10x10, Part 3: Asset owner and manager perspectives on seeking future returns

The following is excerpted from the third installment in the series, which covers asset owner and manager perspectives on the future return environment, the outlook for private markets investing and fee compression. A summary of the second installment in the series, which focuses on climate change investing, was published in November.

Return-seeking strategies: Can a private markets allocation help?

Coming off the heels of fiscal-year 2021, a period in which many investors posted superior performance, asset owner and managers expect a lower return environment going forward. In addition to challenges associated with a lower return outlook, managers must look for ways to adapt to a lower fee environment, namely employing measures to reduce costs.

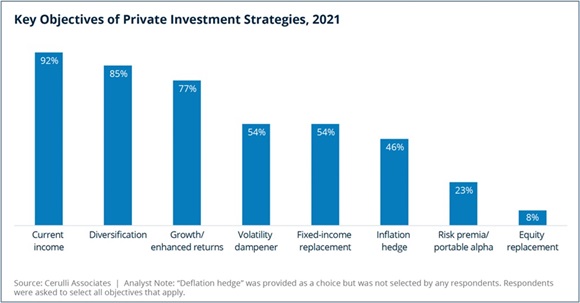

Cerulli found that asset owners and managers generally agree that private markets offer an avenue through which investors can maintain return targets, to an extent. Numerous 10x10 participants noted that private investments are not insulated from the lower return environment. That said, many investors with existing allocations to traditional private equity are looking to expand their portfolios into different sectors of the private investment landscape, including growth, venture capital and private fixed income.

The future return environment

Most asset owners and managers expect lower returns in 2022 and beyond. This group predominantly believes that central banks have run out of policy tools they can use to propel markets.

Several participants told Cerulli that they have lowered their return targets to match their current outlook. One asset manager told Cerulli that most of its clients have incrementally lowered their return targets over the past 10 years, specifying that it is difficult for institutions to make drastic changes to their return targets because it has implications for flows (required contributions and distributions). This manager told Cerulli that its clients generally reduced their return targets from 25 to 50 basis points, annually.

|

"The longer it goes on, the greater the worries become that we get that asset price bubble. Even though we aren't out of the crisis, we are emerging with valuations that are fuller than they have been in other financial crises." – asset manager |

|

If you have an incremental dollar, where do you want to put it? Equities are fully valued. Do you want to be buying bonds? Maybe if you think its QE forever…[The] other place is private equity and venture capital, but there's a ton of capital on the sideline. The valuations are very rich. [There is] not much value anywhere. – institutional investor |

Private markets

For those seeking to move up the risk spectrum and target higher returns, private markets and private fixed income, specifically, are key areas of interest. Investors that have already made headway into the private investment space are looking to expand from traditional private equity (i.e., leveraged buyouts) into growth and venture capital.

Illiquidity is a distinguishing characteristic of private markets investing. While it is often cited as the source of premiums, participating asset owners and managers noted that it is not the sole source of premiums. Namely, premiums derived from the asset class are better described as complexity and access premiums, the former reflecting how investments are being managed and the latter reflecting how investments are brought together. Several 10x10 participants noted that illiquidity offers other benefits, including a smoothing effect on returns that insulate investors from temperamental changes in sentiment and being subject to otherwise-larger swings in required contributions.

|

"What we are seeing today is a tremendous desire for private markets. That move is not finished; clients still want private markets where they can find yield and are willing to take more risk - either volatility risk, credit risk, or illiquidity risk - to fulfill their target returns." – asset manager |

|

"Private equity - you can't do tactically; they are long-term in nature and difficult to reverse course. So the allocations we made 10 years ago, we are cognizant of how we are reinvesting this capital." – institutional investor |

Downward fee pressure

In addition to a lower return outlook, asset managers must navigate an environment of declining margins. As bargaining power continues to shift towards investors, managers have been subject to fee pressure and greater service-level expectations. To remain competitive, many have leveraged high-quality client service capabilities and offered advice beyond the scope of traditional mandates. A common approach to control costs is leveraging technology to streamline their operations and increase efficiencies in client service initiatives. 10x10 participants noted that even private investment firms, which have traditionally been more insulated from fee pressure, may begin to feel effects in the coming years. Additionally, these firms are subject to the same trend of higher expectations surrounding client service.

|

"There's no question that the amount of services we provide has gone up. For the dollar of income we got 30 years ago, that has gone down because we are doing far more for our clients." – asset manager |

|

"We aren't of the mindset that lower fees are always better, because you get what you pay for. All things equal, lower fees are better, but we've tried to make sure we are ever diligent that our fees are incredibly competitive." – institutional investor |

The bottom line

Amid expectations of lower returns and lower fees, asset managers and owners generally believe that an allocation to private markets increases the likelihood of meeting return targets - to some degree. Notably, these expectations are helping elevate risk appetite among private markets investors seeking higher returns.

|

The 10x10 Report 3-part series |

||

*Participating institutional investors included the following corporate retirement plan sponsors, in alphabetical order: The Boeing Company, Fujitsu Global, Mazda Motor Corporation, Microsoft, Mitsubishi Electric, Nestlé, Roche and Unilever. It also included the following non-profit investors: The New York Presbyterian Hospital, Robert Wood Johnson Foundation and Thomas Jefferson University. Participating alternative asset managers included: Brevan Howard, Hamilton Lane and Oaktree Capital Management. Participating fixed-income asset managers included: BlueBay Asset Management and Western Asset Management Company. And participating multi-asset-class managers included BlackRock, J.P. Morgan Asset Management, Morgan Stanley, Putnam Investments and Wellington Management.