Building resilient portfolios: The power of diversification

Executive summary:

- Diversifying a portfolio means spreading the investments across a variety of asset classes, industries and geographies

- Diversification can help reduce the risk of a concentrated portfolio that would be vulnerable to news impacting a specific asset class or geography

- Diversification can help smooth out a portfolio’s returns

The concept of diversification is well-known. The adage “don’t put your eggs in one basket” simply states why diversification is vital in many aspects of one’s life. But it is especially so in an investment portfolio that is intended to help fund a future goal—such as retirement.

Diversification is a strategic approach in which investments are spread across a variety of asset classes, industries, and geographies. This can help reduce concentration risk, which is when one asset class—or even a handful of securities—can come to dominate a portfolio. The problem with holding a concentrated portfolio is that it is vulnerable to any bad news that impacts that asset class or those stocks.

Additionally, diversification may help smooth out returns in volatile times, since different asset classes tend to react differently to economic and market events. That may lead to higher returns over longer time periods, and it may help investors avoid the pitfalls of emotionally based investment decisions.

Let’s look at concentration risk first.

Reduce concentration risk

U.S. equities have experienced a remarkable run-up in value since the 2008 financial crisis. Their outperformance was facilitated by fiscal stimulus, record low interest rates, and strong corporate earnings. Following the onset of the Covid pandemic, tech-focused companies, led by giants like Amazon, Apple, and Microsoft, became the dominant force in driving the U.S. market's overall gains. Investors who had large allocations to these companies were handsomely rewarded.

But tech stocks didn't do so well in 2022 (although they have recovered some ground since) and portfolios that were heavily weighted in those names would have felt that downturn far more than portfolios that had a healthy mix of Canadian, U.S. and international equities, real assets and bonds.

Employing a diversified investment strategy can help investors create a balanced portfolio that avoids overconcentration in any given asset class.

Historical data show that there has never been one consistent asset class that you can bank on to always get you the best return, and there's no way to predict at the start of the year how the next 12 months will unfold. Since we know consistently picking the best performing asset class is not a realistic strategy, the next best option is to diversify your holdings to avoid overconcentration in a single asset class, never miss out on the year's leading asset class, and potentially smooth out returns over time.

Overcoming home country bias for portfolio diversification

Many investors, knowingly or unknowingly, tend to overconcentrate their portfolios in the regions or companies that they are most familiar with. Their thought pattern may run along these lines: “I know plenty more about the economic conditions and current market environment of my home because I am actively participating in both.” Investing in this way is a tendency known as "home country bias" and can be a roadblock to having a fully diversified portfolio. A U.S. investor sticking to just U.S. equities will somewhat limit their investment opportunities because U.S. equities only make up about 60% of the world's market cap.1 It's a much worse scenario for Canadian investors, because Canadian equities only make up about 3.3% of the world's market cap.2

But let's suppose Canadian investors stick primarily to Canada and the U.S., areas they generally know well. This "home country bias" served them well in the past decade.

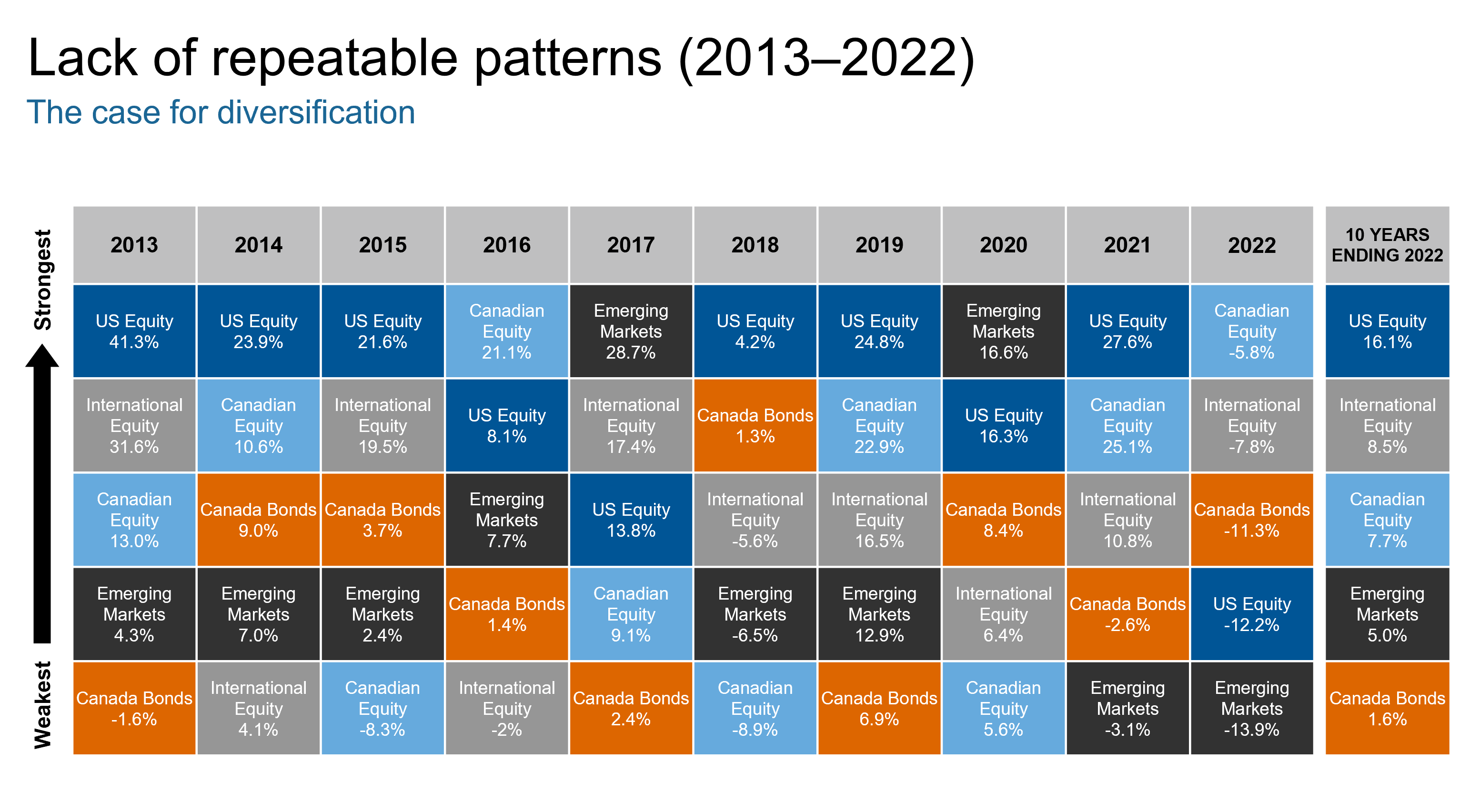

Click image to enlarge

Source: Morningstar Direct, Russell Investments. *Annualized return in CAD. Canadian equity=S&P/TSX Composite Index, US Equity=S&P 500 Index, International Equity=MSCI EAFE Index, Emerging Markets=MSCI Emerging Markets Index, Canada Bonds=Bloomberg Canada Aggregate Index. Indexes are unmanaged and cannot be invested in directly. Past performance is not indicative of future results. Index performance does not include fees and expenses an investor would normally incur when investing in a mutual fund. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets.

As you can see, U.S. equities were in the top three asset classes in any given year over the last decade and recorded the best annualized return over the period. Meanwhile, Canadian equity and Canadian bonds did well in the past two years. It'd be easy to use this as a reason to maintain an overweight to U.S. equities and exposure to Canadian asset classes, without the need to look further afield to other regions. But markets change, and all asset classes cycle in and out of peak performance.

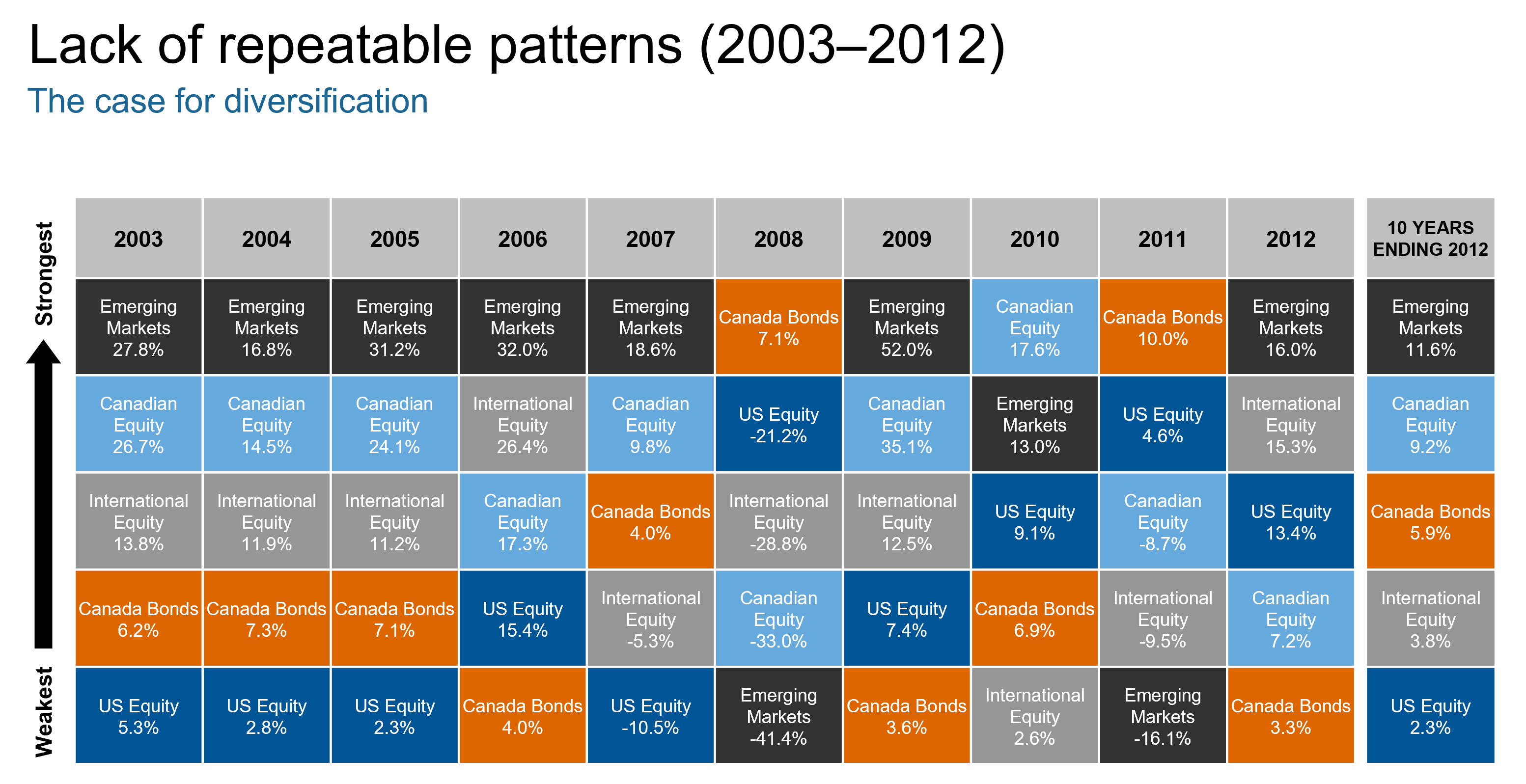

For example, the chart below shows the 10 years preceding the last decade. In this 2003-2012 period, U.S. equities were never the top asset class, and on an annualized basis lagged Emerging Markets, the top performing asset class, more than 9% and Canadian equities were the second-best performers in the decade. The next decade could look the same as this one, the current one, or end up wildly different, since past results are no guarantee of future performance. And since we don't know what the future holds, owning a diversified mix of asset classes can help ensure your portfolio always has a chunk dedicated to each year's top performer, no matter where we are in the market cycle.

Click image to enlarge

Source: Morningstar Direct, Russell Investments. *Annualized return in CAD. Canadian equity=S&P/TSX Composite Index, US Equity=S&P 500 Index, International Equity=MSCI EAFE Index, Emerging Markets=MSCI Emerging Markets Index, Canada Bonds=Bloomberg Canada Aggregate Index. Indexes are unmanaged and cannot be invested in directly. Past performance is not indicative of future results. Index performance does not include fees and expenses an investor would normally incur when investing in a mutual fund. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets.

May help smooth out returns in volatile times

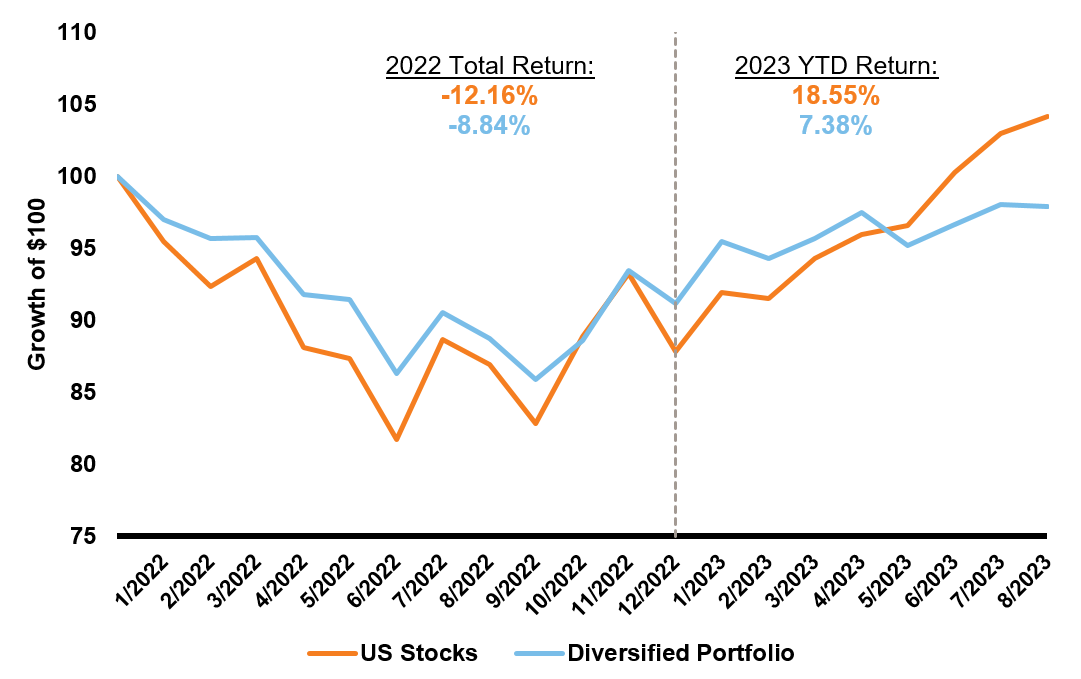

A properly diversified portfolio is comprised of investments whose returns do not move perfectly in the same direction, or with the same magnitude. The idea behind this approach is to help smooth out portfolio returns. While in the past diversification was achieved through a mix of domestic bonds and equities, these days of heightened volatility and increased correlations means investors need exposure across geographies, sectors and industries. Let's take a look at how a diversified portfolio comprised of a mix of Canadian and international equities, Canadian fixed income, global high yield bonds and real assets performed compared to U.S. equities in 2022. As you can see, the diversified portfolio was less volatile even though it too had a rough year, all things considered. More importantly, however, is that because it fell far less than U.S. equities as a whole did, it has had less ground to make up in 2023.

Click image to enlarge

Source: Morningstar Direct, Russell Investments, as of August 31, 2023. In CAD. US Equity=S&P 500 Index, Diversified Portfolio=17% Canadian Equity (S&P/TSX Composite Index), 18% U.S. Equity (S&P 500 Index), 17% International Equity (MSCI EAFE Index), 30% Canadian bonds (Bloomberg Canada Aggregate Index), 10% Global High Yield (Bloomberg Barclays Global High Yield Index), 4% Global Infrastructure (S&P Global Infrastructure Index) and 4% Global REITS (FTSE EPRA NAREIT Developed Index). Indexes are unmanaged and cannot be invested in directly. Past performance is not indicative of future results. Index performance does not include fees and expenses an investor would normally incur when investing in a mutual fund. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets.

Smoother returns may help investors sleep better at night. And it may help them avoid pitfalls of emotionally based investment decisions. Sometimes investors see their portfolios fall in value and panic, then move to cash to avoid further losses. But doing so locks in the decline and means they then have to look for the best point of re-entry. Without a crystal ball, however, they may end up buying back in at the wrong time and miss some or all the market's rebound. This is contrary to the principle of successful investing: buy high and sell low.

The bottom line

Diversification is a tool to help mitigate risk in a portfolio so you can navigate all market environments while keeping focused on a long-term goal. U.S. equities may continue to lead the markets in the next few years – or they may not. History has shown us that market leadership eventually changes. No one can predict when that change will occur, nor which asset class will emerge as the leader. The best we can do is prepare for all potential outcomes with a diversified portfolio.

1 Source: Morningstar: MSCI All Country World Index

2 Source: Russell Investments, based on the MSCI World Index. As of September 26, 2023.