Bank of England: Dovish May dance opens door to summer rate cut

Executive summary:

- Despite holding steady on rates, the BoE keeps the door open to cutting rates faster than some may expect.

- Two of the nine MPC members advocated for a rate cut in contrast to only one member who said so in March.

- There is a possibility that UK rates could start lowering earlier than the U.S. Federal Reserve.

While the Bank of England (BoE) kept policy interest rates steady following today's Monetary Policy Committee (MPC) meeting, the dovish contingent is growing and tilting the committee towards a first rate cut in the summer months.

Of the nine members, a majority of seven favoured maintaining the bank rate at 5.25%, while the remaining two, Dave Ramsden and Swati Dhingra, advocated for a reduction. At the previous meeting in March, the MPC voted 8-1 to hold rates steady, with the sole dissenting voice for a cut coming from Ms. Dhingra. During the press conference, Governor Andrew Baily dropped the bombshell that the BoE may need to cut rates a little faster than markets suggest.

Despite unanimity among the 60 economists surveyed by Reuters for a status quo decision today, markets are looking ahead to easier policy. Money market traders are betting on forthcoming cuts, projecting a 40% likelihood of a lower rate as early as June, and at least two 25 basis point reductions by year-end. If market expectations are correct, the BoE could start lowering rates earlier than the U.S. Federal Reserve.

UK Inflation: An outlier or a laggard?

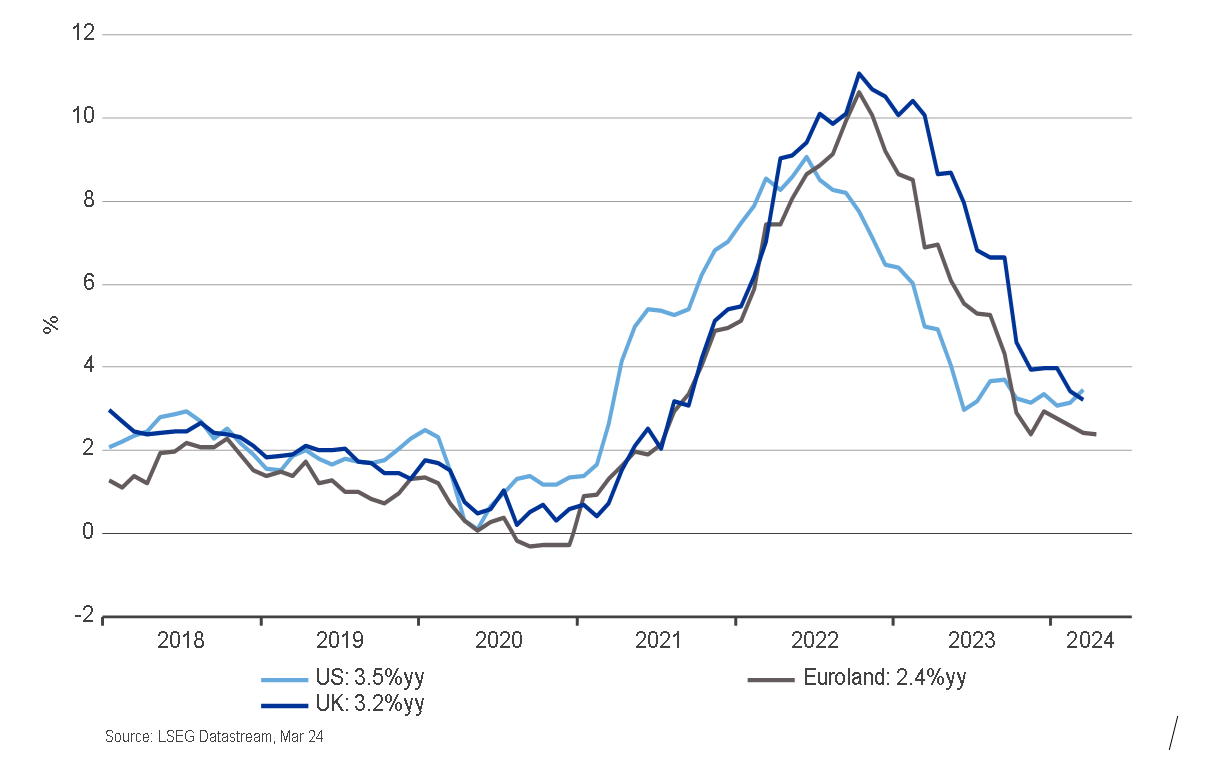

During the current inflation episode, UK price pressures have been higher and lasted longer than in the United States and the eurozone, as we show in the chart below. In the second half of 2022, the peak rate of UK consumer price inflation reached 11.1% year-on-year, compared to 10.6% in the euro area and 9.1% in the United States. On the way down, U.S. inflation dropped below 3% in June 2023 and euro area inflation reached that milestone in October 2023. As of March 2024, inflation in the UK has not dipped below 3% yet, but at 3.2% is lower than its U.S. equivalent.

Inflation in the UK, U.S. and euro area

(Click image to enlarge

On 23 April, the BoE's chief economist Huw Pill noted that the time for cutting the bank rate remained some "way off", emphasising the need for the BoE to maintain tight policy to sustainably achieve 2% inflation. While the headline rate of inflation has made good progress, there are lingering concerns about core inflation running at 4.2%.

The MPC has identified three pillars of inflation persistence: (1) services price inflation, (2) pay growth, and (3) the tightness of the UK labour market. While energy and food prices are largely impacted by global factors, the MPC believes that the persistent inflation component is dominated by domestic forces and can be wrung out of the system with restrictive monetary policy. The effects of Brexit on import prices, fewer people being active in the job market, and a tightening of immigration rules could contribute to persistent upward pressure on the core rate.

Doves exert their influence

While Mr. Pill is still in the majority of MPC members who voted to hold policy steady today, there is a growing minority of policymakers who have an eye on growth. One of them is Deputy Governor Dave Ramsden who sees the UK as less of an outlier in terms of inflation performance and more of a laggard. He thinks that services inflation could dissipate more swiftly, as the impact of the energy price shock gradually diminishes, and inflation expectations return to the BoE target.

The BoE will be pleased so far that disinflation has been achieved without much pain for employment. MPC members like Mr. Ramsden and Ms. Dinghra are mindful not to take the benign labour market for granted and are keen to support job growth by starting to cut rates.

Market reaction

The market impact was modest. The yield on 10-year UK gilts dropped by 2 basis points to 4.15% after the decision. With the BoE staying put today, the yield curve between bank rate and 10-year gilt remains deeply inverted by 1.1%. The inversion suggests that markets are already pricing lower inflation and the rate cuts that the MPC inched towards today.

Sterling has been pushed lower by the softening in UK price pressures and sturdy U.S. data in recent months. It held steady in response to the decision today, trading at 1.25 at the time of writing. With the BoE likely starting its rate cut cycle before the Fed, we think the GBP/USD exchange has limited upside.

The bottom line

The BoE held its key interest rate at 5.25% today but is tilting towards a summer rate cut. The dovish shift on the MPC was largely anticipated by markets and elicited only a modest reaction. Despite the rise in UK gilt yields since the start of the year, we believe peak yields are well behind us. A rate cut cycle starting this summer could usher in lower long-term interest rates.

Changes in bond yields can affect the liability value and funding status of Defined Benefit pension schemes. It's imperative to establish a well-defined approach for mitigating fluctuations in interest rates and funding levels. Following the turbulence of the gilt crisis in 2022, pension fund trustees are well advised to establish and implement a transparent governance and execution strategy for liability hedging.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.