Mythbusting: Combating the top myths in real asset investing

The COVID-19 pandemic has impacted the global economy and financial markets in a myriad of ways over the past year, and real assets - including real estate and infrastructure - have been no stranger to the turmoil.

Global restrictions on travel, along with stay-at-home directives, have seen reduced demand for infrastructure assets such as airports and toll roads. Tack on the massive pivot from offices to a work-from-home environment, and it’s not surprising that some investors are questioning the value of real asset strategies in their portfolios.

In light of these negative connotations, we aim to set the record straight by separating facts from fiction when it comes to investing in real assets today. After all, myths deal with beliefs, not facts. With that in mind, we’re here to bust the most popular real asset investment myths of the past year. Let’s get started.

Myth 1: Isn’t real estate just offices, retail and hotels?

While investors may think that commercial real estate is mainly comprised of offices, shopping malls and hotels, the fact is that over the last decade there has been significant growth and evolution of the investable opportunity set across real estate. For example, in 2010, e-commerce related sectors (which include cell towers, data centers and industrials) accounted for 9% of the industry market capitalisation. By contrast, in 2019, these same sectors accounted for 32% of market capitalisation.1 The significant growth in these non-traditional real estate sectors illustrates how today, investors in real estate can access more diversified and less cyclical investment opportunities that are an integral part of the 21st-century real estate ecosystem.

Myth 2: Isn’t infrastructure dead if no one’s flying?

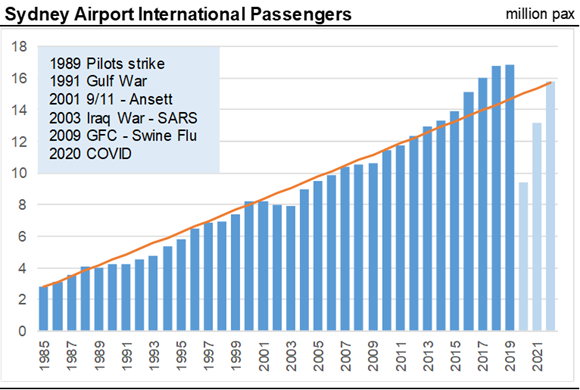

It stands to reason that airport investors would be concerned about the impact on air travel and passenger volumes, considering the lockdowns and travel restrictions surrounding the COVID-19 pandemic. That said, we believe airports remain an attractive long-term investment proposition, given the significant growth in air travel globally over the last several decades.

To illustrate this point, the chart below highlights the growth in passenger volumes at Sydney International Airport, where 16.9 million individuals passed through terminals in 2019 - compared to just 2.8 million in 1985. While the growth in passengers over this time period has been strong, it’s also been interrupted by a few significant events that led to a short-term decline in passengers, prior to a resumption of the long-term growth trend. The September 11, 2001, terrorist attacks and the Global Financial Crisis of 2008-2009 are instances of this. Moreover, while it might not feel like it today, this period of growth is likely not over yet, with global passenger air transport expected to rise 8% from 2021-20232, maintaining the long-term structural growth in passenger air travel.Source: The Passenger Air Transport Industry 2020-2030 – COVID-19 Impact and Recovery Assessment, June 2020

Myth 3: Is there still income generation in real assets?

The COVID-19 pandemic has impacted company dividend payments across a broad range of sectors including financials, consumer goods, travel and industrials. While investors in real estate and infrastructure were rightly concerned about cuts and/or suspensions to dividend payments, the reality is that in aggregate, dividend payments have held up well. For example, the dividend yield on the S&P Global Infrastructure Index over the course of 2020 (through November) averaged 4.33%, which is slightly above its average yield over the prior 10 years of 4.25%. Similarly, the dividend yield on the FTSE EPRA/NAREIT Developed Markets Real Estate Index over the course of 2020 averaged 4.49%, comfortably above its average yield over the prior 10 years of 3.85%.3

The resiliency of cash flows attached to infrastructure assets can be attributed to the following: essential nature of the service provided, structural growth, high barriers to entry and strong pricing power. Similarly, high-quality global real estate securities enjoy strong balance sheets, durable earnings and strong operating performance - namely, robust rent collections and growing demand, particularly from data centers, cell towers, single family homes and logistics assets.

Myth 4: Isn’t the office dead? Doesn’t that mean the death of real estate?

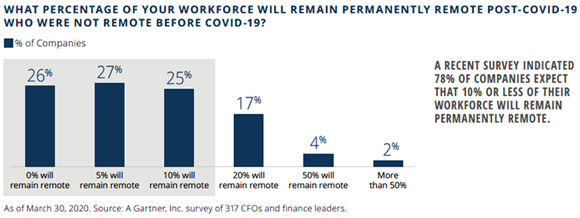

Many headlines in the past year have pronounced the death of the office, in light of the massive transition to a work-from-home environment. Indeed, commentators have been anchoring the narrative that the workforce will remain permanently remote in a post-COVID-19 world, based purely on the 2020 experience. We respectfully disagree. This isn’t to say that the office sector isn’t without its challenges today, but we do expect that people will return to the office when it’s safe to do so, ensuring a future need for high-quality office buildings. Indeed, a recent survey published by Brookfield4 indicated that 78% of companies expect that 10% or less of their workforce will remain permanently remote.

Moreover, once the pandemic has passed, there is a strong incentive for companies to have employees back in the office, for reasons including: developing and maintaining company culture, fostering collaboration, onboarding new employees and mentoring opportunities. Finally, post-COVID-19, we believe that companies will likely reverse the long-standing trend around increased office density, instead seeking more office space for each employee to increase physical distance between individuals.

Source: Brookfield Future of the Office, August 2020

Myth 5: Aren’t energy companies going out of business with the trend toward green energy?

While the trend toward renewable energy and reducing carbon emissions will continue to develop, the fact remains that energy infrastructure - such as pipelines and transmission lines - is vital to the provision of North American energy security and continued economic development. The critical infrastructure required to provide safe and reliable transportation and storage of energy sources such as oil and natural gas - connecting producers to end markets - is crucial to a functioning society. Case in point: During the heatwaves that California experienced in the summer of 2020, renewable energy sources struggled to meet the demand for power generation, leading to blackouts in extreme weather conditions.5

The bottom line

The implications of COVID-19 on real asset investing are more nuanced than what many of today’s headlines may suggest. Ultimately, we believe that the case for real assets remains strong, given the multitude of potential benefits, including exposure to long-term themes such as growth in infrastructure spending, attractive valuations relative to global equities, sustainable income, portfolio diversification and inflation protection.

Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice.

1 Source: NAREIT, August 2020.

2 Source: The Passenger Air Transport Industry 2020-2030 – COVID-19 Impact and Recovery Assessment, June 2020.

3Source: Russell Investments, December 2020.

4 Source: Brookfield Future of the Office, August 2020.

5 Source: The New York Times, "Poor Planning Left California Short of Electricity in a Heat Wave," August 2020.