Executive summary:

- Managers are increasingly focusing on sectors beyond tech that could benefit from the rise in AI in the short term. These include healthcare and consumer companies, which also have more attractive valuations.

- Globally, managers anticipate an increase in mergers and acquisitions through the rest of 2024, which should be supportive of small and mid-cap names.

- Managers see recent corporate governance reforms as likely to improve the return on equity in both developed markets (Japan) and emerging markets (South Korea).

Broad global trends

More discernment on technology

- While some technology stocks continue to have long runways for growth with visible earnings coming through, investors are becoming increasingly wary and discerning of valuations, given the whole sector was lifted by the AI (artificial intelligence) theme over the last year.

- As such, there has been increasing profit-taking in the sector across various markets.

Beyond the Magnificent Seven

- The broadening opportunity set in the U.S. has investors increasingly looking at companies that will benefit from the use of AI in the near term.

- Growth and value investors have been shifting positions toward healthcare and consumer companies, where valuations are more attractive and AI is already having a transformational impact.

Pick-up in M&A activity

- After a pause in M&A (mergers and acquisitions) activity last year, driven to some extent by the high interest rate environment, investors across different markets expect a pick-up in deal activity. In particular, small and mid-cap businesses are seen as targets given attractive valuations.

China recovery

- Extreme negative sentiment toward China has been abating among investors, at least in the short term, with signs that the various policies enacted to stimulate the economy over the last year are finally having an impact in stabilizing growth.

- These observations has been supported by recent macro indicators showing an increase in imports and exports above expectations, including an uptick in manufacturing data.

Value-up: Improvements in corporate governance

- A government-led push to improve corporate governance has been driving up stock prices in Japan and more recently, South Korea, particularly in sectors such as financials, telecommunications, autos, and utilities. Many companies are expected to begin disposing non-core assets and returning cash on balance sheets to shareholders.

Commodities

- Investors have remained bullish on the structural growth dynamics for metals such as copper. This optimism is supported by its importance in both the transition to green energy and increasing demand for data centers due to generative AI, and also because supply is expected to be constrained.

Global equities

Transformation for healthcare

- AI innovation with new medical equipment and drug-testing solutions has led to new techniques, patents, and cures.

- The demographic shift to an aging population with these accelerated technological advancements offers a long and structural runway for growth.

Consumer staples oversold

- While global consumer-oriented companies have lagged, select managers see value in niche segments such as cosmetics and beverages —and could benefit from an inflection turnaround.

Derisking and income

- Interest rate uncertainty has led some value investors to rotate to high cash-yielding sectors, such as utilities and REITs (real estate investment trusts), taking early profits from deep cyclicals that rerated, such as natural resources.

Broadening U.S. growth opportunities

- Beyond the dominant tech giants (dubbed the Magnificent Seven), signs of a broad-based rally have emerged, potentially benefiting previously overlooked segments like small and mid-cap stocks. Growth managers are bullish across the breadth of the U.S. market, buoyed by positive earnings and economic indicators.

Surprise from China

- Despite investor caution and underweights to China, positive macroeconomic headlines have renewed interest in various sectors, such as manufacturing, exports, commodities, and e-commerce.

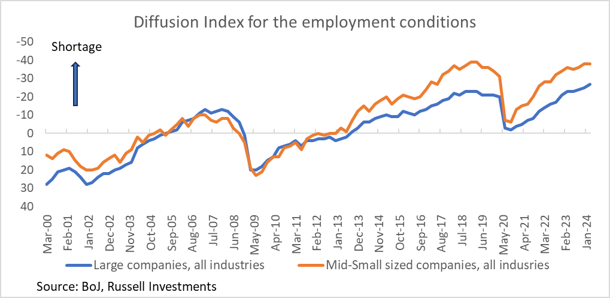

Macro tailwinds in Japan

- The undervaluation of the Japanese yen and the Bank of Japan’s (BOJ) watershed shift from negative to positive interest rates are a pro-cyclical tailwind. Managers are slowly and selectively adding to bank financials.

Early signs of corporate governance change

- Improvements in corporations in Japan and South Korea that had weak governance are initially appearing to unlock value. Autos, financials, and telecommunications companies are disposing non-core assets and returning balance-sheet cash to shareholders to improve returns on capital.

U.S. equities

Cautiously optimistic

- Active equity managers are becoming more constructive on the economic prospects for the U.S., with a resilient labor market expected to spur increased consumer spending.

- That said, managers believe corporate guidance in the current round of quarterly results should continue to reflect a somewhat cautious outlook, given increased uncertainty around the path of interest rates and rising commodity prices.

- Growth and value managers alike are adding to companies within rationally structured industries that have pricing power, but caution that the era of profitless growth being rewarded in the market is over and unlikely to return anytime soon.

Beyond the Magnificent Seven

- After moving together for much of 2023, the Magnificent Seven stocks are showing greater dispersion of returns thus far in 2024, with Nvidia and Meta continuing to outperform while Tesla and Apple have lagged due to increased competitive pressures in China.

- Though AI remains the dominant theme in growth portfolios, managers are now shifting positions toward healthcare and consumer names where AI is seen as an enabling technology.

- Value managers also see opportunities within healthcare and are adding to holdings in the sector. After underperforming in 2023, select utilities are now seen as AI beneficiaries as demand for electricity from data centers drives higher growth.

M&A picking up – time for small caps?

- Managers expect a pickup in deal activity among public companies as the valuation spread between large cap and smaller cap stocks is nearing historically wide levels.

- After an interest-rate-induced pause over the last couple of years, private equity is facing increased pressure to put funds raised to work, which should also be supportive of small caps.

Emerging markets equities

Tailwinds remain for EM

- Despite inflation coming under control, meaningful rate cuts have so far been delayed, as countries look to protect currencies relative to the U.S. dollar (USD) given delays by the Federal Reserve in cutting rates in the U.S.

- The improving macroeconomic environment, along with an expectation of rate cuts, provides a positive backdrop to accelerate the growth differential between emerging markets (EM) and developed markets (DM).

- After a prolonged period of outflows from EM, global investors are under-allocated, presenting opportunities for EM companies to benefit from a renewed interest and inflows.

- Positive earnings continue to broaden, with investors reducing exposure from technology names—which have benefited from the AI theme over the past year—and reallocating more broadly.

Commodities – positive supply/demand dynamics

- Despite recent price weakness, many investors continue to remain constructive on certain commodities that are seen to have structural growth support, such as those supporting the green energy transition, where there are clear supply and demand imbalances.

Signs of recovery emerging in China

- Industrial production and manufacturing are showing early signs of recovery, with increased contribution to GDP growth.

- Better-than-expected exports and imports data is supportive of an improving macro environment.

- The property market continues to lag, but transactions are increasing to levels close to the 15-year average. The government continues to shift to less restrictive policies around ownership limits, which is supportive.

South Korea’s Value-up Program

- Similar to Japan, there has been a drive by the South Korean government to improve corporate governance, which has been pushing up stock prices, particularly in sectors such as financials, autos, and utilities.

Long/short equity

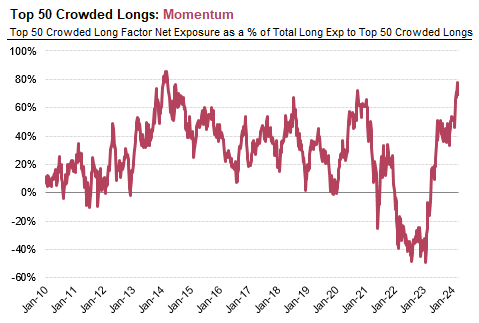

Heightened risks in overbought Momentum factor

- Elevated Momentum exposure: Hedge funds have escalated their stakes in high-Momentum stocks, pushing the Momentum factor performance up by nearly 30% year-to-date. This heightened exposure is notably concentrated among top crowded long positions, reaching the highest levels since late 2021.

- Potential market impact: The over-concentration in Momentum stocks heightens the risk of sharp market corrections, as historically, such buying sprees are often followed by severe selloffs.

Source: MSCI Barra, Morgan Stanley Prime Brokerage, data as of April 8, 2024

Attractive opportunities in merger arbitrage market

- Despite the market mispricing of deal risks, the presence of historically wide deal spreads provides opportunities for outsized returns. This potential persists even amid increased regulatory scrutiny, particularly in complex antitrust cases, where clean deals maintain low break rates and high potential returns.

Interest rate sensitivity risks

- Increased rate volatility has forced equity long/short (L/S) managers to prioritize interest rate sensitivity, particularly in leveraged short positions.

Europe and UK equities

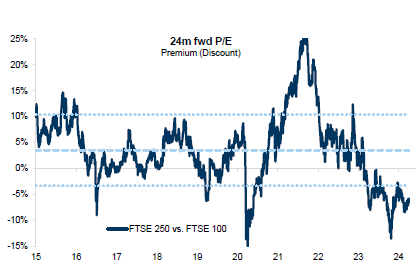

Small and mid-cap tailwinds

- UK small and mid-cap stocks are ripe for increased investor attention. These stocks trade at a material discount to their larger cap peers (see chart below), and a calming political backdrop, falling inflation and stabilizing growth prospects offer an opportunity for domestically exposed mid-cap stocks to break out of their depressed valuations.

Source: GS Investment Research, Factset

- While UK stocks have struggled for investor attention for some time, UK corporates are now seeking to take advantage of the valuation opportunities on offer with an acceleration in M&A activity and share buybacks. After a quieter year in 2023, 2024 has already witnessed an increase in corporate activity for listed firms. An environment with a greater willingness to seek bolt-on acquisitions, which has been largely absent in recent years, has tended to be supportive of returns for mid-cap stocks.

Goldilocks for European banks?

- After 15 years in the doldrums, European banks are finally garnering interest from investors. These banks have cleaned up their balance sheets and have been beneficiaries of the higher interest rate environment. However, despite the improving earnings picture, hard-landing fears have kept their valuations depressed. With these fears now slowly abating, and continued positive interest rates, this could finally be the time for them to shine.

Japan equities

Divergent views on inflation impact investment preferences

- While many managers have begun to acknowledge the likelihood of persistent inflationary pressures, there remains a notable dispersion in their perspectives on its sustainability.

- Those advocating that Japan has shifted into a sustainable inflationary environment—who are predicting an acceleration in wage growth—continue to favor large-cap value stocks, typically banks or trading companies. In contrast, managers anticipating a decline in inflationary pressure, with stabilization expected in the near term, tend to identify opportunities in quality or growth stocks that have become more attractive in valuation due to past underperformance.

Growing focus on lagging cyclicals

- Most managers are cautiously monitoring capital goods stocks, which have notably underperformed amid China-related concerns. Some have begun reducing their underweight positions, enticed by favorable valuations and an anticipated cyclical rebound.

Corporate governance reform continues to gather attention

- Many anticipate improvements in the return on equity (ROE) of Japanese stocks through balance-sheet restructuring. A rising anticipation of the resolution of cross-shareholdings encourages managers to maintain exposure to banks.

Canadian equities

Improving opportunity in banks

- Managers are beginning to become more optimistic about banks and have been incrementally increasing exposure.

- Sentiment is improving in the sector as investors view loan growth at a trough level and likely to improve going forward. This has also been supported with multiple banks exceeding expectations in the first quarter.

- Managers also believe it’s unlikely that interest rates will increase from this point.

Commodities

- While gold mining stocks had a strong quarter, managers are more bullish about copper over the intermediate- to long-term. Copper demand will continue to be bolstered by two key secular trends – (1) increasing electrification of the energy grid, and (2) increasing demand for data centers due to generative AI.

- Within energy, natural gas has been weak, with a warm winter tempering demand. However, managers view the longer-term opportunity as robust, as the European natural gas supply continues to be impacted by the Russia-Ukraine war.

Opportunities in industrials

- Equity investors have a positive outlook for engineering and construction companies, which should benefit from infrastructure projects as well as a general increase in activity as interest rates stabilize.

Defensives for the long-term

- Despite lackluster results in the communication services and utilities sectors, long-term managers believe the valuation setup is very attractive.

- While interest rates are high and offer a compelling alternative to dividend payers, yields are at historically high levels. Utilities are also expected to benefit from an increase in power demand stemming from data centers.

Australian equities

Iron ore supply/demand to worsen

- Some managers are wary of iron ore companies due to a longer-term supply-demand view. They point to the supply impact of the Simandou mine in Guinea, which is expected to add to global production from 2026 and produce ore of similar, or better, quality to Australia’s Pilbara region.

- The increase in ore production is expected to occur at the same time as a moderation of demand for ore, due to an expected slowing in Chinese construction.

Source: Yarra Capital Management, UBS, Wood Mackenzie

Gold – macro hedge with a side of copper

- Managers have continued to retain their gold company holdings, despite a rally during the quarter.

- The reasons for holding are twofold: as a hedge to geopolitical uncertainty, and because copper is also produced at many of the gold mines. Electrification is contributing to the demand for copper.

Real assets

Listed versus non-listed

- There continues to be a disconnect with private real estate and public real estate pricing. Investors view REITs as attractive.

- Each time there have been discounts to private real estate of this magnitude in the REIT market, publicly traded REITs have outperformed private real estate on a three-year-forward basis of 25%-50%.

- Historically, this level of disconnect between private and public real estate has led to significant M&A and consolidation once capital markets stabilize.

- For example, in April 2024, Blackstone acquired AIR Communities, an apartment REIT, at a 25% premium to its share price. Blackstone is underwriting a 20% IRR on the deal, which is going into their opportunistic fund, BREP X.

Real estate

- Data centers should continue to benefit from strong demand for cloud computing and artificial intelligence.

- The residential sector could benefit from affordability issues in the for-sale market, which is leading to higher demand for rental housing, particularly within single-family homes.

- Cash flows remain sound, and an end to central bank tightening tends to be followed by notable strength in listed real estate.

- Real estate debt originations could have further declines ahead, due to rising lender caution and greater regulatory scrutiny after bank failures.

Infrastructure

- The credit environment is likely to remain challenging. Managers are focusing on companies with strong balance sheets, with limited near-term maturities and manageable refinancing schedules.

- Electric and gas infrastructure to support data center demand could drive significant investment opportunities in power.

- Energy transition and AI development has the potential to instigate innovation within digital infrastructure.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.