What’s next for China after COVID-19?

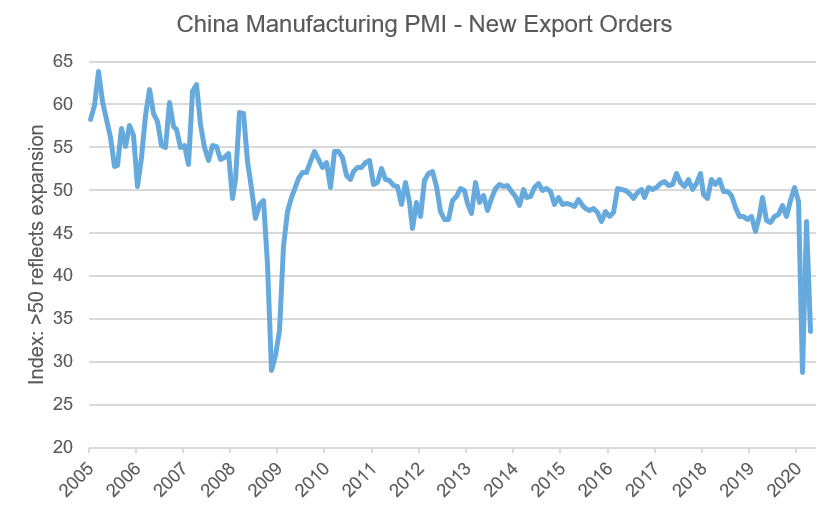

Our outlook for the Chinese economy remains modestly constructive, with the path back to normalcy continuing, and more stimulus in the pipeline. In the shorter term, weak external demand (the global economy is either in final stages of lockdown, or very early stages of restarting) will be a drag on the manufacturing sector. Risks around the slowing of globalization and tensions with the United States have risen and are discussed in more detail below.

China’s economy: A return to normal?

The Chinese economy continues to normalize, led by the manufacturing sector. The services side of the economy, such as retail and hospitality, has been a bit slower in the recovery as the consumer has been more cautious to both spend time in public spaces and also to spend on discretionary goods. This dynamic is also being seen in South Korea, where people are hesitant to visit shopping malls and other public areas.

Click image to enlarge

Source: Refinitiv Datastream, April 2020

The manufacturing sector’s normalisation over the next few months is going to continue to face the headwind of soft global demand, given the lack of activity in the rest of the world. This will disproportionally weigh on private companies, which tend to be more export oriented.

As we noted in a recent blog post, signs of improvement in the economic outlook will show up first in the forward-looking components of the purchasing manager indices, the credit flow data and the trade data. While we have seen some early improvements in the first two, we suspect that a substantial part of the credit uptick has been in the form of bridge loans and other support measures, rather than reflecting a boost in confidence and investment.

Defensive easing likely to continue

The Chinese government has continued to add incremental pieces of stimulus into the fray, and recently announced that the National People’s Congress will be held on May 22. This is the annual event where the Politburo discusses the outlook for the economy and releases the economic growth target. We continue to think that the government will maintain a defensive easing stance, with stimulus being provided whilst at the same time maintaining focus on avoiding significant increases to debt levels.

China-U.S. tensions reignite over virus

The Chinese government has also been very active in providing medical support to nations facing the outbreak, including sending ventilators to Italy. Most recently, China has provided testing kits to Saudi Arabia, Iran and Nepal. Off the back of this, amid concerns about equipment shortages, the outbreak has revealed some concerns about the level of dependence on Chinese manufacturing in relation to medical supplies. Over 40% of all personal protective equipment (PPE) used comes from China1 - and we think that one of the likely consequences of COVID-19 will be a concerted push to reduce that proportion.

Along with the supply of PPE and other medical supplies, tensions between China and the United States (and to a lesser extent, Europe and Australia) have been rising over the origin of - and responses to - the virus. There have been several headlines around ramifications, which have included the selling of U.S. Treasuries by China and a return to tariffs and protectionist policy. Of these, the latter would be the most damaging to financial markets and the economic recovery globally.

Attempting to predict the actions of President Trump or President Xi can be difficult at the best of times, let alone during a deep recession and the lead up to the U.S. election. Clearly, China-U.S. relations have deteriorated in the past two months. However, the reintroduction of tariffs would create a headwind to the economic recovery and to the stock market (something which we know President Trump puts some emphasis on). Importantly, the return of tariffs would hit the manufacturing- and trade-exposed sectors the hardest, which would impact the Rust Belt swing states.

If the 2018-19 trade negotiations are a guide, one thing we can expect is volatility around changing headlines. Another risk to the trade relationship is Joe Biden presenting a tougher view on China, which has the potential to force Trump’s hand.

Is protectionism on the rise?

This tendency toward protectionism may not be just limited to the United States and China’s relationship, and we will be closely monitoring governments worldwide for any comments around trade. There is the potential, albeit a low probability in our opinion, for governments to place countervailing duties on imports. These are anti-subsidy tariffs that are used to discourage state intervention.

It would be legal, under World Trade Organization rules, for a government to place these duties on any imported goods that had been produced by a company that had received government support (i.e., subsidies), regardless of whether the domestic industry had also received support. While this is not exactly an efficient outcome, it could become attractive to some governments, particularly when combined with a national security argument.

Watchpoints in the coming weeks

Looking ahead, we are closely watching China’s purchases of U.S. goods in the short term. Given the shutdown of the economy in the first quarter, it is going to be very difficult to achieve the agreed-upon purchases of the Phase 1 trade deal. However, a ramping-up in purchases could be enough to ease tensions, particularly in the eyes of President Trump. Energy purchases could be an easy candidate, given China has storage capacity, and that would alleviate some of the storage concerns in the U.S.

On the domestic economy, our focus will remain on credit growth, as well as the upcoming National People’s Congress meeting in the latter half of May. We’ll continue to keep you apprised of the latest developments. Stay tuned.