In times of crisis, is cash king?

Clichés are just sayings that become true

We’ve all heard the clichés:The best time to invest is when you have the money to put to work! and It’s not about time-ING the market, it’s about time IN the market! I’ve always thought they both sound cheesy, but I can’t even begin to fathom the number of times I’ve used some version of these myself. The reason clichés work is that they tend to be true. We take that for granted.

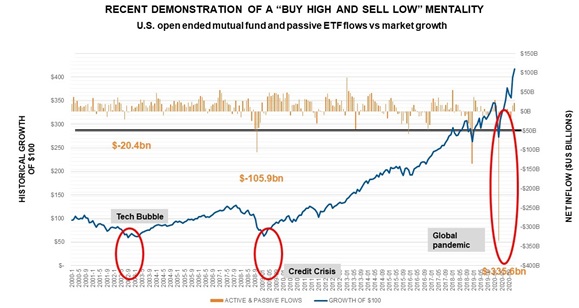

All of these phrases can be boiled down to the oldest investing principle in the book: buy low and sell high. As pretty much any graph on behavioral finance can tell you, investors clearly don’t have a firm grasp of that concept.

Indeed, our basic human instinct to follow the herd often leads us to buy high and sell low. This was clearly evident at this time last year when financial markets were jolted by the global spread of the COVID-19 pandemic and authorities imposed lockdowns that effectively shuttered large portions of the global economy. As the graph below shows, investors took $335.6 billion out of equities in just a few short weeks.

Click image to enlarge

Investors don't always do what they should

Data shown is historical and not an indicator of future results. | Sources: Monthly mutual fund, passive ETF flows and Russell 3000® Index, Morningstar, Direct. | Blue line shows growth of $100 invested in Russell 3000 Index. Orange bars indicate monthly inflows into mutual funds and passive Exchange-Traded Funds (ETFs). Data as of December 2020. Index performance is not indicative of the performance of any specific investment. Indexes are not managed and may not be invested in directly.

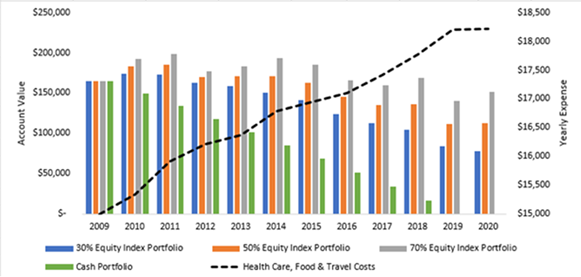

Where did that money go? The next graph may provide a clue.

Click image to enlarge

Source: Morningstar Direct. U.S. Category Group: Money Market. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

As you can see, by the end of May 2020, there was roughly $1.1 trillion MORE in money market funds than there had been in January 2009, at the height of one of the worst crises our country had seen in nearly a century. Indeed, in March 2020 alone, $685 billion went into money market funds. While some of those funds have been put back to work, there is still a substantial amount of cash on the sidelines.

This spells OPPORTUNITY for financial advisors to both help their clients make informed decisions for their financial future and to grow their advisory practice. To show you what I mean I’m going to help financial advisors answer exactly why the best time for their clients to invest is … wait for it … when they have the money to put to work!

How to talk to clients with cash on the sidelines

When it comes to talking to clients with too much cash on the sidelines, everyone has (or should have) their go-to discovery questions.

- What is it for?

- Why do they have it in cash rather than something else?

- What level of risk is appropriate for your situation?

The second question is key, as that is how you can tell if there is an opportunity or not to invest the money. Most client responses to this one can be narrowed down to two key points:

- Cash carries little perceived risk to many investors, while investing in the market can have a downside. People like the idea that cash is inherently safe: no market risk comes with having your cash sitting in the bank.

- Cash is liquid. People like knowing they can access it at the drop of a hat.

Let’s address these.

Cash carries little perceived risk to many investors

We can start with the obvious: inflation exists. Inflation is the silent killer of cash value. Last year the U.S. Federal Reserve (Fed) announced it will now target an average of 2% inflation. One advisor I know questions her clients: What would you say if I told you your cash gets 2% less valuable every year? to effectively introduce the topic. Whichever way you spin it, this is an issue that clients don’t tend to fully understand.

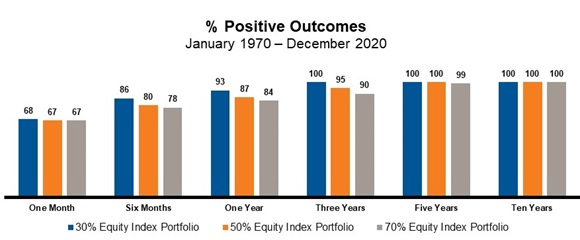

Let’s say in 2009, an investor set aside $165,000 to cover 11 years of food/dining expenses, travel expenses and healthcare expenses ($5k/year for each expenditure). She wanted to be sure that money lasted as long as she needed it to, so she considered four different options: leaving it in cash, investing in a 30% equity/70% fixed income portfolio, investing in a 50% equity/50% fixed income portfolio, or investing in a 70% equity/30% fixed income portfolio. What would have been the best choice?

Click image to enlarge

1 Diversified Portfolios: Three Index Portfolios Comprised of S&P 500 Index (S&P500), MSCI EAFE Index (EAFE), and Bloomberg U.S. Aggregate Bond Index (AGG); 30% Equity: 20% S&P500/10% EAFE/70%AGG, 50% Equity: 34% S&P500/16% EAFE/50% AGG, 70% Equity: 47% S&P500/23% EAFE/30%AGG. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

The cash option may seem to be a reasonable option, but as the above graph shows us, it isn’t quite so simple. Due to the inflation rate over that length of time that $15k/year budget rapidly declined in purchasing power, and by 2019 there was no money left in the cash portfolio. To put it simply, the money she set aside to cover 11 years of expenses only covered nine.

The other three portfolios all had some value at the end of the period, but inflation also ate away at their ability to fund her expenses.

It’s a simple example, but it illustrates a very important point. Cash may give you principal preservation, but not principal protection.

What can be done? Most of the time it comes down to finding a solution that matches the client’s goals and risk tolerance.

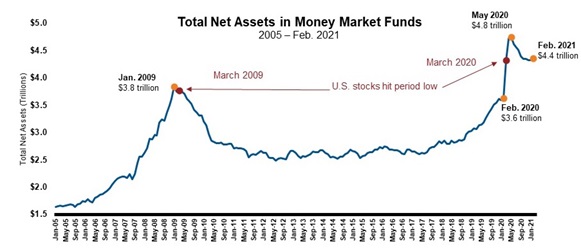

Click image to enlarge

1 Diversified Portfolios: Three Index Portfolios Comprised of S&P 500 Index (S&P500), MSCI EAFE Index (EAFE), and Bloomberg U.S. Aggregate Bond Index (AGG); 30% Equity: 20% S&P500/10% EAFE/70%AGG, 50% Equity: 34% S&P500/16% EAFE/50% AGG, 70% Equity: 47% S&P500/23% EAFE/30%AGG. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

In the above chart, as of Dec. 31, 2020, a well-diversified portfolio with 30% equity had been positive in every single three-year rolling period over the last half-century. That includes the Global Financial Crisis in 2008/09, the Tech Bubble in the early 2000s and even the start of the COVID-19 pandemic last year.

Naturally that brings up the question of time horizon to the client: Do you need ALL of this money within the next three years?

Cash is liquid

That brings us to the second reason many investors give for hanging on to cash: liquidity. This one is simple, and yet it is all too often misunderstood by clients. If they have their money in a managed account1 using mutual funds, when necessary they can liquidate and the money can hit their bank accounts within just a few days. The next time clients are concerned about liquidity, ask them what the odds are that they will need to access their money with less than three days’ notice.

Summary

Uninvested cash is one of the best opportunities out there to grow your advisory book and help clients reach their financial goals. Whether it’s an unexpected windfall like an inheritance or insurance payout, a Certificate of Deposit (CD) coming due, the sale of a home or business, or some other source, a good game plan for sidelined cash is a must as we emerge from the pandemic.

1 A type of investment service which packages a selected group of funds in a portfolio for individual investors.