Private market strategies, part 1: More than meets the eye?

Fuelled by a global need to fund long-term obligations, the demand for private market strategies1 is projected to grow. Are investors considering the full opportunity set?

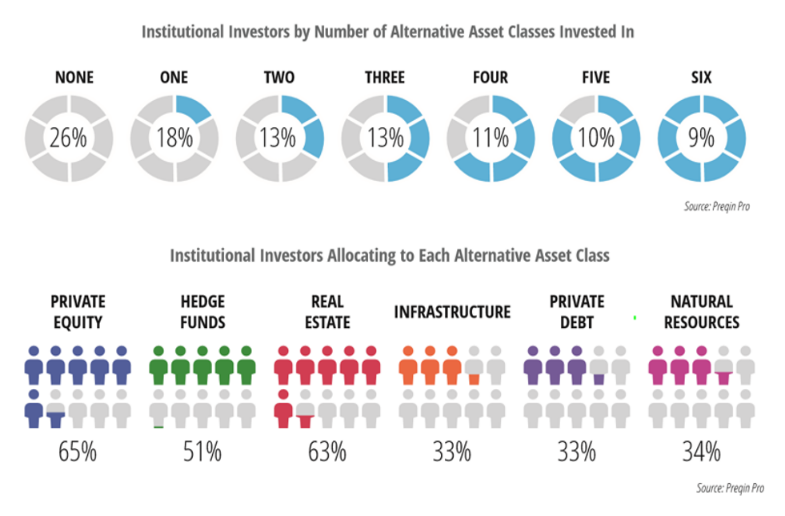

A recent investor survey indicates only ~40% of investors have allocations to three or more alternative segments.1 Opportunity exists to incorporate more sources of diversity and return into portfolios.

Given the business cycle and entry points, should investors be seeking these strategies?

This marks the first in a multi-part series of posts addressing the mechanics and outlook for key private market strategies. Part 1 is intended to set the stage, discussing foundational principles relevant for new and existing investors across the board.

Click image to enlarge

Before diving in, it’s worth a refresher on the general case for private market investing. The argument for inclusion typically involves some combination of the following:

- Potential for superior returns, as compared to traditional asset classes. Note, incremental returns are required to compensate for the complexity, illiquidity and transparency.

- Correlation benefits with other asset classes. While there is smoothing from quarterly valuations, private markets do not experience the same level of mark-to-market volatility as public markets.

- Multiple dimensions of diversification, which can vary by strategy, from pure exposure investors cannot easily gain through listed markets.

- Potential inflation hedging benefits, particularly for select natural resources, real estate, infrastructure equity and private income strategies.

- A rising contingent of investors seeking the dual objective of generating return and impact (i.e., profit with purpose). While impact measurements are still evolving and transparency needs improvement, we believe the listed market will pave the way with metrics and private markets will soon follow.

While these factors support inclusion into portfolios, a well-developed investment approach—anchored by sound philosophical beliefs as well as appropriate cycle and value considerations—should be in place to guide decision-making.

Where are we in terms of cycle?

For any asset owner or adviser, this is important and in practice, the most difficult to tactically chase. Why? For most private market strategies, entry points can be at one phase of cycle while exits (i.e., full realisations) often occur at a completely different phase.

Trying to time entry and exit points is not a winning strategy. General Partners (“GP’s”) also have flexibility to change the cadence of cash deployment and should be leaned on. For example, a disciplined value-oriented distressed manager may face a low supply of opportunity during the first half of a five-year investment period but ramp the portfolio in years three and four. Depending on the funding source, the effect of averaging down capital deployment can be beneficial when listed markets are trending negative and a performance drag while trending positive.

Truth be told, irrespective of a market appearing overheated or distressed, we believe the focus should be on finding talent, leveraging data-driven insights and grasping secular trends to take full advantage of a longer-term horizon. On the latter point, there will be no shortage of long-term or landscape shifting trends worth considering. Examples include, but are not limited to:

- How do demographics impact the strategy? By 2030, most if not all the Baby Boomer population will be out of the workforce. 70% of global income earners will be in the Millennial generation or younger.3

- How might geopolitical trends impact the strategy? For example, in 2020, the U.S. is projected to be a net exporter of energy.4 How might naval protection of key trade routes change as a result? What will be the cyclical and secular impacts on global supply chains?

- How will technology impact the end-market? Technology has shifted from a vertical to a horizontal - i.e., tech impacts everything. For instance, how will digital ledger technologies (“DLT”) impact private wealth transfer and private market investing?

- How will secure 5G wireless network bandwidth impact business and policymaking? How might an advancement in additive manufacturing (i.e., 3D printing) and trends in localisation impact supply chains, commercial real estate, or even long-term fundamentals for specific transportation assets?

This may all sound easy - but it’s far from it. Resources, relationships, local market insight and process are all required. Indiscriminately funding past winners without a view is risky, notably considering succession and generational wealth transfer among private market firms.5 We’ve also observed launching or allocating to something new becomes exponentially harder in the depths of a downturn. Why? Decision-making bodies are prone to polarisation during challenging periods, which are often the best times to start investing.

What about dry powder?

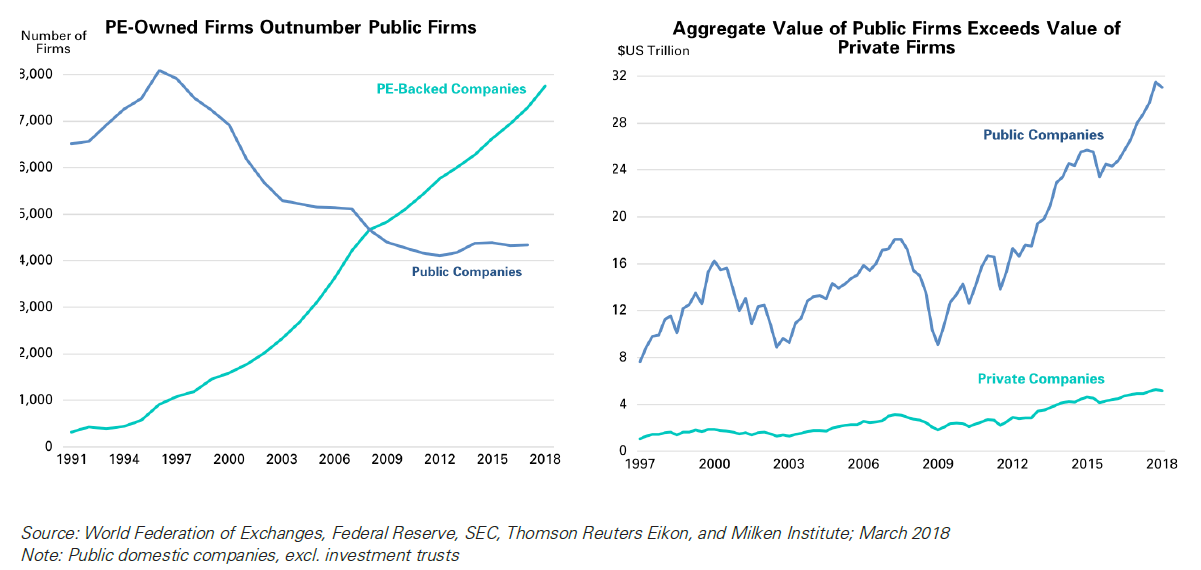

The availability of dry powder - the amount of undrawn capital already in queue to compete for deals - is a key consideration for investors. Fundamental changes in how companies use public markets to raise capital are also afoot, including direct listings and companies staying private longer.

Several key points are worth consideration:

Absolute levels: Absolute dry powder levels are high across most private market strategies. Levels should be viewed by strategy and in the context of the total addressable market. Deal activity compared to fundraising is a fulcrum metric. Competition remains strong but these markets are large.

Click image to enlarge.

Relative levels: Whether viewing fundraising as a percentage of beginning of period assets or dry powder as a percentage of net asset value (NAV), both are below average relative to the past 15 to 20 years.6 What does this mean? Probably not much. Success of private markets has driven the trend. Existing investors have been recycling huge distributions and new entrants have been arriving. What happens when distributions and/or recycling declines? Will the “denominator effect” reemerge and force a need for liquidity solutions?7 Will lack of potential ‘legacy issues’ improve the ability of new investors to focus and opportunistically launch programs?

Breadth: Private markets are not just control-equity or buyout strategies. Relative to total market dry powder, buyout strategies have declined from well over 50% at the turn of the century to less than 35% today. Conversely, income-oriented strategies have increased from 4% to 14% over the same period.8 The global nature of private markets and the breadth of strategy selection will only increase. We believe a global multi-asset relative value view informed by local market or in-country resources will be increasingly valuable.

Private markets vs capital markets: For private markets to sustainably grow, many believe transaction volume will simply need to grow as a percentage of total capital markets activity. Could global buyouts as a percentage of total mergers and acquisitions (“M&A”) increase to north of 20-25%?

Click image to enlarge.

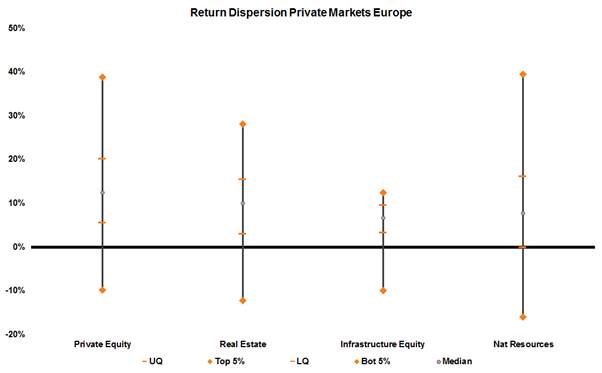

The ultimate question: Are there enough assets, labour talent, sellers at right prices and skill to go around to originate and generate required returns for all? No. This is fundamental and should be expected. It’s also a reason why the range between good and average performance is so wide in any private market strategy.9 Manager and strategy selection will continue to matter in upcoming vintage years.

Where is value then?

While timing is no doubt tough, we do believe in relative value. When coupled with sound governance and the flexibility to be dynamic in any given vintage, asset owners or advisers can benefit from a view. While we will detail in a forthcoming series, this is particularly true for more cyclical strategies where entry points matter more. For example, distressed is not an evergreen strategy. Therefore, a well-developed approach for investing based on both cycle and value considerations can be rewarded.

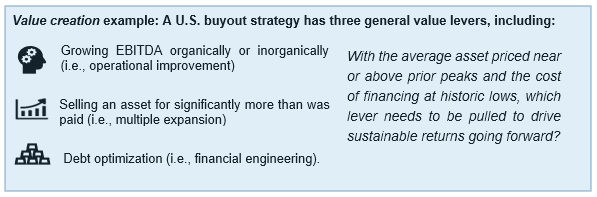

One key to selection is pinpointing sustainable value creation. Most equity-oriented strategies (i.e., development, value-add, buyout, growth, turnaround, etc.) will point to some form of operational value creation as a major return driver. To separate fact from fiction, it’s necessary to parse through track records. Oftentimes, this simply enables the ability to ask better questions. Fierce competition and high entry prices have only intensified the requirement for operational or asset management edge. A lot of hard work will be necessary to drive good exits (i.e., returns) from assets acquired today.

Click image to enlarge.

At any point in the cycle, select value opportunities and perceived financing gaps will arise. Currently, upstream energy, metal and mineral development and/or European financials all fall into this category. In these and other sector-specific situations, specialists truly shine - and superior domain expertise can pay off. Depending on the strategy or the opportunity set, larger or smaller funds may be better suited to execute. It may also be determined access is more attractive via a secondary (i.e., acquire assets or partnership interests, hopefully at some discount to NAV) versus a blind pool primary fund - or some combination.

More broadly, there’s nothing wrong with generating a return from multiple expansion, cap rate compression and/or financial engineering. Private markets are as much a collection of strategies as they are asset classes. If purchase multiples and debt are cheap, these tools will be used to make money for owners. However, trouble quickly arises when adaptions are not made. Sustainable return will need to come from operational improvements … an argument we acknowledge is convenient and often overused.

In this function, private market strategies play a key capital markets role. After all, the Industrial Revolution in the 18th century was not sustained via raising debt, cutting costs and sweeping cash back to shareholders (i.e., buybacks, dividends, recapitalisations, etc.). To continue growing, equity-oriented GP’s will need to reinvest to fund capital expenditures as well as future-proof assets built or purchased via technology and R&D spend. Cost-containment strategies can be tempting and easier as compared to forming a clear vision for the future and investing for growth.

Note, these principals apply to both public and private markets. In fact, at the end of 2018, buybacks across S&P 500 companies exceeded capital expenditures for the first time in ten years.[10] While magnified in the short-term by tax reform, this may not signal well for future earnings growth. Where will investors go to find growth and income to support required returns?

The bottom line

Amidst a backdrop of diminishing return expectations, Russell Investments’ expects asset owners and advisers to continue to seek both growth and income-oriented exposures in private markets. However, despite the range of opportunities, most seasoned investors appear to be allocating to a narrow subset. For prospective investors, uncertainty around macroeconomic environment, entry points, and/or estimates of dry powder, all seemingly serve as perpetual countervailing forces against launching programs.

Irrespective of current views on private markets, a perennial focus should be on finding talent, leveraging data-driven insights and grasping secular trends to take full advantage of a longer-term horizon. Funding operators who make money because they source better; invest smarter due to a superior understanding of an industry; have an elite operating partner network and access to talent pools; employ highly aligned key professionals … all transcend cycle. However, there will be plenty of tripwires to befall both new and existing participants along the way. We believe this reinforces the value of working with experienced and trusted private equity professionals.

1 In this article, we define private market strategies to include private equity, natural resources, real estate, infrastructure equity, and private debt. These strategies can be combined into a portfolio or, alternatively, specialist strategies can be managed. For example, a dedicated venture capital secondary strategy or an evergreen private income fund or a custom purpose-driven private impact mandate.

2 Brown, et al., Can Investors Time Their Exposure to Private Equity? (October 17, 2019). Kenan Institute of Private Enterprise Research Paper No. 18-26. Available at SSRN: https://ssrn.com/abstract=3241102 or http://dx.doi.org/10.2139/ssrn.3241102

3 World Bank

4 Department of Energy, Annual Energy Outlook 2019, January 2019

5 2019 Bain Private Equity Report

6 Cobalt, Morgan Stanley

7 https://www.privateequityinternational.com/the-return-of-the-denominator-effect/

8 Russell Investments, Preqin, Inc. Income-oriented strategies include credit, core real estate, and core infrastructure.

9 ThomsonOne, data as of 31 March 2019

10 Bloomberg: https://www.bloomberg.com/news/articles/2019-03-03/stock-buybacks-top-capex-for-first-time-since-2008-citi-says

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.