Part 2: Climate Change Investing

The 10x10 report

Part 2: Climate Change Investing

Who’s leading the way on investing for the E in ESG? What’s driving progress and innovation? What’s preventing it? And why is climate change a priority for some organisation and managers more than others? This report will look at climate-change investing with the objectives of both asset managers and asset owners firmly in hand.

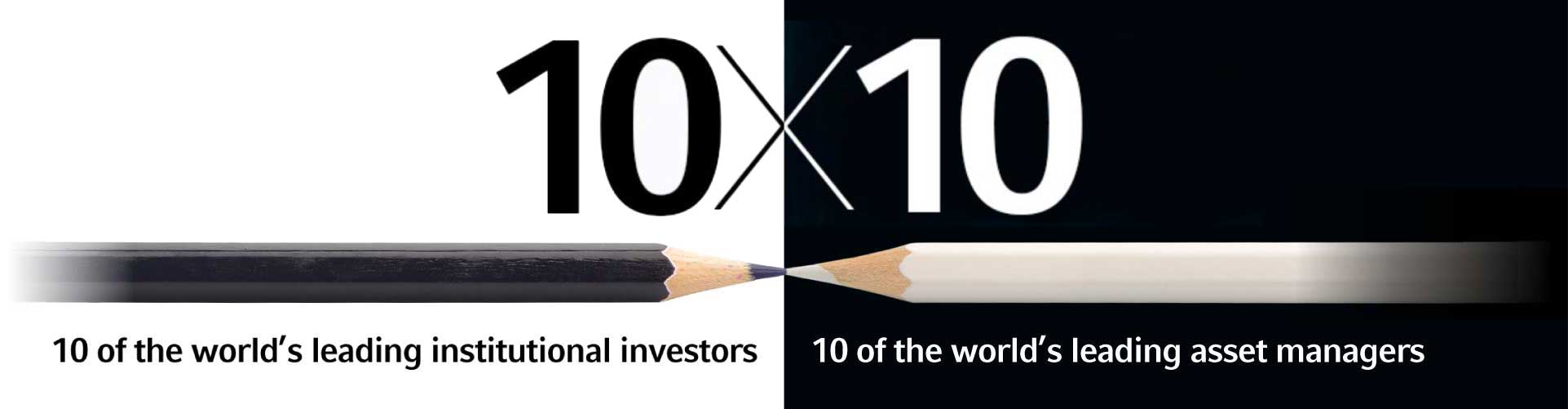

The 10x10 Report—independently implemented by research consultant, Cerulli Associates—addresses these topics from the points of view of 10 of the world’s leading institutional investors. Those views are then contrasted with 10 of the world’s leading asset managers.

About the 10x10 report

In 3Q 2021, Russell Investments held its annual Partner Innovation Lab, a roundtable event where large asset owners from various geographies brainstorm their greatest concerns and areas of interest. We asked Cerulli Associates to interview participating organizations, as well as some of our asset management partners, to extract individual perspectives on topics discussed at the event.

The result is a three-part series:

Part 2: Climate Change Investing

(This report)

Participating institutional investors included the following corporate retirement plan sponsors, in alphabetical order: The Boeing Company, Fujitsu Global, Mazda Motor Corporation, Microsoft, Mitsubishi Electric, Nestlé, Roche and Unilever. It also included the following non-profit investors: The New York Presbyterian Hospital, Robert Wood Johnson Foundation and Thomas Jefferson University.

Participating alternative asset managers included: Brevan Howard, Hamilton Lane and Oaktree Capital Management. Participating fixed-income asset managers included: BlueBay Asset Management and Western Asset Management Company. And participating multi-asset-class managers included BlackRock, J.P. Morgan Asset Management, Morgan Stanley, Putnam Investments and Wellington Management.

Climate change investing trends

Compared to asset managers, asset owners were more varied in their adoption of climate metrics in their investment processes, according to participants in the 10x10 report. Several managers have built out proprietary research initiatives, leveraging their size and resources to provide more insights into climate initiatives. Among asset owners, nonprofits have generally made greater strides on the climate front.

From the experts:

Investment portfolios are also used to help with organization-wide climate goals. Several asset owners have sought to offset their carbon footprints via their investment portfolios, investing in technologies like carbon recapture. Some have set up separate portfolios to do this. Asset managers have sought to provide these types of investment options for their clients, as well as investing their own corporate funds into various technologies.

Climate focus catalysts

Asset managers told Cerulli that their adoption of sustainable investing capabilities is primarily driven by external client demand. Managers generally believe that clients bear the ultimate responsibility in adopting a climate change investing lens. While asset managers take their own measures, internally, to combat climate change, most have clients that do not consider ESG metrics at all and, as fiduciaries, they must invest in a way that is in line with their clients’ objectives.

For asset owners, on the other hand, internal values are the key driving force behind their adoption of environmental metric considerations. Sometimes these internal values emerge from the investment office itself, and other times they trickle in from other parts of the organization. In addition, some asset owners are beginning to adopt a climate focus simply because they project that climate change investing is inevitable.

From the experts:

Strategic partners & dedicated resources

There are significant challenges when it comes to gathering, interpreting and acting upon data in the climate realm. As such, asset owners often rely on their intermediaries to provide guidance. A nonprofit explained that its investment consultants are charged with helping them implement ESG considerations and opportunities. A corporate plan sponsor explained that it collaborates with its consultant on developing sustainable equity options for its DC plan and creating the right management structure. Another corporate plan sponsor told Cerulli that its consultant plays a pivotal role in collecting and consolidating data.

In response to ESG demand, asset manager participants said they have built functions or assigned dedicated resources to addressing climate investing. Several managers have hired heads of ESG to assist in developing frameworks and ultimately integrating ESG policies broadly. Some asset owners report hiring heads of ESG as well, although this is a bit rarer as the investment offices tend to be limited in size. ESG heads are often charged with leading their firm’s proprietary climate research efforts and, in some cases, heads of ESG were also responsible for promoting their firms’ D&I efforts.

From the experts:

Climate data

In addition to other challenges, industry participants struggle to find consistent data across the universe of companies. As asset owners and managers continue to streamline their processes, they are likely asking U.S. companies for the same metrics that European companies are required to disclose, providing an avenue through which there could ultimately be some standardization. That standardization issue also extends to the definition of ESG and how that lack of a definition impacts data and reporting.

From the experts:

Barriers to adoption

The most oft-cited barrier to implementation is regulatory hurdles, specifically rules surrounding pecuniary factors. U.S. corporate plan sponsors say that they have not integrated climate considerations because they fear going against Department of Labor (DOL) guidance.

Among firms that have not taken steps, one of the primary reasons was that they did not want to exclude potential investment candidates from their selection processes. A nonprofit told Cerulli that energy sectors that contribute to global warming are often necessary and that it did not wish to exclude entire sectors from its investable universe. A corporate plan sponsor from Japan also told Cerulli that its plan participants are generally not interested in restricting their investment options for the sake of climate initiatives.

Another factor preventing a fully integrated climate stance is the uncertainty in how to look at passively managed assets. A corporate plan sponsor that allocated a large portion of its assets to passively managed strategies told Cerulli that exclusions are one of the only tools it can use for those assets.

From the experts:

This is just a snapshot. Get the full Climate Change Investing report by registering at the top of the page.