De-risking? Get your transition management plan in place first

Executive summary:

- For plan sponsors, the trend toward de-risking often leads to a simplification of the equity manager lineup in the return-seeking portion of the portfolio. We believe that DB plans moving to streamline their manager lineup should work with a transition manager during the entirety of the process.

- We also think these plans should have their transition manager chosen and under contract well before the implementation process begins.

- The process of transitioning assets is often complex and requires a blend of deep expertise and specialist capabilities. We believe a skilled transition manager is best situated to oversee this process, as they can ensure best practices are followed, unnecessary costs are minimised, and risk is mitigated.

*This article is largely U.S. focused. Yet, even though UK DB pension schemes are ahead of the game when it comes to de-risking their portfolios (with the 2022 Gilt Crisis acting as a catalyst for this change), it is still important for schemes to review their approach.*

Fuelled by high interest rates and strong equity markets, the trend toward de-risking in the defined benefit (DB) space has accelerated in 2024, with several large DB plans continuing to move more money out of equity markets and into fixed income markets. Although the U.S. Federal Reserve has hinted at potential rate cuts later this year, it’s likely that rates will remain elevated for quite some time, keeping the value of a plan’s liabilities in check.

Amid this backdrop, we believe de-risking can provide several potential advantages for DB plan sponsors, including a reduction in both funded-status volatility and potential future contributions. However, de-risking does not make sense for all plans. Each sponsor should first consider their organisation’s goals, circumstances, and preferences to determine if de-risking is the right move. And for those plan sponsors that do decide to jump onboard the de-risking train, we firmly contend it’s vital to have a transition management provider (and perhaps multiple) selected and contracted well before implementation begins.

Why? The de-risking process creates a key issue that is often not revealed until de-risking begins: the reduction in risk assets reduces scale and a plan’s purchasing power with money managers. This often leads to the simplification of the equity manager lineup, reducing the number of managers to keep fees levels low. Let’s dive in to understand why.

Simplification of the manager lineup

A key trend we’ve observed among DB plan sponsors today is a more streamlined approach to the equity manager lineup in the return-seeking portfolio. This is a stark reversal from not too long ago, when these portfolios were typically designed with a complex manager structure. The reason for the complexity was simple: the multi-manager portfolios were built to cover the spectrum of the available security universe. This meant that managers would span from large cap to small cap and from value to growth.

Often, these structures had multiple managers within both value and growth, with each providing differing approaches and, as a result, different coverage areas. For instance, within value, there might have been a relative value manager, a deep value manager, and a defensive value manager – each representing a different flavour of value. Likewise, within growth, there might have been a consistent growth manager and an earnings momentum manager. Portfolios would also use a combination of active and passive management strategies.

The graphic below illustrates this, showing a hypothetical return-seeking portfolio for a DB plan before the simplification trend took hold. A client could have multiple managers within value (dark blue circles), multiple managers within growth (light blue circles), both active and passive core (orange circles), and small cap (red circle). In sum, having eight managers, like in this example, was not uncommon. And that was just for a U.S. equity portfolio. A global equity portfolio might have had even more managers with the inclusion of emerging markets.

Source: Russell Investments. Hypothetical example only.

Today, as more U.S. DB plans mature and become fully funded, they’re transitioning their status to closed (i.e., no longer open to new employees joining the firm) or frozen (i.e., no longer accruing new benefits for those already in the plan). As this happens, the plans are shifting from return-seeking to liability-hedging assets, causing the dollar value of the return-seeking portfolio to shrink. Notably, many European DB plans went through this same de-risking trend a decade earlier, leading to a simplified return-seeking portfolio structure with more latitude given to a concentrated roster of managers to capture value.

The net effect of this trend is that it’s become less practical for DB plans to have a large number of managers in the portfolio – both from a complexity standpoint and from a fees and administrative-burden standpoint. As the return-seeking portfolio shrinks, manager fees may increase. Depending on the situation, this may result in a loss of buying power. This has led some sponsors to place more assets with a core group of managers in order to mitigate fee pressure.

The trend toward manager simplification has also resulted in less of a regional approach, with a shift to a streamlined global equity approach. We’ve also seen a greater concentration of assets into passive, and a streamlining of the flavours of value and growth exposures that DB plans want to have. These streamlined portfolios are designed to be more risk-controlled, which means it is no longer as palatable to hold deep value and earnings momentum managers with high tracking errors.

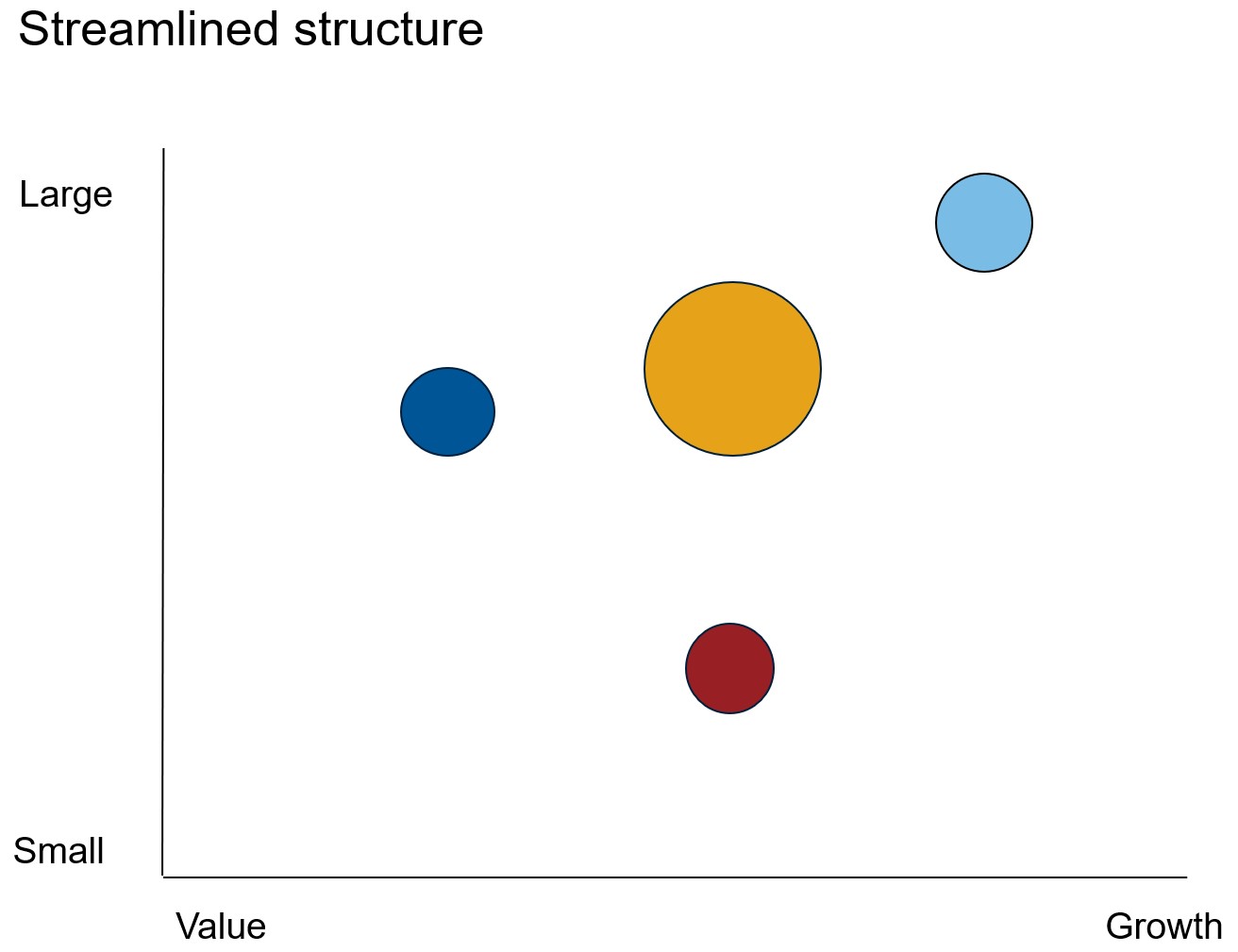

A streamlined portfolio might look more like this:

Source: Russell Investments. Hypothetical example only.

We’ve even recently seen some plan sponsors take this streamlining approach even further, moving down to a total of two or three managers in the return-seeking portfolio.

The value of using a skilled transition manager for implementation

From our vantage point, a best practice for defined benefit plans is to use a qualified and experienced transition manager to implement this streamlining, managing risk and minimising costs – rather than attempting to go at it alone and instructing asset managers to liquidate portfolios and deploy the cash to target allocations.

This is because, quite simply, the process of transitioning assets is often highly complex. Factors such as country domiciles, the regulatory environment, currency considerations, and the liquidity associated with the old and new managers must all be considered. For an organisation without the right capabilities, the process can lead to inefficiencies, unnecessary trading, tax drag, and loss of market exposure.

For instance, when simplifying a manager lineup, many securities in the current portfolio will overlap with those in the streamlined portfolio. A transition manager ensures these assets are retained during the transition, preventing them from being sold and later repurchased by individual managers working independently. The transition manager oversees these complex moves, ensuring best practices are followed, minimising unnecessary costs, and mitigating risk. The transition manager also provides clear attribution of the costs of such an undertaking, enabling the plan sponsor to fully understand the total costs and benefits of making these very meaningful changes.

Ultimately, successfully executing a transition event requires a blend of deep expertise and specialist skills.

The bottom line

For defined-benefit plan sponsors, we believe this trend makes one thing unmistakably clear: Systematic changes are coming to your plan. Consider having a transition manager in place before they do.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.