Ready or not, the second age of ESG investing is here

Anyone who thinks markets are not paying attention to ESG is kidding themselves.

Case-in-point: While you may not have made a single move to reduce the carbon footprint of your portfolio, it’s probably already been significantly decarbonized—whether you like it or not.

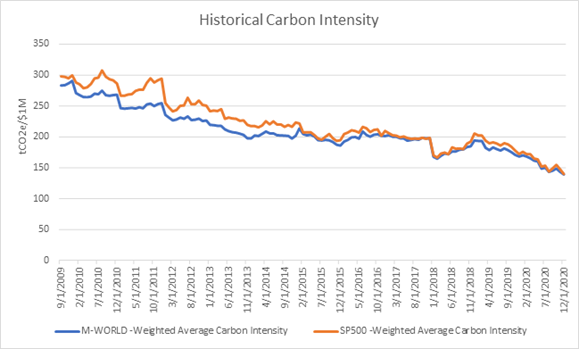

A quick look at the composition of the S&P 500® Index illustrates this well. According to The Washington Post, oil and gas companies today make up just over 2% of the U.S. equity benchmark—a far cry from their 15% weighting in the index only 12 years earlier.1 Even more telling evidence of this shift is found in the chart below, which shows that investors in both the S&P 500 and the MSCI World Index have seen the weighted average carbon intensity of their portfolios cut in half since 2009.

Click image to enlarge

Source: MSCI World Index, S&P 500 Index

This persistent, dramatic plunge is reflective of the fact that, despite recent rises in spot oil prices driven by the economic recovery and some supply squeezes, investors are expecting long-run diminishing returns on these companies’ future output.2 In effect, they are discounting a global decline in the demand for oil that may take years to materialize but which long-term investors would be foolish to ignore. This has been driven by the increasing alarm around climate change and a resulting clamor for alternative energy sources as ESG-conscious governments, investors and activists make an increasing impact on corporate decision-making and investor expectations. In our view, this widespread recognition of the need to transition to a clean-energy economy, coupled with the heightened scrutiny on the social and governance practices of corporations worldwide, means that the first stage of ESG investing has come to a close.

Why? In a nutshell, many important ESG-related matters previously seen as non-financial in nature have shifted from being distant concerns with unknowable impacts to urgent problems that occupy center stage for businesses across the globe. In the first age of ESG investing, until a decade or so ago, accounting for the sunsetting of fossil fuels in the global economy, for example, seemed aggressive.

Although many were calling for it, the market had yet to accept it as a high-probability event, and it was certainly not seen as inevitable. These views are widely accepted first principles today.

This is how emergent ESG considerations enter the mainstream, gradually gaining ground until a tipping point is reached and a new consensus is baked into investment expectations.

A second, more challenging era for ESG investors dawns

As these transitions from under-appreciated to fully priced-in occur, some lessons for the next stage of ESG investing are emerging. For institutional investors in this second age of responsible investing, the pathway to generating superior, risk-adjusted returns under an ESG lens will be through the ability to identify themes, handicap their likely trajectory and successfully map the impacts to asset class, sector, industry and company dynamics. No one needs to wonder anymore whether these broad phenomena, many exogenous to the financial system, can have a powerful impact on financial assets. The focus will inevitably turn from the macro to the micro, away from will things change? to how will that change impact society?

At the start of the last decade, it wasn’t all that difficult to identify corporations whose stock prices would be impacted by a large scale transition to alternative energy sources. Large oil companies, for example, stood out easily—especially in the wake of the Deepwater Horizon disaster. In a similar vein, businesses with poor track records on social and governance issues could be flagged relatively easily by ESG-aware investors—and many remained unrepentant. But that’s changed dramatically in recent years, with ESG matters becoming front and center in corporate boardrooms worldwide. Now, the same oil-and-gas behemoths that made for easy targets 10 years ago have doubled down on their investments in alternative fuels—in some cases, becoming significant investors in green energy.3 Traditional mining companies, such as BHP, are now some of the largest investors in rare-earth metals that enable clean technology. Meanwhile, many of today’s well-known tech giants, routinely criticized in the past for poor governance and a lack of attentiveness to social issues, are working hard to improve their operating structures and have stepped up their commitments to the pressing social matters of the day.

The long and short of all of this is that, for a variety of important reasons, advocates for the vital importance of ESG factors in investing have won the battle. Look no further than the chart at the top of this article to see the evidence. Ignoring these factors is no longer an option—nearly all companies must seek to move down the ESG risk spectrum. This is clearly good from an ESG values standpoint, but from a return-seeking standpoint, it likely means that the opportunity for outsized returns has decreased. In other words, the companies who rate highly on the widely proliferating ESG scoring systems are likely to be lower risk than their counterparts, but any massive gains from increased awareness of the issues is likely behind them. Why? Because the knowledge of how these companies are positioning for the future, in regard to environmental, social and governance risks, is now recognized public information—in other words, widely known. This means, for instance, that a company’s plans to achieve carbon neutrality or boost the diversity of its executive team have already been factored into its stock price—leading to possibly higher valuations, sure, but possibly also to less dramatic upside surprise. We refer to this as the working of an efficient market in information—If everyone knows it and everyone values it, there is no extraordinary return to be extracted.

As these transitions from under-appreciated to fully priced-in occur, some lessons for the next stage of ESG investing are emerging. For institutional investors in this second age of responsible investing, the pathway to generating superior, risk-adjusted returns under an ESG lens will be through the ability to identify themes, handicap their likely trajectory and successfully map the impacts to asset class, sector, industry and company dynamics. No one needs to wonder anymore whether these broad phenomena, many exogenous to the financial system, can have a powerful impact on financial assets. The focus will inevitably turn from the macro to the micro, away from will things change? to how will that change impact society and corporations?

So, then, where can investors who still want to achieve strong returns while maintaining a focus on ESG matters turn in this second era of ESG investing?

How an actively managed approach can help ESG investors meet their goals

Enter active management.

With this new consensus around giving attention to ESG considerations upon us, success will require specialized knowledge, forward thinking and a long time horizon. In other words, the same skills that have driven successful active investing will continue to be required, but with a twist.

Investors will need to look beyond the obvious. Every oil company trumpets their commitment to alternative energy, but which ones have an edge at generating it (and will they compete well with upstart competitors)?Among companies with poor records in governance or social issues, which can execute successful turnarounds with a combination of improved management practices, accelerating growth and a boost in market appreciation through better ESG scores (as opposed to just giving lip service to increase their metrics)? Which companies will bring the new technologies and business models to capitalize on emergent societal needs?

Another area where insightful active investors can help is in untangling unintended consequences. As we are seeing in today’s markets, because of the combination of less capital flowing to dirty energy production and supply chain challenges, we are likely to experience a period of high energy prices. Who will be the winners and losers of this environment in the context of a long-run energy transition? Will electronic vehicle companies see a spike in sales? Will this be a short or long-term windfall to energy companies? These are not easy questions—changes of this magnitude in economic practice and infrastructure never are straightforward.

At Russell Investments, our investment approach has long been guided by the simple insight that no single asset class or style always outperforms. Yesterday’s winners don’t necessarily make tomorrow’s winners, and vice versa—a fact that history has shown to be true time and time again. After all, to borrow from one of our industry’s most well-known phrases, past performance is no guarantee of future results.

This is why we strongly believe in the value of a diversified, actively managed portfolio that embeds the forward-looking insights of best-in-breed managers for all investing strategies—and ESG investing is no exception. This is especially true during this next era of ESG investing, where most of the low-hanging fruit has already been snatched up. There is nothing wrong with building a portfolio of companies which show up well using standard ESG metrics. This will likely protect investors from some of the most obvious risks associated with poorly managed companies. But it is less likely going forward to yield a major return benefit, both because many of the worst offenders are being squeezed out and because some of the biggest return gains from ESG factors will come from firms who improve their ESG standing.

We favor combining attention to advanced ESG metrics—weighted to the materiality of ESG factors—with a dynamically managed, forward-looking approach. One that can harness the insights of skilled active managers who are searching for companies who both stand to benefit most from sustainable trends and to spot those firms with the most to gain by improving their ESG practices. Investing hasn’t gotten any easier, but it also hasn’t gotten any harder. If you can secure an analytical advantage, you can identify inefficiencies in the marketplace and set up manager opportunities for potential outperformance.

What value can skilled ESG managers add? A real-world example

For a real-world example of how these unique insights can be embedded into a multi-asset portfolio, let’s turn to the burgeoning food-delivery industry. Businesses in this sector make money from the fees they charge to participating restaurants and customers, and then use portions of this revenue to pay their delivery drivers. Because of the extremely low profit margins in the industry,4 most food-delivery companies classify their drivers as contractors, rather than employees, in order to avoid incurring additional costs.

However, with more and more employers facing mounting pressure from stakeholders and activists on issues like equal pay and affordable healthcare, we believe it’s only a matter of time before food-delivery companies will be forced to make changes to how they classify drivers and other employees. This conviction of ours is shared among our hire ranked managers, who in turn have identified the specific companies in this industry that they believe are most likely to take this step ahead of the rest. Because we believe that sustainable practices such as these will result in improvements to a company’s fundamentals, and ultimately, its bottom line—as long as the changes enacted are material to the business—we see a significant upside to the valuations of these companies. Needless to say, we’ve adjusted the weightings of these companies in our portfolios accordingly.

The bottom line

This example is one of many that, in our opinion, exemplifies the benefits of active management as the second age of ESG investing takes root. We believe that this new era will present new challenges for institutional investors to navigate passively—especially when it comes to satisfying the dual mandates of avoiding risks and generating returns. Put more bluntly, investing in passive funds that check an ESG box may help you sleep better at night, but given its reliance on static, public data, it represents a sub-optimal approach to a dynamic set of market influences and phenomena. We believe that a more future-focused approach to ESG makes sense for investors seeking to add value through ESG, but requires investors that show demonstrable insight on the likely path and materiality of ESG factors.

Success in the second age of ESG investing isn’t going to be easy. The road to achieving your outcomes is probably going to be longer and harder than ever before. But we believe that with the right strategic partner and the right actively managed strategy, it can be traversed successfully. Let us know if you need a lift.

1 Source: https://www.washingtonpost.com/business/2020/09/04/exxon-dow-jones/

2 It is worth remembering that the market, and market valuations, are not the same thing as the economy. Global emissions have gone up while weighted average carbon intensity has gone down. This results from two things: high emitting companies representing a lower weight in the portfolio (as discussed above), and also that companies in some cases are generating more revenue for each unit of emissions. In other words, company-level emission intensity can be declining even though their absolute emissions are increasing. Weighted average carbon intensity is a widely used metric for measuring portfolio carbon emissions but ultimately the choice of carbon metric can influence how the portfolio exposure trends over time.

3 Source: https://www.sciencedirect.com/science/article/pii/S2211467X19300574

4 Source: https://www.wsj.com/articles/doordash-and-uber-eats-are-hot-theyre-still-not-making-money-11622194203