Why does my green fund look dirty?

So, you’ve decided that you want to invest in sustainable or green products, but what does that look like? Sustainable investing typically considers environmental, social and governance (ESG) factors in portfolio selection and management, and there are numerous, robust ESG-managed products that are positively differentiated and credible. This natural variety is positive for investors seeking to meet specific sustainability goals but also introduces complexity.

Some strategies will appear to have greener credentials, such as a lower carbon footprint or ESG risk score, than others. Does that mean that they are more sustainable or more green? Not necessarily.

Determining that requires a deeper dive with the investment manager on how they evaluate and invest around environmental risks and return opportunities. That’s where we, the Russell Investments manager research team, open the book to find out.

Intent, process and outcome: How we assess ESG managers

Our manager research team uses an I-P-O framework when assessing manager products for recommendation into sustainable or ESG-focused universes and funds. Specifically,

- The Intent (I) of the strategy

- The Process (P) by which the manager integrates ESG

- The Outcome (O) of how the portfolio measures up

Let’s look at these a bit closer.

What do we mean by intent? Intent rests on product design. A sustainable or ESG-focused strategy will typically have an explicit sustainable objective, such as investing in companies which offer low ESG risk and/or carbon footprint, produce sustainable goods or services, or align to sustainable development goals (SDGs), alongside financial objectives.

What is an ESG-friendly investment process? Our manager research team evaluates a manager’s commitment to ESG-oriented practices, its assessment and integration of risk and return opportunities, and active ownership practices. Strategies that earn high marks in these areas are considered to have above average ESG process integration.

Lastly, in our framework, a sustainable or ESG outcome is evidenced through product characteristics, i.e. quantitative metrics. These may include low ESG risk or low carbon emissions. However, as described above, data can be an imperfect or insufficient indication, and this is where confusion about green credentials might arise.

The perils of relying only on outcomes

The danger of relying too much on outcomes is best illustrated through an example.

Consider Manager A, which offers a global thematic strategy focused on businesses that are developing innovative solutions to resource challenges in environmental markets. Said more plainly, this manager invests in companies with a meaningful portion of revenues that come from environmental markets, including new energy, water, sustainable food/agriculture, and water/waste recovery solutions.

Next, consider Manager B, which invests in quality or well-run companies where sustainable practices reinforce the competitive advantage. Specific ESG criteria embedded in its fundamentals-based research include workplace policies, sustainable supply chains, product integrity and governance and disclosure, environmental impact and community impact.

Both Manager A and Manager B demonstrate intent through explicit ESG-related objectives and an ESG-friendly investment process.

However, the ESG outcomes for these strategies are notably different, particularly the carbon footprint.

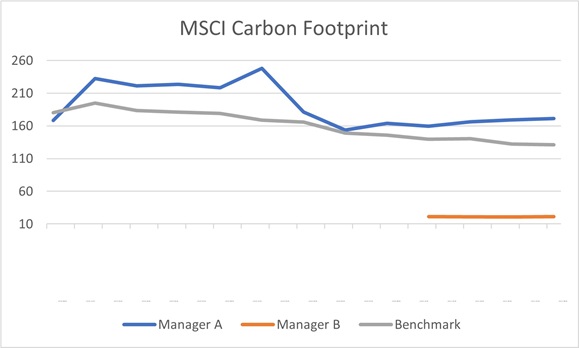

As illustrated in the chart below, Manager A’s carbon footprint is consistently higher than its benchmark while Manager B’s carbon footprint is materially lower, even though both strategies consider environmental impact in their investment processes.

Does this mean Manager B is better at evaluating environmental risks? Not necessarily.

Let’s look more closely at these outcomes through the lens of sector exposures and each product’s top offenders, i.e. the companies with the highest carbon footprint. Manager A is focused on businesses developing green solutions while Manager B’s selection criteria considers environmental impact but allows for an investable universe that is broader in scope. As a result, Manager A is overweight utilities, materials and industrials - all industries that can be considered less environmentally friendly, and Manager B’s portfolio offers more balanced sector exposures, which limits the portfolio’s total carbon footprint.

Click image to enlarge

Date: 9/30/2021

How we assess ESG risks

In our process, we take a closer look at some of the highest greenhouse gas (GHG) emitters in Manager A’s portfolio to determine whether these investments are appropriate given the product’s objectives. Our discussions with Manager A focus on the overarching investment thesis and its alignment with their stated investment philosophy and security selection criteria.

- Company 1 (MSCI carbon footprint: 1327.5) is a leading global industrial gases and engineering company in the materials sector. It has well-articulated and measurable environmental goals, including a 35% reduction in GHG emissions intensity, significant investment in decarbonisation initiatives (1/3 of total research & development budget), achieving 100% water management and zero waste at hundreds of sites, as well as contributing 50% of philanthropic spend toward climate-related programs.

- Company 2 (MSCI carbon footprint: 1330.4) is a Canadian power producer in the utilities sector dedicated to developing, building owning and operating clean and green power infrastructure assets globally. Corporate sustainability targets include reducing electricity generation carbon intensity by 65% by 2030 and increasing gross renewable energy capacity by 4-5 gigawatt (GW) by 2030.

- Company 3 (MSCI carbon footprint: 1026.4) is an American waste management services company in the industrials sector with an overarching goal to reduce GHG emissions from its landfills, fleet and electricity use, while increasing the emissions-avoidance services that it provides to its customers.

More than meets the eye: Why context matters

These businesses operate in carbon-intensive industries and if Manager A only considered carbon footprint, it would have been deemed un-investable or blindly excluded from the investment universe. A deeper review highlights that looking beyond that characteristic enables unique and compelling investment opportunities that have positive environmental impact. Our key focus is to conduct careful reviews and ongoing monitoring to ensure Manager A adheres to its investment philosophy.

Let’s return to Manager B. Although it is not explicitly targeted, Manager B is void both the materials and utilities sectors. This is most likely because of its overarching preference for higher quality, less cyclical businesses, which tend to be more difficult to find in these industries. However, the industrials sector is more heterogenous in nature and includes businesses with less earnings variability and a wide range of GHG emitters.

For example, Manager B owns a Swedish multinational industrial company that manufactures and services industrial tools and equipment. This company’s MSCI carbon footprint is notably lower (18.5), which is compelling to Manager B and aligns with its stated objective of investing in businesses with limited environmental impact. However, this company does not offer innovative solutions to resource challenges in environmental markets - and therefore would not be part of Manager A’s investable universe. This example highlights that a company’s carbon footprint (or even a product’s) does not tell the whole story. Returning to the idiom we started with, to determine suitability of a sustainable strategy, you need to read the book.

The bottom line

In our view, both Manager A and Manager B are credible solutions for clients looking for a green strategy. This example shows how a simplistic check-box framework is insufficient to capture the complexity of usable solutions.

At Russell Investments, our I-P-O criteria and thorough, ongoing review of the ESG landscape help illuminate compelling sustainable products that may otherwise be ignored. Ultimately, when it comes to ESG investing, there’s far more than meets the eye. As the world moves toward a cleaner future, it’s clear that the inherent risks and opportunities for ESG investors are expanding as well. Caution and flexibility are required to ensure that overall expectations are met, and new means of measurement are considered.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.