Tax-managed investing

New to the active tax management concept? Explore this page for the highlights.

What is active tax managed investing?

Active tax-managed investing is an investment approach aimed at minimizing tax drag and maximizing after-tax wealth. Tax drag is the impact that investment taxes have on a portfolio. This dynamic approach uses real-time, year-round techniques such as tax loss harvesting, minimizing wash sales, and tax-smart yield management to systematically target sources that may erode investment returns, thereby helping investors keep more of what they earn.

How does tax management help me?

In a world where investors are fixated on a pre-tax investment perspective, after-tax investment value tends to be an afterthought.

Yet, compounding tax drag nevertheless continues to weigh down portfolios and reduce returns. Fortunately, this perpetual problem has a systematic solution in the form of active tax management. Designed to target actual problems faced by investors, this dynamic approach carries out real-time, year-round measures aimed squarely at minimizing avoidable losses and maximizing after-tax wealth.

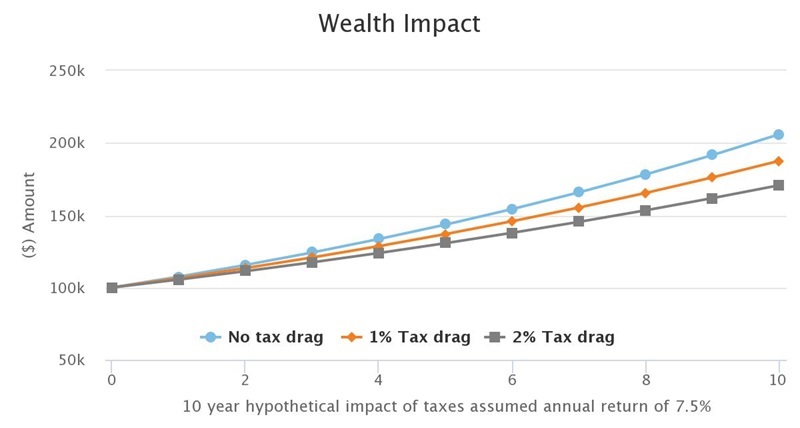

How can tax drag negatively impact my ending wealth?

Even a 2% tax drag can have a massive effect on your portfolio.

Consider the hypothetical growth of a $100k portfolio over 10 years with an average 7.5% return. If the annual tax drag on that portfolio was 2%, it would have an ending value after 10 years of $171K. With no tax drag, that portfolio would have an ending value above $200K.

NOTE: This is a hypothetical illustration and not meant to represent an actual investment strategy. Tax drag is the reduction of potential investment returns due to taxes. Taxes may be due at some point in the future and tax rates may be different when they are. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Our active tax-management approach

Because it's not what you make, it's what you get to keep.

Explore our tax-managed solutions designed to maximize after-tax returns.

When you invest what you earn, you should never settle for good enough. We're not only leaders in active tax management, we are also pioneers, having spent more than three decades in the U.S. sharpening an approach tailored to remove complexity, solve problems and save time.

Looking for long-term, tax-managed capital appreciation through diversified exposure to global equities using some of the world’s leading investment managers? Consider the Russell Investments Tax-Managed Global Equity Pool.

Seeking diversified exposure to US equities with long-term, tax-managed capital appreciation? Consider the Russell Investments Tax-Managed US Equity Pool.

Formerly known as Russell Investments Focused Global Equity Pool and Russell Investments Focused US Equity Pool.