Does an overlay program make sense in your OCIO program?

Does overlay make sense for your investment program? The answer likely depends on a few factors: your type of plan, the size of your fund and the problems you’re trying to solve. It's probably harder to justify the incremental cost and administrative burden on staff for clients that don't have separate-account custody relationships. That said, a derivative overlay portfolio is a powerful addition to the toolkit if the economics pencil. Even one single custody account can be used for so many purposes within an overlay program.

Overlay means many things in the investment industry. In this case, we're talking about the use of futures, such that cash exposure—wherever it sits—can be covered by other risk premia—generally equity index or Treasury exposure.

Here are a few common overlay uses in greater detail:

Hedging interest-rate risk

The most critical use case that would justify the addition of a separate account overlay to a fund-based OCIO client arrangement is LDI completion. This is a surplus risk management consideration for Corporate DB clients, so they would be the most common client type with this need. (Note: Public DB plans, healthcare organizations, and non-profit foundations may still find overlay useful, but the use of separate-account overlay is less common in these situations.)

|

ADVANTAGES OF AN OVERLAY PROGRAM

|

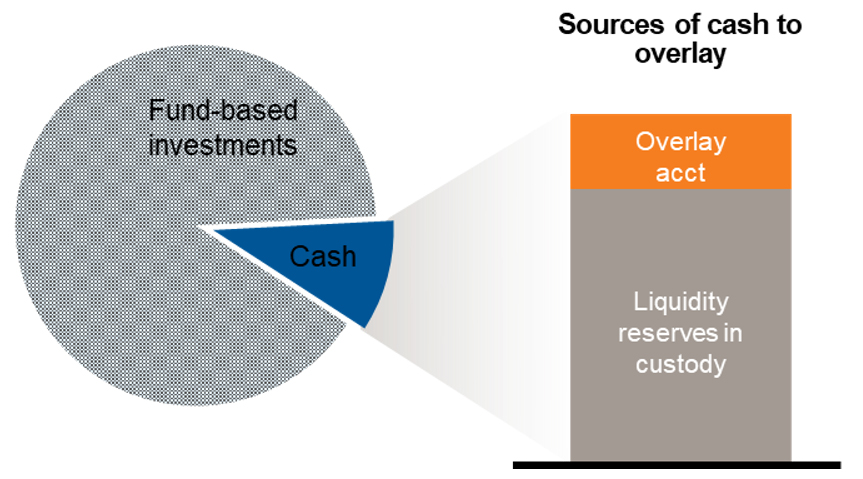

This application of an overlay comes into play when the existing fund-based LDI components need a bit more capital efficiency to reach the desired LDI Hedge Ratio. This generally occurs in cases where the value of the liability is greater than the value of the fund's assets. In this case, the fund can maintain its desired growth asset exposure to close the funding gap while more effectively managing the downside risk to funded status in falling interest rate environments.

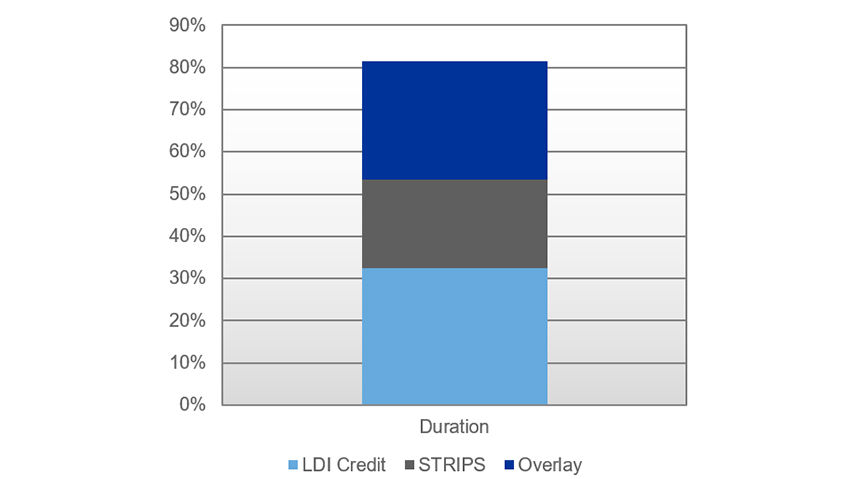

Overlay also makes sense to address specific curve risks relative to the liability. Russell Investments' fund components for LDI include various Treasury STRIP funds and an LDI Credit fund. An additional overlay account may be considered if the fund-based components are otherwise unable to adequately hedge surplus risk.

LDI COMPLETION OVERLAY

Various long Treasury futures used to manage LDI hedge and improve capital efficiency

LDI HEDGE RATIO

This application of an overlay comes into play when the existing fund-based LDI components need a bit more capital efficiency to reach the desired LDI Hedge Ratio. This generally occurs in cases where the value of the liability is greater than the value of the fund's assets. In this case, the fund can maintain its desired growth asset exposure to close the funding gap while more effectively managing the downside risk to funded status in falling interest rate environments.

Overlay also makes sense to address specific curve risks relative to the liability. Russell Investments' fund components for LDI include various Treasury STRIP funds and an LDI Credit fund. An additional overlay account may be considered if the fund-based components are otherwise unable to adequately hedge surplus risk.

Rebalancing or maintaining asset allocation

Since fund-based OCIO clients enact rebalancing or glide path de-risking shifts via unitized transactions in the component funds, there is generally not a standalone need for a rebalancing overlay. That said, larger OCIO clients that implement via a separate accounts may also benefit from a rebalancing overlay to improve efficiency and cash flow management. With an overlay in place, funding of benefit payments and other cash outflows do not require a just-in-time sale—or purchase in case of inflows—of component funds. In such an arrangement, greater cash balances can be maintained in a liquidity reserve account in custody, but they do not need to result in cash drag relative to the investment policy. The example below shows a case where both long and short futures are allowed to make rebalancing more efficient. This is particularly attractive in the case of OCIO clients that use some less-liquid funds, which are less able to absorb rebalancing flows. Less liquid asset classes—or in some cases even private asset classes—can be proxied with more liquid futures contracts on a public asset class.

REBALANCING OVERLAY

Uses long and short futures positions to specific asset classes to also implement rebalancing policy

Liquidity management

In other cases, clients bias the overlay need to a particular asset class. Maintaining larger cash balances in the payment account is possible without having the cash drag of being uninvested. Using futures can reduce liquidation costs required to fund benefit payments (or other cash outflows).

Tactical flexibility

While most pension portfolios track a policy portfolio with varying degrees of range tolerance from a target, it's often the result of relative market returns, causing exposures to drift from target levels. A tactical overlay can make exposures more deliberate and target additional return generation from the top-down. Russell Investments offers a service called Enhanced Asset Allocation (EAA), such that the discretion to make risk-controlled asset allocation tilts resides with us. This means the tilt does not require governing-body approval to open or close positions. From our experience, traditional governance approval takes too long to allow for efficient return capture, which means most plans do not tactically tilt on their own.

Not every OCIO client needs an overlay

While larger institutional clients that are already administered via separate accounts have a lower cost/benefit hurdle for adding an overlay program, it may be challenging for some OCIO clients to make a compelling business case for such a move. Here are some examples where the decision may not pencil:

- No separate account custody relation in place. Investors should consider incremental custody costs and complexity, as well as overlay management fees. The smaller the client, the larger those costs are in terms of percent of plan assets. Remember, you're already getting world-class implementation via commingled funds, often using futures and coordinated risk-trading to enact investment changes.

- No need for LDI program to manage surplus volatility. Since this is the most obvious case where an overlay can offer benefits, client types that don't manage risk in this way may be less prone to add the complexity of an overlay, especially if their fund-based program is already functioning well.

- Clients with low-risk allocations already may have little need for increased capital efficiency an overlay can deliver.

Final thoughts

If an overlay is suited to your situation, it's important to build these criteria into your OCIO search early in your process to identify a shortlist of suitable candidates. While many providers might be able to run such a program, one that does it every day for large clients around the world is more likely to run it better. An overlay shouldn't create additional work or confusion. Russell Investments' Overlay Services team is well-versed at reporting overlay results. And complementing existing performance reporting on your plan is a top priority.