Five key ways advisors deliver value in 2019

We believe advisors have never been more valuable.

For the past four years, we’ve created an annual report that holistically analyzes the real value advisors deliver to their investor clients in their portfolios, in vital services advisors provide, and in their after-tax returns.

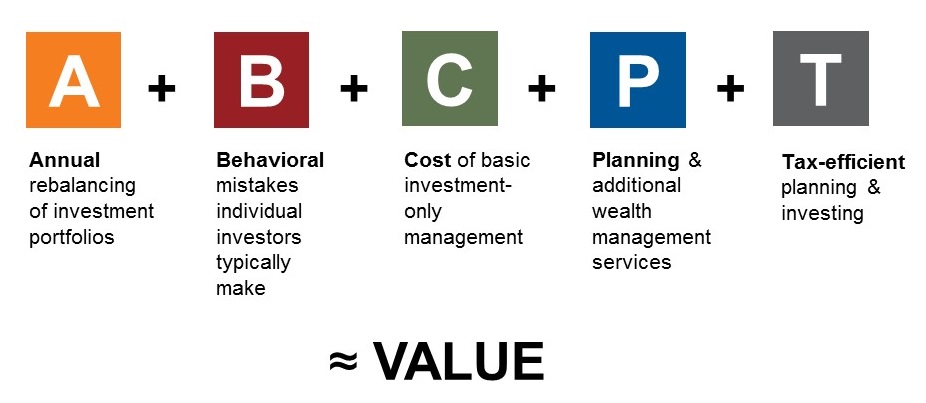

It’s hard to avoid the growing regulatory attention on advisory fees and natural consumer skepticism about delivered value. So today’s advisors may be challenged to articulate the material value they deliver. That’s why it’s so important to provide a simple, easy-to-follow equation that shows the full value of an advisor’s services. It’s as easy as ABC, and then some:

Value of an Advisor = A+B+C+P+T

A is for Annual rebalancing

When markets are rising, it can be easy to underestimate the importance of disciplined rebalancing1. We believe rebalancing is vital, because it is designed to help investors avoid unnecessary risk exposure. Imagine you have a hypothetical balanced index portfolio that has not been rebalanced. In certain market conditions, the asset mix could change and expose the investor to risk they didn't agree to. The annual rebalancing an advisor provides can help keep that from happening.

We believe there are two reasons that many end investors don’t rebalance if left to their own devices:

- Because it’s an easy thing to forget to do. Investors know they’re supposed to do it. We also know we’re supposed to change the batteries on our smoke alarms once a year. But do we really do it?

- Because, in many cases, rebalancing may be the equivalent of buying more of what’s been hurting my portfolio and selling what’s been doing well. It may run counter to what an investor’s gut feelings are telling them they need. Rebalancing takes discipline. Advisors can help deliver that discipline and help position investors for long-term success.

Source: Russell Investments Canada Limited. Original Portfolio Asset Mix: 40% Fixed Income (FTSE TMX Canada Universe Bond Index), 20% Canadian Equity (S&P/TSX Composite Index), 20% US Equity (S&P 500 Index), 20% Foreign Equity (MSCI EAFE Index). Indexes are unmanaged and cannot be invested in directly. For illustrative purposes only. Not meant to represent any actual investment. Past performance is not indicative of future results.

B is for Behavioral mistakes

Behavior coaching is one of the most vital parts of the trusted advisor job description. It’s inherent in the idea of advising. And when it comes to delivering value, avoiding behavioral mistakes is a significant contributor to total value—perhaps even the most significant.

Left to their own devices, many investors buy high and sell low. Between January 2007 and December 2018, investors withdrew more money from Canadian Equity mutual funds than they put in. All the while, $100,000 constantly invested in the S&P/TSX Composite Index - shown in the blue line below - would have risen to $157,000. Helping your clients avoid pulling out of markets at the wrong time and sticking to their long-term plan is one way advisors provide substantial value.

Source: IFIC, Thomson Reuters DataStream, Russell Investments. As of December 31, 2018. Domestic equity flow of funds based on Investment Funds Institute of Canada (IFIC) data. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

C is for Cost of investment-only management

What is a bare-minimum investment management worth? Let’s be brutally fair with these numbers: What would investment management cost if a robo-advisor did it? And what does a robo-advisor deliver?

Most robo-advisors that deliver investment-only management and no financial plan, no ongoing service, and no guidance, still charge something, even if it’s just a small amount. Even if it’s just for annual statements, online access, and a phone number to call in case of questions. Are you making sure your clients acknowledge that you provide the value of investment management as only one small part of your offering?

P is for Planning costs and ancillary services

Advisors advise. As obvious as this sounds, it’s worth stating that financial advisors add value by doing the hard work of shepherding a strategy from origination to outcome. That means plan reviews, analyzing savings and investments, looking at student loans and stock options, considering employee benefits, Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs), post-secondary education funding and tax and estate planning.

What is the value of a comprehensive financial plan? Per a recent financial study conducted by Michael Kitces, the average standalone planning fee for a comprehensive plan was around $2,9002. Are your investor clients aware of that value?

And what about the ancillary services you and your team offer? We believe advisors and their staff consistently underestimate the value of the ancillary services—insurance needs, custom requests and questions—they may provide their clients. These additional services can quickly consume 20, 50, or 100 hours each year. Make sure your clients consider what those professional hours are worth.

Source: www.kitces.com

T is for tax-efficient investing

When it comes to investing, it’s not what you make. It’s what you get to keep. We believe wise advisors don’t just focus on returns. They focus on after-tax returns. Providing a more tax-efficient approach can have substantial impact on the size of those after-tax returns.

Tax-efficient advisors can help add this value by helping build and implement a personalized, comprehensive, and tax-sensitive portfolio.

For illustrative purposes only. All examples shown are based on the following 2018 Ontario marginal tax rates for calculating the tax liabilities: interest income = 46.4%, Canadian eligible dividends = 29.5% and capital gains = 23.2%

The bottom line

Advisors charge for their service. The focus on fees is a daily conversation in our industry. Your clients hear that conversation. Do they also hear about the value you provide? We believe advisor value far surpasses the typical amount charged in fees. Your clients should believe the same. Remember, your satisfied clients—those who believe in your value—are your most persuasive advocates. Helping them understand the value you deliver is key. This formula offers a memorable and repeatable framework for you to have that conversation with confidence.

1Rebalancing is the periodic buying and selling of assets in your portfolio to maintain your originally desired asset allcoation--or mix of investments.

2Source: The Kitces Report Volume 1, 2018 – www.kitces.com