The simplified management structure can broaden investment manager inclusion and make it easier to screen holdings and apply portfolio customizations, such as stock exclusions to meet ESG requirements.

Enhanced Portfolio Implementation (EPI)

Centralised management of multi-manager portfolios.

What is Enhanced Portfolio Implementation (EPI)?

Enhanced Portfolio Implementation (EPI) is a platform designed to address inefficiencies, reduce costs and give greater control for investors who use multiple managers or strategies.

Accomplished by first transforming Investment managers portfolios into advisory models, EPI combines all models and investment insights into one centrally managed segregated account.

Providing solutions to your daily challenges

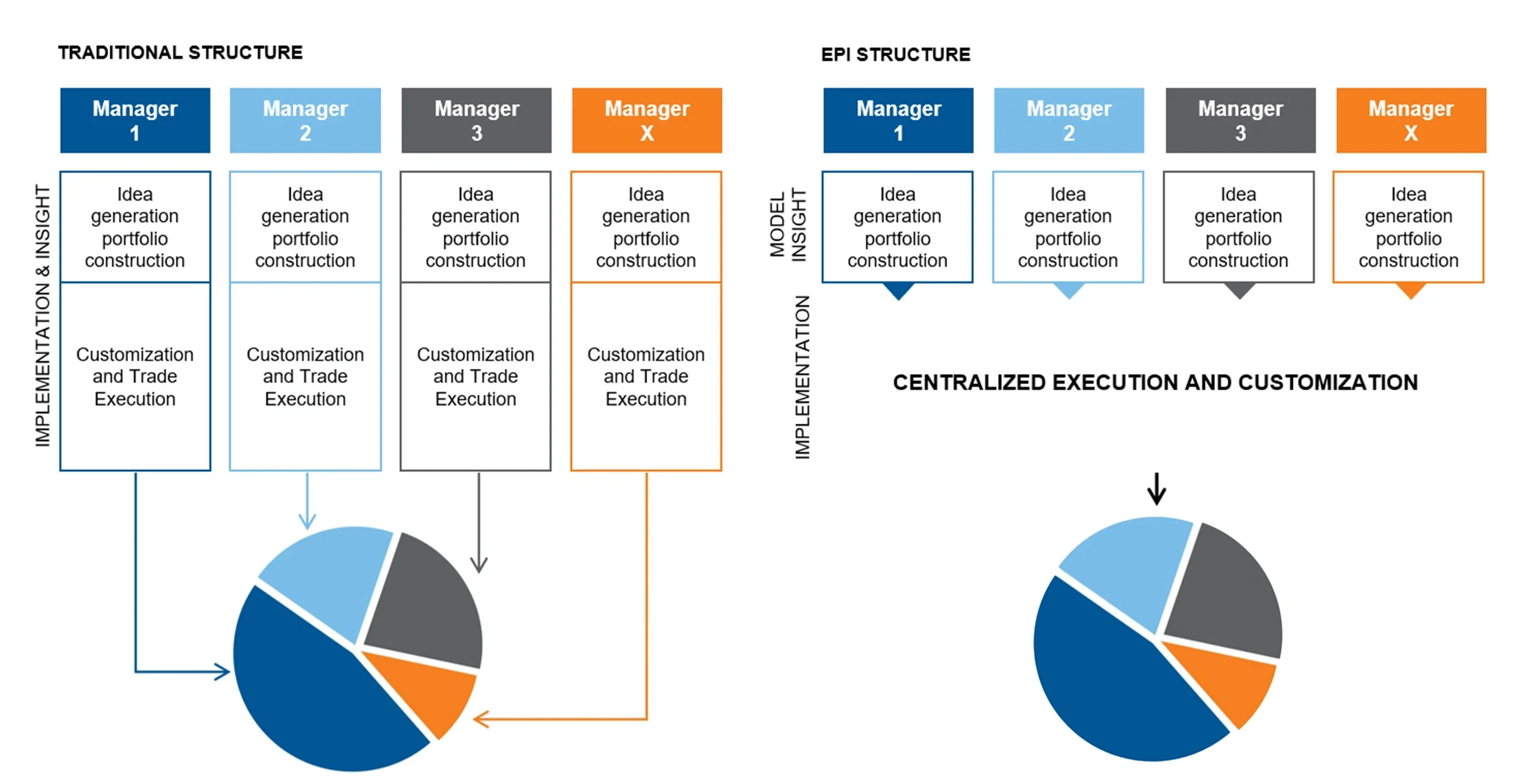

Traditional multi-manager portfolios appoint investment managers that provide both the idea generation and implementation of their portfolio allocation.

However, when managers implement their portion of the portfolio independently from one another this can create additional complexity, cost and operational challenges for the asset owner.

Our solutions provide the opportunity to:

A central management approach creates operational efficiencies and gives daily visibility and control of the aggregate portfolio back to the client, enabling more informed and quicker decisions. All in a single account.

Consolidating all active trade ideas on one platform with an overseeing manager results in fewer transactions and the avoidance of trades that are deemed immaterial at the total portfolio level; therefore, reducing transaction costs and performance drag.

Re-thinking the traditional structure

Anchored by proprietary technology integration and 15 years of experience, EPI helps investors rethink how to construct multi-manager strategies that unlock new opportunities while recouping unnecessary costs.

Source: Russell Investments. For illustrative purposes only.

Russell Investments is recognised again by RIAA as a Responsible Investment Leader 2024.

Why Russell Investments for enhanced portfolio implementation?

Utilising investment models

A proprietary implementation platform designed to access active equity management through advisory models implemented in a single segregated account, rather than multiple segregated or pooled accounts.

Centralised execution and customisation

When working within multi-manager/strategy, we believe there should be coordination of both physical and currency trades. EPI also considers the tax implications at the total portfolio level.

Single point of control

Manage cash flows, investment manager changes, guideline monitoring, exclusions, reconciliation, transaction reporting – all in the same account with a single instruction point.

EPI is a powerful tool to implement additional portfolio opportunities

Environmental, social, and governance (ESG)¹

The application of ESG criteria within investment portfolios has gained significant traction in recent years due to increased awareness of sustainability and responsible investing. EPI offers a powerful methodology for aligning investment portfolios with specific ESG mandates, including carbon footprint.

Investment Manager Selection

Using model investments provided by Russell Investments, based on partnerships with selected global managers, helps optimise portfolio management, potentially reduce costs, and simplify the often-complex process of active manager selection and contracting. We aim to offer investors more efficient access to diversified investment strategies while navigating the challenges of managing active investments.

¹ Applying sustainability and ESG criteria to the investment process may cause the portfolio to forgo some market opportunities available to portfolios that do not use sustainability criteria. The portfolio performance may at times be better or worse than the performance of portfolios that do not use sustainability criteria.

An experienced, well-resourced global outsourced trading team

18+ yrs

Experience in EPI in 2024

150+

Mandates using EPI

130+

Managers have used our EPI program globally in 2024

£49.7 B

EPI assets managed

Source: Russell Investments, as of 31 December 2023.

Execution services are provided by Russell Investments Implementation Services Inc., member FINRA/SIPC. Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

Navigating a multi-manager portfolio is complex. Independent investment managers bring operational challenges and costs. Innovations for portfolio manager portfolios

We took part in a Portfolio Institutional Roundtable where we discussed the key trends and challenges from across the industry and how we are helping clients address them.

Learn more

Explore these related insights

A journey to decarbonisation

We used our EPI infrastructure to help The Wales Pension Partnership (WPP) reduce the cost of investment and incorporate environmental, social, and governance (ESG) considerations to £2.6 billion of their global assets.

Our experts work hard to solve the complex issues our clients encounter.

Our collection of research shows our dedication to solving complex investment problems.

Private Markets Playbook: Positioning for a New Reality

How to spot opportunities and gain exposure to private investments without taking on too much risk.

Read the articleEye on private credit

Understanding the basics and beyond

With a robust supply of asset-based investments, the private credit market has grown to over $5T dollars and is anticipated to be worth nearly $8T by 2027, driven by structural shifts in the lending environment.

Start exploringOutsourced CIO

The Right OCIO Can Cure Insomnia in Restless Markets

Even in normal times, managing an investment program is a challenging job. But when you add on tariffs and trade wars, it's bound to lead to some sleepless nights. Learn how an OCIO firm can provide relief.

Read the articleCustomised Portfolio Solutions

Specialist expertise and strategies to help your team gain greater portfolio control, limit costs, reduce risk, and enhance returns.

Partner with us

Get in touch with us through this form and we'll reach out to you.

Maarten Roeleveld

Managing Director, Head of Customised Portfolio Solutions, Europe

About Maarten