UK disinflation under way

Executive summary:

- UK gilts rally after headline and core inflation numbers surprise to the downside.

- With producer prices dropping in June, further falls in inflation appear likely.

- We believe these market moves highlight the importance of maintaining liability hedging for defined benefit pension schemes that are seeking to control funding level variability.

UK disinflation under way: Gilts are attractive

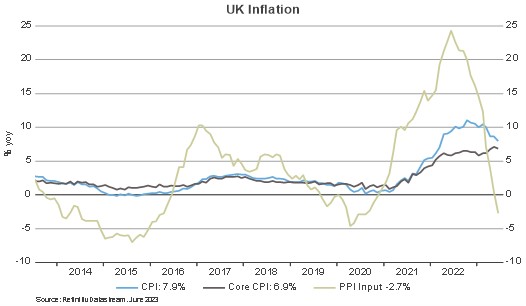

You could almost hear sighs of relief in the Bank of England and the UK government at the inflation data that was published today. The consumer price index (CPI) for June rose by 7.9% year-on-year, 0.2% lower than the consensus expectation of economists according to Refinitiv. More importantly, the core inflation rate (excluding food and energy) also surprised solidly on the downside, coming in 0.2% below expectation at 6.9% year-on-year. This was the first inflation print in six months that was softer than anticipated.

What most observers did not pick up on was that more disinflation is coming through the pipeline from the prices that are being charged at the factory gate. The producer input price index (PPI) dropped by 2.7% in June compared to the same month last year. Since producer prices lead consumer prices (see chart), further falls in inflation are likely. Heeding the disinflationary signals from the CPI and PPI reports, UK gilts rallied hard. At the time of writing, the 2-year gilt yield dropped by a whopping 21 basis points and the 10-year yield by 15 basis points. The rally could have further to run. Based on the 10-year gilt yield adjusted by expected inflation for the next year, the UK bond market still screens highly within the G6.1

In contrast to the surge in bond prices, the pound fell sharply after the CPI data as the implied peak policy rate dropped to below 6%. Despite the currency’s appreciation in 2023 to 1.29 vis-à-vis the US dollar, it is still relatively cheap.2 However, our indicators suggest that long positioning in the pound has become stretched, limiting the scope for the currency to appreciate further.

What are the potential implications for pension plans?

These market moves highlight the importance of maintaining liability hedging for defined benefit pension schemes that are seeking to control funding level variability. After the events of 2022, ensuring an effective governance and implementation framework remains paramount. We believe that outsourcing these sorts of decisions can help pension schemes focus on bigger-picture strategic and funding objectives.

The bottom line

In our last article, we feared the Bank of England was already overtightening monetary policy. Higher interest rates have finally started feeding through to falling inflation. Producer prices signal further disinflation, which keeps us bullish on UK gilts.

1 The G6 bond markets comprise Australia, Canada, Germany, Japan, UK and the US.

2 The purchasing power parity exchange rate for GBP/USD is around 1.48. Source: Organisation for Economic Cooperation and Development.