Private markets capabilities: The investment and operational resources your OCIO should deliver

One of the top concerns we hear from our OCIO clients and prospects is around the topic of private markets capabilities and how they intersect with OCIO capabilities. So let's talk about it. If you're an institutional investor considering working with an OCIO provider, what private markets capabilities should you look for?

Let's be sure to look at both halves of the issue: investment capabilities and operational support. You need both. One doesn't work without the other.

The investing side of private markets investing

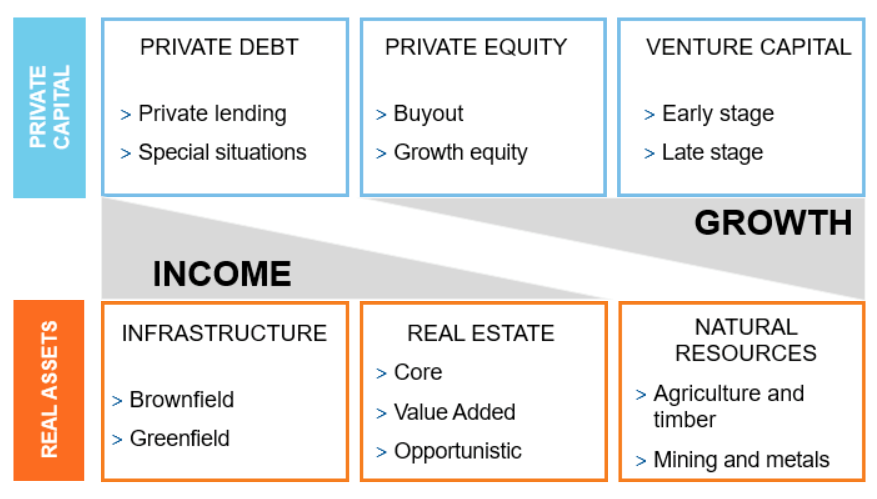

Private markets meets two primary objectives—income and growth. It needs to meet these objectives while maintaining a certain liquidity profile. Make sure your provider has deep capabilities across the income/growth spectrum, particularly in the following categories: private debt, private equity, venture capital, infrastructure, real estate, and natural resources, and other commodities.

Click image to enlarge

Why private debt?

Private credit comes in many forms, but most commonly involves non-bank institutions making loans to private companies or acquiring existing loans on the secondary market. Private credit has outperformed its public counterpart (Credit Suisse Leveraged Loan Index) in 20 of the last 20 vintage years by an average of 5.48%, according to 2021 data from Hamilton Lane.

What private credit capabilities do you need?

Work with a strategic partner that is continuously researching private debt managers and identifying opportunities they believe will deliver the best outcomes for investors. Make sure the strategic partner's manager research considers risks as well, such as higher default rates, managers' ability to minimize loss and patience in deploying capital. We believe in the value of a practical and prudent approach, one that aims to select managers who have the highest lending standards, well-developed lending relationships and sourcing channels. In addition, we believe the value of asset protection, covenant enforceability and portfolio diversification are greatest when going into an elevated credit risk environment.

Why private equity?

Investor participation and interest in private equity continues to grow. Investors are attracted to private equity for different reasons, including access to the significant investable opportunity set that exists across the universe of private companies, along with lower volatility when compared to public equities. That said, arguably one of the most attractive benefits is the potential for greater returns relative to public markets. Indeed, Hamilton Lane finds that buyout pooled returns have outperformed on a public-market equivalent basis against the MSCI World Index for all but one of the last 20 vintage years. (McKinsey & Company, McKinsey Global Private Markets Review 2021, April 2021)

What private equity capabilities do you need?

Success within the private equity sector requires deep market insight, highly specialized research, robust due diligence and, perhaps most importantly, access to best-in-class strategies. Ensure your provider has deep experience and an extensive range of private equity solutions. Size matters, so be sure they're big enough to get the opportunity access you need.

Why venture capital?

Within the total portfolio context, we believe there is a compelling case for exposure to VC. In addition to exposure to key technological trends and innovation, along with the potential for attractive absolute returns, there are also some additional structural market dynamics that may be attractive for investors. Consider that companies are staying private for longer. In previous decades, venture-backed companies tended to go public earlier in their lifecycle. For example, Amazon went public in 1997 when it was three years old. At the time of Google's IPO (initial public offering) in 2004, it was six years old.

What VC capabilities do you need?

There is a wide dispersion of returns across the universe of venture capital managers, and having the necessary relationships to access these top-tier firms whose returns have typically been found to be persistent, is critical to success. In addition, having the depth of resources to be able to identify and access top-tier funds around the world—including the United States, Europe and Asia—is also key.

Why private infrastructure?

We believe that the case for real assets and infrastructure remains strong, given the multitude of potential benefits. In addition to portfolio diversification, sustainable income and inflation protection, infrastructure provides exposure to long-term themes such as growth in infrastructure spending and decarbonization.

What infrastructure capabilities do you need?

Work with a provider who manages infrastructure investments around the world. Be sure they offer capital markets expertise, rigorous due diligence of the global manager universe and multi-manager portfolio construction. We believe the best providers incorporate risk management and diversification and provide efficient implementation of the investment strategy.

Why private real estate?

Real estate offers high diversification benefits. On a historic basis, there has been a very low correlation between private core real estate and public equities and bond indexes. The investment holdings emphasize quality income-producing investments across a broad spectrum of regions. There is also the opportunity for appreciation in private core real estate. Real estate also has high sensitivity to long-term inflation. The high-quality real estate holdings mean that there is the potential to move with rising inflation through rent or lease increases. While equity and bond-related indexes tend to suffer during periods of rising inflation, core real estate tends to exhibit returns during those periods that are relatively similar to those that they deliver during periods of normal inflation.

What real estate capabilities do you need?

Look for flexible investment options, experience and access. Be sure your chosen firm can provide you with alternative real estate investment products designed to fit your portfolio's diversification objectives and liquidity needs. Real estate investing is complex and varies by region, so global experience matters. And, like most things private markets, access matters, too. Be sure your provider has the breadth to research the global universe of real estate products and can offer investors access to diverse investment opportunities.

Why commodities?

Commodities are typically diversifiers to traditional stocks and bonds. At a time when both equity and fixed income markets are struggling, commodities may provide that rare hedging strategy. In addition, as pressure to combat the intensifying climate crisis mounts, the demand for materials needed to produce alternative energy sources is likely to accelerate as well, far outstripping supply. At the same time, the global reliance on traditional energy sources, such as oil, will likely remain elevated due to the amount of time it takes for alternative energy sources to come online—and prices can stay elevated or rise further due to an expected diminishing supply of traditional fuels as more companies invest in and transition to cleaner alternatives. Together, we believe that these widening mismatches in supply and demand—fueled by a skyrocketing focus on ESG factors and climate neutrality—are likely to boost prices for commodities in the coming years.

What commodities capabilities do you need?

We believe commodities performs best under active management. Active managers can try to outperform passive indexes by using opportunistic roll-timing strategies around the index commodity roll periods (delaying the purchase or sale a few days after the index trades), over or under-weighting sectors or individual commodities, buying commodities that aren't in the index and other active strategies to take advantage of potential mispricing opportunities.

The private markets operational demands

Investing in private markets is only part of the picture. The total portfolio still has to work together and has to support the investment strategy, within the agreed-upon constraints. It all needs to work operationally as well. And let's face it: Private markets are more complicated. To do it well, you need the right set of operational skills and experience.

Here is the list of operational capabilities we believe you need from your private markets partner:

Addressing legacy private market investments

This capability actually crosses both investing and operations and it is key. The fact is, many organizations we work with already have as much as a 10-20% exposure to private markets. Since private markets are less liquid than traditional equities, they are harder to move, so must be incorporated into a total portfolio strategy. Make sure the provider you choose can not only work with your existing private markets exposures, but can optimize them as part of a holistic strategy—taking advantage of their existing strengths and also using them to balance other opportunity-seeking endeavors.

Private market research

Every strategy should be chosen on its merits, with incentives solely based on future net-of-fee outperformance of the recommended strategy.

Investment tools and technology

The right private markets tech stack should provide efficient accounting, improved visibility and oversight of the private markets portfolios. When comparing providers, weigh these questions about their tool sets:

- Can you track subscriptions, redemptions, capital commitments, calls and distributions?

- How well does it provide performance analytics? Is it cloud-based? Can it calculate IRRs on the fly?

- How well does it handle data? Does it provide business intelligence? What about data visualizations? Benchmarking? Automated diligence reports?

High-touch portfolio management

Technology is great, but the human factor must still be the key part of private markets portfolio management. Make sure your provider can handhold your portfolio through forecasting allocations, preparing client/fund performance reporting, assisting operations with corporate actions, and confirming capital calls.

Portfolio administrative support

We believe operational services should be comprehensive and designed to support the client's administration of the portfolio. This should include the following:

- Execution of underlying fund subscription agreements

- Corporate actions related to updates to legal agreements

- Review of contribution, distribution notices from underlying funds with notification

- Delivery of underlying fund audited financial statements

- Assistance on transaction reconciliation

The bottom line

Private markets capabilities should be a key consideration when choosing an OCIO provider. It is too powerful a tool not to consider. As the customer, institutional investors should demand the right set of skills, including a total-portfolio approach. Choose to work alongside a strategic partner with a holistic understanding of this high-potential space.