Is the growing U.S. debt sustainable? Not indefinitely, but don't ring the alarm just yet.

There is an increasing unease regarding the sustainability of rising debt levels globally but particularly for the U.S. To be clear, such concerns are not new and typically intensify around recessions as government borrowing ramps up to offset the dearth in private sector demand. We could debate whether higher debt levels can be sustained indefinitely. But let’s start with describing the three broad categories of debt in the economy:

Three types of debt

- Corporate debt – As the name suggests, this is debt incurred by businesses and is typically used by corporations to support general business operations and investment activities.

- Household debt – Mortgage debt represents the largest share of household debt, but this category also includes credit card and student debt, among other types.

- Government debt – Also referred to as public or sovereign debt, this is the obligation of the federal government. The primary source of revenue for the government is tax. When tax revenue falls short of covering expenses, debt is incurred to finance total spending.

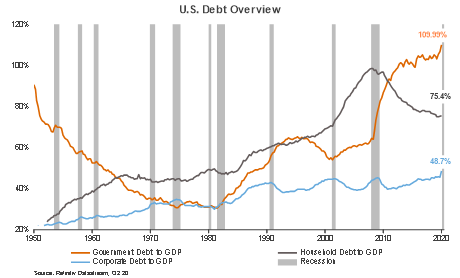

Figure 1 provides the historical evolution of all three types of U.S. debt measured against gross domestic product (GDP) starting in the 1950s. Some observations worth noting:

- Irrespective of the type, debt is not constant and will ebb and flow over time based on prevailing financial market and economic conditions.

- Household finances have improved remarkably since the Global Financial Crisis (GFC) of 2008-2009. The household debt-to-GDP ratio has declined from the pre-GFC peak of nearly 100%, to 75%. While the rise in the rate of unemployment in the U.S. is the current concern, household finances are as good as they have been in almost 20 years and are buttressed with low interest and below-average debt service costs.

- Compared to households and the government, corporate debt represents the smallest share when measured against GDP. The broader concern, however, is that corporate debt is at a historical high. Even though the COVID-19 crisis has stressed corporate balance sheets, by way of the U.S. Federal Reserve (the Fed)’s massive support of corporate bonds, credit risk is now partially shared by the federal government, which has had a pacifying effect on credit markets.

Figure 1: Debt to GDP

Click image to enlarge

Source: Refinitiv DataStream, Russell Investments, as of 1Q2020.

Getting back to federal debt, Figure 1 shows U.S. sovereign debt has steadily increased since the GFC. But the pace has now accelerated due to historic fiscal support in response to the COVID-19 pandemic. U.S. debt-to-GDP at 110% has crossed the psychologically important 100% level. While U.S. deficits have recovered from such levels in the past, notably after World War II, the COVID crisis brings its own unique challenges.

Therefore, the operative question is: Is the current pace of debt accumulation sustainable?

The short answer is no, but the actual answer is a bit nuanced. Fiscal profligacy cannot be sustained indefinitely, and fiscal discipline is necessary at some point. Nonetheless, when the forecast calls for rising flood waters, the objective is reinforcement. The rebuild comes later. Similarly, fiscal policy now is focused on containing the damage brought on by the pandemic. Only once the storm passes can the focus shift to rebuilding.

Rebuilding starts with stabilizing the debt-to-GDP (D/GDP) ratio. So, let’s first break down both components of that ratio in order to gain a better understanding of the moving parts.

- Debt: There are two principal components to consider here. The aggregate debt outstanding and the cost of servicing the debt. Debt outstanding will rise during recessions due to rising deficits as the economy stalls and federal support ramps up. Meanwhile the interest expense, which is the cost of servicing debt, is influenced by the past and prevailing rate of interest.

- GDP: Gross domestic product is the total output the economy produces. The GDP contracts during recessions and expands once the recovery commences.

Looking ahead, it’s important to consider the trajectory of the D/GDP ratio over multiple time horizons. Over the immediate timeframe, it’s reasonable to expect it to rise further as the government runs large deficits to offset the demand shock due to the pandemic. Over the medium to longer term, however, the focus shifts towards its stabilization.

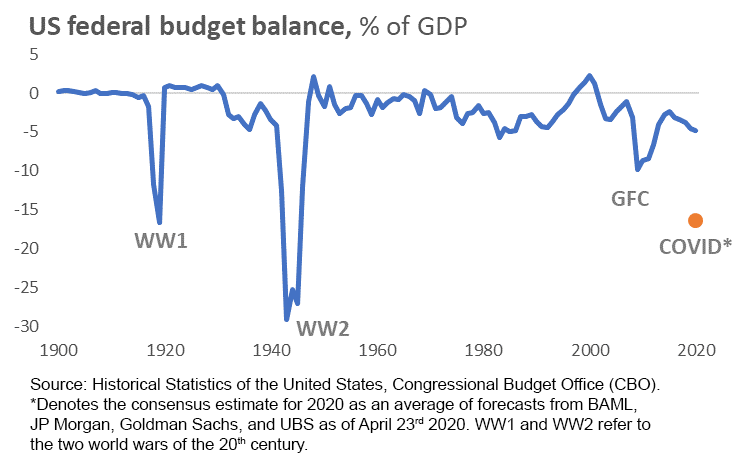

As the economy emerges from the recession, GDP will shift from contraction to expansion. And as Figure 2 shows, historically, the budget balance gradually improves once the crisis passes and as the recovery becomes more enduring. This in turn slows the rate at which debt accumulates. Interestingly, the prevailing interest-rate environment allows the federal government some wiggle room to run deficits (though not as large as currently projected for 2020 due to COVID). For instance, with the current yield on the 10 Year U.S. Treasury Bond at roughly 0.7% and trend nominal GDP growth expected to be around 3.7%, the U.S. can sustain a 3% primary budget deficit (3.7% nominal growth less 0.7% interest rate). With interest rates expected to remain near historic lows for the foreseeable future, what’s clear is financing this debt becomes less onerous.

Figure 2: U.S. Federal Budget Balance

Click image to enlargeThe bottom line

Indeed, the U.S. is not alone in this predicament. Globally the response to this unprecedented crisis has been similar as governments are taking historic measures to support their respective economies. That said, forever increasing the burden of debt is also not sustainable. The path forward is likely to include a combination of fiscal discipline, improving economic growth and low interest rates. This will at first facilitate stabilization, but ultimately, bring about the gradual improvement of the debt-to-GDP ratio, moving it toward a sustainable path.