The risks of fleeing to cash in times of crisis

As markets unraveled this past March, there were few places for investors to hide. As the coronavirus spread at an alarming rate across the globe, equity markets sold off indiscriminately, causing many panicked investors to sell riskier assets in exchange for cash. Unsurprisingly, the U.S. dollar was one of the few assets to strengthen during this time, due to its perceived status as a safe haven in times of crisis.

Flight to cash

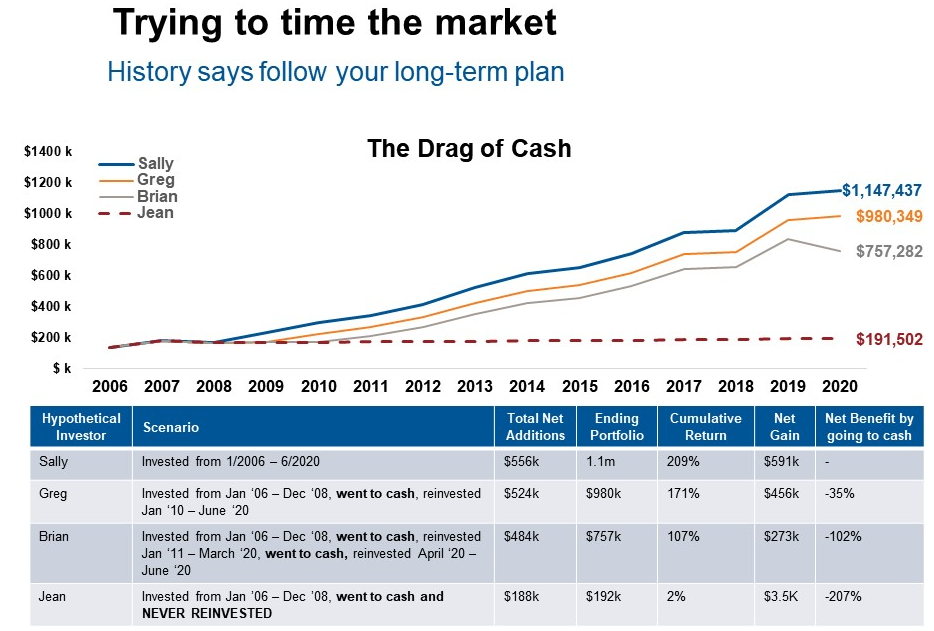

All told, investors pulled $71 billion from U.S. equities, as illustrated in the chart below. But was it a wise move? The data suggests otherwise. Consider this: As of June 30, 2020, investors who sold their equity holdings at the market bottom in late March would have missed out on a 39.3% rebound, as measured by the S&P 500.

Parting ways with equity investments at or near a market bottom isn’t a new trend. Many investors have approached equities with caution since the Global Financial Crisis (GFC) in 2008-09.

Click image to enlarge

Source: Morningstar Direct. Cumulative Flows: Bond Flows: Morningstar Broad Category, Bonds: Taxable Bonds, U.S. Equities, Cash: Money Market – Taxable.

Where did that money go?

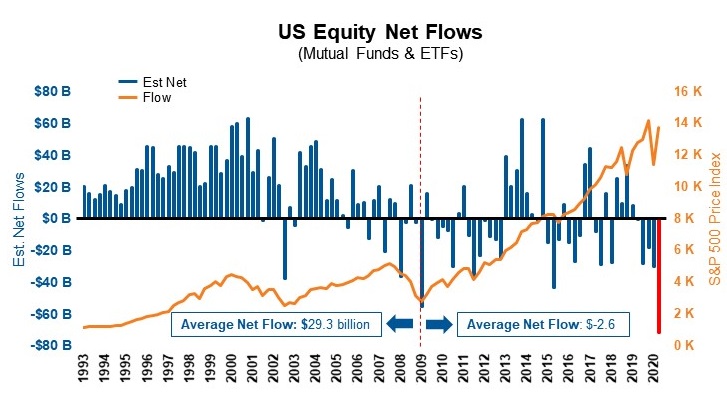

Looking at the numbers below, one could make a guess that safe-haven assets like cash and bonds were the primary beneficiaries when investors decided to exit the market. From the beginning of January 2009 to the end of June 2020, U.S. equities experienced $123 billion of net outflows, while $2.3 trillion and $1.7 trillion piled into bonds and cash, respectively.

Click image to enlarge

Source:Morningstar Direct. Cumulative Flows: Bond Flows: Morningstar Broad Category, Bonds: Taxable Bonds, U.S. Equities, Cash: Money Market – Taxable. Cumulative Returns: U.S. Equities: S&P 500 Index, Bonds: BbgBarc US Aggregate Index, Cash: Dreyfus Basic Money Market.

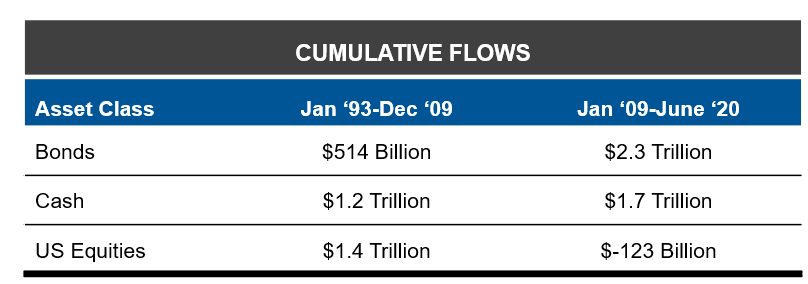

Are investors better off invested in cash?

From January 2009 through June 2020, equities returned 337% (while average net flows were negative $2.6 billion). Cash and bonds, meanwhile, returned 5% and 64% during the same time period.

Click image to enlarge

Source:Morningstar Direct. Cumulative Flows: Bond Flows: Morningstar Broad Category, Bonds: Taxable Bonds, U.S. Equities, Cash: Money Market – Taxable. Cumulative Returns: U.S. Equities: S&P 500 Index, Bonds: BbgBarc US Aggregate Index, Cash: Dreyfus Basic Money Market.

During times of crisis, many investors who’ve worked their whole lives saving for retirement start thinking about what happened during past recessions, such as the GFC. Memories of these prior events, coupled with the barrage of frightening headlines from media outlets, can make it tough to maintain a planned asset mix and stay invested amid a market correction. But are investors well-served by abandoning their long-term allocations to move to the safety—but limited return potential—of cash? It’s true that with the turmoil of the COVID-19 sell-off still in its infant stages, the future is yet to be fully seen. However, it’s fair to say that moving to cash at this year’s market bottom and forgoing a 39.3% return from equities is likely to have been a costly mistake for many investors.

The story of moving to cash

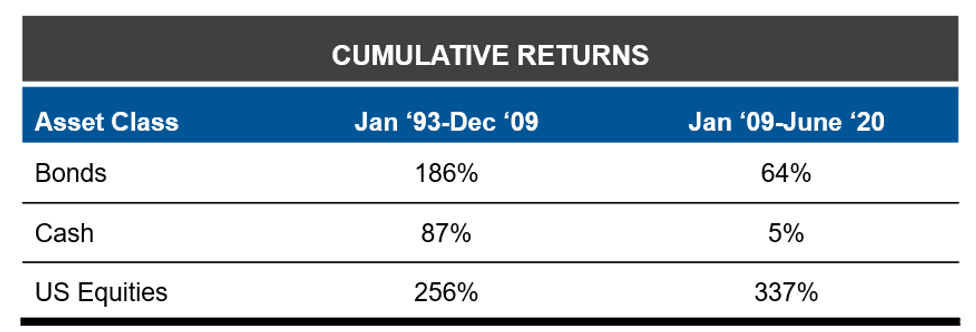

For perspective, let me show you a longer-term scenario of four hypothetical investors and their slightly different paths through two major crises. Each investor starts with $100,000 in a balanced portfolio on January 1, 2006.

- Sally (stays invested through thick and thin)

- She also invests $8,000 per quarter until the end of June 2020. Over this 14+ year period, Sally’s net investment was $556k and by the end of the last month, her portfolio was worth over $1.1 million. Despite going through both the GFC and the COVID-19 crisis, Sally’s portfolio had a cumulative return of 204%.

- Greg (learns from the Global Financial Crisis and stays invested during the COVID-19 crisis)

- Invests the same way as Sally, although Greg moves to cash at the end of December 2008 where his portfolio is worth $166k at that time. Even though Greg lost principal, he managed to bail before the bottom of the GFC which occurred on March 9, 2009.

- On Jan. 1, 2010, when the GFC rebound was seven months old, Greg comfortably re-enters and moves his cash back into a balanced portfolio. Greg also resumes $8,000 dollar cost averaging each quarter.

- By the end of June 2020, Greg’s portfolio is now worth roughly $980k or roughly $167k less than Sally’s.

- Brian (tries timing the market … and stumbles)

- Has a similar strategy to Greg, although he waits an extra year before re-entering the market in early 2011. Then, after being invested for over nine years, he moves back into cash at the end of March 2020, days after the COVID-19 market bottom on March 23 when the S&P 500 closed at 2,237.40.At the end of May 2020, Brian has some serious fear of missing out after seeing an 18% return from equities, 2% in bonds and .06% in cash, and decides to reenter his balanced portfolio. If you thought missing out on the positive returns was bad, 11 days after the point of reentry, Brian was greeted with an 831-point drop from the S&P 500.

- By the end of June 2020, Brian’s account would be worth $757k, over $390k less than Sally’s account and $223k less then Greg’s.

- Jean (stays in cash)

- This scenario could be considered the worst case, where Jean used the same investment scheme as Greg. However, after leaving the market in 2009, she was never comfortable resuming her previous investment strategy. Jean’s portfolio has gained 2%, and is worth $191k, or approximately $3,500 more than the total invested.

Click image to enlarge

Source: Morningstar Rebalance monthly. Net Benefit by going to cash: Cumulative return of Greg, Brian, or Jean minus cumulative return of Sally. Balanced Portfolio: 60% S&P 500 Index, 40% Bloomberg U.S. Aggregate Bond Index. Cash:1.25%. For illustrative purposes only.

Timing the market

We all know the market goes up and down each day, although wild swings can make even the most collected investor second-guess their strategy. Sometimes swings are much more volatile than usual—meaning that checking your investment account daily can create unnecessary stress and perhaps worse, major investment setbacks in trying to time the market.

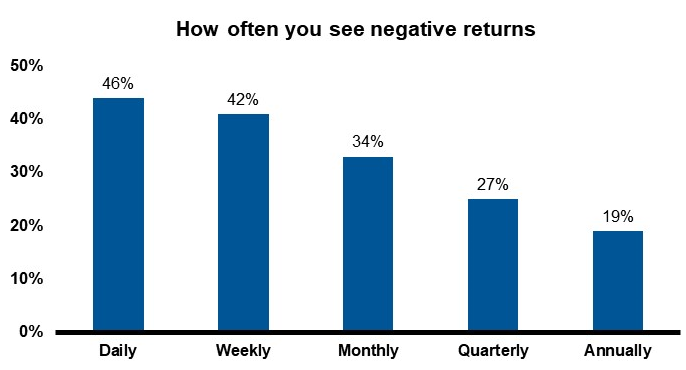

History says that if you check the market daily, you’ll likely see a negative return 46% of the time—although as you check less frequently, seeing a negative return also becomes less frequent, as shown below.Although it’s important to monitor your investment accounts, reducing the amount of times you check can help lower the tendency to make impulsive moves.

Click image to enlarge

Source: Morningstar Direct. U.S. Equities: S&P 500 Index

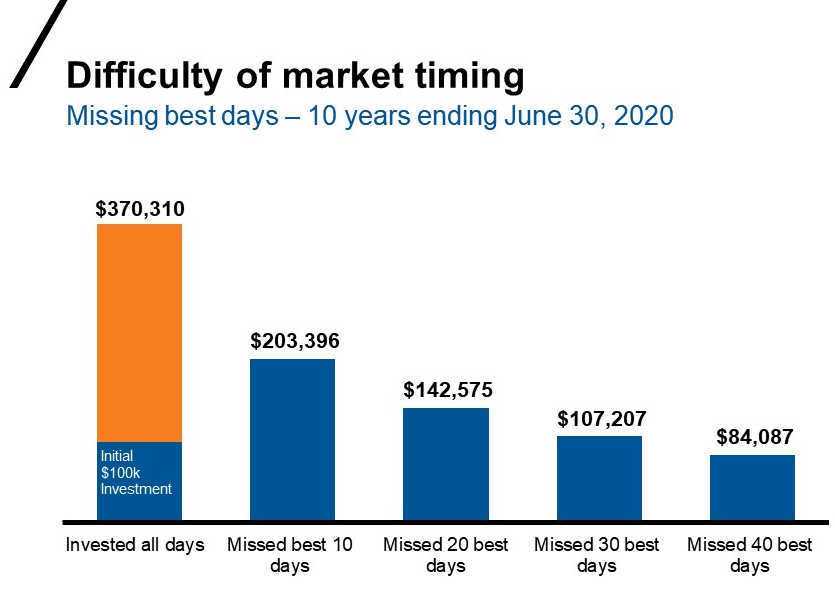

As shown in the chart below, investors who attempt to time the market tend to miss out on important days of growth. In the past 10 years, missing out on the 10 best days meant that your portfolio ended approximately 44% lower than it would have had you stayed in the market.

Click image to enlarge

Source: Russell Investments, Confluence. In USD. Returns based on S&P 500 Index, for 10-year period ending June 30, 2020. For illustrative purposes only. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly

The bottom line

Another way to look at this is to consider that your home is an investment—even though it’s often not viewed as one in the same manner that your retirement is. Like the equity market, the housing market also sees frequent swings in value. But do you check the value of your home each and every day? If you’re not planning to sell soon, you likely don’t.

We believe the same logic should hold true for your other investments as well. If you have a long-term time horizon and an investment plan in place, but find yourself tempted to stray from that plan amid the COVID-19 crisis, it may make sense to discuss further with a financial professional—in order to fully understand the impacts of trying to time the market.

Ultimately, staying invested may pay off, even in times of crisis.Got clients riding the wave of emotions in the market? This blog is part 1 of a series that looks at how emotions can affect investment choices. Read it, then explore our surfable chart: The cycle of investor emotions.