Responsible investing roadmap: Part 3

This post is part of a 3-part series which has been CPD certified. Download the full document and request your CPD certificate here.

In the second part of our roadmap, we looked at educating your team on responsible investing and defining your beliefs. Now we’re ready to look at implementation approaches. In this final piece in our series, we’ll explain the different ways to integrate your new ESG (environmental, social, and governance) principles into your organisation.

ESG integration

The PRI (Principles of Responsible Investing) defines ESG integration as ‘the explicit and systematic inclusion of ESG issues in investment analysis and investment decisions.’1 To put it another way, it means proactively considering sustainability or other social factors during your investment process.

Should I use an active or passive approach when investing responsibly?

Companies with robust ESG practices are more likely to have enduring business models. Investing in these companies can help deliver portfolio performance over the long term and reduce volatility in the interim. While passive strategies like ESG index tracker funds can offer access, an active approach is better suited towards recognising these opportunities. Active management is particularly useful for ESG fixed income investing given some of the unique technical characteristics of the asset class.

Why active management and ESG integration are a good fit:

- ESG risks are often not adequately priced into the market. For example, we believe global equities is an asset class where active management generates alpha. With ESG risks priced inadequately, there are good opportunities for active managers to generate alpha in ESG equity strategies.

- More broadly speaking, robust ESG management by companies gives a good indication of overall quality and helps identify the companies most likely to have successful long-term business models.

- Active management also makes better use of the power of engagement and stewardship and holds greater weight when voting. On the other hand, passive investing replaces this human element with a benchmark-driven approach, which cannot be matched entirely to a client’s responsible investing beliefs.

Incorporating negative ESG exclusions or positive ESG screens

An ‘exclusion’ is when an entire sector, country, or company are excluded from a portfolio. It’s the simplest way to implement ESG considerations. The screening process uses transparent metrics like activities (e.g., animal testing), practices (e.g., corruption levels), personal values (e.g, gambling) and risk considerations (e.g, nuclear power). Political issues could also be a consideration.

What is positive selection?

Positive screens - factors that you want more exposure to - could be stocks in companies that use renewable energy or that score highly in employee satisfaction.

How to incorporate negative or positive ESG screens?

There are a few ways of incorporating these negative or positive ESG screens, depending on your provider.

For commingled fund managers, choose managers that incorporate your desired exclusions or positive ESG screens. However, ensuring uniform exclusions or screens across all managers may be difficult. Even ESG-conscious managers are likely to have small differences in which stocks they include or which screens to utilise.

For separate account mandates, you can often work with a manager to incorporate negative exclusions or positive ESG screens. If a manager doesn’t have the capabilitity to do so, another option may be to use a different implementation manager to handle these exclusions or screens.

Make sure your manager or implementation partner understands and can implement the ESG exclusions you desire. For example, any exclusions by carbon footprint could result in unintended consequences like underweighting companies that are making significant strides in energy transition. This would compromise the benefit of ESG incorporation in the first place.

Active ownership

Active ownership is the use of the rights to influence the activities of investee companies. Active ownership, whether through proxy voting or shareholder engagement, is generally regarded as an effective mechanism to reduce ESG-related risks, maximise returns, and have a positive impact on society and the environment.

Proxy voting

Proxy voting is the exercise of voting rights on management and/or shareholder resolutions to formally express approval (or disapproval) on something. Voting can be done in person, during an Assembly General Meeting (AGM), or by proxy (i.e., proxy voting).

Shareholder engagement

Shareholder engagement is any interaction between the investor and investee companies in relation to ESG practices or disclosure. It helps enhance shareholder value and rights. Engagement can happen at multiple levels, whether via sub-advisers, market participants, or direct corporate engagements.

Bondholder engagement

Engagement is more common among equity investors. But our annual ESG Manager Survey showed that fixed income managers are beginning to leverage the unique features of fixed income investing in a more implicit manner. While bondholders do not have voting rights per se, as capital providers to corporations, they do have a direct line of communication to management.

That said, the explicit limitation exists for bondholders who cannot engage in proxy voting. We have observed that fixed income market practitioners with equity offerings leverage their equity counterparts to increase influence. Some bond managers who have limited or no equity offering look to partner with other bond managers to similarly have their voices heard. Russell Investments is a member of Climate Action 100+, an investor-led climate engagement coalition that launched in 2017 to help such bond managers coordinate their engagement activities with other investors.

Establish a reporting framework

Now it’s time to ask: how will you measure how well your ESG policies are being implemented? A robust reporting framework helps communicate your efforts to your stakeholders and community, demonstrating the positive work your organisation is accomplishing.

Your investment manager or investment consultant should have the capacity to report your investments’ impact. However, you’ll still need to create a process to evaluate your portfolio’s ESG performance, whether it be through climate disclosures or metrics-driven reporting.

Establish a reporting framework

Now it’s time to ask: how will you measure how well your ESG policies are being implemented? A robust reporting framework helps communicate your efforts to your stakeholders and community, demonstrating the positive work your organisation is accomplishing.

Your investment manager or investment consultant should have the capacity to report your investments’ impact. However, you’ll still need to create a process to evaluate your portfolio’s ESG performance, whether it be through climate disclosures or metrics-driven reporting.

Task Force on Climate-related Financial Disclosures (TCFD)

Investors are demanding more disclosure on portfolio positioning and regulators around the world are expanding their requirements. Your provider should have a thorough understanding of the implications of climate change for investing and provide you with the information you need.

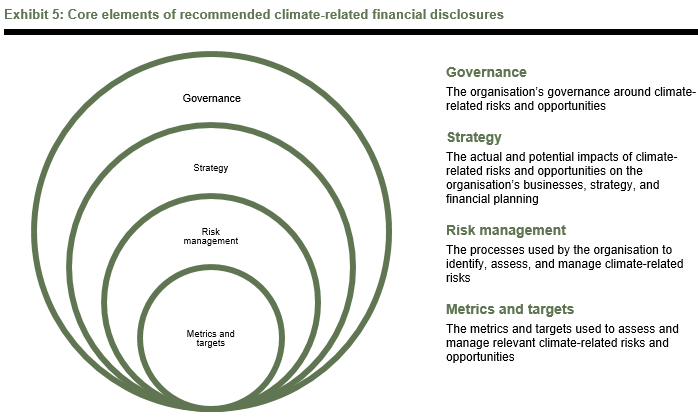

We recommend that you and your provider review the TCFD initiative, which was established by the Financial Stability Board (FSB) in December 2015. The initiative created a set of voluntary, consistent disclosure recommendations for use by companies providing information to investors about their climate-related financial risks. The TCFD has an established framework for reporting on climate-related topics, as illustrated in Exhibit 5.

Source: TCFD

Metrics-driven reporting

Demand for metrics-driven reporting is generally twofold: one for ESG criteria broadly, and one for metrics related to climate change, such as carbon footprint.

You should make sure your provider can put together detailed ESG reports both at the individual fund and total portfolio level. These reports include key statistics on ESG factors such as ESG risk scores, carbon footprint indicators, and exposures to certain sectors (i.e., tobacco). They also include proprietary information for portfolio managers on the vast array of details related to responsible investing ranks, metrics, and engagements.

The images in Exhibit 6 are examples of total portfolio-level ESG reporting. Reporting should be tailored to meet the specific needs of your organisation

The bottom line

We believe that responsible investing is intelligent investing. ESG values are a sign of well-run teams and future-proofed business models.

There are multiple approaches to integrate responsible investing into your portfolio, from screening to different ownership styles. Once you have decided on the method that works for you, establish a reporting framework to ensure your goals are being met.

Download your copy of the full roadmap

1UNPRI. (2018, April 25). “The term “ESG integration” is often used when talking about ESG investing.” Available at: https://www.unpri.org/fixed-income/what-is-esg-integration/3052.article

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.