Impact investing: How a fund of funds approach can help address challenges

Private equity markets have seen a surge of interest in impact investing in recent years. In a recent survey by Pitchbook, 65% of respondents managing external money said that they had offered impact strategies to their clients, up from 57% in 2021.* However, challenges around transparency, reporting and access to opportunities are common. Here’s how a fund of funds approach can help.

Minimising the negative societal consequences of an investment is no longer just a ‘nice to have’. Investors today are increasingly prioritising positive and measurable environmental, governance or social outcomes alongside financial gains. We call this impact investing.

Impact investing is complex

The complexity involved when researching an opportunity is amplified when you must consider impact as well as financial gain. This is especially true for small companies or other investors who do not have the time or resources required to be deployed in this critical part of the process. Conversely, larger investors can suffer from diseconomies of scale due to the more nimble nature of smaller fund sizes in the impact universe. This is where a fund of funds approach can help.

Fund of funds strategies help investors diversify into a plethora of fund categories that they might not otherwise have access to, all wrapped up in a single investable portfolio. The approach is ideal for retail investors who lack the expertise, capital, or risk appetite to invest directly in individual securities or funds. If we add an organisation’s bespoke impact considerations to the mix, then the support a fund of fund structure offers can be crucial.

Overcoming the metrics hurdle – measuring success in impact investing

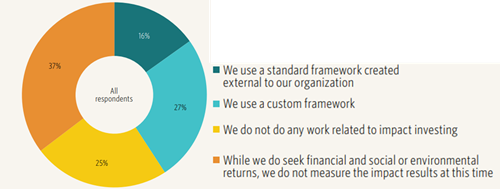

This is a common challenge. The achievement of goals like helping the less fortunate or combating global warming are inherently more difficult to quantify than straightforward financial outcomes. The Pitchbook Sustainable Investment Survey results again highlight the disparity between approaches to measuring impact, as seen in the pie chart below:

If you do any Impact Investment work, how do you measure Impact?

Source: PitchBook | Geography : Global | Respondents : All

Question 08

A fund of funds approach helps close this gap. It sets clear metrics in a framework that can be easily understood and utilised, whilst being flexible enough to be applied to different kinds of opportunities. This approach aggregates the information from a broad range of managers covering many strategies and geographies into a clear set of outcomes. In this way, the investor, the manager, and the funds themselves are on the same page and can hold each other accountable.

Diversification adds value and lowers risk

Investors may be limited by geography, familiarity and access when they look at impact investing themselves, or follow a “place based” approach to achieving Impact. This could mean putting money in local projects only (like a community hospital) and, missing out on global opportunities (like improving healthcare and sanitation in the developing world).

Fund of funds can provide an opportunity to make a difference at both levels, negating the need for compromise. Investors’ capital will often go further abroad than it will at home, but some of the benefits of the investment, for example, improvements from breakthroughs in healthcare, may in time be experienced by those much further afield than the initial investment location.

This diversification between the local and global domains also has the added benefit of mitigating risk. Investing in emerging impact funds or a single manager carries a higher level of risk, so spreading exposure across a broad range of opportunities is a smart move.

Track records matter

Understanding exactly how your money will be used is a challenge for many investors investing in private markets when allocating to blind pool funds. This kind of ‘blank cheque’ underwiring is especially problematic for investors with environmental or social concerns. To be nimble and make the most of opportunities as they emerge, managers of ‘blind pool’ funds have limited restrictions placed on their decision making. This can elevate financial risk for an investor and diminishes the opportunity for oversight when it comes to decisions on impact.

The solution could be going through a fund of funds manager, who will have experience in holistically assessing emerging specialist strategies which are prevalent in the impact world. They can provide a clear and superior underwriting of the potential risks, an assessment of the impact reporting structure with transparent impact KPIs and blend different levels of experience within a portfolio.

The skill required to properly evaluate the track records of different fund managers cannot be overstated. Due diligence is crucial in maximising impact while ensuring financial security.

The bottom line

Financial returns and personal values need not be mutually exclusive. But balancing the two can be a challenge for many investors. Understanding how to measure success, how to balance risk, and knowing who to trust, takes time and expertise.

A fund of funds approach can make impact investing that bit easier. Investors get access to the best managers across a range of regions and sectors, ensuring that their portfolio exposure is properly diversified. With clearly defined goals and fully vetted managers, clients can be confident that their money is invested thoughtfully.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.