even our relatively upbeat expectations, with consensus estimates for economic and earnings growth recovering almost all their post-Liberation Day declines.

That resilience now gives way to a new phase—the great inflection point. The policy shocks of 2025 may have tested the system, but they also accelerated deeper shifts in technology, growth dynamics, and global capital flows. As the macro landscape stabilises, markets are no longer reacting to policy disruption; they are repositioning for what comes next.

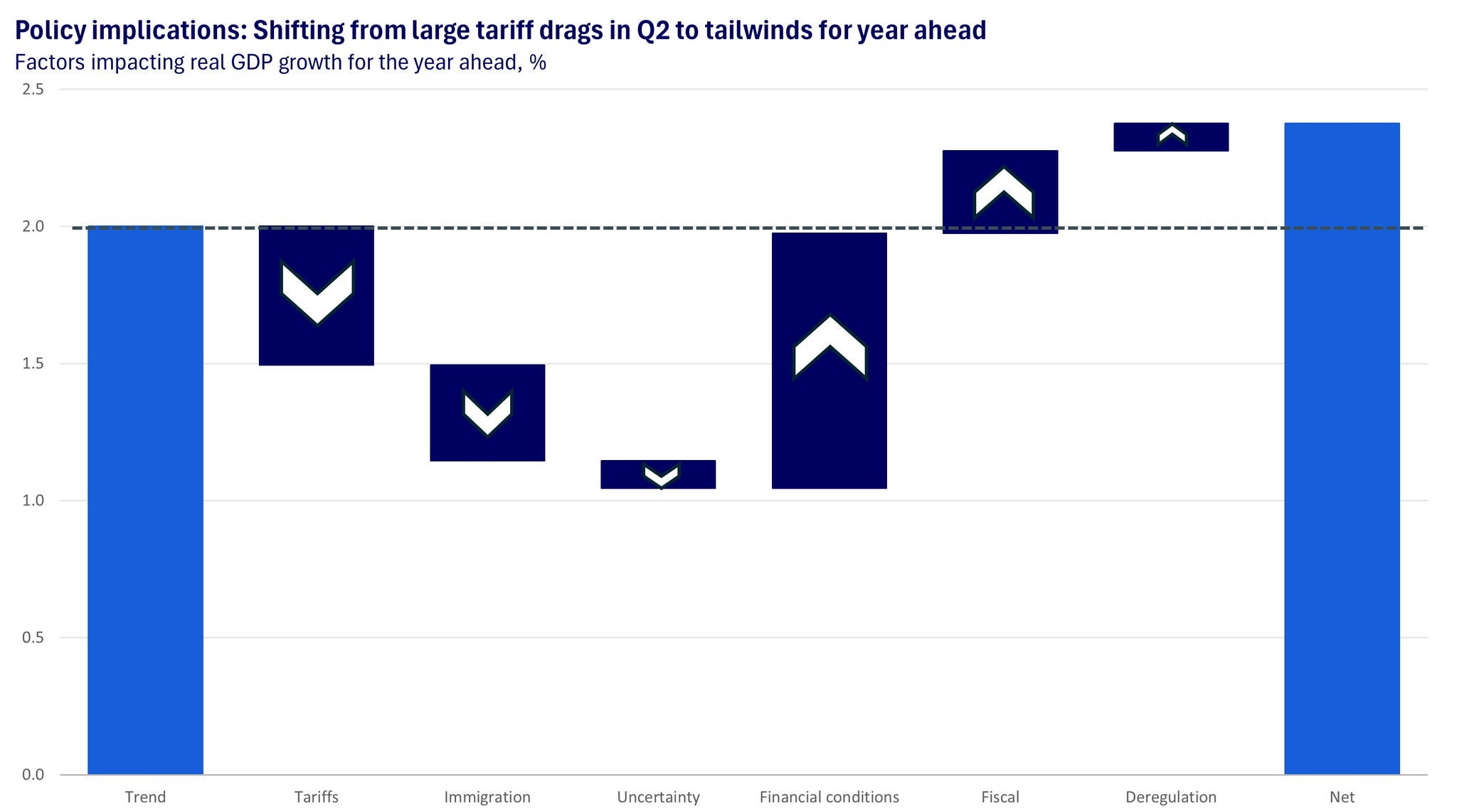

We see three inflection points that are likely to drive the investment landscape into 2026 and beyond. First, AI adoption is likely to accelerate further, reshaping energy demand, productivity, and profitability across sectors. Second, we see potential for the U.S. economy to regain momentum as the drags from tariffs and policy uncertainty fade and the tailwinds from loose financial conditions and fiscal stimulus build. Third, we expect a broadening opportunity set, with greater performance dispersion as capital rotates toward new areas of leadership in the next phase of global growth.

Rise of the Machines: The Productivity Revolution

Generative AI adoption is expected to accelerate in 2026. The next phase of AI integration is set to extend well beyond the technology sector, where most of the activity has occurred so far. At the macro level, these changes could reshape labour demand and growth dynamics as technology augments many roles. At the company level, they are likely to produce wider differences in performance, reflecting how effectively firms integrate and scale new AI capabilities.

While there has been little evidence so far of AI-induced layoffs, companies appear to be finding success in enhancing their existing workforces with new technology — effectively doing “more with the same.” Some academic studies have emerged that show how AI is disrupting early career hiring in exposed occupations like software engineering and customer service, where the technology is profoundly benefitting productivity. As adoption broadens beyond the technology sector, these labour and productivity dynamics are likely to play a larger role in shaping both economic growth and corporate performance.

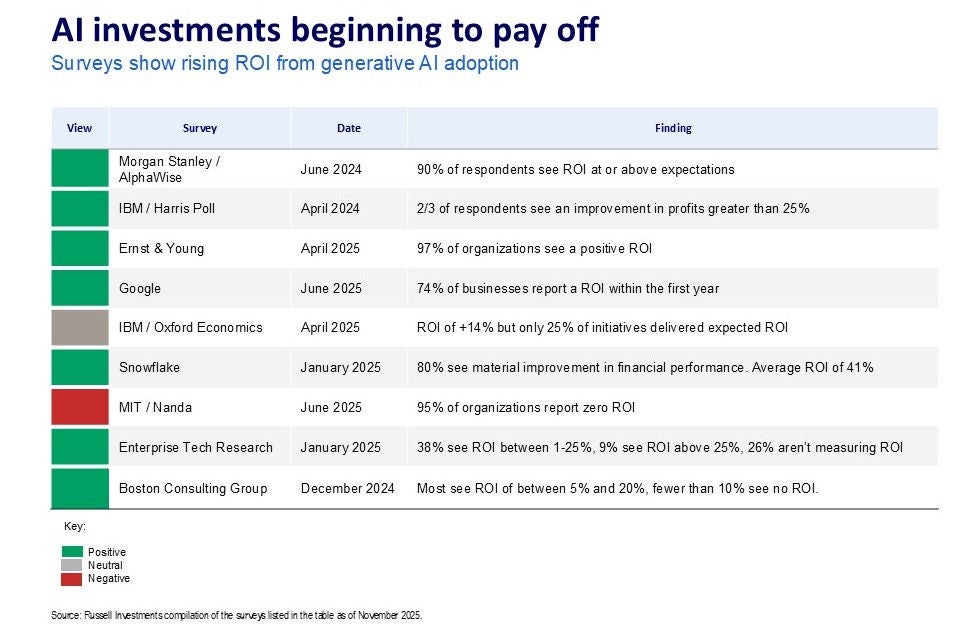

We expect the benefits to economy-wide productivity and profitability to ramp up in 2026. Importantly, the productivity cycle from new technologies often mimics a “J-curve” pattern of initial negative results followed by eventual long-term gains. This is because companies face upfront costs from purchasing new systems and experimenting with how they can deploy them effectively while workers must learn new routines. Where are we in that process? Surveys conducted by consultants, hyperscalers, and asset managers generally show companies are starting to see a positive return on investment from their generative AI deployments.

This is good news for two reasons. First, it’s likely to sustain AI investment and adoption. Second, it suggests the benefits are starting to spread from AI builders to AI users. This could support a positive broadening out of fundamentals and performance.

While AI-related capital expenditures and the data centre buildout are already contributing to growth in the United States and China, they also pose important risks to economies and markets. For instance, AI could disrupt labour markets if adoption proves to be much faster than prior general-purpose technologies. It could also upend long-standing business models. There is already evidence of this occurring, with some online knowledge platforms reporting a significant decline in web traffic revenue. Lastly, the scale of capital required to build AI could pressure funding markets. For now, this capex is overwhelmingly funded by internal cash flows, but by 2030 financing needs could be more than $1 trillion.

Rethinking Resilience

The global economy stands at an inflection point. While investors continue to face a complex mix of technological and policy crosscurrents, growth drivers are starting to shift within the United States and globally. In the U.S., trade agreements have stabilised tariff rates in recent months and lessened some of the policy uncertainty that plagued markets in the first half of 2025. This suggests we have passed through the peak hit from tariffs. Meanwhile, very loose financial conditions—particularly from the strong rally in equity markets—are likely to support economic growth, especially amongst higher-income consumers. As headwinds fade and tailwinds build, our analysis suggests the balance of risks are shifting from resilience to reacceleration. We see the potential for above-trend real GDP growth of 2.25% to 2.5% in 2026.

Source: Russell Investments

Source: Russell Investments

Building upon the resilience theme from 2025, we believe solid economic fundamentals should support strong earnings fundamentals and protect against a layoff cycle. While weak hiring trends are a key risk to this view, we estimate 85% of the recent decline in job growth comes from immigration restrictions and curtailed government employment. In other words, we think the slowdown is being driven mostly by policy choices and isn’t a symptom of cyclical weakness. If our outlook for the economy proves correct, the Federal Reserve—which recently cut interest rates to protect against emerging labour-market weakness—may slow down or halt its easing cycle into early 2026. 10-year Treasuries currently trade near our 4.1% fair value estimate1, supporting a strategic allocation to duration risk in portfolios.

Outside the U.S., the European economy is in a good place with inflation running near the 2% target, a healthy and balanced labour market, normal European Central Bank policy rates, and steady economic growth. A key watchpoint for the region will be the crystallisation of infrastructure and defence commitments from Germany’s fiscal stimulus package, with some estimates suggesting it could double growth in the region’s largest economy next year.

Meanwhile, emerging markets show mixed economic performance, with China expected to deliver annual growth near the government’s target of 5% in the near-term. Corporate earnings have been a clear bright spot in the region, with a substantial upgrade cycle driven by Chinese technology names and a structural reform program in South Korea that is already paying dividends. The emerging markets remain a preferred overweight in our global equity strategies for 2026.

1 Fair value estimates are our opinions, subject to change, and are not a guarantee of market levels.

The Great Rebalancing

We believe broadening growth and profitability, supported by AI-driven gains, signal a turning point in market leadership beyond the U.S. hyperscalers. We expect greater dispersion ahead, creating new opportunities for selective positioning.

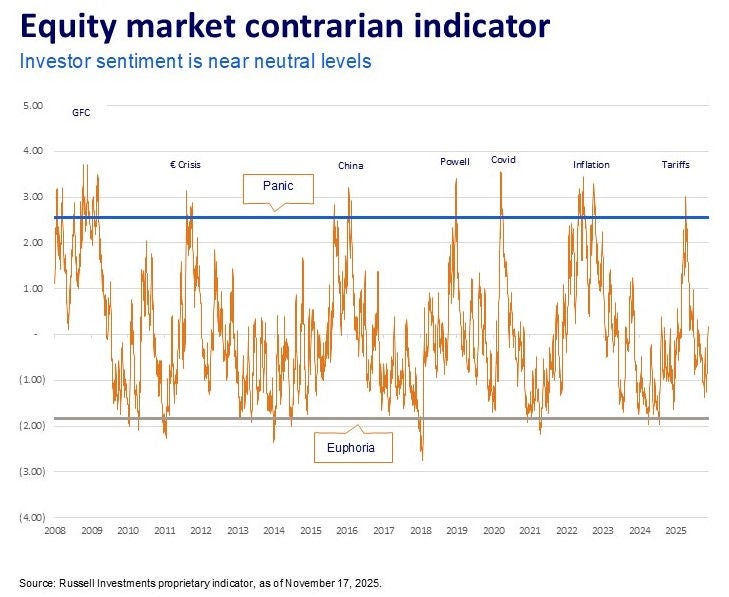

While equities trade near all-time highs and valuation multiples are high relative to history, our proprietary indicator of market psychology for the S&P 500 does not show worrying signs of euphoria that would motivate a more cautious tactical posture in portfolios. Based on current sentiment levels, we believe equities may outperform bonds over the next 12 months. We believe retail and institutional investors should stay invested with risk levels up near strategic targets.

Improving global earnings fundamentals and the potential for the trade-weighted U.S. dollar to weaken supports the case for global diversification, with emerging markets being one potential area of opportunity for active management to shine.

U.S. Treasuries trade near our estimates of fair value across the curve, supporting a strategic allocation to duration in fixed income and multi-asset portfolios. At the same time, public market credit spreads are historically tight with specialist managers finding opportunities to rotate exposure into equities, securitised credit, and private market debt—which continues to trade at a substantial yield advantage to public markets.

In addition, long-term shifts toward increasing geopolitical risk, supply chain resilience, and record and rising government debt levels highlight the importance of extending portfolio resilience and access through allocations to real assets, private markets, and new alternative diversifiers.

Investor Implications

For 2026, we’re positioned for resilience and reacceleration over recession. We’re staying invested, leaning into security selection to add value in disperse markets, and leaning into an increasingly diverse set of return drivers to support portfolio outcomes.

Equities Outlook

By Will Pearce, Megan Roach, and Pierre Dongo-Soria

Broadening leadership across public and private markets

Equity markets are entering a new phase of broadening growth as fundamentals strengthen and leadership widens. Public and private assets alike are benefiting from renewed optimism tied to the next phase of the AI investment cycle and a more balanced global backdrop. We see greater dispersion creating opportunities for active managers to add value across both listed and private markets.

Key takeaways

- Market leadership is broadening as AI adoption shifts from early “builders” to widespread “users.”

- We see improving breadth across Europe, Japan, and emerging markets.

- Active managers are finding opportunity in valuation gaps and heightened dispersion.

- Private equity and venture capital are capturing the next wave of AI-enabled opportunities.

Capital flow and the new AI phase

The defining force for equity markets continues to be the AI buildout, but its impact is changing. The early infrastructure cycle—led by hyperscalers and semiconductor firms—is now expanding into broader corporate adoption. Companies that apply AI to boost productivity and margins are emerging as the next beneficiaries.

This evolution is reshaping global equity performance. While U.S. mega-caps remain influential, the investment impulse from AI infrastructure and adoption is now reaching non-U.S. regions and mid-cap innovators. For equities, that means a shift from a narrow trade in platform leaders toward a wider set of opportunities grounded in earnings delivery and operational efficiency.

Managers see this broadening phase as an opportunity to differentiate through stock selection. With fundamentals improving but valuations uneven, disciplined active positioning remains key to capturing dispersion.

Global breadth and active opportunity

Valuations remain elevated overall, but participation is improving. Europe and Japan continue to benefit from policy reform and fiscal momentum, while Asia’s technology and industrial sectors are leading earnings upgrades. We see particular value where fundamentals are improving yet pricing remains reasonable—from emerging-market technology to European cyclicals and U.S. firms embedding AI to drive efficiency gains.

We believe this renewed dispersion favours active management. Portfolio managers are emphasising diversified selection, measured tilts toward value and quality, and selective exposure to small and mid-caps. High-momentum names remain underweighted as teams focus on durable earnings and balanced regional exposure. Across our platform, managers highlight that the current cycle rewards precision—allocating capital where fundamentals are improving faster than valuations.

Growth and value managers alike are adapting their approaches to the AI evolution. Growth-oriented teams are focusing on firms demonstrating tangible productivity gains and scalable earnings leverage, while value managers are identifying opportunities in companies adopting AI more gradually, where fundamentals and pricing power are improving. This stylistic balance reflects a disciplined shift toward quality and sustainability within active portfolios.

Private markets in parallel

Private capital is advancing alongside public markets. The AI infrastructure wave is fueling new deal flow in data centres, automation, and energy transition technologies. Venture and growth equity investors are targeting innovation adjacent to public-market leaders, while private equity managers are finding improved exit conditions as leadership widens beyond U.S. mega-caps.

Should valuations reset, disciplined entry points could emerge for long-term private investors. Many managers view this as a constructive moment to align private exposures with listed-market themes, emphasising the complementary role of private assets in capturing the next leg of innovation and growth.

Investor implications

We see equity markets transitioning toward renewal—characterised by improving growth, rising dispersion, and broader leadership across regions, styles, and asset types. For investors, this environment supports a balanced approach: diversified, quality-oriented equity exposure complemented by private and growth-stage strategies positioned to harness structural innovation.

From our vantage point, active management remains central to navigating dispersion and identifying where the next phase of value creation will emerge—across both public and private markets.

We believe managers who can integrate insights across public and private opportunities—and balance growth innovation with value discipline—are best positioned to capture the evolving AI-driven landscape.

Fixed Income Outlook

By Van Luu, Riti Samanta, and Keith Brakebill

Duration, debt, and dispersion

Lower policy rates and shifting fiscal dynamics are reshaping the global fixed income landscape. Public and private debt markets enter 2026 from different starting points, yet both face a year likely to be marked by dispersion, selectivity, and recalibration.

Key takeaways

- U.S. Treasuries remain near fair value, offering strategic duration and portfolio ballast.

- Divergent global policy paths create opportunities for relative-value positioning.

- We believe tight public credit spreads favour active security selection and exposure to securitised credit.

- Private credit and asset-based finance continue to deliver structural yield and diversification.

A market in transition

Fixed income delivered strong results in the second half of 2025 as policy rates declined and credit spreads tightened. Inflation pressures have eased, and investor focus has turned to the fiscal outlook across developed markets.

Public and private fixed income markets are now diverging. In public markets, U.S. Treasuries have regained footing following the Federal Reserve’s rate cuts. In private markets, the higher-for-longer yield environment continues to underpin attractive opportunities for long-horizon investors. Together, these segments offer complementary roles: duration and diversification from public debt, and structural yield from private credit.

We believe all-in yields remain compelling. AAA-rated investment-grade bonds offer about 50 basis points over 10-year Treasuries, while higher-quality high yield bonds deliver yields over 6%2. Fundamentals remain sound with manageable leverage and strong interest coverage, while issuance has been robust and oversubscribed. Tight spreads have led many managers to hold elevated Treasury allocations, though short-lived selloffs have created selective relative-value opportunities. Early signs of stress in subprime borrowers remain isolated and contained.

A weaker U.S. dollar has also supported local-currency emerging-market bonds, expanding opportunity sets that had been narrow through much of 2024. Policy and data uncertainty, including delayed U.S. economic reports, remain a watchpoint as investors navigate the next phase of easing.

Policy easing meets fiscal strain

The Fed’s shift toward easing marks a clear inflection point for global rates. Short- and intermediate-term maturities have benefited most, while fiscal pressures in other developed markets have introduced fresh dispersion. At the 10-year maturity point, UK gilts and U.S. Treasuries trade roughly 50 basis points apart—illustrating how divergent inflation and growth narratives can shape opportunities.

We expect this combination of monetary accommodation and fiscal strain to keep yield curves biased toward mild steepening as long-term issuance rises. In the U.S., Treasuries remain close to fair value, supporting a neutral duration stance. UK yields appear attractive following fiscal-driven volatility, suggesting scope for recovery as budget clarity improves. Across bond markets, investors continue to weigh policy relief against fiscal risk—a tension likely to define 2026.

Credit markets: Structure over spread

Public credit spreads remain near historic tights, leaving limited room for compression. We have trimmed exposure to investment-grade corporates, where valuations already price in optimism, while favouring securitised credit—particularly non-agency mortgage-backed securities—for their exposure to real assets with lower rate sensitivity. Collateralised loan obligations (CLOs), roughly a third of the securitised universe, offer low-duration, floating-rate structures that suit an uncertain rate backdrop.

We believe private credit remains a bright spot. Yield advantages and structural protections continue to attract capital, particularly in asset-based finance secured by tangible collateral. The next phase of AI-driven corporate investment is also expanding issuance across both public and private credit markets, creating new opportunities for managers able to navigate complexity and structure.

Investor implications

We see value on both sides of the fixed income spectrum. Public markets provide fair-valued duration and liquidity as policy easing unfolds, while private markets deliver yield, diversification, and access to real-economy assets.

Fiscal expansion and elevated issuance may keep long-term yields under gentle pressure, underscoring the importance of selectivity and active management. We see the coming phase as less about chasing yield and more about balancing liquidity, credit quality, and curve exposure—in order to position portfolios for resilience across the fixed income landscape.

2 Source: Federal Reserve Bank of St. Louis

Real Assets Outlook

By BeiChen Lin and Tim Ryan

Infrastructure, real estate, and the AI buildout

As the global economy shifts from resilience to reacceleration, both public and private real assets are emerging as essential diversifiers. Listed infrastructure and real estate offer liquidity and market access, while private real assets provide durable cash flows, structural yield, and direct exposure to the AI and energy transition buildouts. Together, we believe these exposures can anchor multi-asset portfolios through 2026 as secular demand for power, resilient logistics, and defence-adjacent infrastructure grows.

Key takeaways

- Valuations in listed real assets look attractive versus equities, but less so versus government bonds.

- We see AI, energy transition, and national security as persistent demand drivers for infrastructure.

- We believe private real assets offer yield and resilience while public markets provide liquidity and tactical access.

- Security selection and manager skill remain the primary return drivers across public and private strategies.

Portfolio diversification in a new macro phase

With recession odds lower and policy uncertainty easing, real assets are poised to reclaim a central role in diversification. Listed infrastructure and REITs continue to trade at discounts to broader equities, highlighting relative value opportunities for public allocations. At the same time, private strategies can smooth volatility and capture long-dated cash flow growth that listed markets may not fully reflect. We favour a balanced approach that uses public markets for tactical tilts and private markets for structural exposure.

Infrastructure: Power, transition, and defence

Three themes continue to define infrastructure’s appeal: the rise of AI, the energy transition, and increasing national security investment.

First, AI’s expanding footprint is lifting power consumption and stressing grids already near capacity. That creates a multi-year investment cadence for generation, storage, and distribution projects—opportunities accessible through both listed utilities and private energy infrastructure. Second, the energy transition continues to advance unevenly but meaningfully across regions. Europe’s renewables push and grid upgrades is a great example of this. Third, rising national security budgets are reallocating capital to defence-adjacent infrastructure, from military accommodation to logistics and secure energy facilities.

Energy security and defence themes are attracting growing private capital. U.S. markets currently offer more transactional scale and faster private capital deployment than some parts of Europe—factors that shape where private managers are active.

Real estate and private markets: The power of selectivity

Real estate benefits from the easing rate cycle, but valuation appeal varies across subsectors. Data centres remain a high-conviction area because AI drives sustained demand for hyperscale capacity. Ageing demographics support senior housing and healthcare real estate. In private markets, managers are targeting assets with essential, contracted cash flows—utilities, telecom towers, logistics and specialised industrials—while steering clear of more cyclically exposed properties.

Defence-related and energy security assets are also moving from niche to mainstream for institutional allocators, with governance and regulatory clarity shaping European investor appetite. This reinforces our view that manager selection and thematic alignment will be critical in driving outcomes.

Investor implications

We see both public and private real assets as core building blocks for 2026 portfolio construction. Public real assets provide liquidity, price discovery, and valuation discipline. Private real assets offer income durability, lower public-market correlation, and direct exposure to structural spending on AI infrastructure, energy security, and defence-adjacent projects.

We believe investors should consider balancing listed and unlisted allocations, emphasising specialist managers with sector expertise, and prioritising assets with contracted or essential cash flows. Where private markets show faster deployment—particularly in the U.S. for defence and energy security—investors may find attractive entry points, but they should also account for regional regulatory and execution differences.

Asset Class Preferences

This snapshot highlights our latest asset class views. Click on each box to learn more about the opportunities and risks shaping our perspective.

Regional snapshots

United States

The U.S. economy is likely to strengthen as policy drags fade and tailwinds from loose financial conditions, tax policy, and deregulation build. Corporate earnings are solid and broadening with favourable management guidance lifting consensus earnings growth for 2026. Broadening fundamentals support broadening equity market leadership. The Federal Reserve is weighing solid growth alongside weak hiring. If our constructive outlook holds, the Fed is likely to pause and eventually pivot on rates as the economy heats up again into 2027. Treasuries trade near our fair value estimates while corporate credit spreads are historically tight. Key risks to our upbeat macro view include: a sharper degradation in labour markets; commanding valuations; whether recent idiosyncratic failures extend into a full-blown credit crunch; and the aggressive financing needs for AI capex that, over time, could pressure funding markets.

Canada

Canada had two back-to-back months of significantly stronger-than-consensus job creation in September and October, a sign that cyclical risks might have come down from the peak. Nevertheless, with the unemployment rate still around 7%, we continue to believe the nation may be more prone to recession risks than the U.S. over the next 12 months.

We remain neutral on Canadian equities, as cyclical headwinds are offset by better relative valuations compared to U.S. equities. Canadian government bonds are close to fair value, though they can still serve as an important strategic diversifier. Although overnight rates being at the lower end of the BoC’s neutral rate estimate creates a high hurdle for further rate cuts, the lingering macroeconomic uncertainty and remaining fragility in the labour markets imply there might still be more room for rate cuts into 2026.

In the near-term, we expect the Canadian dollar might remain under pressure from the soft economy, but will likely strengthen over the medium term against the U.S. dollar.

Eurozone

Divergent fiscal policies are likely to drive divergent euro area growth outcomes in 2026. A ramp-up in German defence and infrastructure spending is likely to accelerate growth in the bloc’s largest economy, with positive spillovers to key trading partners like Austra, Belgium, and the Netherlands. Meanwhile, fiscal consolidation in France, Italy, and Spain is likely to keep the region in low-gear growth with GDP running a whisker above 1% in 2026. We think ECB policy is in a “good place” with inflation near target and labour markets steady. German bunds trade near our estimate of fair value. Value is a preferred style exposure in eurozone equities.

United Kingdom

The UK economy continues to stagnate with activity and labour markets weakening in recent months. Growth drivers are likely to shift from fiscal to monetary policy during the year. The budget is expected to raise taxes with a backloaded drag on growth in 2026. We expect the Bank of England to cut policy rates to 3% to stabilise the economy as upside risks to inflation fade. UK gilts are a preferred exposure across G7 sovereigns for 2026. We believe UK equities are likely to outperform the UK economy as the index’s weighting to large multinationals provides exposure to a healthier global business cycle.

China

China is likely to experience another year of soft economic growth, with the structural overhangs of the weak property market and consumer spending still in place. One of the focuses from a policy perspective will be the approach to “anti-involution” —i.e., trying to adjust some of the extreme competitive pressures that are causing deflation. We expect targeted stimulus through the year, but nothing that will dramatically stimulate the economy. We may see a reduction in interest rates as well. Chinese equities have had a very strong year in 2025, led by technology names. Despite this strong run, we think they still look attractively valued and should be supported by improving return on equity.

Japan

The focus for Japan in 2026 will be new Prime Minister Sanae Takaichi’s fiscal policy and how that interacts with monetary policy. Takaichi campaigned on expansionary policy, and her popularity is tied to that policy. We expect Japan to see trend-like growth, with the risk skewed toward above-trend if fiscal policy surprises to the upside. The Bank of Japan is likely to be very patient in its approach to further normalisation, with one rate cut possible through 2026. Japanese equities continue to be supported by improving corporate governance. The Japanese yen appears undervalued, but there are few catalysts for appreciation other than a potential global economic slowdown.

Australia and New Zealand

The Australian economy has started to see improvement in the last three months, with consumer spending responding to Reserve Bank of Australia (RBA) rate cuts earlier this year. The labour market has softened over the last six months, with some spare capacity opening up, but hiring intentions remain robust. We expect the RBA will reduce rates once in the first half of 2026. Australian government bonds look attractive relative to global bonds, while we think Australian equities have limited upside.

The New Zealand economy is likely bottoming out following the substantial rate-cutting cycle from the Reserve Bank of New Zealand (RBNZ). The housing market has been weighing down the economy, but lower rates should start to support a housing recovery. The New Zealand dollar looks undervalued, while New Zealand equities remain expensive relative to global equities.