Maybe far away, or maybe real nearby? Analysis of the uncertain economic environment in Europe and the UK

- Europe and the UK are already facing energy challenges, which could be worsened by colder-than-expected weather or more geopolitical tensions

- Government relief measures could provide some support, but they also bring about their own challenges

- The blend of high recession risks but strong oversold sentiment means that investors should consider sticking to their strategic asset allocations rather than tactically over/underweighting asset classes

The bottom line: Investors will need to closely monitor how the situation in Europe and the UK unfolds. Although valuations have improved, the macroeconomic backdrop is far from certain, ultimately combining into a situation where we believe investors would benefit from staying disciplined and sticking to their strategic asset allocations for now.

Introduction

The popular song from the musical Annie perhaps best encapsulates the thoughts of many market participants. As Europe and the UK deal with a potential energy crisis, investors are wondering whether a recession is inevitable, and if so, what the implications on their portfolio might be.

In this report, we assess the situation through multiple lenses. First, we consider the relative demand and supply of energy sources in Europe. Next, we examine how well-equipped consumers and businesses are to weather the economic storm, and the degree to which government intervention may cushion the damage. Finally, we look to see how much damage has already been baked into market pricing.

We’ll need energy, tomorrow: Why energy needs could be much higher this fall/winter

As cliched as the saying may be, energy is a necessity. We need energy to be able to heat and power our homes and businesses. According to Our World in Data, countries in the European Union consumed more than 16,000 terawatt hours of energy in 2021. That’s the equivalent of powering 1,600 trillion 100W lightbulbs for an hour each!

Although we consume energy on a daily basis, seasonal factors play a key role in determining energy consumption. When the weather cools down in the winter, your furnace has to work harder to keep the temperature inside your home and workplace comfortable. This means that energy consumption tends to increase when winters are colder or more protracted than usual.

The bad news is that might be exactly the type of winter weather we are heading for. According to a Sept. 8 update from the U.S. National Weather Service, climatologists are expecting a 91% probability of a La Nina event for the Northern Hemisphere for the fall, meaning that we will likely see colder temperatures. Even as we get into winter season, La Nina is still expected to be the most likely outcome, with a 54% probability from January to March.

Thus, all things being equal, Europeans would likely need to consume even more energy this fall and winter compared to the previous fall and winter.

A hard-knock life for Europe and the UK: These regions will face energy supply headwinds

While the world has made remarkable progress in trying to shift energy sources towards renewables, we still need oil and natural gas. According to Our World in Data, oil and gas accounted for a combined 62% of all energy consumption in the European Union in 2021, and in the UK, oil and natural gas consumption totaled more than ¾ of energy consumption!

Historically, Europe has been heavily reliant on Russia for energy imports. The International Energy Agency notes that approximately 40% of Europe’s natural gas consumption was imported from Russia in 2021. In contrast, the UK is less directly reliant on Russia natural gas—UK government data show that the UK imported only 4% of its gas from Russia. That being said, a disruption in Russian natural gas supplies would still likely have a significant impact on the UK, as it would push up prices paid for natural gas.

Unfortunately, the conflict between Russia and Ukraine has made obtaining energy from Russia much more challenging. Earlier in the year, Russia decided to suspend natural gas exports to Europe via the Nord Stream 1 pipeline indefinitely. And although the Russian authorities had cited maintenance as the reason for the suspension, the political dynamics mean that it is unlikely for the gas flows to resume in short order. Moreover, in late September, authorities discovered gas leaks in the Nord Stream 1 pipeline, which further prolongs the shutdown of Nord Stream 1.

In addition, Russia has also been disrupting the supply of natural gas to certain other European countries as well. France, Poland, Denmark, the Netherlands, Italy, Finland, Austria, Slovakia and the Czech Republic are all countries that have either seen a partial or total halt of Russian gas exports.

In an attempt to offset the impacts, countries have been taking steps to try to fill their gas reserves ahead of the winter season. As of Sept. 30, data from GIE AGSI+ shows that European countries have filled an average of 88% of their storage capacity, while the UK has filled 91% of its gas storage capacity. While it’s great that these countries have been building their reserves, the reserves might still not be enough to fully make up for the potential losses in natural gas inflows from Russia. At full capacity, European gas reserves would only be able to store around 1,100 terawatt hours of gas. But based on data from the Bruegel Institute, Europe imported more than 1,700 terawatt hours of gas from Russia. Thus, European countries (and likely the UK by virtue of regional pricing) would be significantly impacted if Russia ceased all natural gas exports.

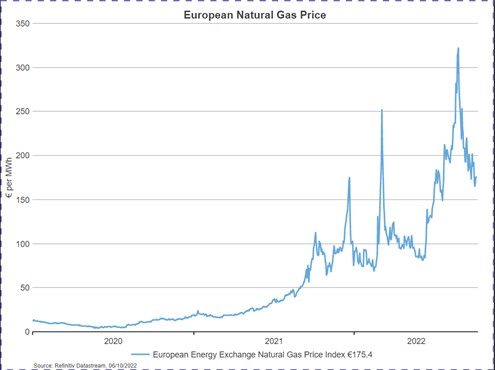

Concerns about a natural gas shortage have fueled a substantial increase in natural gas prices year-to-date. Although European natural gas prices have pulled back from their peaks, they are still much higher than the pre-Ukraine-conflict price levels. And as of now, Russia has still not yet cut off 100% of gas flow to Europe. If they fully turn off the taps, it’s likely that prices will rise even more.

Source: Refinitiv Datastream, Oct. 5, 2022

Next, let’s turn our attention to oil, the other major energy source fueling Europe and the UK. According to the BBC, approximately 27% of European oil imports came from Russia. Meanwhile, Russia had supplied 24% of UK’s oil imports prior to the Ukraine conflict, but has stopped importing oil from Russia as of June 2022, according to the UK government.

Notwithstanding the historical reliance on Russian oil imports, Europe has also decided to move away from dependence on Russian oil, seeking to ban Russian oil imports by sea by December 2022.

While seeking alternative suppliers for such a large energy source can be difficult, mitigating factors make the oil situation somewhat less dire than the natural gas situation. Unlike natural gas, which relies heavily on pipelines that have a limited range, oil can be transported much easier on transoceanic ships. This means that a portion of the embargo on oil imports will merely be a substitution effect: the Russian oil gets diverted to countries like India and China that are willing to buy discounted oil. In turn, these countries can buy less from non-Russian producers, freeing up a portion of the supplies for Europe and the UK.

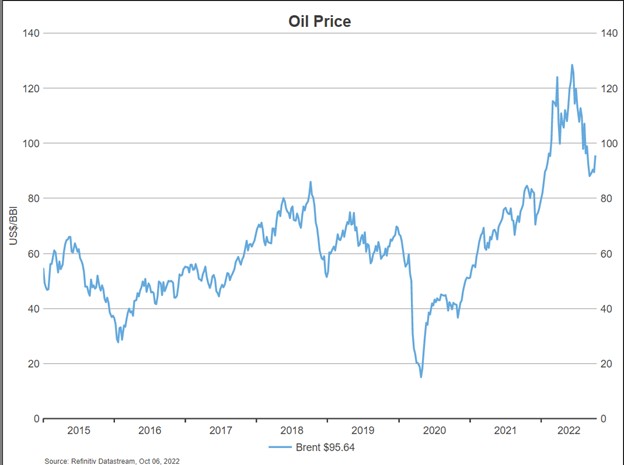

Global growth concerns in recent months have pushed oil prices down from their peaks, As central banks in many developed markets raise interest rates further and further, the likelihood of seeing a slowdown in economic growth increases. Such a slowdown in economic growth would likely mean a reduced need for oil consumption. In addition, the continuation of China’s zero-COVID policies throughout much of the year likely also weighed on oil consumption.

In September, Brent oil (a popular European crude oil benchmark) prices retreated to less than US$90 US/barrel, back down to pre-invasion levels. That being said, it’s likely too early to breathe a sigh of relief. OPEC+ countries announced that they would cut oil production by around 2 million barrels per day. This caused Brent oil to rebound to around US$95/barrel as of early October. And if more geopolitical tensions arise, it’s possible that oil prices will rise even further.

Source: Refinitiv Datastream, Oct. 5, 2022

An uneasy street: High risks and uncertainties

Given that the energy situation this winter will likely be precarious for Europe and the UK, it’s worthwhile to consider the macroeconomic impacts. While it can be difficult to quantify the probability of a recession, it’s fair to say that the situation looks somewhat bleak.

Even before the arrival of winter, we have already been seeing signs of a slowdown in Europe and the UK. PMIs (purchasing managers’ indexes)—an important leading economic indicator—have already entered contractionary territory (PMI < 50) for both Europe and the UK. Final PMI estimates show that the S&P Eurozone PMI Composite Output Index dipped to 48.1 in September, the lowest level in 20 months. The UK didn’t fare much better—its September Flash PMI Composite Output Index dipped to 48.4 in September, also setting a 20-month low.

Meanwhile as growth concerns mount, inflationary pressures still remain a significant challenge. The Eurozone saw inflation rates hit 10% year-over-year in September. Meanwhile, the UK August CPI showed a 9.9% increase year-over-year, while the UK August RPI showed a 12.3% increase year-over-year. This means the respective central banks will likely continue hiking interest rates in an attempt to restore price stability. But as central banks push up interest rates higher and higher, the chances of tipping the economy into recession also increase.

When central banks raise interest rates, cost of borrowing for consumers will go up. According to Moneyfacts, mortgage rates for both two and five year fixed mortgages in the UK are now around 6%, the highest level since 2008 and 2010, respectively. The higher costs of debt servicing will put pressure on budgets, and give consumers even less wiggle room to tackle elevated energy costs. They may have to cut back their discretionary spending, which could adversely impact economic growth.

It’s also worthwhile to keep an eye on debt levels. Data from research firm CEIC show that household debt levels in the EU have risen to 51.1% of GDP, only slightly shy of the 54.6% peak seen in 2010. Meanwhile, data from the same firm shows that UK household debt-to-GDP reached 89.4%. When household debt levels are already elevated, it reduces the amount of additional borrowing available to consumers, thus putting pressure on how they respond to the energy crunch.

While we believe there is a high likelihood of recession in Europe and the UK, a recession is still not inevitable. Whether Europe and the UK ultimately land in a recession will be heavily driven by how the energy situation unfolds, but the existing macroeconomic backdrop can still play a key role in either amplifying or dampening the shocks.

A new deal for the winter season: Governments are unveiling ambitious plans, but challenges remain

With cost challenges potentially on the horizon for consumers in Europe and the UK, governments have been working on measures to alleviate the price challenges. The British government announced measures to cap the energy prices consumers and businesses in the UK would face. In total, these measures would amount to approximately 180 billion British pounds, or roughly 8% of the UK’s GDP. Germany announced a 200 billion euro package of measures, including an emergency brake on gas prices and subsidies for electricity use. And the EU as a whole is also reportedly working on coordinated relief measures.

While government support may potentially offset some of the challenges businesses and consumers face, other hurdles still remain. Price caps often only reduce part of the rate hikes. For example, the UK’s plan would cap energy bills at 2,500 pounds, but that would still be more than double the maximum price that consumers paid in 2021.

In addition, just as Milton Friedman quipped that “there’s no such thing as a free lunch,” investors also have to understand that there’s no such thing as free energy. The costs for all these support measures would have to be financed either through additional borrowing, increased taxes, or by reallocating government funds that were originally intended for other purposes. This means that even though the plans might give some relief to consumers and businesses in the interim, they may actually be counterproductive in the long-term.

Government spending also often acts as an inflationary force, which could compel the European Central Bank (ECB) and the Bank of England (BOE) to implement even more rate hikes in order to achieve price stability.

But without these measures, there would potentially be more short-term pain than the economies of Europe and the UK can weather. Alas, the governments are caught between a rock and a hard place, and that does not bode well for investor confidence.

Hard for investors to like it here, but there might still be glimmers of hope

Amid all the doom-and-gloom that Europe and the UK potentially face, investors may be tempted to forego investing in these regions. But at Russell Investments, we believe that investors ought to stay disciplined, and carefully digest the evolving landscape. In our recently released 2022 Q4 Global Market Outlook, we outlined some of our views on European and UK markets. In the sections below, we’ll expand on how, despite the many obstacles, there could still be glimmers of hope.

European and UK equities outlook

Equities are inherently risk assets, and with a recession looking increasingly likely amid the energy crisis, equity market performance could be weighed down by the bleak macroeconomic environment. In fact, European equities are already down by around 20% YTD through Oct. 5.

Despite the large selloff, European equities are not exactly cheap. While equity valuation is more of an art than a science, our models suggest that European equities are trading close to fair value at the moment. And if the winter weather does in fact turn out to be colder than expected, unleashing more economic damage, then European equities may have even more room to fall. This restrains us from a tactical overweight to European equities in our portfolios.

At the same time, we are seeing elevated levels of investor panic in European equity markets. Our measure of European equity-market investor fear has risen to more than three standard deviations above neutral. When investors are this panicked, we believe underweighting equities is also not a good idea, as even a mild dose of good news could drive a rebound.

All that said, under the current circumstances, we believe investors should consider sticking to their strategic asset allocations with respect to European equities.

Similar to European equities, we also believe that investors should be neither tactically overweight nor underweight UK equities. We see a bleak macroeconomic outlook but a strongly oversold sentiment signal, combined with valuations near the fair value range.

European and UK government bonds outlook

The looming recession puts central banks in a bind. On the one hand, they cannot afford to loosen their grip on inflation when inflation rates are in the double digits and there is a risk that inflation expectations could become unanchored. On the other hand, restrictive monetary policy can worsen the economic downturn. Ultimately, we believe that central banks are likely to continue viewing inflation as public enemy number one until a recession more firmly takes hold and reopens slack in the economy.

From a valuation perspective, markets have continued to price in an increasingly hawkish path, particularly for British gilts. While valuations have improved as bonds sold off, we see a stronger value proposition in U.S. bonds than European and UK government bonds. From a sentiment perspective, we see mild signs of potential pessimism in European government bonds, with more pronounced signs of pessimism in UK government bonds. We believe that government bonds for Europe and UK can still potentially serve as important diversifiers, and should not be blindly excluded from an investment portfolio.

Outlook: Equities in other regions

Spillover effects are hard to gauge, as the world has become very integrated. That being said, the lack of easy transportation for natural gas results in a regionalized market model for natural gas prices, which should help insulate customers outside of Europe and the UK from natural gas price shocks.

Nevertheless, macroeconomic headwinds are still present in these regions, and valuations range from being near fair value (e.g., emerging markets) to being somewhat expensive (e.g., U.S.). Like in Europe/UK, strong contrarian signals in some of these other regions serve as an offset against a weak macroeconomic backdrop.

Commodities outlook

Commodities are more challenging to analyze, given that they don’t offer a stream of readily forecastable cash flows. Commodity prices will depend on the supply and demand balance, including factors like the severity of the winter in Europe, and the extent of further escalations in geopolitical tensions. Perhaps something we can be more confident in is that the volatility in commodity markets will likely continue to persist into the foreseeable future.