11 sales ideas to try this fall

Every month my teammate Jeff and I do an 11-minute call with advisors. You might ask why 11 minutes? When I was young, I was a huge fan of Los Angeles Rams quarterback Jim Everett, who wore the number 11, so it is a little homage to him. And quite frankly, the attention span of most people is around 11 minutes.

In these calls I try to cover a topic I think financial advisors would find interesting. This month’s discussion was around 11 marketing sales ideas for fall. I had a great response to the call, so I wanted to share it here. The ideas are in no particular order. Just pick a couple and go.

11. Events

I know some advisors think that holding an event is a waste of time, but I disagree. You can do events virtually or in person depending on your firm. I think the smaller the event, the better. Think wine tasting, whisky tasting or something similar. If you are worried about turnout, just send a survey to clients to check their comfort level before proceeding. Just remember to be consistent with holding events. You can’t do one and expect to have great results; you need to hold them regularly to build a real connection. Russell Investments call help you organize an event focused on any one of a variety of subjects. Contact us to find out more.

10. LinkedIn

I know that conventional wisdom says social selling doesn’t count, but if used correctly LinkedIn can help with a lead list, referrals and general reconnaissance. Most advisors use LinkedIn for prospecting, but the social platform is also great for many other things. LinkedIn is like having a real-time resume available to clients around the clock. If you don’t think new clients look at your online presence you could be wrong. LinkedIn also allows you to share with the world what makes you different as an advisor and what thoughts you have on certain subjects.

If you don’t know where to start, take a look at this book.

9. Calls

Yes, I am referring to picking up the phone and talking to someone. It seems simple, but no one does it enough. This last year has been a doozy and many people are making changes in their lives, so why not check in with your clients to see what’s new? You could call to see if they want to make any changes to their beneficiaries, or just confirm the personal information you have. My favorite excuse is calling on the anniversary of when they opened an account with you.

Need some help with those rediscovery calls? It could be as simple as this: Hey Tim. I know we are going to meet later next month for our quarterly review, but to make sure you get all you can out of that meeting, I just wanted to see how you and your family are doing with everything that is happening in the world. I have noticed a lot of clients are making some big changes in their lives. Has anything changed in your life?

It is okay to call and just check in. Just remember you can’t fake it. You have to care about the person you are calling. You need to be authentic. And you need to listen.

8. Website tour

Do clients even know what is on your website? Do they know how to use it?

Many advisors spend a lot of time putting together a great website and then never bother to show clients how to use it. Clients want to consume information on their timeline, not ours. If you have a great website, it is more likely that clients will interact with it.

Here are a couple of ideas for a good website:

- Don’t put a picture of a couple holding hands walking on the beach as your main picture … everyone does that.

- Make it interactive. Add calculators, articles and videos.

- Make sure your clients can access their accounts through your website. Clients love that stuff.

- Your clients want to learn more about you and your team. Maybe have each member of your team do a short video introduction. Everyone likes videos.

- Once you get your website set up the way you like, hold a webinar for clients and walk them through all of the features.

7. Create an advisory board

An oldie but a goodie. I have discussed this previously. Get some of your clients together and get feedback on your business and what you can do better. You can do this virtually or in person. We have a step-by-step guide to help you. Just ask your Russell Investments representative for a copy.

6. Discovery cards

People are reassessing their lives as the pandemic wanes. Why not reach out to them and see if their goals or circumstances have changed? Our discovery cards allow you to do that virtually or face-to-face. Reach out to your Russell Investments representative to find out more.

5. Referrals

If you have clients who stayed invested through all of last year, this is a great time to go back to them and get a referral. I have discussed Carl Richards' verbiage, If you were me before, but you can also just use the Tim Halverson verbiage. I am not as articulate as Carl, so if I want to get an introduction, I just ask my clients, Who do you like hanging out with and could any of them use a second opinion on their investments? I am too old to work with people I don’t like.

4. Niche

One of my favorite books ever is “Win Without Pitching" by Blair Enns. There are some great nuggets about building a business in this book, but my favorite is about niching. As author Seth Godin notes, a niche is the smallest viable audience. I know some advisors hate niching, but if you can figure what group of people you enjoy working with, you can then see if you have enough of those people to start a niche. Once you figure out your niche, you can then target those people with blogs, seminars and other material focused specifically on their needs. You become the expert in that area and that could mean never having the discussion about fees again.

3. Centers of Influence (COI)

My advisors are always asking where other advisors get new clients and a lot of those times those advisors are getting great leads from their COIs. I can already see some advisors rolling their eyes as I write this, but it is true. The best way to build a relationship with a COI is to get connected with them through your existing clients. If the COI knows you can affect their relationship with someone else, they will take the call. We at Russell Investments can help you with continuing education courses or identifying certified public accountants in your region.

2. Cash off the sidelines

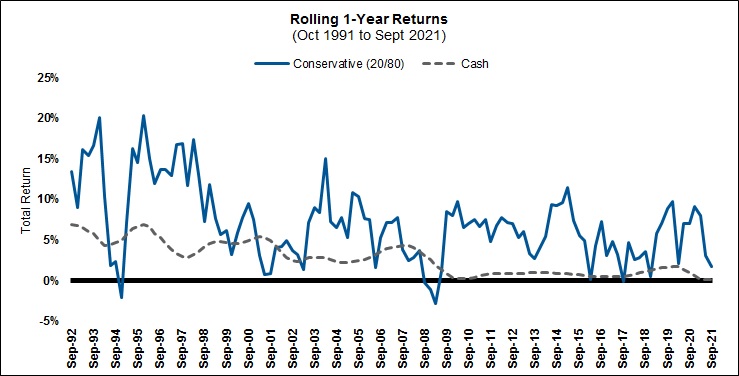

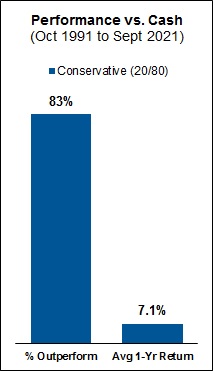

I am sure there are some clients who have been in cash since March 2020 or have recently moved to cash because market valuations are stretched, but we all know the return on cash is minimal. Peter Lynch had one of the greatest lines in financial history: ”Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” We all know people are living longer, taxes are probably going up and returns could potentially be lower going forward. That means clients need their money to work harder than ever. If you have a client who is sitting in cash, maybe think about showing them a 20/80 model. If you look at the graph below you can see how that could potentially help.

Source: Morningstar Direct, Russell Investments. Rolling 1-year returns with 3-month step from 10/1/1991 to 9/30/2021. Conservative Portfolio: 80% FTSE Canada Universe Bond Index, 6.67% S&P/TSX Composite Index, 6.67% S&P 500 Index, and 6.67% MSCI EAFE Index. Cash: FTSE Canada 30 Day Treasury Bill Index.

As you can see, since 1991, a diversified conservative portfolio of 20% equities and 80% fixed income, delivered an average one-year return of 7.1%, with one-year returns beating cash 83% of the time.

1. Taxes

With all of the changes that the COVID-19 pandemic has wrought, people's tax situation may have changed: they may be working from home permanently, they may have changed residences, purchased a vacation property, or have built up their savings. No matter their situation, they are likely to need help ensuring their financial plan is the most tax-efficient possible. You can talk to them about the investments held in their Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA), or provide information on corporate class funds or structuring a trust. There are solutions for each unique tax situation and as a tax-aware advisor, you are in a key position to help.

I know these ideas are not earth-shattering—and that was the point. Pick a couple of ideas and make a commitment to do them. I have always said financial advisors do not need better products, but they can always use better partners and that is what Russell Investments strives to be. Be safe and enjoy the fall.