Taxman: There's one for you, nineteen for me ...

George Harrison of the Beatles clearly understood the role that taxes had on his wealth. In his 1969 anti-tax song (Taxman), Harrison was facing a marginal tax rate of 95%! In disbelief, he and fellow Beatles penned one of the greatest anti-tax songs. For those too young or unfamiliar with the song, I encourage you to check it out on iTunes, Pandora, Spotify or wherever you stream or rent your music.

Although the marginal rate for Canadian investors is well below the 95% rate, taxes still play a huge role in determining one’s residual wealth. Taxable investors often ask how they can reduce the amount of taxes they pay. While there are many different strategies, a good first step is to know the difference between a marginal and effective tax rate.

Marginal, average, effective tax rate? Know the differences.

You must know both tax rates to make informed investment decisions. For example, any monies received through taxable distributions could raise your marginal tax rate. And don’t forget to include provincial taxes in any calculation.

Tax-efficient investing provides the opportunity to lower the effective tax rate and may help lower one’s marginal tax rate. Structuring a portfolio so that the distributions are in the form of return of capital can be one way to reduce the tax burden.

Who cares about taxes?

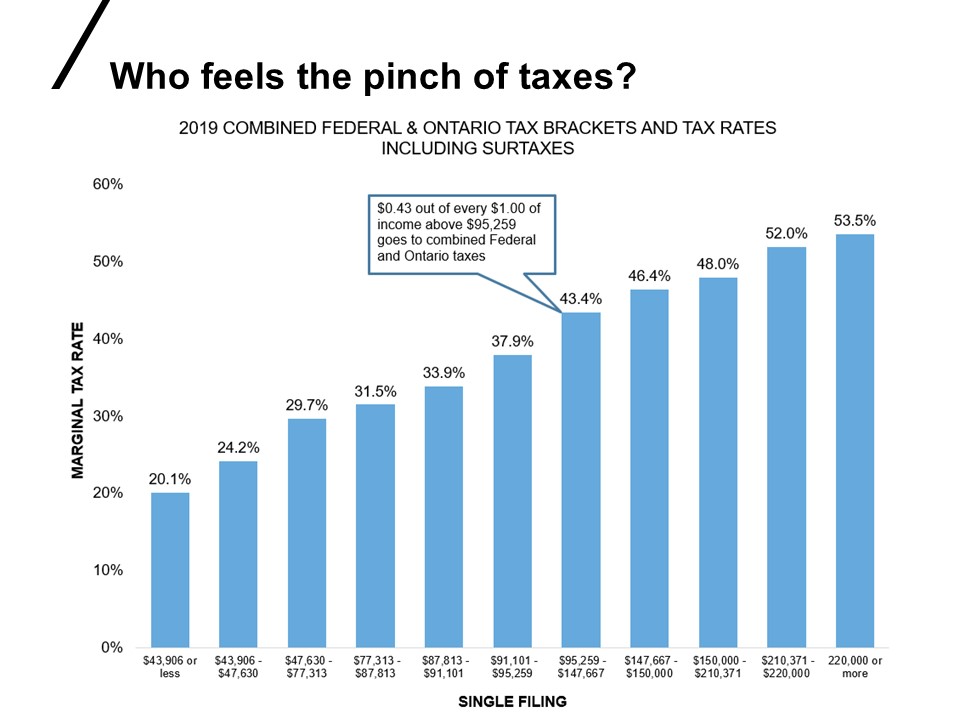

The short answer: It depends. You don’t have to be in the top tax brackets to feel the pinch of the taxman. Consider the marginal tax rates below on taxable income. This rate applies to income such as wages, interest income, 50% of capital gains and a portion of eligible dividends. This includes things like interest income from Guaranteed Investment Certificates (GIC’s), savings accounts, earned income, a stock sold, etc.

Click image to enlarge

Source: Russell Investments, Canada Revenue Agency

Using combined federal and Ontario rates as an example, a client who has taxable income above $95,259 faces a marginal tax headwind of $0.43 out of each incremental $1.00 earned. Their combined federal and provincial marginal tax rate would be 43.4%. They would keep this marginal rate until taxable income crosses $147,667 at which point their marginal rate would increase to 46.4%. This is the progressive nature of Canadian individual tax rates. Generally, the more you make, the more you pay.

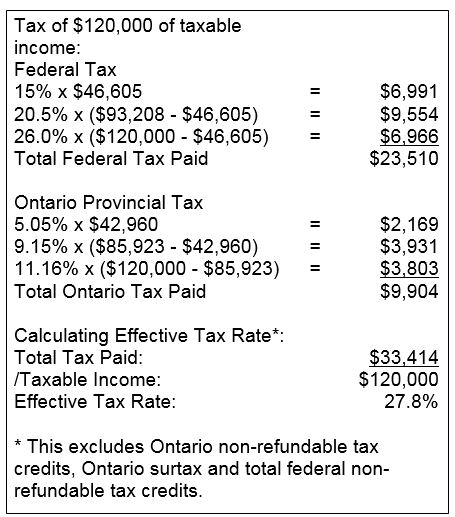

If this client had federal taxable income of $120,000 that included wages, interest income, capital gains (of which 50% are taxed) and eligible dividends, their effective tax rate would be:

For this client with $120,000 of taxable income, their marginal tax rate of 43.4% is materially different than their effective rate of 27.8%. Not knowing the difference or being clear in client discovery can lead to materially different decisions around investment choices, asset location and withdrawal strategies.

The bottom line

When focusing on taxes for your client, remember it’s not necessarily about tax avoidance, but higher ending wealth. Too many investors get hung up on trying to reduce their tax bill, that they lose sight of the bigger picture—their long-term financial goal. Working with your client on being smart about their marginal and effective tax rates can make a meaningful difference on achieving successful long-term outcomes.

And if nothing else, be glad that our marginal tax rate is not 95%—yet!

If you drive a car - I’ll tax the street;

If you try to sit - I’ll tax your seat;

If you get too cold, cold - I’ll tax the heat;

If you take a walk - I'll tax your feet. Taxman (George Harrison)