5 lessons for advisers from 2022’s turmoil

What a remarkable, memorable and, at times, challenging year 2022 was.

It will definitely be remembered as an unusual year for financial markets. For the first time in more than 50 years, bonds and equities both fell in value: we discovered that correlations can reach 1:1 and that diversification doesn’t guarantee positive results.

It also spelled the end of “cheap money”. We’ve witnessed the fastest tightening of monetary policy by developed market central banks in decades as they aim to get inflation back to target. This has impacted nearly every major asset class and we don’t yet know the longer-term implications.

Click image to enlarge

Source: Board of Governors of the Federal Reserve System (U.S.), Federal Funds Target Rate (DISCONTINUED) [DFEDTAR] illustrated for hiking cycles from Oct 1982 to Dec 2008 and Federal Funds Target Range - Upper Limit [DFEDTARU] illustrated for hiking cycles from Jan 2009 to Dec 2022, retrieved from FRED, Federal Reserve Bank of St. Louis. “Month 0” represents the month prior to the first increase after a trough in the Fed funds target rate. The hiking cycle ends in the month the peak target rate is reached.

As an adviser, you probably dealt with panicked clients, frustration over having both fixed income and equities in negative territory.

In 2022 we also saw an incredible number of economic and market headwinds including Russia invading Ukraine, an inverted yield curve, the meltdown of crypto, layoffs in the technology sector, and a weakening U.S. dollar.

On the personal side it has been hard to compartmentalise the humanitarian and investing components. Our financial and emotional well-being often go hand-in-hand. I also found it difficult, and at times heartbreaking, to see the worry, fear, and doubt that many investors have expressed over the last 12 months. I'm sure you and your team have worked hard to help reassure clients who have confided in you about these concerns. Now that we have navigated 2022’s turmoil and are beginning a new year, it seems a good time to look at the lessons we’ve learned. Here are a few things I have taken away from last year’s challenges (and the opportunities they can offer to astute advisers):

1️. Calm seas don’t make good sailors

Just when we think it’s plain sailing, things can knock us unexpectedly off course, so be prepared. Also, don’t get complacent when you think things are going well: it’s never quite as good as you think. Equally, when it feels like you’re at a low point, it helps to remember that what you’re going through is temporary. This too shall pass and it’s teaching you valuable lessons that are helping you grow and develop.

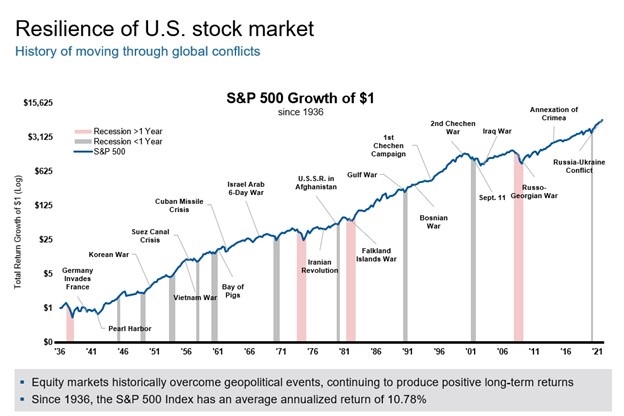

Whenever I feel overwhelmed by the turmoil in the financial markets, I look at the chart below and it reminds me that the stock market has withstood numerous blows over time and historically has always recovered eventually.

Click image to enlarge

Source: St. Louis Federal Reserve & Morningstar Direct. S&P 500 index as of 31/3/2022. Log: Lognormal scale. Total Return: Includes dividend reinvestments.

2️. Mindset is key

When things get tough, do you see opportunities to thrive and excel or obstacles and roadblocks? Clients, colleagues and businesses value people with a positive mindset who can find solutions. Difficult market environments can also be the best time to demonstrate your value as an adviser.

Our annual Value of an Adviser study has consistently shown that helping clients avoid making decisions based on their emotional response to the market’s ups and downs is one of the greatest components of an adviser’s value. It’s your ability to keep calm in the storm and guide your clients through the waves that can help them reach their financial goals.

3️. Build a world-class team

Create a team culture that focuses on providing opportunities that allow everyone to take responsibility and do a great job, both enjoying what they do and where they work. When you get this right, things should continue to work seamlessly when anyone is out of the office – be that on annual leave, unexpectedly unwell or dealing with any other unforeseen event.

Moreover, a well-functioning team is essential to help deliver superior client service – another way you can distinguish yourself as an adviser. Taking care of your team leads to a better client experience, especially for those advisers providing holistic wealth management services. Just like putting your own oxygen mask on before helping others in an emergency, you can’t take care of anyone else unless you take care of you and your house team first.

4️. Remember that sales is a people-facing business

By better understanding the needs and objectives of our clients, prospective clients, colleagues and everyone else that we interact with, the better outcomes we can achieve. Invest time in deeply understanding all the people you work with. Approach every interaction thinking what does a ‘win-win’ outcome look like? Then try to deliver it.

When it comes to your clients, the deeper the discovery conversation, the better experience you can provide. Not only will you have a better understanding of their unique circumstances, needs and goals, you will be better placed to help them achieve financial security. The turmoil of 2022 and the ongoing pandemic may have caused some clients to reassess their priorities – putting you in the unique and valuable position to help these clients revise their plans accordingly.

5️. Competition is good

Competition forces us to up our game, innovate and exceed our own and others’ expectations. Would Roger Federer’s legacy be the same without Rafael Nadal? I doubt it. Embrace competition and keep striving to be the best you can be. Although you may not always win, know that each time you’re competing for assets or helping a client develop a holistic investment plan, it’s making you better and helping you grow. And that in turn is good for your clients: they are more likely to get better service and more engaged advisery teams helping them navigate their most complex financial decisions.

The bottom line

We are there with you. We understand what a difficult market this has been, and we too feel the stress volatile markets have placed upon us. Don’t go it alone. Build yourself a team with differing perspectives, but a common goal in mind. One of the things that might be worth reminding investors in times like these is that we build financial plans to account for years like 2022 and that if our three core tenets have not changed -- objectives, risk tolerance, and time -- then maybe the best course of action is to “thoughtfully do nothing”. I love a good quote, and one of my favourites comes from Albert Einstein: “In the middle of difficulty lies opportunity”. Time to smash 2023 and find those opportunities. We are here to help.

Many thanks to Owen Davies, Director, for the original concept for this article.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.