Q4 2021 Fixed Income Survey: The persistence of transient inflation.

In this latest survey, 53 leading bond and currency managers considered valuations, expectations and outlooks for the coming months.

In the 2Q 21 survey, the economic recovery was astoundingly rapid in many parts of the world. This pushed up inflation considerably and our managers understood that these levels were mostly “transitory”. Managers were accurate in estimating potential interest rate rises, as the Federal Reserve (Fed) started to shift its tone by forecasting rate increases in 2023. Regardless of the shift in tone for the Fed and survey participants’ concerns around potential inflation, it was clear that managers’ outlook for most of fixed income assets was relatively stable, but with a preference for the higher yielding segments.

Since then, the positive market momentum which dominated the first two months of the third quarter reversed quite sharply in September. Lingering concerns about higher inflation persisted throughout the whole period, forcing major central banks to turn significantly hawkish. The Fed confirmed that it will taper its asset purchase programme in November, whilst the Bank of England (BoE) fell just short of raising rates at its November meeting. The European Central Bank (ECB) acknowledged higher inflation but only resorted to buying assets at “a moderately lower pace”. At the same time, the spread of the “Delta” variant of Covid-19, China’s crackdown on several domestic sectors and Chinese property developer Evergrande’s debt crisis, added to volatility and growth concerns.With this in mind, we are keen to see how managers’ views have therefore evolved regarding persistent inflation, monetary policy tightening and rising risk levels.

Inflation Remains

Views from interest rate managers

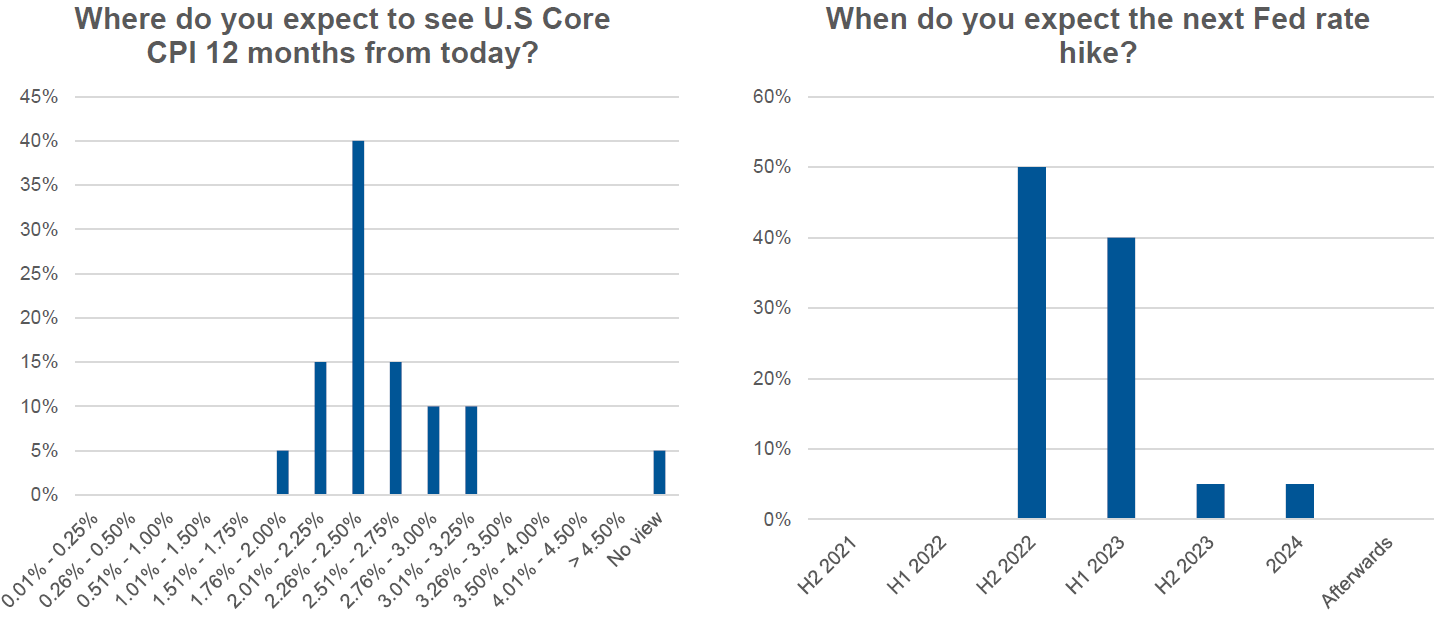

- Inflation expectations are more disperse. 55% of managers expect inflation in the U.S. for the next 12 months to stand between 2.26% and 2.75%, with just 20% of managers expecting higher levels than that. Circa 80% of managers do not expect the inflation rate to fall below the Fed’s target of 2% in the next five years.

- There has been an update in relation to interest rate increases. In the 2Q21 survey, 80% of managers expected the next interest rate hike not to occur before 2023. However, half of investors now expect the Fed to hike in the second half of 2022. Investors expect the Fed to start tapering this year (as evidenced in November) and terminate the process within six to nine months. 90% of managers expect between two to four rate hikes per year after lift-off. In contrast, most investors (75%) do not expect the ECB to taper prior to 2023.

- Little consensus around movement of the U.S. yield curve. 35% of managers expect a bear steepening of the yield curve in the next 12 months, while 45% expect a bear flattening. Thus, despite a negative outlook, investors do not seem to agree on which end of the curve the impact will be more significant.

- 42% of respondents expect the 10-year U.S. Treasury to trade between 1.61% and 2% in the next 12 months, with another 42% expecting rates to trade above 2% in the year ahead. Views are considerably more spread out, as in the previous survey, 72% of managers expected 10-year U.S. Treasury to trade in the narrower range of 1.80% to 2.20%.

- Managers consider that the 10-year Treasury level needs to be circa 2.25%, before the Fed could consider it as disruptive. This contrasts to 1.90% in 1Q 21 and 2.30% in 2Q 21.

Click to enlarge the image

Views from IG credit managers. Is sentiment changing?

- 30% of respondents are expecting a moderate widening in spreads in the next 12 months (circa ten to thirty basis points [bps]) in line with what was obtained in the previous survey. 60% of them still see spreads in a range bound for the next 12 months.

- Following the recovery in economic conditions and companies’ profitability, leverage decreased. Now, investors expect the pace of deleveraging to slow down as the share of investors that expect companies to decrease leverage fell from 69% in 2Q 21 to 52% in this survey.

- In the meantime, the share of investors that believe that current spreads compensate for potential risks of deteriorating credit quality, declined. However, the share of investors that believe that caution should be warranted, due to current spreads and leverage expectations, also decreased.

- Europe (ex-UK) replaced the U.S. as the region with the most attractive returns. Emerging Markets (EM) regained some momentum, with interest levels in line with the U.S. The UK still lagged other regions.

Global leveraged credit. More balanced views.

- 80% of managers expect range bound of spreads over the next 12 months, in line with the previous survey. No manager is expecting a tightening of spreads whilst 20% expect a moderate widening suggesting that managers see little catalyst for weakness but recognise the expensive valuations on offer.

- However, they remain constructive on fundamentals: 25% of managers are expecting to see material improvement in corporate fundamentals and 60% expect some modest improvement. As a result, there is little expectation for rising defaults; 95% of managers see defaults below their long-term average of 3%. This is up for 78% in our previous survey.

- Leverage loans had been managers favoured asset class in the previous survey, however they are now tied with mezzanine collateralised loan obligations and high yield emerging market bonds.

- It is worth mentioning however, that investors decreased their expectations for returns within U.S. HY. The share of investors that expect a return in the next 12 months between 4% and 5% decreased by 13% to 48% and the share of investors that expect a return between 0.5% and 3% increased by 10%.

- Inflation, rising interest rates and slowing Chinese growth are what managers consider the most concerning potential risks for the global high yield market in the next 12 months. China related risks were ranked third most important. These were likely driven by views on slowing economic growth coming on the back of credit issues from property developers like Evergrande. However, it is worth noting that most leveraged investors were not overweight to the sector.

- Confidence in fallen angels (FAs) increased as most managers consider fallen angels to be rising stars (57% in 4Q 21 vs 23% in 2Q 21).

Risk across the globe

Emerging Markets: Less bullish overall

- Within local currency emerging market debt (LC EMD), some concern has grown for the outlook of EM FX, likely due to the outlook over higher interest rates, Chinese growth and inflation. Over the next three years with the proportion of positive views falling to 62% from 71%. Furthermore, the weighted expected return for next year has fallen from 5.6% to 3.5%; the lowest level since the survey began.

- Managers expect the Russian rouble, Brazilian real and the Egyptian pound to be the best performing currencies in the next 12 months. 32% of managers expect the Turkish lira to be the worst performing currency in the year ahead. Local currency managers remain bearish on the lira, with more than 30% of respondents considering it to be the least attractive, in line with the previous survey.

- Managers are also less bullish within the hard currency emerging market debt (HC EMD) space. Only 29% of the managers expect spreads in the HC EMD index to tighten in the next 12 months, versus 33% in 2Q 21. On the other hand, 17% of managers expect spreads to widen. Weighted average expected return stands at 3.7% over the next 12 months, in line with the previous survey but considerably below the historical average.

- Wide gap in terms of growth differential between EMs and DMs: 48% of managers expect growth differential to remain between 1% to 2% vs 47% of managers that expressed such view in our 2Q 21 survey. 40% now expect growth differential to be between 2% to 3% over the next 12 months, up from 31%.

- Managers expressed again, their preference for Egypt, Ukraine and Mexico as the countries with the highest expected return over the next 12 months. China and the Philippines remain as the top two least preferred countries.

- For managers, the Fed policy is the most significant risk factor for the hard currency EMD performance in the next 12 months, followed by changes in the level of U.S. Treasuries.

Europe - currencies

- Tighter expectations for the Euro: 63% expect the U.S. dollar to gain value vs the Euro and to trade below the current 1.16 EUR/USD. This is a considerable adjustment given that in the last survey circa 80% of managers expected the pair to trade in the 1.21/1.30 range.

Securitised Sectors

- More confident views in the securitised segment: the proportion of investors seeking to reduce securitised risk declined while the proportion seeking to maintain or add, slightly rose.

- The attractiveness of BBB collateralised loan obligations has increased steadily for the last three surveys and is now the preferred securitised segment. Following close behind are BBB- commercial mortgage-backed securities. Residential mortgage exposure has modestly declined as the favoured segment.

- 50% of managers expect non-agency spreads to moderately tighten in the next 12 months. Moreover, 31% of respondents expect spreads to range bound.

- Managers expressed more balanced views regarding concerns for the CLO market with 69% mentioning broad risk-off market sentiment as main the risk, followed by underlying loan collateral credit deterioration.

Conclusion:

Inflation proved to have a bigger bite than previously thought, forcing investors to consider earlier interest rate rises. Whether the Fed will hike in the second half of 2022 remains to be seen, but the Fed has certainly signalled that this may be the case and managers often tend to get the timing right.

Higher inflation is also clearly playing a risk role within HY, more so than in the previous survey. However, with inflation remaining transient for a little longer than expected, is the ECB’s more toned-down rhetoric on higher prices an issue with the slight manager preference for EU over U.S. credit going forward?

Within Emerging Markets, sentiment has cooled down understandably, but debt concerns for Chinese property developers remain for now. Will a potential fallout of a Evergrande default be containable or not? This remains to be seen.

There are also unresolved issues around global supply chain problems and labour shortages, which have dented economic growth momentum. These issues will cloud risk momentum going into the next quarter, but similarly to thoughts around inflation in the last survey, could the problems of supply chains and labour shortages be more persistent rather than, transient?

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.