Russell Investments’ annual ‘$20 billion club’ analysis

Seattle, 2024-03-05 – Pension plan funded status stalls as liability growth outpaces asset returns

Following two years of gains, the average funded status for the largest pension plans declined slightly in 2023, according to Russell Investments’ annual analysis of 21 publicly listed U.S. corporations that have historically held more than $20 billion in pension liabilities. Even so, the average funded status for each corporation over the past three years was closer to the 100% threshold than any prior year since 2007. Dubbed the $20 billion club, these large plans represent about 40% of all pension and liability assets of U.S. listed corporations.

“The $20 billion club also experienced a funding deficit increase from $30 billion in 2022 to $43 billion.”

“Despite the ongoing effects of risk transfer, plan closures and plan freezes, total liabilities were still up, due to the decline in discount rates and higher interest cost in comparison to prior years,” said Justin Owens, senior director, co-head of strategic asset allocation at Russell Investments. “The net effect was a slight decline in funded ratio for the $20 billion club, with assets inching downward and liabilities inching upward."

Owens added that employer contributions in 2023 hit the lowest point that he has seen in 19 years of data tracking for this group, ending the year 25% below the high point in 2017. He also points out that each company’s disclosed expectations for 2024 indicate little appetite to contribute beyond government requirements.

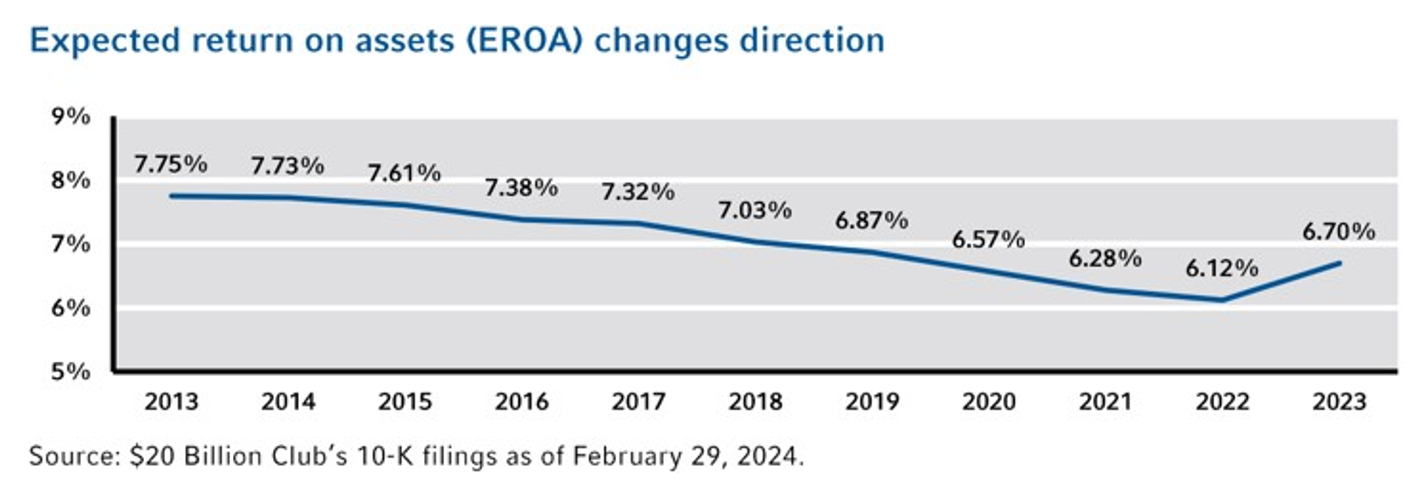

In addition, the average expected return on assets (EROA) assumptions increased year-over-year for the first time since the $20 billion club’s inception in 2011. Owens attributes the general decline in EROA assumptions in recent history to two factors: First, an increase in liability-hedging fixed income in defined benefit portfolios as closed or frozen plans implement glidepath strategies naturally reduces return expectations. Second, as rates declined, expected returns on fixed income also decreased. At least one of these factors changed in 2023.

“Expected returns on fixed income are much higher than they have been,” Owens said. “Most of these companies (13 of 21) chose to increase expected return assumptions for accounting purposes, some quite dramatically. For these companies, a higher EROA assumption would lead to lower pension expense (or higher pension income) disclosed on the corporate income statement.”

Additional observations from this year’s $20 billion club analysis include:

- Liabilities (projected benefit obligation), which had dropped to about $700 billion in 2022 to the lowest level since 2009, increased to $708.5 billion at year-end 2023.

- Assets declined to $665.6 at year-end 2023 from $672 billion at year-end 2022, which had marked the first time below $700 billion since 2011. The peak was $933 billion at year-end 2021.

- Deficit, or excess assets above/(below) liabilities, totals reached ($42.9 billion) at year-end 2023, compared to ($29.6 billion) at the beginning of the year. Contributing factors included actuarial loss ($23.1 billion) partially offset by investment returns minus interest cost ($10.6 billion).

About Russell Investments

Russell Investments is a global investment solutions firm providing a wide range of services to institutional investors, financial intermediaries and individual investors. The firm has $291.9 billion in assets under management (as of September 30, 2023) for clients in 30 countries. Headquartered in Seattle, Washington, Russell Investments has 17 offices in major financial centers, including New York, London, Paris, Toronto, Tokyo and Shanghai.