B is for Behavior Coaching. Perhaps the most important role advisors play.

Rising interest rates and soaring inflation. War in Ukraine. Political upheaval. The ongoing pandemic. Midterm elections in the U.S. There’s plenty to worry investors these days.

But the truth is that there is always a reason not to invest in the markets. No matter what time frame you look at, there is always something that could present a threat to financial markets. Over the past century, markets have been jolted by recessions, two world wars, political assassinations, and several pandemics, yet still have managed to push steadily higher over the long run. Indeed, since 1924 the S&P/TSX Composite Index has ended the year positively 74% of the time.1

And that’s why we so strongly champion the value of advisors. We believe the most important role advisors play is that of behavior coach, helping their clients avoid making decisions based on their emotional reaction to the market’s ups and downs. Humans are so prone to investing based on their emotional response to the market’s activity that an entire field of study, known as behavioral economics, is devoted to this phenomenon.

Our annual Value of Advisor study has consistently found the value an advisor brings to their clients by keeping them invested through thick and thin is one of the highest components of the total value provided.

We quantify that total value through this simple formula:

A+B+C+T

We’ll be discussing the various contributions that advisors make to their clients’ investment journey in a series of blog posts diving deeper into our 2022 study. The first blog post was on the value of actively rebalancing—the A in the formula above—through all types of market environments.

This post will look at the B in our formula: behavioral coaching that financial advisors provide to their clients.

During our decades of working in this industry, we’ve learned that most advisors spend the bulk of their time trying to minimize their clients’ behavioral mistakes, especially when markets become volatile. Left to their own devices, many investors buy high, usually at the top of a market cycle and sell low, typically at the bottom of a market cycle, leading them to not reap the full returns of the markets in the process. Have you ever heard the saying “it’s not about timing the market, it’s about time in the market”? I’m sure you have and have even coached your clients with similar language during bouts of volatility in the markets.

As a trusted advisor, you can help calm an investor’s nerves when markets are spotty, simply by providing a historical perspective. Looking at how markets have behaved over time, we know they invariably tend to recover and even advance into new territory after major shocks. Just think back to how badly markets were battered in the Great Financial Crisis of 2008/09 and then consider how they rose strongly and steadily for more than 10 years afterward.

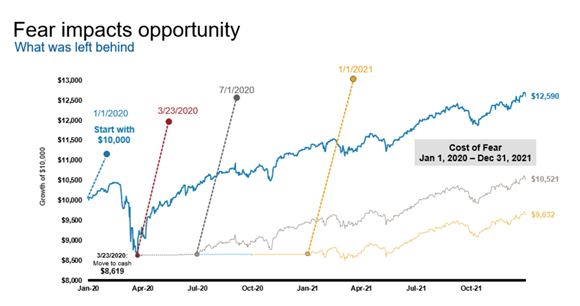

Similarly, markets quickly rebounded after the sharp COVID-related decline in March 2020, leaving investors who fled to cash in fear struggling to find a new entry point over the next two years. Those who listened to their advisor’s guidance and stayed the course were most likely rewarded.

Now let’s look at another graph that demonstrates how much of an impact missing out on even part of the market’s rebound can have. There is no doubt that over the 10-year period shown below there were numerous downturns in the market. And yet, remaining invested throughout resulted in a triple-digit return.

Source: Morningstar. In CAD. Returns based on S&P/TSX Composite Index, for 10-year period ending December 31, 2021. For illustrative purposes only. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

Helping your clients avoid pulling out of markets at the wrong time and sticking to their long-term plan is how advisors can provide substantial value.

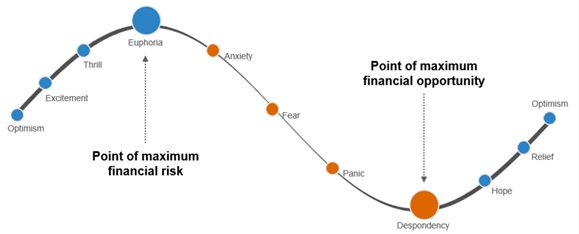

The cycle of investor emotions

Source: Russell Investments. For illustrative purposes only.

It’s true that the past few years have been a bit of a roller-coaster. So far in 2022 investors have faced an escalating conflict in Ukraine, supply-chain problems, a deepening political divide and a U.S. Federal Reserve and the Bank of Canada taking strong action to contain soaring inflation. Advisors, here’s your chance to guide them through the turmoil and demonstrate your value.

Investors, like all humans, look for patterns, even when they shouldn’t. Sometimes, looking for patterns can get investors into trouble, especially when their pattern-chasing inclinations cause them to follow the herd and make a wrong decision at the wrong time. The herd tends to leave the market when it is falling—meaning investors tend to sell low. And the herd tends to enter the market when it is rising—meaning investors tend to buy high. An advisor who can keep their clients from succumbing to their human instincts to buy high and sell low can be incredibly valuable.

Obviously, this common investor behavior can hurt investor returns. Practically speaking, if an investor’s personal situation really hasn’t changed, then staying the course and riding through these periods of volatility is the logical course. But that is humanly hard. So what can a good advisor do, since we can’t control the markets? We can control—or at least help control—this very behavior. That means instead of panicking and fleeing to cash when markets plunge, an investor will have a conversation with you, where you can coach them through these challenging conversations. And that conversation—just that simple conversation—could save them from making a costly mistake.

Behavioral economics: Where finance and psychology meet

We mentioned behavioral economics at the beginning of this blog because it is so important to understand the role that psychology plays in investing. We’ve discussed some of its impact already.

One of the key beliefs of behavioral economics is that changing bad investor behavior begins with awareness. Consider how your smart phone’s screen time app shows how much time you spend on social media and games. You probably don’t look at it most days, but what happens the days you do? Do you vow to reduce your screen time over the next few days? For your clients, behavioral change begins with personal awareness of their investing behavior—of the investment biases that may be causing their mistakes. Once your clients are aware of these biases, you, the advisor, can be that accountability partner to help them stay on course.

Four common investment biases

Within the science of behavioral economics, there are over 200 identified biases that impact money decisions.2 Here are the four we consider to be the most common—and the most important for advisors to address.

- Loss aversion – Humans tend to prefer avoiding losses more than acquiring equivalent gains. In other words, the pain of loss is a more powerful force than the gratification of gain. This fear of loss may cause your investor clients to want to sell winning securities too early. And the fear of missing out may cause investors to hold onto losing securities too long.

- Over-confidence – Investors tend to over-estimate or exaggerate their ability and expertise. In other words, they tend to believe they are experts when they are not. Their belief in their ability to time the market, for example, may cause them to trade too often or at the precisely wrong time. Or their belief in their ability to identify opportunities may cause them to risk too much exposure on a perceived hot stock.

- Herding – Humans tend to mimic the actions of the larger group. When the herd tends to sell and pull out of the market, individual investors tend to join in, even if it means selling low. When humans tend to buy, individuals tend to jump on the bandwagon, even if it means buying high.

- Familiarity – Humans tend to prefer what is familiar or well-known. We see this in the way investors tend to overweight their portfolios toward their home countries, even when there might be a recommendation to diversify globally.

The bottom line

In the formula of advisor value, B is for the behavioral coaching that financial advisors provide to their clients. If you are keeping your investors from knee-jerk reactions to the current volatility, then you are providing significant value. As we have seen, remaining invested can have a huge impact on investment outcomes. In fact, addressing the investment behavior of your clients may be the greatest value you provide.

To learn more about the 2022 Value of an Advisor Study, click here.

¹ Source: Russell Investments, Confluence