Global investing and currency hedging: Performance and impact

This was originally posted on 19 February 2019 and has since been updated.

There are a whole host of factors that come into play when investing in a global selection of assets. Often disregarded, a key element of global investing is currency exposure, and with that, the associated exchange rate risk.

Over the long term, currency hedging can provide you with valuable protection and returns, particularly in volatile markets. However, against the current market backdrop, which is seeing significant sterling volatility, currency hedging could have a negative impact.

Here we outline some of the key considerations for UK investors exposed to global equities and explain how currency hedging can impact or benefit a global, multi-asset portfolio.

Global equity investing: Currency exposure is an automatic by-product

You don’t just have to think about currency and exchange rates when travelling abroad, it applies to investing, too. To put it simply, if you’re a UK investor with any stocks or bonds in your portfolio from outside of the UK, you are automatically exposed to the currency of those countries.

Take for instance the MSCI World Index, which is only made up of 5% UK equities.1 The rest is comprised of equities from outside the UK such as the U.S., Europe and other countries. An investor in this index therefore, doesn’t just have equity holdings – they also have direct exposure to the other countries’ currencies such as dollar, euro and yen. In other words, this currency exposure is an automatic ‘by-product’ of a global equity investment.

Currency exposure and exchange rate risk

You wouldn’t want only 5% of your salary to be paid in sterling, and the rest in dollars, euros and yen etc. – would you? So why accept your investment income like this?

Ideally, it needs to be converted into your home currency. Therefore, a global equity investor is subject to an additional layer of risk: the risk of loss when these other currencies are exchanged for their equivalent in sterling, i.e. exchange rate risk.

In order to manage this exchange rate risk, the currency exposure can be hedged using forward exchange contracts.

Currencies move up and down: Use Purchasing Power Parity as a value anchor

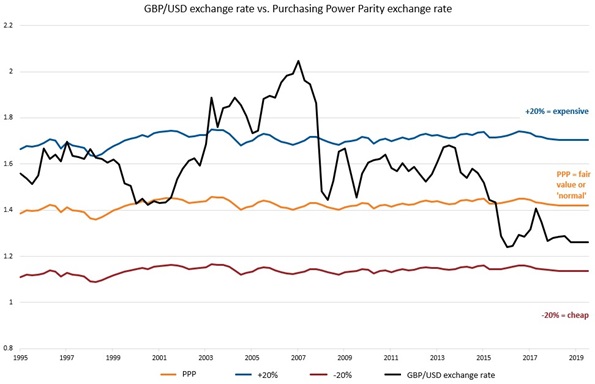

Like most asset classes, currencies go through prolonged return cycles, moving up and down over time. Purchasing Power Parity (PPP) is used to compare different currencies and is a value anchor for their moving prices. It works by calculating the exchange rate at which a basket of goods cost the same in two different countries by accounting for differences such as inflation rates and cost of living.

In the chart below, we have mapped the standard market exchange rate for GBP/USD (black line) against the Purchasing Power Parity exchange rate (orange line) since 1994. As you can see, it is not rare for the market exchange rate to deviate 20/30% above or below the Purchasing Power Parity exchange rate (blue and red lines). When the exchange rate is very expensive or cheap like this, there is a tendency for it to eventually return back to the Purchasing Power Parity rate which is considered fair value or ‘normal’.

Chart 1: GBP/USD market rate regularly deviates from PPP, but eventually mean-reverts

Source: Thompson Reuters Datastream as at 15 March 2020.

Brexit and the depreciation of sterling: Performance implications

Between 2018 and the end of March 2020, sterling depreciated significantly, falling well below its Purchasing Power Parity exchange rate. Since 1994, this has only happened once before – following the Brexit referendum on the 23rd of June 2016. We attribute this fall in the price of sterling then, and more recently, to the political uncertainty surrounding Brexit.

Sterling hedged equities suffered negative returns of -2.9% between the end of 2018 and 31 March 2020, due to the continued fluctuations and depreciations in sterling. As you can see in the table below, unhedged global equities benefitted from their currency exposures and rose by 1.0% in the same period.

MSCI World total returns 31 December 2018 to 31 March 2020

| Sterling-hedged global equities | -2.9% |

| Unhedged global equities | +1.0% |

Source: Bloomberg as at 31 March 2020.

Sterling volatility looks set to continue amidst the current COVID-19 pandemic and ongoing uncertainty surrounding Brexit. This may result in sterling-hedged assets continuing to suffer versus their unhedged peers.

However, we believe that over a longer-term perspective, the price of sterling will stabilise once the future relationship between the UK and the European Union becomes clearer.

As in the chart above, past experience suggests that sterling is likely to appreciate and return to fair value, or to a more ‘normal’ price.

The bottom line

Sterling staged a recovery in late 2019, as investors gained confidence that sudden cliff edge Brexit was unlikely. Investors also cheered the re-election of the Johnson government and sterling rose further on hopes for more stimulatory government fiscal settings.

However, sterling weakened through early 2020 as fears once again rose that an aggressive Brexit strategy might be favoured by the government, this fall continued further as the COVID-19 shock created expectations for a deep recession.

The result is that as of April 2020, sterling remains significantly undervalued compared to its Purchasing Power Parity value.

1Source: MSCI World Index, data as at 15 April 2020.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.