LDI: The reports of my death are greatly exaggerated

When financial journalist and political commentator Robert Peston is tweeting about the LDI (liability driven investment) collateral calls of defined benefit pension funds, you know something is going on!

Today, the Bank of England announced it will immediately begin purchasing long-dated government bonds—an extraordinary step taken by the central bank in order to calm the sharp selloff in bond markets triggered by last week’s tax-cut announcements.

Source: Robert Peston, Twitter: 28 September 2022. 12.57

While the theory of rising rates triggering capital calls and the possibility of liquidity problems is valid, I think the reality of fire sales of quality assets is largely overstated. For the most part, pension funds have been able to weather the challenges presented by rising rates very well. Over recent years, governance structures have been improved through OCIO and fiduciary management, allowing greater nimbleness and flexibility.

Funds have de-risked over the last couple of years, reducing leverage and making them more resilient to rising rates. The reality today for many schemes is that recent rate rises have translated into an improved funding position and a smaller balance sheet. Given the fixed nature of deficit recovery contributions, for many schemes the smaller balance sheet means the returns required from assets in the future will actually be lower. Said another way, the fixed deficit recovery contributions will go a lot further in improving the pension scheme’s funding level than before the recent market events.

For most schemes with sound governance structures, further de-risking at the moment is orderly and part of the plan. It's a far cry from the headline-generating fire sales.

What of today’s events?

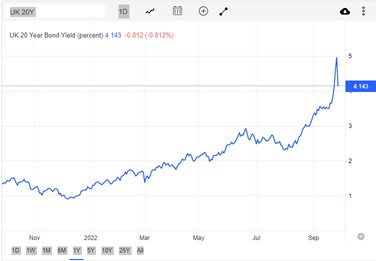

The Bank of England’s intervention is of course extraordinary and provides much needed support to gilt markets. After the announcement, the 10-year yield fell from 4.6% in early trading to 4.1%. The effect on the 20-year yield was even greater, falling from 5.0% to 4.2% in the wake of the announcement.

While this is indeed a pause to recent yield rises, they still remain significantly higher than a week ago or a year ago and this leaves us in a fundamentally different place. This is being felt through the real economy and the financial markets alike and will continue to do so for some time.

For now at least, the chancellor is sticking to his position and fiscal and monetary policy appear at loggerheads. Even if we were to see a moderation from the Truss government, that genie is out the bottle. The muted reaction of currency markets to the Bank of England’s intervention suggests it might have stabilized the gilt market but has not done much to elevate the UK’s international standing. A slap from the IMF (International Monetary Fund) won’t have helped either.

The end result? A pause, but sadly, not the end of heightened gilt market volatility.

Click image to enlarge

What should pension schemes consider today?

Our experience over recent days with UK corporate defined benefit clients is that there is no crisis management required. Liquidity remains more than sufficient to meet the collateral requirements of liability hedges. Improved funding positions present an opportunity to take stock, further de-risk and continue along the path to an end game solution.

Ultimately, the emphasis that trustees have placed on ensuring robust governance and risk management structures has been well rewarded over recent weeks, and once again the importance of appropriate delegation has been highlighted.