Value of an advisor: A is for the Active Rebalancing of investment portfolios

In a difficult year such as 2022, rebalancing between asset classes that are declining may seem a futile exercise. But rebalancing, even in down markets, remains vital to keeping a portfolio within the right risk/reward ratio and is a key element of the value that an advisor can provide to their clients.

Why? Well, markets that go down then invariably go up. And it’s hard to know when the tide will turn. When markets shift, a portfolio that has moved away from its designated risk/reward ratio may not perform as the investor may expect. The investor may be exposed to too much risk for their comfort level, or too little risk and potentially less reward. An advisor who keeps a portfolio on its intended track can help the investor stick to their plan. But because rebalancing is a regular duty, many advisors (and investors) don’t realize its true value.

That’s why we have produced our Value of an Advisor study every year for the past decade. We believe there are distinct ways that advisors provide value to their clients – value that is above and beyond the fees they charge. We also believe that many advisors find it difficult to not only quantify that value but communicate it.

This is where Russell Investments comes in. Our annual study both quantifies the value that advisors can add through the holistic wealth management services they may provide, and it shows advisors how to communicate that value to their clients.

We do this through our relatively simple formula:

This is the first of a series of blogs that will do a deeper dive into each of the components of our Value of Advisor study. In this blog, we will look at the importance of Active Rebalancing.

The first letter of our formula stands for Active Rebalancing, a routine part of the traditional management of investor portfolios. As we can demonstrate, rebalancing (or not) can have a substantive impact on a portfolio.

Rebalancing can add value in three ways:

1) in maintaining an investor’s mix of assets to the original allocation

2) in potential return

3) in reducing volatility.

In this year’s study, the value of rebalancing was weighted toward the role it plays in keeping the strategic asset allocation on track -- and therefore remaining appropriate for the investor’s stated goals. Regular rebalancing also provided a slightly higher return with only a marginal increase in volatility.

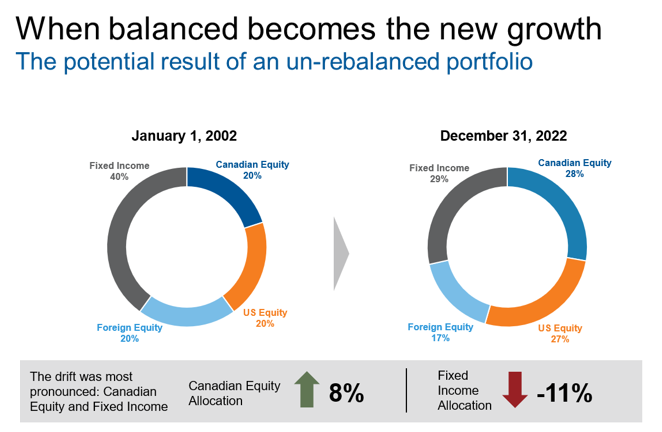

Let’s consider the impact on the investor’s asset allocation. If an investor had purchased a hypothetical balanced portfolio of 60% equities and 40% fixed income in January 2002 and the portfolio had not been actively rebalanced since then, by the end of 2022 the portfolio’s profile would be substantially different. That original balanced portfolio would have become a growth portfolio, with approximately 72% invested in equities and only 29% in fixed income (all numbers have been rounded). That kind of imbalance makes the investor more exposed to the risk of a drawdown in equities than they had expected.

If you don’t think regular rebalancing has value, imagine the 2022 review conversation with a client whose portfolio had become more heavily weighted in U.S. stocks (especially growth stocks that have dominated performance both up and down in the past few years), compared to the conversation with a client whose portfolio had been rebalanced back to the initial allocation. The S&P 500 Index lost 12.2% in the year while the S&P TSX Composite fell 5.8%.1

Click image to enlarge

For illustrative purposes only. Not intended to represent any actual investment. Source: Russell Investments. Analysis based on data from 1/1/2002 - 12/31/2022. Initial asset allocation: 20% S&P/TSX Composite Index (Canadian equity), 20% S&P 500 Index (US Equity), 20% MSCI EAFE Index (Foreign Equity), and 40% FTSE Canada Universe Bond Index (Canadian Fixed Income). Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

It’s a pretty good bet that over the past decade or so, most investors would only have focused on the benefit of the increased allocation to U.S. growth stocks and how that would have driven strong returns in previous years. They wouldn’t have considered the increased risk until the markets turned. If advisors don’t discuss the importance of rebalancing, then we can’t expect investors to understand its value.

The value communication gap

We consistently find there’s a big gap between what investors believe advisors do and what advisors actually do. In other words, there’s a value communication gap between advisors and their clients. But wouldn’t it be great if you could tell your clients that by regularly rebalancing their portfolio, you have maintained their asset allocation in line with their stated risk appetite while also helping smooth out returns?

How to tell the rebalancing story

Are you sharing your rebalancing strategy consistently with your clients? Are you letting them know how frequently their portfolios are rebalanced, whether you are doing it manually or whether it’s the rebalancing policy of the model/strategy partner you’re working with? We recommend four simple touchpoints to make the communication both easy for you and meaningful for your clients.

- The potential benefits of an active rebalancing policy—Explain what can happen if rebalancing isn’t done (last year is a great example) and how rebalancing regularly helps keep their portfolios on track with their goals and their risk profiles.

- What the rebalancing policy is—Let your clients know the basics of the policy, how it works to be both efficient and oriented toward their desired outcomes.

- How frequently the portfolios are rebalanced—Explain how often you will rebalance their portfolio and why you believe that frequency makes sense for them.

- The importance of actively rebalancing during periods of market volatility—Let your clients know how taking actions that may seem counterintuitive – such as reducing their exposure to the fastest-growing segments of the market - can help them

avoid costly mistakes, such as following the herd, buying high and selling low, and leaving the market at the worst times.

The bottom line

In the formula of advisor value, A is for actively rebalancing investor portfolios. As we have shown, rebalancing can help maintain an investor’s established asset allocation, it has the potential to boost returns and, in most years, it can help smooth out volatility. That in turn can help investors meet their desired financial goals. That is valuable and is something investors should understand. We think you should let them know.

To learn more about the Value of Advisor study, click here.

1In Canadian dollar terms