A is for Annual Rebalancing. Do your investors know why this matters?

Russell Investments believes in the value of an advisor. It is part of our corporate DNA. For advisors, delivering, communicating and elevating your value so your investors have a better chance at meeting their financial goals has never been more important. That’s why we’ll be sharing a deeper dive into our own study on this topic. This blog post on the benefits of rebalancing is the first of five blog posts on the subject.

Many advisors struggle to quantify their value, even though we see many studies like ours that do just that. All of these studies work to elevate the conversation around the value that advisors bring even as investor demands increase. When it comes to hiring an advisor, investors want to know what value they are getting for their money.

The value communication gap

Do your clients recognize the value of what you do? Establishing the value of all the good things that advisors do is dependent on good communication. This communication should not just include what you write — via email, online or traditional mail — but should also include what you say directly to your clients.

There continues to be a disconnect between what advisors do and what their clients think they do — otherwise known as the value communication gap.

We each think that we’re good at communication. But in our decades of working with advisors, we’ve found it’s an area that all of us needs continual work. Do your existing client communications clearly and consistently define the value you provide? If not, consider using our simple formula.

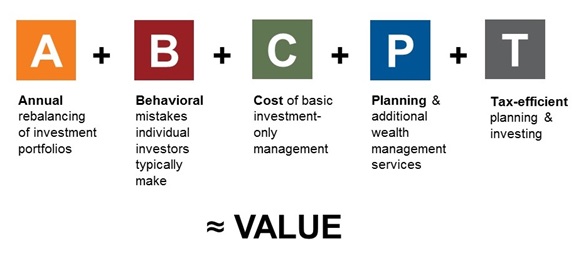

Value of an Advisor = A+B+C+P+T

A = Annual rebalancing of investment portfolios

A is for the annual rebalancing1 of investment portfolios. But its value is often downplayed, even by advisors themselves. Why? Because it’s something they do every single day. It’s like breathing for advisors, and most of their clients don’t think about the impact of doing it or not doing it.

Unless you clearly communicate the value of rebalancing, don’t expect your clients to appreciate it. They should, because we think clients practice reverse rebalancing much of the time. We believe that without the help of advisors, clients are more likely to buy high and sell low. They wait to see what’s doing well in the markets and then buy more of that.

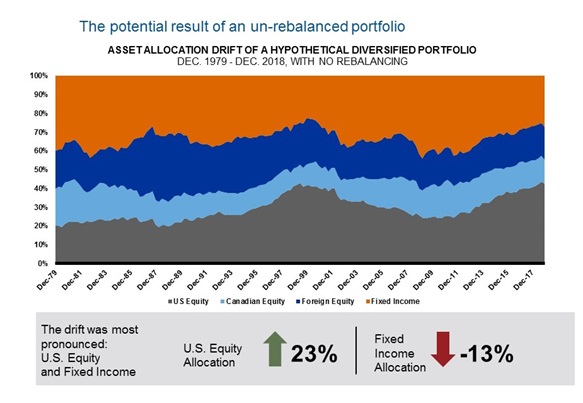

The good news is that with technology, rebalancing is easy to turn on. The bad news is the same: With technology, rebalancing is easy to turn off. Investors who don’t rebalance can end up with a very different portfolio than even they might realize. In other words, unbalanced portfolios can look very different over time versus their initial goal.

The chart below shows a theoretical portfolio of 60% stocks and 40% fixed income that was not rebalanced between December 31, 1979 and December 31, 2018. During that time, growth of U.S. equities and a downward trend in fixed-income markets transformed this portfolio into one where the U.S. equity allocation alone represents more than 40% of the portfolio and the fixed income allocation fell to below 30%.

Source: Russell Investments Canada Limited. Original Portfolio Asset Mix: 40% Fixed Income (FTSE TMX Canada Universe Bond Index), 20% Canadian Equity (S&P/TSX Composite Index), 20% US Equity (S&P 500 Index), 20% Foreign Equity (MSCI EAFE Index). Indexes are unmanaged and cannot be invested in directly. For illustrative purposes only. Not meant to represent any actual investment. Past performance is not indicative of future results.

Do you think most investors even realize that this sort of thing occurs? Do they recognize the value of annual rebalancing and how it’s a vital part of wealth management? If advisors don't talk about rebalancing, then we can't expect investors to understand its importance.

How to tell the rebalancing story

Are you sharing your rebalancing strategy consistently with your clients? Are you letting them know how frequently their portfolios are rebalanced, whether you are doing it manually or whether it's the rebalancing policy of the investment solutions provider you're working with? We recommend four simple touchpoints to make the communication both easy for you and meaningful for your clients.

- The benefits of a systematic rebalancing policy—Explain what can happen if rebalancing doesn’t happen and how annual rebalancing helps keep their portfolios on track with their goals and their risk profiles.

- What the strategic rebalancing policy is—Let your clients know the basics of the policy, how it works to be both efficient and oriented toward their desired outcomes.

- How frequently the portfolios are rebalanced—Explain how often strategic rebalancing happens and why you believe that frequency makes sense for them.

- The approach to strategic rebalancing policy during periods of market volatility—Let your clients know how sticking to a long-term, disciplined rebalancing policy can help them avoid costly mistakes, such as following the herd, buying high and selling low, and leaving the market at worst times.

The bottom line

In the formula of advisor value, A is for the annual rebalancing of investment portfolios. But for your investor clients to understand the value of strategic rebalancing, you need to talk about it. This doesn’t have to be a complicated conversation. But we believe it needs to happen, because rebalancing is a key part of helping your investors reach their desired outcomes. And that’s what matters most.

1Rebalancing is the periodic buying and selling of assets in your portfolio to maintain your originally desired asset allocation, or mix of investments.